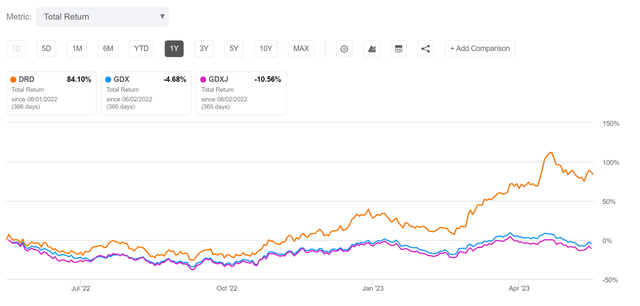

While looking at various gold producers, I came across DRDGOLD Limited (NYSE:DRD), one of the strongest performers in the past year with 84% 1Yr return compared to -5% for the VanEck Gold Miners ETF (GDX) and -11% for the VanEck Junior Gold Miners ETF (GDXJ) (Figure 1).

Figure 1 – DRD vs. GDX and GDXJ (Seeking Alpha)

Upon further analysis, I believe DRDGOLD has an exceptional business model that is perfect for the current ‘ESG’ focused investing environment. DRD reprocesses historical waste tailings and extracts leftover precious metals. This significantly reduces technical mining risk, as well as help remediate the environment from decades of mining.

With the Fed stuck between high inflation and a slowing economy, I believe we are on the cusp of inflation expectations becoming unanchored and driving gold prices significantly higher. With very high operating leverage to higher gold prices, I believe DRD will be a prime beneficiary.

Company Overview

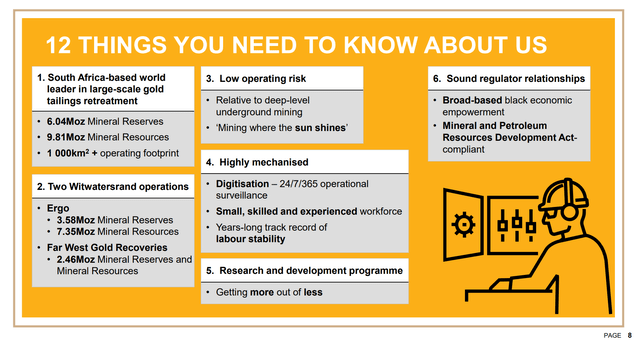

DRDGOLD Limited (DRD) is a South African gold mining company best known for producing gold from reprocessing historical waste tailings.

DRDGOLD is actually South Africa’s oldest continuously listed mining company still in operation and was established in 1895. Originally, DRD was founded to exploit the rich gold deposits in the Witwatersrand Basin. By most measures, the Witwatersrand Basin is the single richest gold field in history, having produced some 2 billion ounces of gold at an average grade of 15 g/t.

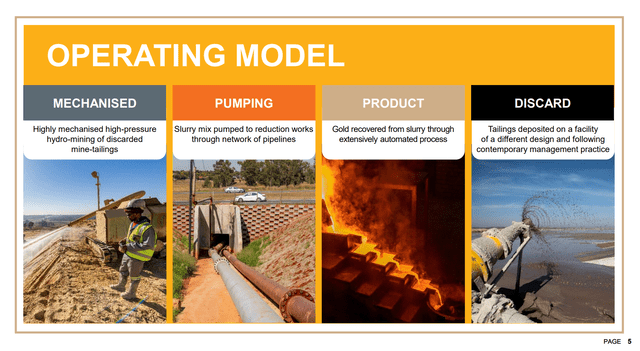

While DRDGOLD’s gold mines are long since depleted, the company has continued to produce gold from reprocessing surface tailings (i.e., waste) since the 1990s. DRD’s revolutionary approach not only allows DRDGOLD to continue to produce precious metals but have also contributed to remediation and restoration of the environment left behind by decades of mining (Figure 2).

Figure 2 – DRD operating model (DRD investor presentation)

Tailings Reprocessing In Detail

Ergo Mining Proprietary Limited (Ergo) is DRD’s surface gold tailings reprocessing operations based in Johannesburg. The process begins with historical waste dumps that still contain significant amounts of precious metals. Remember, the Witwatersrand was producing gold at 15g/t, so material that was considered ‘waste’ in the early 1900s could have contained multiple g/t of precious metals!

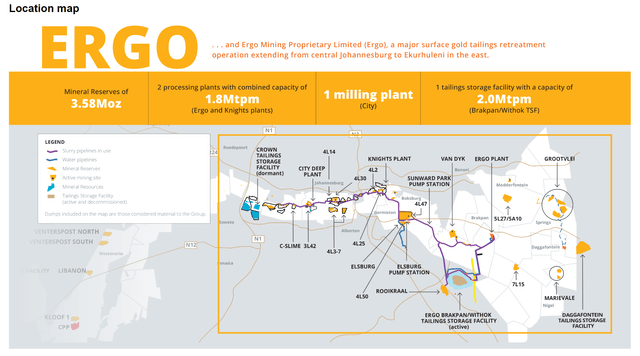

These tailings are re-pulped with water and pumped to a treatment plant. There, the pulp is treated using screens (for sifting), cyclones (for separation), ball mills (for grinding), and a carbon-in-leach (“CIL”) circuit to extract the leftover gold (Figure 3).

Figure 3 – Ergo operations (DRD investor presentation)

The Ergo plant is capable of treating 1.8Mtpm of material delivered via feeder pipelines from various historical tailings sites around the Johannesburg area. After processing, the new tailings are deposited in a tailings storage facility (“TSF”) following contemporary best management practices.

After operating for many years with Ergo Mining, DRDGOLD expanded into the West Rand region of South Africa, where significant historical mines operated. Altogether, DRDGOLD’s Ergo and Far West Gold Recoveries operations combine to give the company more than 6 million ounces of gold reserves and almost 10 million ounces of resources, which should support operations for years to come (Figure 4).

Figure 4 – DRD has large gold reserves from mining waste dumps (DRD investor presentation)

Unlike primary miners that have to constantly drill and explore for new deposits and veins to mine, DRDGOLD’s model of reprocessing historical tailings is a relatively low risk endeavour that is basically an earth moving exercise. The key risks has to do with mechanical failures in its processing flowsheet rather than a failure to locate mineable resources.

Economics Scalable With Leverage To Gold Price

DRDGOLD’s business model is highly scaleable as long as the company can find suitable sources of tailings to reprocess, like the Far West transaction in 2018. Furthermore, the economics of DRD’s business model is more akin to manufacturing and materials handling, where key performance indicators are throughput and operating expenses.

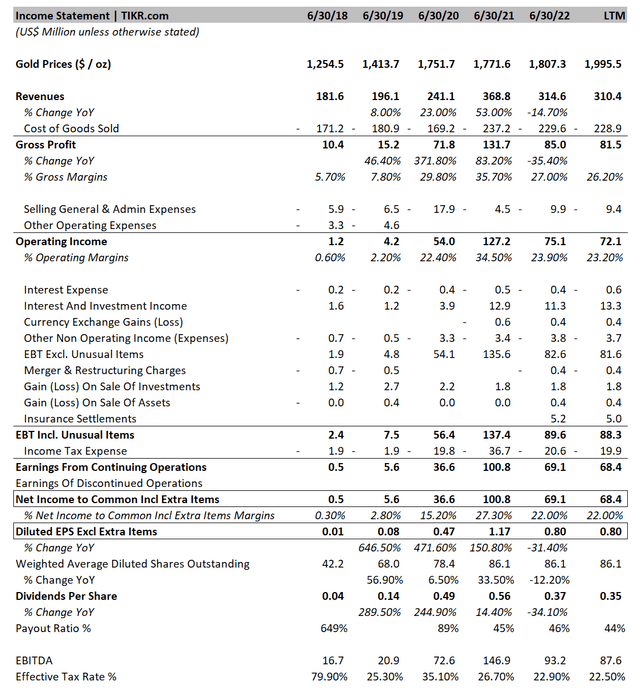

Financially, we can see the company has very strong leverage to gold prices. When gold prices were low in 2018 and 2019, the company’s gross margins were commensurately low, at just 5.7% and 7.8% respectively, and DRD barely produced any profits (Figure 5).

Figure 5 – DRD financial summary (Author created with data from tikr.com)

However, as DRD’s cost base is relatively fixed, when gold prices took a step-up to $1700+ in 2020, DRD’s gross margins expanded to ~30% and DRD’s profitability soared. Since 2020, as gold prices have stayed higher, DRD has continued to mint profits for shareholders, with dividends paid surging from $0.04 / share in 2018 to $0.56 / share in 2021 and $0.37 / share in 2022.

Inflation Is A Problem For DRD

However, like all businesses operating in the current environment, inflation is a major headache for DRD. As we can see from Figure 5 above, even though fiscal 2022 revenues are much higher than 2020, gross margin % has actually declined.

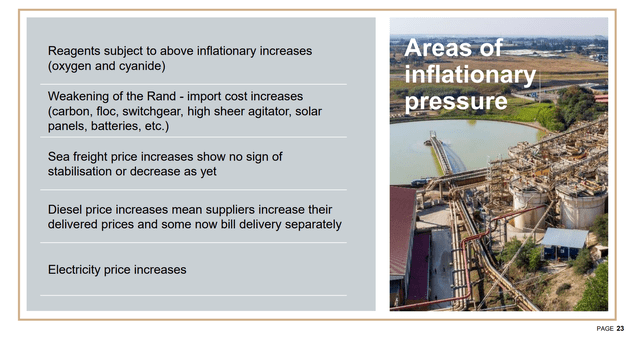

Specifically for DRD, operating costs such as reagents used in the CIL circuit and electricity prices have increased costs of production, eating away much of the revenue gains (Figure 6).

Figure 6 – DRD facing inflationary pressures (DRD investor presentation)

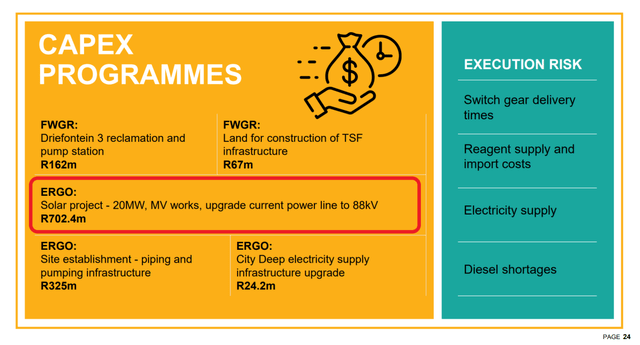

To address some of these cost issues, DRD has been spending capital to build a solar power plant at it’s Ergo facilities to reduce the consumption of diesel and reliance on the unstable South African power grid (Figure 7).

Figure 7 – DRD building a solar power plant to reduce power costs (DRD investor presentation)

DRDGOLD Is An ESG Standout

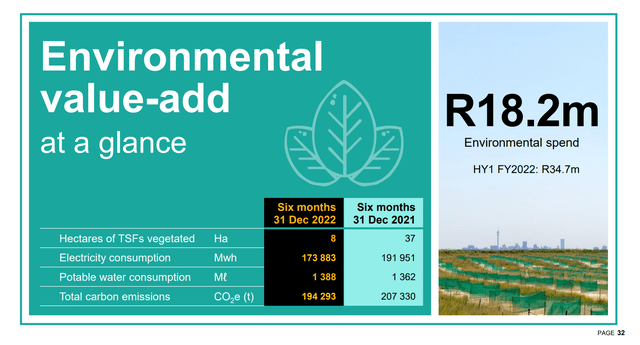

Transitioning to solar power not only saves money, but also reduces the company’s environmental footprint. YoY, the company has reduced its electricity consumption by 9.4% and carbon emissions by 6.3% for the six months ended December 31, 2022 (Figure 8).

Figure 8 – DRD has been reducing its carbon footprint (DRD investor presentation)

Furthermore, in an era of ‘ESG’ focused investing, DRDGOLD is a standout for its business model that turns waste into literal ‘gold’. By reprocessing tailings dumps and following the latest management best practices, DRD is actively rehabilitating mining-affected lands.

Valuation Stretched But Price Momentum Still Strong

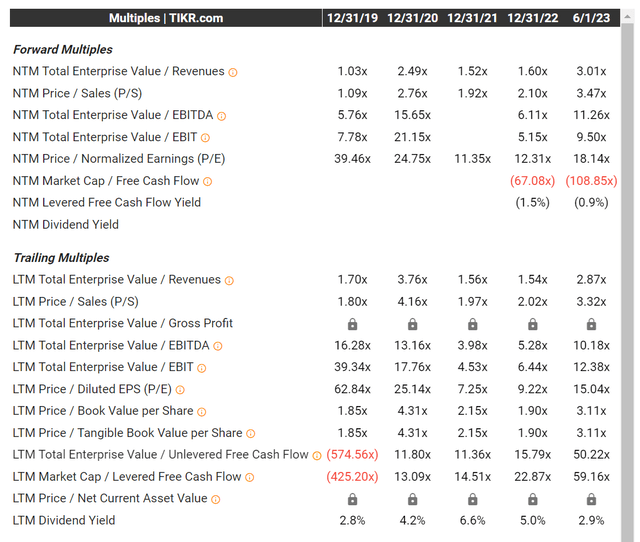

In terms of valuation, DRDGOLD is not a cheap stock, currently trading at 18.1x Fwd P/E with a 2.9% trailing 12 month dividend yield (Figure 9).

Figure 9 – DRD valuation is stretched (tikr.com)

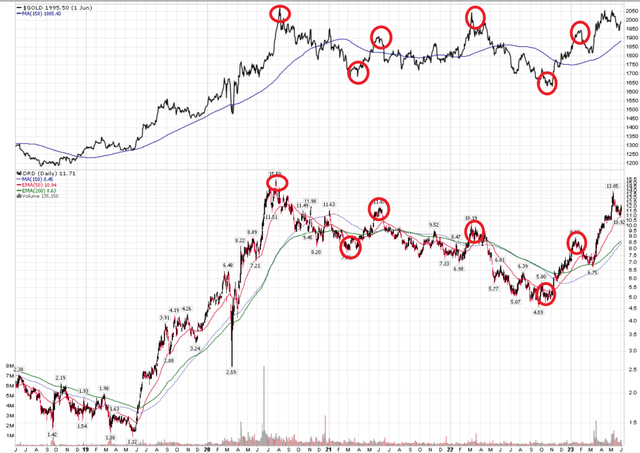

However, from my years of experience managing resource funds, I believe commodity producers like DRDGOLD are more reactive to the price momentum of the underlying commodity than actual financial results. For example, in Figure 10 below, we can see that the inflection points in DRD’s stock price align with inflection points in gold prices.

Figure 10 – DRD’s stock price align with gold prices (Author created with stockcharts.com)

If gold prices continue to rally higher, there is a high likelihood that DRD’s stock price will follow.

Bullish On Gold

In March, I turned bullish on gold after the collapse of regional banks like SVB Financial prompted the FDIC to step in and bail out depositors. Clearly, the Federal Reserve have raised interest rates too far and too fast, causing instability in the financial system. There is increasing political pressure on the Federal Reserve to pause their interest rate increases, lest they push the U.S. economy into a full-blown credit crisis. Recently, multiple Fed officials have hinted that they will take a pause at the upcoming June FOMC meeting.

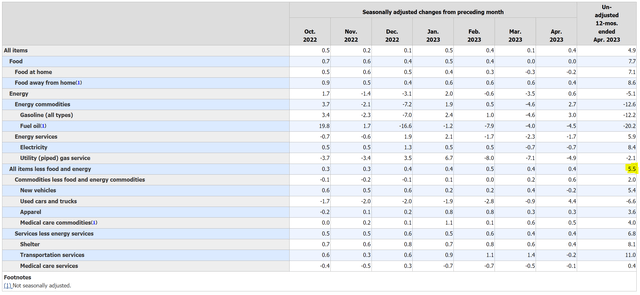

On the other hand, inflation remains stubbornly high, with the latest April CPI inflation report showing core inflation still increasing at a 5.5% YoY rate in April, far above the Fed’s 2% target (Figure 11).

Figure 11 – Core inflation remains far too high (BLS)

Inflation May Become Unanchored, Driving Gold Prices Higher

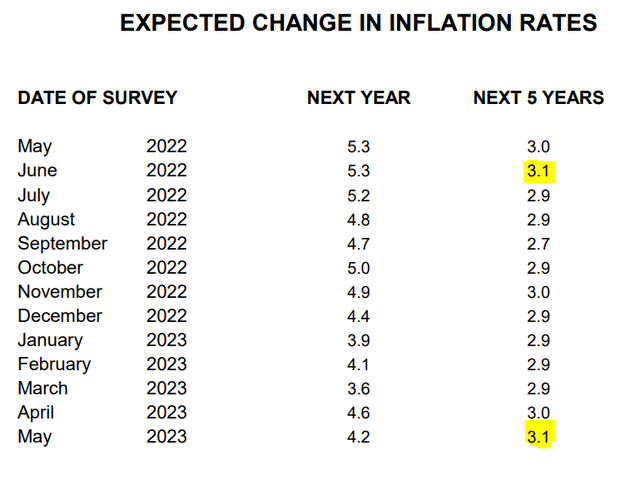

If the Fed stops raising interest rates with core inflation still above 5%, then inflation expectations may become unanchored. In fact, according to the latest University of Michigan Consumer Sentiment Survey, consumer expectations for 5Yr inflation has been inching higher in recent months to the highest level since June 2022, despite headline CPI inflation declining to 4.9% YoY in April (Figure 12). This suggests high inflation is becoming entrenched in consumers’ minds.

Figure 12 – Inflation expectations near cycle highs (University of Michigan Consumer Sentiment Survey)

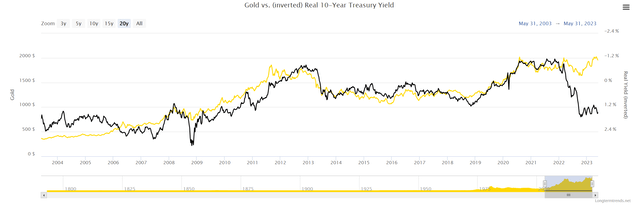

Historically, gold prices have a -0.82 correlation to 10-Yr real interest rates, measured as the Nominal 10-Yr Treasury Yield subtract the 10-Yr Inflation Breakeven Rate (Figure 13).

Figure 13 – Gold prices negatively correlated with real interest rates (longtermtrends.net)

If the Federal Reserve gives up its fight against inflation and consumer inflation expectations become unanchored, then we may see real interest rates plummet, driving the next leg higher in gold prices.

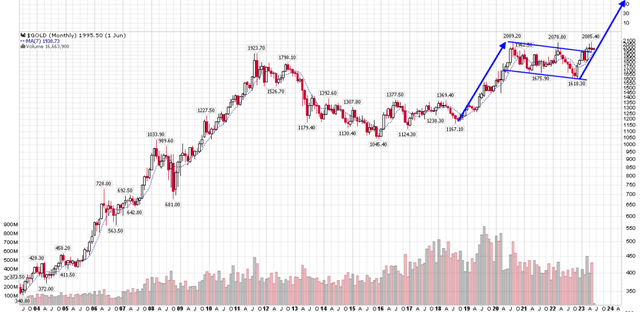

Technically, gold prices have recently broken out of a multi-year consolidation pattern. If we take a measured technical projection of the move from $1,150 to $2,100, we could see gold prices reach $2,550 to $2,600 before this cycle is over (Figure 14).

Figure 14 – Technicals on gold suggest $2,550-2,600 this cycle (Author created with stockcharts.com)

Conclusion

DRDGOLD is a South African mining company that is literally minting gold from waste. Its business model revolves around reprocessing historical tailings dumps and extracting leftover precious metals.

While DRDGOLD’s current valuation is stretched relative to recent history, trading at 18.1x Fwd P/E, I believe the shares can continue to trade higher, as long as gold prices maintain positive momentum.

I am bullish on gold prices, as I believe the Fed is stuck between a rock (stubborn inflation) and a hard place (recession). With the Fed potentially pausing and perhaps even ending their interest rate increases with core inflation still above 5%, there is a chance inflation expectations become unanchored and driving gold prices significantly higher.

I am bullish on DRDGOLD’s shares as its business model has one of the least mining technical risk for a gold producer, as it is more akin to materials processing than actual mining. It also has outstanding operating leverage to higher gold prices, as its costs are relatively fixed.

Read the full article here