By Nicolás Cachanosky

Inflation targeting has been a cornerstone of the Federal Reserve’s monetary policy for several years. Recent murmurs within the Fed, however, suggest some would like to revisit the 2 percent inflation target. Michael S. Derby reports on the discussion, highlighting the rationale behind this potential adjustment.

The Federal Reserve’s desire to minimize financial stress while managing disinflation is the primary motivation for revisiting the inflation target. With recent instances of bank failures and concerns about the potential impact of interest rate hikes, a higher inflation target would allow the Fed to strike a balance between controlling inflation and avoiding unnecessary economic turbulence.

Translation: It would allow the Fed to reduce interest rates sooner. The current 2 percent inflation target, which was formally adopted in 2012, has not produced the desired results.

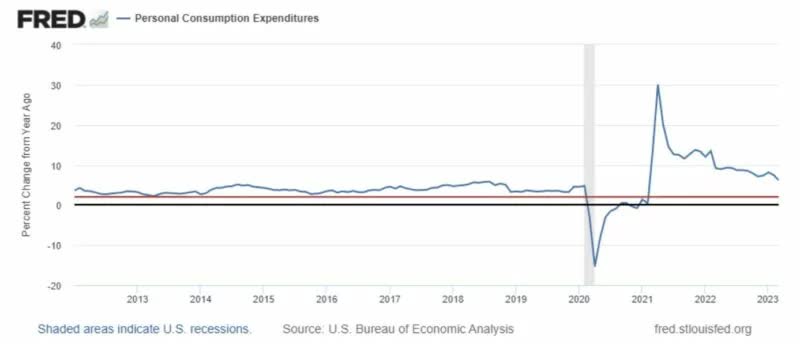

From 2012 to 2020, inflation was generally below 2 percent. With this in mind, the Fed moved to an asymmetric average inflation target in August 2020. In the time since, inflation has generally been above 2 percent. Rather than improving the system, the Fed’s move to an asymmetric average inflation target has just swapped one set of errors for another.

Some now wish to change the Fed’s target. But changing the target – especially at a time when inflation is well above target – would raise questions about the effectiveness and credibility of the Fed’s monetary policy.

No doubt, some will worry that the Fed will fail to hit a higher target as well, which might prompt further revisions to the goal in the future. The most prudent course at the moment is to stay the course.

Once the Fed drives inflation back down to 2 percent, it can consider revising its target. It should not increase its inflation target, though. Rather, it should replace its inflation target with a nominal spending target.

There are several compelling reasons for the (Fed) to transition to a nominal spending targeting regime. By targeting nominal spending, this approach ensures that the money supply adjusts in response to changes in money demand.

Consequently, it directly aims to maintain monetary equilibrium, where the money supply equals the money demand. On the other hand, solely targeting inflation can lead the Fed astray.

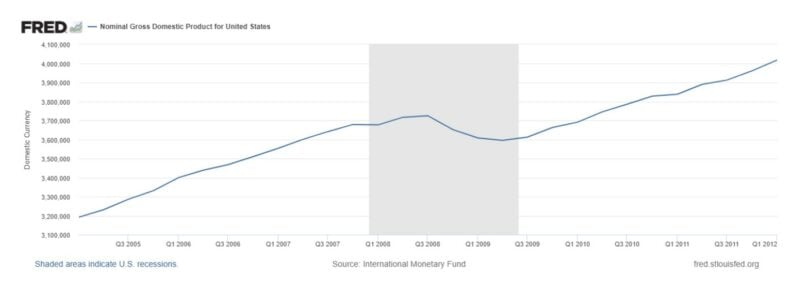

To illustrate this point, consider a scenario where nominal spending falls below its trend level. If nominal spending remains low, as it was following the 2008 financial crisis, consumers will reduce their purchases in an attempt to replenish their monetary reserves. The result is a (sometimes severe) recession.

Under a nominal spending target, the objective is to return nominal spending to its pre-shock trend path. By supplying sufficient money to meet demand, a nominal spending targeting central bank discourages consumers from reducing their purchases to replenish monetary reserves. Recessions are avoided – or, at least mitigated – as a consequence.

Inflation targeting, in contrast, does not necessitate this corrective action. Following the sharp decline in nominal spending, the central bank would only need to deliver 2 percent inflation going forward.

It is important to note that, while the same inflation rate can occur at different levels of nominal spending, the macroeconomy is not indifferent to any level of nominal spending. This is an important advantage of a nominal spending target over an inflation-targeting regime.

By adopting a nominal spending target, the Fed would embrace a regime that provides clear guidance on the required spending level during times of crisis. This shift would enhance the Fed’s ability to navigate economic downturns effectively.

Another advantage of a nominal spending target lies in its flexibility. Such a regime is better suited to handle various types of shocks, whether they are nominal or real in nature. This is important because different shocks necessitate distinct policy responses.

The appropriate course of action differs when the economy experiences a change in money demand (a nominal shock) compared to being impacted by a natural disaster (a real shock).

When the central bank targets nominal spending, the focus is on maintaining monetary equilibrium while allowing the price level to adapt to changes in real-world conditions. Conversely, an inflation-targeting regime fails to make this distinction.

For example, in the case of an oil crisis leading to a decline in output and an increase in prices, targeting inflation would require a monetary contraction that reduces output even more than required by the oil shock. A nominal spending target requires no such contraction.

The Federal Reserve’s recent history with inflation targeting has been far from stellar, necessitating a serious evaluation of its policy framework.

Revisiting the inflation target should prompt a larger conversation about adopting a nominal spending target, which offers advantages in achieving monetary equilibrium, handling shocks, and addressing concerns about deflation.

By targeting what truly matters, the Federal Reserve can position itself at the forefront of monetary policy, providing a more effective and credible approach to maintaining economic stability.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here