Introduction

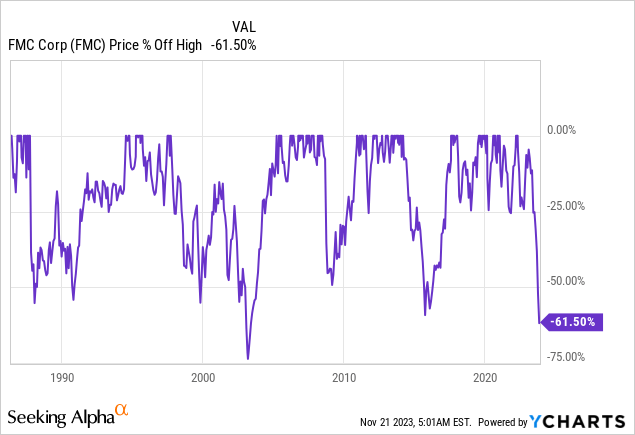

On September 29, I wrote an article titled Why FMC Could Fly Once Demand Improves. Back then, the stock was down roughly 45% since November 2022.

Unfortunately, since my bullish article, the stock is down another 20%, making it the second-worst sell-off in its history. The sell-off is now much worse than during the Great Financial Crisis and a bit worse than the pandemic-related stock price implosion.

The FMC Corporation (NYSE:FMC), which is one the largest agriculture input players in the world, has a major footprint in insecticides, herbicides, fungicides, and related products.

FMC Corporation

Although agriculture operations are often anti-cyclical (we all need to eat), its business is far from anti-cyclical.

FMC is currently suffering from an unwinding of factors that pushed its stock price higher after the pandemic. Global inventory destocking is hurting demand, pricing is down, and future expectations from analysts have been significantly adjusted.

The good news is that after dropping more than 60% off its highs, so much bad news has been priced in.

Even better, the company sees a path to strong growth after 2023, agriculture fundamentals are increasingly healthy, and the focus is on debt reduction.

While FMC remains a highly speculative trade (I prefer less volatile dividend growth stocks), the stock has gotten so attractive that I’m considering buying FMC at these levels.

So, let’s get to it!

3Q23 Was A Total Mess

At the end of October, FMC reported its earnings after it had warned investors that it encountered more weakness than initially expected.

Hence, it started its third-quarter earnings call by acknowledging the continued industry-wide destocking activity during the quarter.

The value chain is adjusting inventory levels in response to heightened security of supply and increased interest rates.

Latin America, typically a strong contributor in Q3, experienced a more severe decline than expected due to underestimated destocking.

In other words, because of higher funding costs, it is more expensive to keep high inventories of products like plant protection. On top of that, I believe the decline in crop prices has put some pressure on farm income, which adds to the need to run operations with lower inventories.

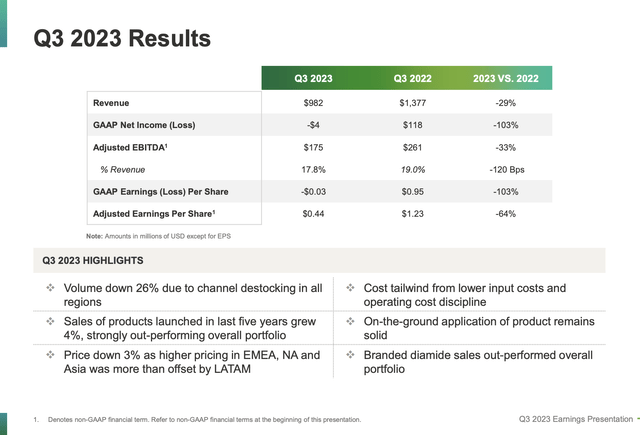

As a result, Q3 revenue saw a 29% YoY decrease, both including and excluding currency changes.

FMC Corporation

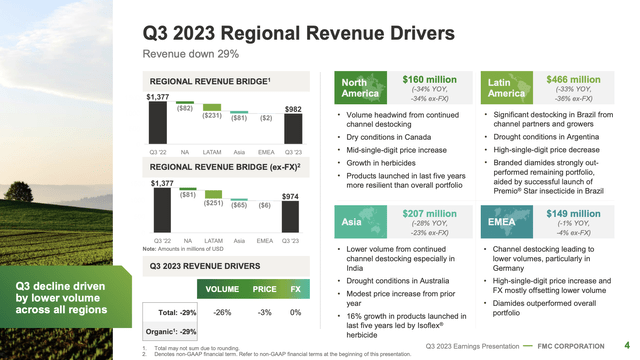

As we just discussed, this decline was primarily attributed to lower volumes resulting from channel destocking, particularly in Latin America.

While sales were down significantly, the application of crop protection products remained steady and, in some countries, even increased compared to the prior year.

- North America: Sales were down 34% YoY, driven by destocking activity.

- EMEA: Relatively flat sales with a 1% decline and 4% excluding FX. Volume saw pressure from channel destocking, partially offset by higher prices and strong diamide sales.

- Latin America: Sales were down 33%, 36% excluding FX, due to destocking, especially in Brazil and Argentina. FMC had a successful launch of Branded Diamide Premio Star in Brazil.

- Asia: Sales declined by 28%, 23% organically, impacted by destocking, particularly in India. New products launched in the last five years showed resilience.

FMC Corporation

EBITDA came in at $175 million, down 33% YoY, attributed to volume decline and a smaller pricing headwind, partially offset by lower costs.

The Future Looks Bright

One of the worst things of the third quarter was the company’s comments regarding the future of the agriculture market.

While some investors may have expected a scenario where demand bounces back hard, the company said to keep expectations low.

Going forward, the company anticipates that the market will not experience a snapback restocking period after global destocking concludes.

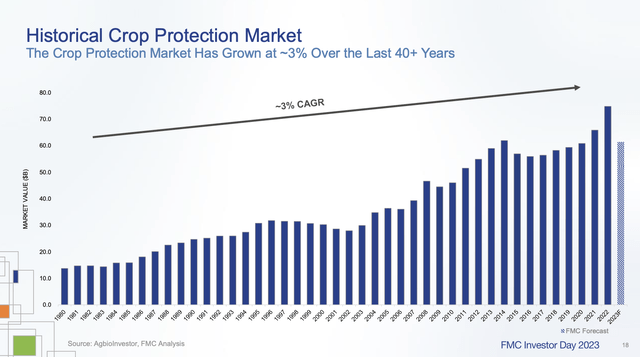

Instead, they expect the crop protection market to grow from the reset inventory base at a more historical growth rate.

During this month’s Investor Day, the company reiterated this call.

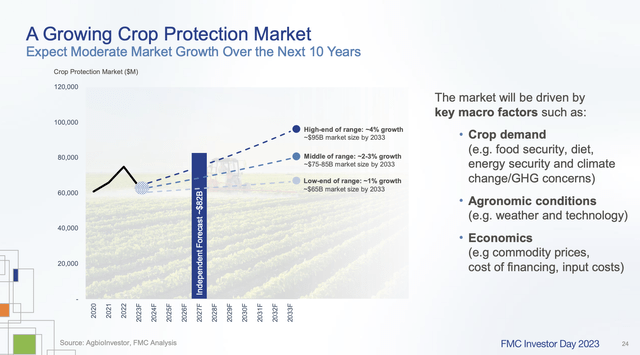

As seen in the chart below, over the past 40 years, the market has grown at a rate of about 3%, driven by factors such as commodity prices, agronomic practices, and advancements in crop genetics.

Since 2010, above-average growth has been attributed to strong commodity prices, regulatory changes, and increased demand for food, biofuels, and animal protein.

FMC Corporation

Both 2009 and 2015 saw similar inventory buildups, resulting in pressure on the FMC stock price.

While the company is acknowledging the difficulty in forecasting the market size for 2023, it anticipates a high teens percent decline.

Looking ahead, the company foresees low to mid-single-digit growth in the global crop protection market over the next decade, influenced by factors like commodity prices, technology adoption, interest rates, food security concerns, and extreme weather events.

FMC Corporation

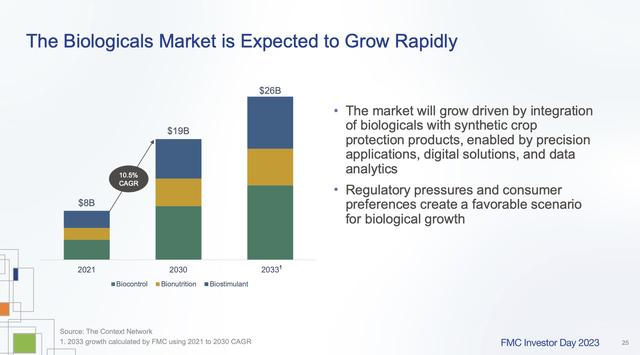

To achieve outperforming growth in this market, the company has a focus on market segments poised for faster growth, particularly biologicals, expected to grow at a rate possibly 10x that of the overall market.

FMC Corporation

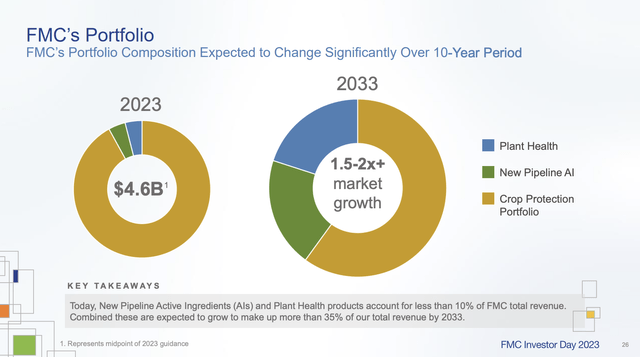

During the recent Investor Day, the company discussed its current crop protection portfolio, including diamides, plant health products, and the new pipeline of active ingredients.

FMC projects that these will collectively contribute more than 35% of total revenue by 2033.

FMC Corporation

Furthermore, 2023 is expected to be the bottom in earnings.

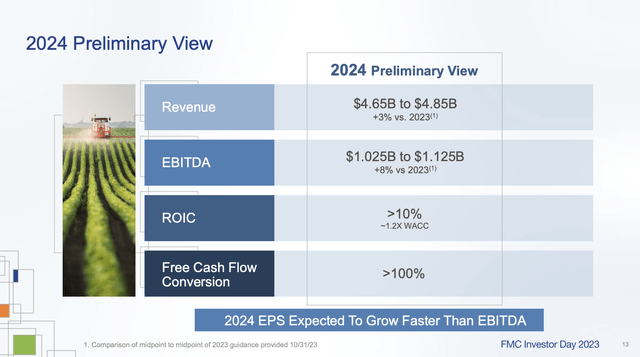

While 2024 expectations include ongoing destocking impacts, FMC expects revenue of $4.65 to $4.85 billion, an 8% increase in EBITDA compared to 2023, with a focus on profitability and debt paydown.

FMC Corporation

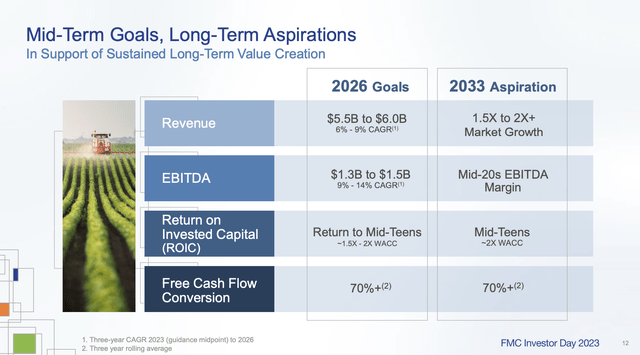

Looking to 2033, FMC aims to outpace the market in revenue by 1.5 to 2x, achieve a mid-20s EBITDA margin, maintain mid-teens return on invested capital, and at least 70% free cash flow conversion.

FMC Corporation

In the meantime, to address challenges, FMC announced immediate steps, including a restructuring plan targeting $50-75 million in savings by 2024 and $150 million by 2025.

This also includes reducing debt.

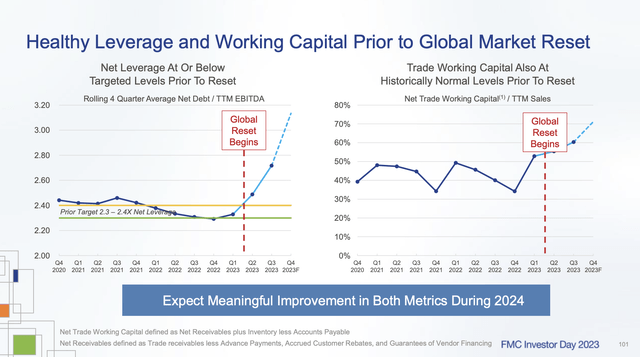

As we can see below, the company’s leverage ratio was well within its target range – until global destocking started. After all, the net leverage ratio relies on both net leverage and EBITDA. Even if debt levels remain unchanged, lower EBITDA causes the debt ratio to increase.

FMC Corporation

In 1Q24, the company expects peak leverage, supported by a normalization in working capital.

Analysts expect the company to reduce net debt from $3.8 billion at the end of this year to less than $3.0 billion by 2025. When incorporating a recovery in EBITDA, the net leverage region is expected to enter the 2.3x to 2.4x EBITDA range again in 2025.

The company has an investment-grade BBB credit rating from Standard & Poor’s.

Valuation

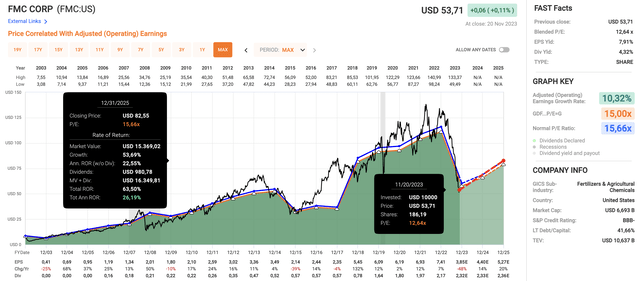

Using current analyst estimates and valuation numbers (all seen in the chart below), we see that the stock is trading at a blended P/E ratio of 12.7x.

Furthermore:

- Going back two decades, the normalized P/E ratio is 15.7x.

- This year, EPS is expected to decline by 48%, making it the worst decline in its history.

- Next year, EPS is expected to increase by 14%, followed by 20% growth in 2025.

- A return to a 15.7x multiple by incorporation of expected growth rates would pave the road for a THEORETICAL return of 26% per year through 2025.

FAST Graphs

Unless we enter a deep recession, I believe that’s a realistic potential performance, which would give the stock a price target of roughly $83, which is 54% above the current price.

I also need to mention that this is based on data after massive adjustments.

- Six months ago, analysts expected the company to generate $8.84 in 2024 EPS. Now, that number is $4.40!

- The same goes for 2025 estimates, where the EPS projection has gone from $10.07 to $5.35.

In other words, if the company enters a new cycle of recovering demand and pricing, it could benefit from both a low stock price and earnings upgrades down the road.

Once analysts start upgrading their outlook for the company, the valuation becomes much more attractive.

With all of this in mind, I believe that FMC offers deep value.

I’m considering buying it at these levels, as I expect to be able to sell it at much higher prices a few years from now.

The only reason why I haven’t bought it is because I’m figuring out how to manage my current cash. I have a number of stocks I want to buy and have to figure out how to balance long-term investments and shorter-term trades.

I’m also waiting for more clarity on how much I’ll have to pay in taxes for this year, which could have a much bigger impact on my cash than I initially expected.

Also, please be aware that FMC Is very volatile. It’s not your typical long-term (dividend) investment. We could also see some more downside in case we’re in for a full-blown recession.

That said, the long-term risk/reward seems to be very attractive to me.

Takeaway

Despite FMC’s recent challenges and a turbulent market, I find its current valuation highly compelling.

The significant drop in stock price, driven by global destocking and market uncertainties, presents an opportunity.

Meanwhile, FMC’s strategic focus on faster-growing segments, debt reduction, and cost savings sets the stage for recovery post-2023.

Read the full article here