Co-authored with Philip Mause

Eagle Bulk Shipping (NYSE:EGLE) closed Thursday at $48.61 a share. Its trailing twelve-month dividend is $4.70 for a yield of 9.6%. EGLE is a dry bulk shipper with a large fleet of 52 mid-sized cargo ships. It is a “clean” story in what has often been a somewhat besmirched industry.

Shipping stocks often show up on value screens with very low PE ratios and high dividend yields. More research often reveals that companies that are incorporated outside the United States are subject to looser supervision by the SEC, have an LP structure with the master partner taking a big share of cash flow, have multiple related party transactions with management firms, and – to top it off – have very high leverage. As a result, a seeming bargain does not look as attractive upon closer scrutiny.

EGLE is different from the vast majority of securities in this sector. It is a US-based corporation (incorporated in the Marshall Islands, which adopts Delaware corporate law) and is subject to full SEC jurisdiction. EGLE shareholders have the same claim on earnings as shareholders of other US-based companies – there is no master partner or management company with a related party conflict to share the earnings with. Perhaps most importantly, EGLE has very low leverage. Its net debt is a tiny bit more than 1/2 of its full-year 2022 EBITDA.

The Business

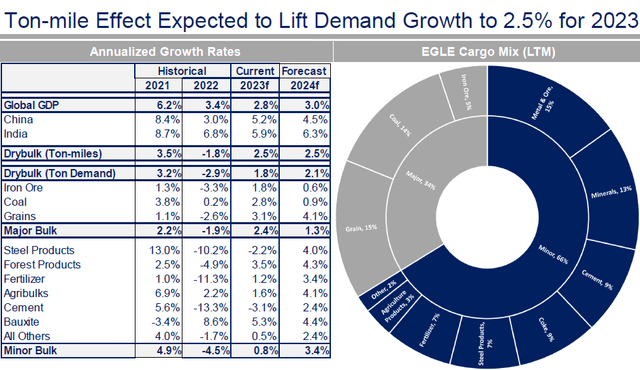

EGLE is in the dry bulk shipping business. Dry bulk is pretty much what it sounds like. It does not include tankers or container ships. Dry bulk ships generally transport raw materials (and some other items) in bulk in the holds of the ships. Coal, iron ore, and grain are some of the largest components of traffic. Mid-sized and smaller container ships are generally versatile and can also carry sugar, nickel ore, forest products, and scrap. The volume of traffic is somewhat seasonal and also cyclical, which gives companies with light debt loads an enormous advantage. Source

EGLE May 2023 Presentation

The industry has come under environmental scrutiny in recent years. Ships without scrubbers are required to burn much more expensive low-sulfur fuel. 50 of EGLE’s 52 ships have scrubbers, and this allows them to burn cheaper fuel. Environmental rules may lead some ships to be scrapped at earlier than expected dates. In some circumstances, ships are taken offline in order to be retrofitted or have to operate at slower speeds. All of this has the effect of reducing capacity and creating more price support for ships in compliance with the rules.

Recent Results

2022 was a solid year for the industry and for EGLE. Revenue was $719.8 million, and net income came in at $248 million or $19.09 per share (so that – at its current price – EGLE is trading for a little more than two times last year’s earnings). 2022 EBITDA was $326.2 million. Readers should be aware that – in contrast to some other industries – depreciation allowances in the shipping industry generally reflect a real year-to-year decline in the value of the ships.

The first quarter of 2023 was weak for the industry. EGLE’s revenue came in at $105.2 million with a net income of $3.2 million or 24 cents a share. While trailing twelve-month dividends are $4.70, dividends in the first quarter of 2023 were only 10 cents. EGLE now has a dividend policy of paying 30% of net income as dividends but in no case paying less than 10 cents a quarter.

EGLE has a solid balance sheet with (as of the end of the 2023 first quarter) total debt of $322.6 million and cash of $153.2 million for net debt of $169.4 million. It has been calculated that net debt is now 15.7% of fair market fleet value.

EGLE does not have an explicit policy to eliminate net debt, although it has paid debt down considerably in recent years. It also appears to be willing to take judicious steps to update its fleet even if a debt increase is necessary to achieve this objective. In recent months, EGLE appears to be taking advantage of a somewhat depressed market for ships. It has sold three ships built in 2011 and bought two ships built in 2020 at a net cost of $10.4 million. It has also increased its borrowing capacity by $175 million.

Fair Market Valuation

EGLE has provided (in its latest earnings presentation) pro forma financial calculations setting forth its balance sheet after the above-described transactions. Net debt is $179.4 million. EGLE calculates that net debt is 15.7% of the value of its fleet. Using these numbers, we can back into an estimate of EGLE’s fleet value and, thus, the fair market value of the company.

Based on the 15.7% number, the value of EGLE’s fleet would come to $1.14 billion. At this point, in order to do a per-share calculation, we have to take into account that EGLE has convertible bonds which would convert to 3.235 million shares if converted (the conversion price is $32.19 a share so that it is fair to assume that they will be converted). Added to EGLE’s current share count, we would have fully diluted shares of 16.3 million. If we are assuming that the bonds are to be converted, then we have to subtract the face value of the bonds ($104.1 million) from net debt bringing net debt to $75 million. This reduces the net asset value of EGLE from $1.14 billion to $1.039 billion. Dividing this number by 16.3 million shares gets to a per-share net fair asset value of $63.74 – well in excess of the current share price.

EGLE’s numbers seem to make sense. It has – in its pro forma – some 52 vessels. The valuation numbers imply valuations of a little more than $20 million per vessel. EGLE just paid about $30 million apiece for two 2020 vessels with scrubbers and was paid about $16 million apiece for three old (2011) vessels without scrubbers. Most (48 of 50) of EGLE’s other vessels have scrubbers, and most are newer than the vessels that EGLE just sold but older than the vessels that EGLE just bought. So an average price of a little over $20 million for these vessels seems to be – if anything – a conservative valuation.

Outlook

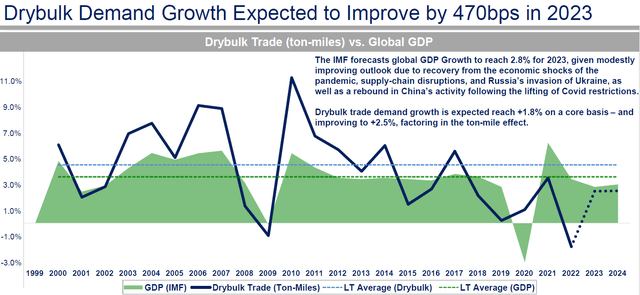

EGLE protects itself from the swings in demand by using some advanced charters. In that regard, the evidence appears to be that the dry bulk market bottomed out in the first quarter and is recovering.

EGLE May 2023 Presentation

Of course, a great deal depends upon the recovery of the Chinese market as well as other global economic developments. The dry bulk fleet is aging and the “order book” is not robust, so capacity could get tight if demand picks up. With a low debt load, EGLE is in a good position to ride out a slow market and perhaps even add capacity at low prices.

Recommendation

Shipping stocks are not “buy it and go to sleep” investments. The industry is subject to cycles. Most importantly for dividend investors – EGLE’S DIVIDENDS WILL VARY CONSIDERABLY FROM QUARTER TO QUARTER AND YEAR TO YEAR. It is, however, a reasonably safe assumption that investors at the current price will see a very solid yield on original cost over a 3 to 5-year period, but there is no guarantee that the dividends will reliably come in like clockwork.

Subject to these caveats, EGLE stock is very attractive at the current price.

Read the full article here