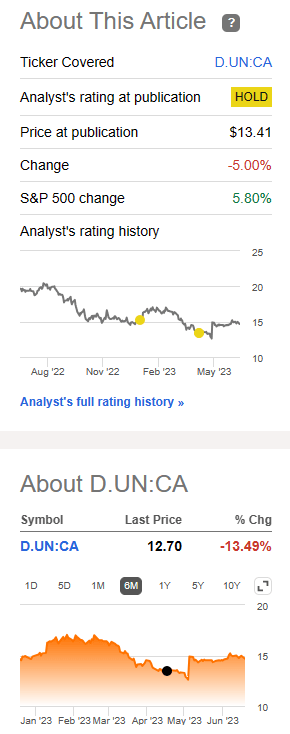

It’s OK to pass on distressed stock opportunities. Not everything is a “buy” just because it’s down or because it appears cheap. That was our take the last time around when we covered Dream Office (TSX:D.UN:CA). While we recognized the phenomenal efforts made by management to turn this around, we just could not get ourselves to a “buy rating.” Specifically we said,

If we back that out and adjust for the debt, the implied cap rate is close to 7.4%. That looks fair for the current market conditions and offers investors a good upside if office does come back. We still think this is not a compelling buy as the risks just don’t offset the rewards. Investors have a slightly better risk-reward in H&R REIT (HR.UN:CA), (OTCPK:HRUFF) due to their large residential and industrial property holdings, and we even passed on that.

Source: 4% Cap Rates In Office Properties Must Be A Dream

At first it appeared that we had missed an important trough as the stock rallied from those levels. Today things took a turn for the worse.

Seeking Alpha

Let’s look at the Q1-2023 results, the substantial issuer bid and reflect on them in light of what’s happening in the real estate markets.

Q1-2023

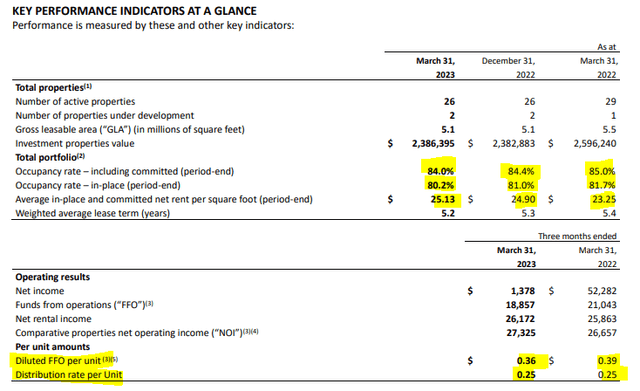

Dream’s Q1-2023 results were about in line with expectations. This is usually the case with the first quarter as the Q4-2022 results are released rather late into Q1 and there are no surprises. Still, investors must have been disappointed to see yet another quarter where committed and in-place occupancies declined. At 80.2% we’re getting into really low territory for the latter.

Dream Office Q1-2023 Financials

Funds from operations (FFO) declined to 36 cents a share, though they remained comfortably above the distribution do note what we show next.

Dream Office Q1-2023 Financials

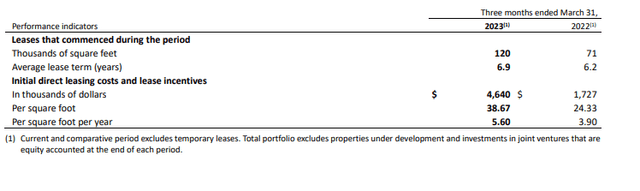

Those are the leasing costs and tenant/lease incentives. This is a renter’s market and Dream Office doled out fairly large sums this quarter relative to last year. If you just subtracted these amounts out from the FFO, you would get an Adjusted FFO (AFFO) of near 27 cents a share, barely above the distribution level.

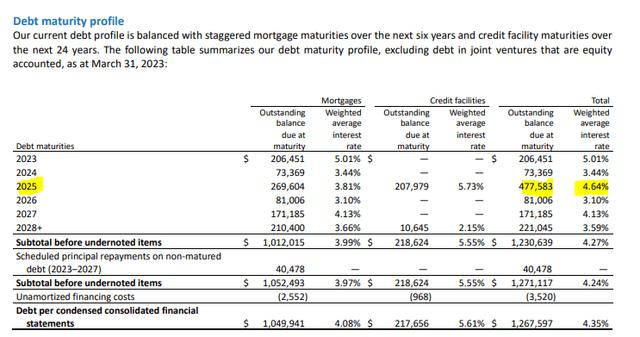

Two other notable points that we want to make about the results. The first being that the debt maturity profile continues look really short relative to the risks the REIT faces. There’s half a billion coming up in 2025 and another $300 million before that.

Dream Office Q1-2023 Financials

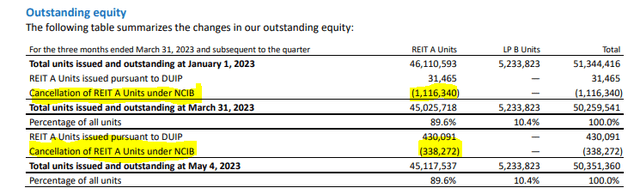

The REIT continued to remove units at a furious pace in Q1-2023 and about 1.5 million units were repurchased till May 4, 2023.

Dream Office Q1-2023 Financials

What this means is that the REIT was using excess liquidity to try and enhance unit value. While that may seem like a bold endeavor by itself, Dream Office took it one level higher.

Substantial Issuer Bid

Dream Office had recently sold Dream Industrial (DIR.UN:CA) units it held. Following this it announced the substantial issuer bid to buy back its own units.

The Trust intends to use the net proceeds from the Secondary Offering, together with cash on hand and drawings under the Trust’s existing credit facility to fund the commencement of a substantial issuer bid (the “SIB Offer”) pursuant to which the Trust will offer to purchase up to 12,500,000 of its outstanding REIT units, Series A (“REIT A Units”) at a purchase price of $15.50 per REIT A Unit in cash (the “Purchase Price”). Consistent with the Trust’s strategy of maximizing net asset value (“NAV”) per unit for our unitholders, the Trust’s Board of Trustees has authorized the commencement of the SIB Offer as it allows the Trust to monetize a portion of its holdings of 26,039,307 units of Dream Industrial REIT and to offer our unitholders the option to either access liquidity by selling their REIT A Units for cash at a premium to the current trading price of the REIT A Units or potentially increase their ownership in the Trust

Source: Dream Office

This announcement was a surprise to us. We would have guessed that the REIT would just shore up its liquidity by converting its sister company holdings into cash. The substantial issuer bid appeared as a poor choice for funds. Well they proceeded anyway and today we got the results of that. The bid was massively oversubscribed, i.e. people were really happy to get out at $15.50. More interestingly, Dream Unlimited Corp. (DRM:CA), the parent and manager announced yesterday that it expected that 7.0 million of its Dream Office units will be taken up by this process. This will net it about $110 million. This meant that DRM tendered its entire stake.

Impact

Assuming you believe the NAV that was released with the Q1-2023 results, this switch is quite accretive. Dream Industrial units were sold at a small discount to NAV, but Dream Office units were picked up at a far larger discount to NAV. Great from that point of view. What is problematic is that net debt to EBITDA goes up after this. We were already teetering near 10.5X at the end of Q1-2023. Dream Office raised the ante here. With the cash or cash equivalent (Dream Industrial units) gone, we are looking at close to 12.0X net debt to EBITDA. Just how does one justify this level of leverage in a market in distress? Yes a lot of that is property level mortgages, but that 12.0X number should send chills down your spine.

Equally troubling here is that DRM was ready to sell all their units. Now, they must know that there will be other offers, but it’s not encouraging them to be ready to exit here. Ultimately their relative stake was largely unchanged, but it does remove some confidence from the market. As we head into Q3-2023 the challenges for Dream Office will likely get more acute. In all likelihood tenant incentives and leasing commissions will rise. FFO run rate should fall off further. This is partially offset with this substantial issuer bid which removes a lot of units out of circulation and boosts both FFO and AFFO. Overall, we think both FFO and AFFO remain flat but the bigger story is the debt load and we remain concerned.

Verdict

Dream Office is trading at an 8.0% implied cap rate. This is about what we think is fair for office properties in today’s market. Yes their own NAV shows over $30 per share. The bulk of the analyst community thinks that the mid $20’s is where NAV stands. We have to just disagree on that. There’s no buying interest here and the 12.0X debt to EBITDA number makes even a bigger discount warranted. We would not be surprised to see the units hit single digits at some point when official recession metrics are confirmed. We would stay out. There are better and safer REITs being sold at a discount and there is no need to catch this falling knife.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here