I believe investors should avoid the DoubleLine Income Solutions Fund (NYSE:DSL). Even though the fund pays an attractive 11.1% distribution yield and is lead managed by the ‘Bond King’ Jeff Gundlach, its performance appears to be yet another ‘return of principal’ fund that may lead to loss of principal and income in the long run.

Fund Overview

The DoubleLine Income Solutions Fund focuses on delivering high current income from a portfolio of debt securities and other income-producing investments around the world.

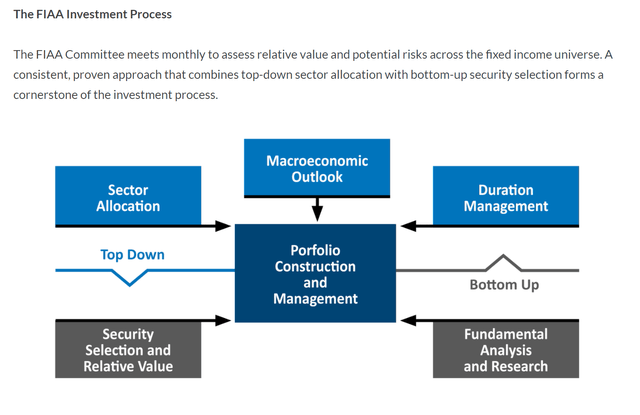

The DSL fund is managed by DoubleLine’s Fixed Income Asset Allocation (“FIAA”) committee led by the ‘Bond King’ Jeff Gundlach. The committee looks at the relative value and potential risks across the fixed income universe, combining top down sector allocation with bottom up fundamental research and analysis (Figure 1).

Figure 1 – DSL investment process (doubleline.com)

DSL’s flexible mandate allows the fund to invest in various kinds of fixed income securities including mortgage-backed securities (“MBS”), asset-backed securities (“ABS”), treasuries, corporate bonds, international sovereign bonds, and short-term investments. Essentially, the DSL fund can be thought of as a ‘go anywhere’ fixed income hedge fund incorporating the best of DoubleLine’s investment ideas.

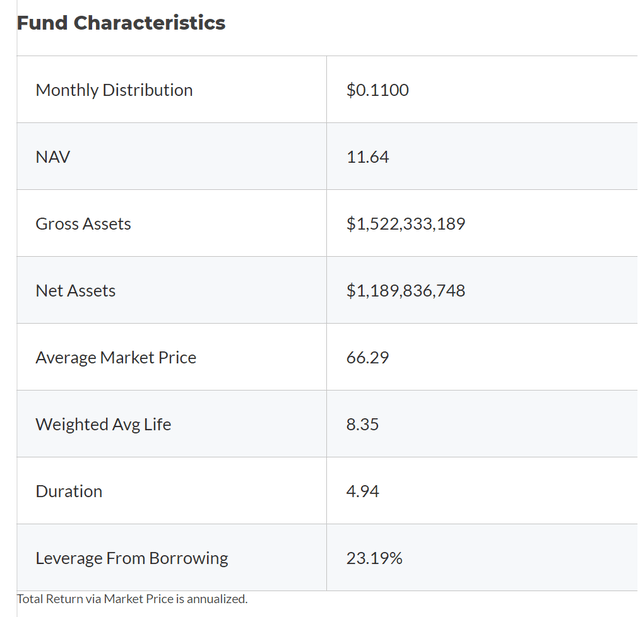

As of May 31, 2023, the DSL fund had $1.2 billion in net assets and $1.5 billion in gross assets for 23% effective leverage (Figure 2).

Figure 2 – DSL fund characteristics (doubleline.com)

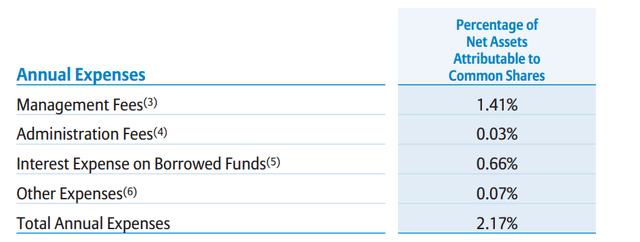

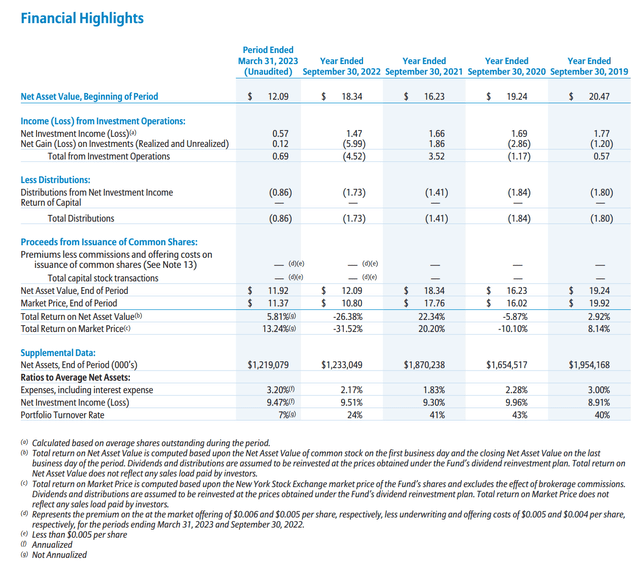

The fund charges a hefty 3.2% annualized net expense ratio in the half year to March 31, 2023. Note, the DSL fund’s total expenses have soared in 2023, as the fund’s leverage is obtained from a floating rate credit facility. In the year to September 30, 2022, DSL’s total expense was lower, at only 2.17% (Figure 3).

Figure 3 – DSL expenses in 2022 (doubleline.com)

Portfolio Holdings

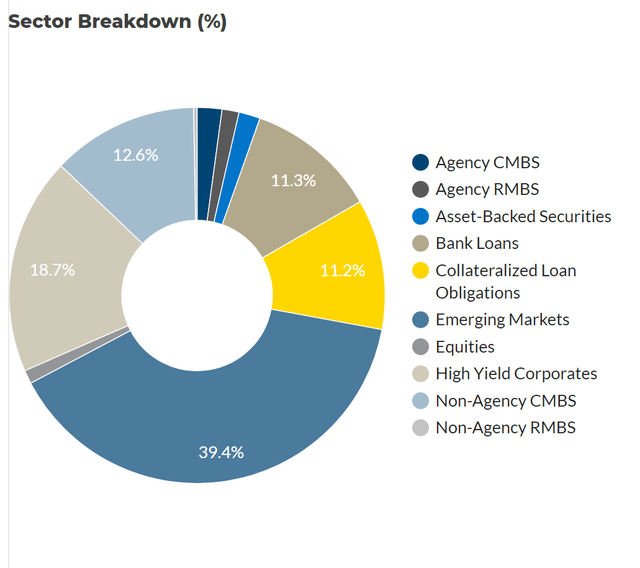

Figure 4 shows the sector allocation of the DSL fund as of May 31, 2023. The largest sector weight is in Emerging Market bonds at 39.4%, followed by High Yield Corporates at 18.7%, non-Agency CMBS at 12.6%, Bank Loans at 11.3% and CLOs at 11.2%.

Figure 4 – DSL sector allocation, May 31, 2023 (doubleline.com)

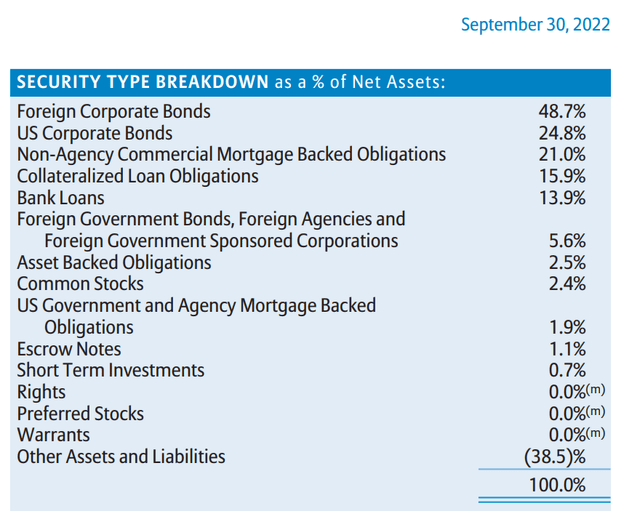

Investors should note that the DSL fund’s allocation may change quite a bit from period to period as the fund is essentially a tactical hedge fund. For example, as of September 30, 2022, the DSL fund had a much greater allocation to foreign and domestic corporate bonds, as well as non-Agency CMBS (Figure 5).

Figure 5 – DSL sector allocation, September 30, 2022 (DSL 2022 annual report)

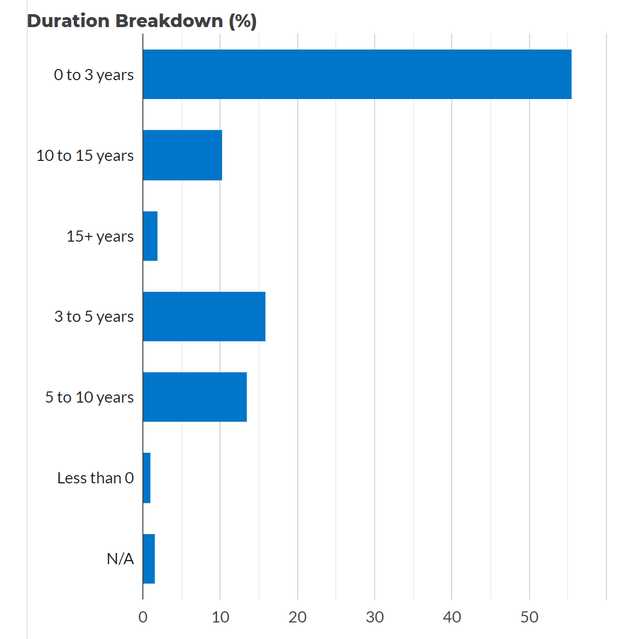

Overall, the DSL fund has a weighted average duration of 4.9 years, with 55.6% of the portfolio in short-term 0-3 years securities, 16.0% in 3-5 years, and 13.6% in 5-10 years (Figure 6).

Figure 6 – DSL duration allocation (doubleline.com)

Returns

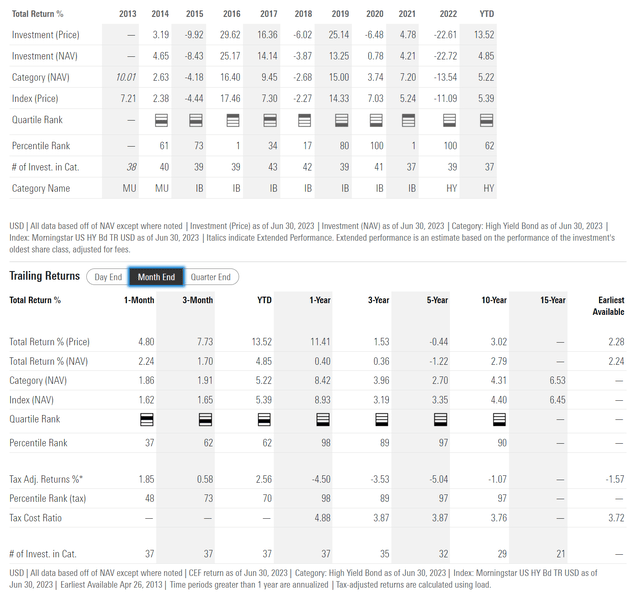

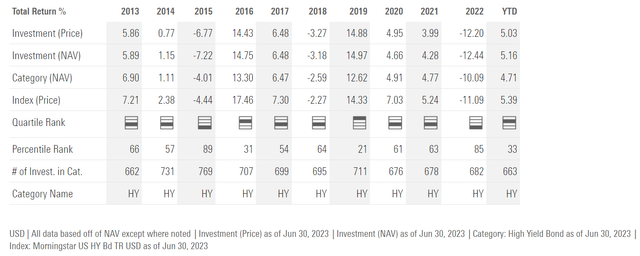

Figure 7 shows the historical returns of the DSL fund. The DSL fund’s performance has been poor, with 3/5/10Yr average annual returns of 0.4%/-1.2%/2.8% respectively to June 30, 2023. In particular, 2022 was a horrible year for the DSL fund, as it lost 22.7%.

Figure 7 – DSL historical returns (morningstar.com)

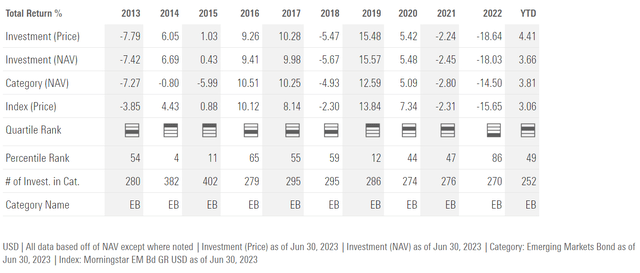

In fact, DSL’s 22.7% loss in 2022 is one of the worst performance I have seen from fixed income funds. For example, emerging market bonds, as modeled by the iShares JPMorgan USD Emerging Markets Bond ETF (EMB) only lost 18.0% in 2022 (Figure 8).

Figure 8 – EMB annual returns (morningstar.com)

High yield bonds, as modeled by the SPDR Bloomberg High Yield Bond ETF (JNK) only lost 12.4% (Figure 9).

Figure 9 – JNK annual returns (morningstar.com)

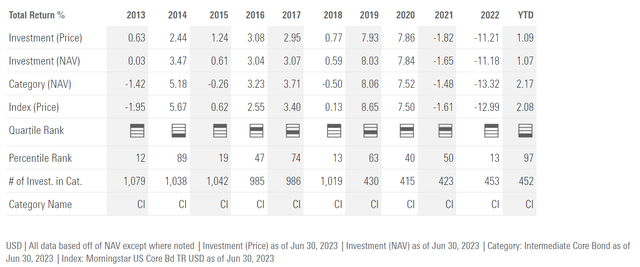

CMBS, as modeled by the iShares CMBS ETF (CMBS) only lost 11.2% (Figure 10).

Figure 10 – CMBS annual returns (morningstar.com)

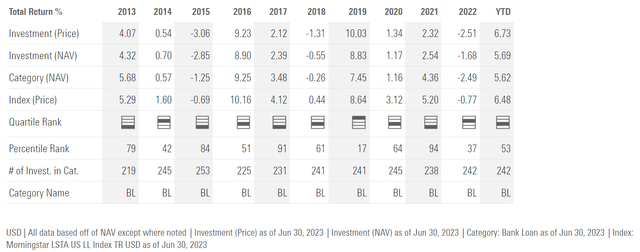

And bank loans as modeled by the Invesco Senior Loan ETF (BKLN) only lost 1.7% (Figure 11).

Figure 11 – BKLN annual returns (morningstar.com)

So the DSL fund, being a tactical portfolio of these fixed income asset classes managed by DoubleLine’s investment committee, actually managed to underperform every asset class by a wide margin.

Distribution

Despite poor total returns, the main attraction of the DSL fund for investors is its high distribution yield. The DSL fund pays a monthly distribution of $0.11 which has been maintained since 2020. The forward yield on the DSL fund is 11.1% on market price and 11.2% on NAV.

Historically, DSL’s distribution has been funded from net investment income (“NII”) (Figure 12). However, I have reservations about DSL’s distribution sustainability.

Figure 12 – DSL financial highlights (DSL 2023 semi-annual report)

As I have written ad nauseum, instead of just looking at NII versus distribution yield, as many authors superficially do, investors should consider total returns. If we compare the DSL fund’s long-term total returns of 2.8% over 10 years versus its 11.1% forward distribution yield, it becomes clear that the DSL fund is yet another example of an amortizing ‘return of principal’ fund, as described in an Eaton Vance whitepaper.

The interesting thing about the DSL fund is that it is not a traditional ‘return of principal’ fund that cannot earn NII sufficient to cover its distribution and must liquidate NAV. However, as I have written in my critiques of the Apollo Senior Floating Rate Fund (AFT) or the Blackstone Strategic Credit Fund (BGB), funds can show seemingly fully covered distributions yet have an amortizing NAV, a characteristic of ‘return of principal’ funds (Figure 13).

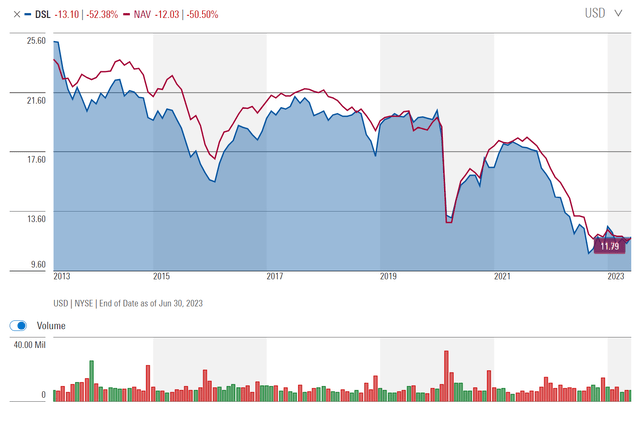

Figure 13 – DSL has a long-term amortizing NAV (morningstar.com)

This is because NII only considers interest and investment income. However, if the funds ‘stretch for yield’ and invest in poor quality investments that suffer losses, the losses show up in the ‘net gains on investments’ line. Overall, if we look at DSL’s latest semi-annual report (pp 20 and 21), we can see the DSL fund has accumulated $11.47 / share in ‘realized and unrealized losses’ since 2013.

While it’s certainly true that fixed income securities suffered lots of unrealized losses in 2022 due to the rise in interest rates that may reverse in future years, I believe the trend is clear as 7 of 10 years from 2013 to 2022 saw the DSL fund suffer net losses on investments, with losses greater than subsequent recoveries.

Over time, investors in ‘return of principal’ funds may see a loss of principal (as market price tracks the decline in NAV) and lowered income (as there is less assets to earn income with).

The DSL fund initially began trading in 2013 with a $0.15 / month distribution. This was subsequently cut to $0.11 in 2020. I believe the distribution will inevitably be cut again in the future if the NAV continues to shrink.

Conclusion

The DoubleLine Income Solutions Fund is a fixed-income closed-end fund managed by revered portfolio manager, Jeff Gundlach. Unfortunately, my analysis indicates the DSL fund is yet another ‘return of principal’ fund that earns total returns less than its distribution yield. I recommend investors avoid ‘return of principal’ funds because they lead to long-term losses in both principal and income.

Read the full article here