Note: All amounts discussed are in Canadian Dollars

It is great to buy things cheap. It is even better when you and the insiders have aligned interests. We see this confluence in the stock we will examine today, Dream Unlimited (TSX:DRM:CA). On our last coverage, we recognized the quality of the asset base and the long-term equity compounding. We still did not give it a “buy rating”. Instead, we left with this message.

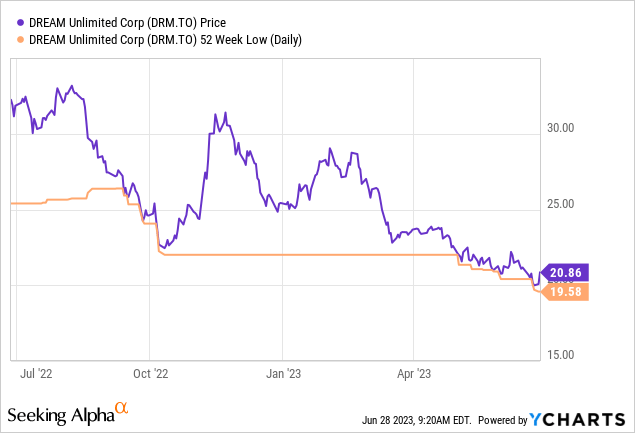

The next 12 months will be challenging for the company as it fights multiple battles from closing residential sales to stabilizing occupancy levels in Dream Office. The earnings estimate for the next fiscal year is likely optimistic, and we could easily do half as much. The small dividend though is very safe, and we think there is room to grow it over time. The asset base underlying the stock is pretty good, but considering a lot of real estate is very cheap today, we are not too crazy about chasing an asset manager. We are rating the stock a hold for now. We might buy it, if it drops below $20.00.

Source: Quality Player At 50% Of NAV

Well guess what? We got $20.00. We actually got as low as $19.58.

Let’s see if we can dive in at these levels.

Q1-2023

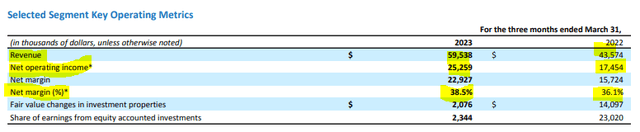

Q1-2023 results continued to show the growth in DRM’s asset management side. Fee bearing assets under management increased by almost $6 billion, and this was largely on the back of the Summit deal using the Dream Industrial REIT (DIR.UN:CA) base. DRM’s assets under management have grown far more rapidly than other more known names, but the company has yet to get credit for it. These assets under management growth has consistently boosted recurring fee income and is slowly moving DRM away from its more cyclical development business. For the quarter, revenue was $59.5 million and net operating income or NOI of this segment was $25.5 million, 44% over last year’s levels.

DRM Q1-2023 Financials

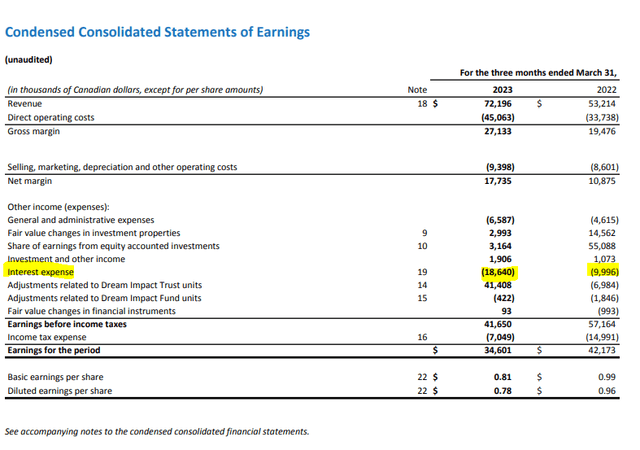

On the development side, condo closings were actually lower than last year, no doubt influenced by interest rate headwinds. Speaking of which, we also saw interest expense rise materially for DRM as its floating rate interest debt really hit them hard.

DRM Q1-2023 Financials

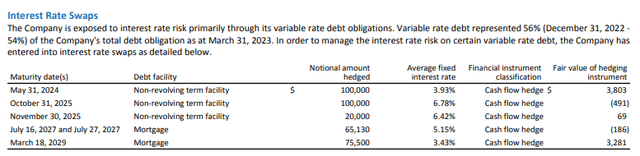

Why would interest expense jump that much in just one year? Well they went hook, line and sinker on variable rate debt (56% of total) and now they have to face the consequences of that. They did have some hedges in place, but we ballpark the total as about 35% of the variable (not total) rate debt.

DRM Q1-2023 Financials

There is still more pain to come on this front as Bank of Canada hiked once more recently.

Outlook

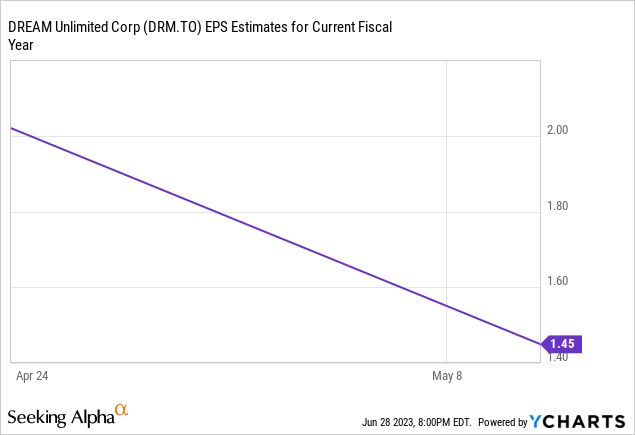

We had previously suggested that earnings estimates remain quite optimistic, and we are seeing that in the change over the last three months.

We think this likely goes a bit lower as analysts start building a recession into their models.

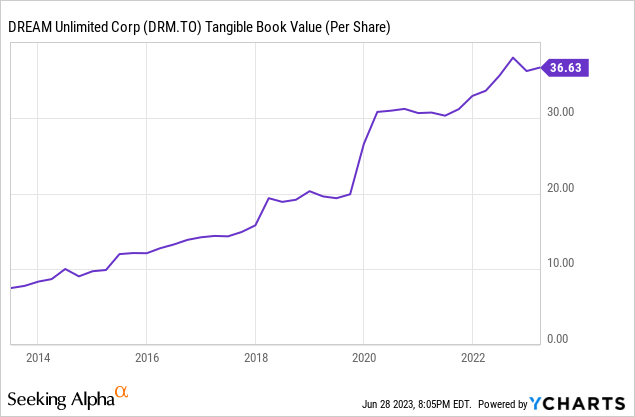

The good news for DRM is that there is a big housing shortage and DRM is part of the solution in getting housing units out there. While timing of delivery and sale of condo units may not be perfectly predictable, they are coming. The second positive aspect here is that their assets under management continues to create a larger and more stable cash flow stream. Finally, the stock remains very disconnected from its estimated NAV. Most analysts we have read assign a $50-$60 NAV estimate. Keep in mind that for Canadian REITs under IFRS, tangible book value and NAV are pretty much in the same postal code. But DRM is not a REIT. You can also see its tangible book value per share has been rising steadily over the last decade, but is nowhere near this $50-$60 number range.

The key difference here is that analysts are marking land owned by DRM to fair value vs the book cost under IFRS. Those estimates are actually quite reasonable in our view. The other difference is assigning a value on the asset management business. That part is far more subjective, but even if we ignore that aspect, we would probably get to $45 NAV.

The risks for DRM come from a significantly slowing economy with sticky inflation that keeps its debt load very expensive. The other major risk comes from potential fallout from Dream Office REIT (D.UN:CA). DRM is the manager of the REIT and recently tendered in almost its entire holdings to be repurchased by Dream Office in a substantial issuer bid. Since everyone else also did similar things, DRM was not able to offload every share it owned. But the run for the escape hatch was likely a negative for Dream Office’s perception by the market. Investors can read our thoughts on Dream Office here. The Cliff Notes edition is that there is an existential threat here, as Dream Office is dancing with potential 12X debt to EBITDA. Should that happen, don’t expect the asset management side of DRM to not get hit. After all, if their flagship publicly traded REIT cannot make it work, the reputation is bound to suffer.

Verdict

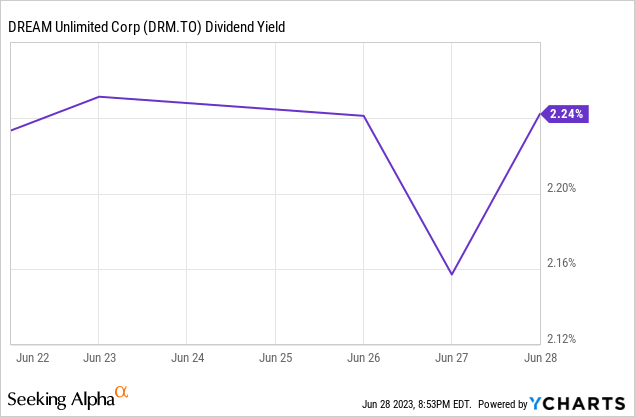

DRM is cheap, and so are a lot of real estate plays. Most quality REITs we follow are down about in line with DRM. Unlike with the quality REITs, DRM’s dividend remains very tiny.

The company also stopped buying back shares in the last quarter.

The big question is whether the discount to NAV is good enough to jump in. After all. DRM has compounded its equity at incredible rates. Even just the tangible book value has compounded at 15% plus rates since inception. Weighing all the information gets DRM a 4 on our potential pain scale rating.

Author’s Pain Scale

We would be very interested if DRM had options listed. We are sure, with the high volatility, we would get adequate premiums to improve an entry point. As it stands, DRM has actually reached our previously declared buy point, but a lot of other stocks seem more appealing. Those stocks also have options listed. So we are taking a pass here for now and monitoring the situation.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here