Investment Thesis

Ecopetrol (NYSE:EC) is popular among high-dividend investors, and it is based on last year’s earnings and is paid out in three steps. Given the lower oil prices and, thus, falling EPS, the dividend should be significantly lower next year. The company’s plans include a further oil production increase until 2030 and a general strategy shift towards renewable energies, hydrogen, CO2 storage, and energy transmission. It isn’t easy to find out the exact ratio of the future car pack, how much of the profit from oil and gas will be invested, and how much will be left for dividends in the future. Moreover, in the case of this company, the political risk seems to be real; the President seems determined not to issue any more oil exploration licenses. Given this ambiguity and risk, I will wait and see.

Company Overview

I became aware of the company because I’m invested in Petrobras (PBR). In the comments, someone mentioned Ecopetrol. The two companies have several things in common: based in South America, cheap valuations and high dividend yields, politically rather left-wing country, high government shareholding, and uncertainty about the future course of the companies due to the political leadership. The big questions are if the companies will pull back more and more from their cash flow generating oil and gas investments and instead focus on renewables, hydrogen, and similar areas.

2040 corporate strategy

The 2040 plan is the company’s long-term strategy based on several pillars:

1. Grow with the Energy Transition

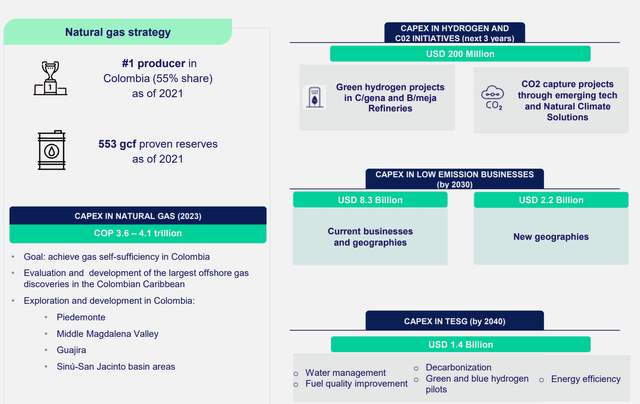

The focus is on maintaining competitiveness in the hydrocarbon business while investing in technologies to produce and improve gas supplies. The plan calls for substantial investments, mainly in upstream projects. The long-term goal includes diversification into low-emission businesses, investments in green hydrogen, and carbon capture projects.

2. Generate Value Through TESG

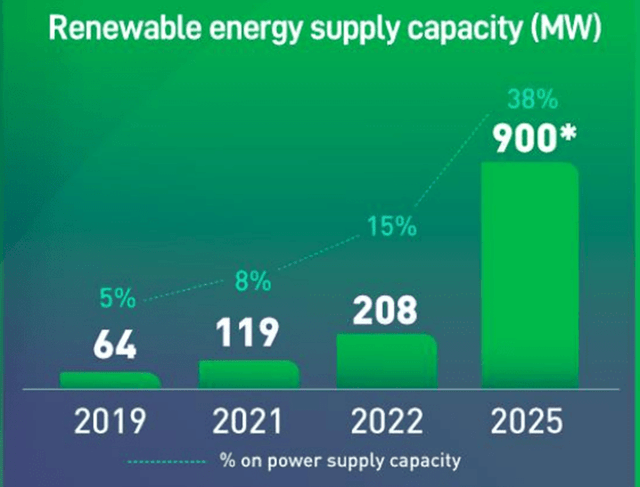

This strategy focuses on building ethical relationships with stakeholders and promoting environmentally responsible operations. The 2022-2024 plan includes investments in water management, decarbonization, and alternative energy sources. The goal is to support the energy transition, increasing self-generation capacity with renewables. Long-term targets involve achieving net-zero emissions by 2050, zero routine gas flaring by 2030, and contributing significantly to education and job creation in Colombia.

3. Cutting-edge Knowledge

This pillar aims to build capabilities through comprehensive science, technology, and innovation strategies. This includes allocating over $240 million to projects involving digital transformation, cyberdefense, and production optimization. The long-term goals include generating significant cumulative EBITDA through technology and innovation, reskilling a majority of workers by 2030, and achieving full automation of talent processes.

4. Competitive Returns

The final pillar involves capital discipline, efficient resource use, and cash protection. With a breakeven price of 36 USD/Bl for investment projects, the plan is set to yield incremental returns above capital discipline pricing. A new competitiveness agenda is designed to achieve significant efficiencies by 2024, thus reducing costs across the board. Long-term objectives include consistently high EBITDA, achieving a ROACE between 8% and 10%, maintaining a dividend policy of 40% to 60%, and keeping the Gross Debt/EBITDA ratio below 2.5x.

The Plan is profitable and robust at Brent prices of 63 USD/Bl for 2022 and 60 USD/Bl for 2023 and 2024, with an EBITDA margin above 40%.

2040 Strategy

EBITDA from the energy transition

Overall, the company seems to be very serious about shifting the share of its EBITDA away from hydrocarbons and towards renewables. For investors, it is essential to know that operating wind and solar farms can generate significant cash but only after years of investment. I am also invested in Brookfield Renewable Partners (BEP); they deliver good returns and rising dividends. The same applies to Brookfield Infrastructure Partners (BIP), which operates in the business of energy transmission and toll roads.

Investor presentation

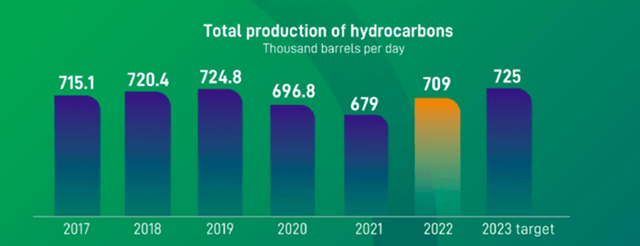

However, the revenues from oil and gas are not to be reduced but increased in order to be invested in low-emission areas, and energy transmission. The company has managed to significantly ramp up production in 2022, and this is expected to be even higher in 2023.

Investor presentation

The following quote is from February 2022, when the company announced its new strategy. Given the numbers given here, the company seems to be on track to meet its own targets, and by 2030 production would be almost 20% higher again.

The Plan estimates production levels of between 700 and 705 thousand barrels of oil equivalent per day (mboed) in 2022, reaching levels close to 730 mboed in 2024. In terms of unconventional reservoirs, investments totaling USD 1,870 million are expected by 2024 to continue to grow in the US Permian basin. In the long term, the Plan seeks to strengthen the EBITDA by maximizing reserves and production, pursuing resilience and competitiveness. The expected production in 2030 is nearly 850 mboed.

The Ecopetrol Group launches its 2040 Strategy

CAPEX

In the distribution of CAPEX, we see in which direction the company is heading. CAPEX for the oil business is mentioned elsewhere but not in the 2040 Strategy paper. It is a bit confusing. But as I showed earlier, the company is still increasing its oil production, and this is expected to continue until at least 2030. As for the total CAPEX for oil & gas the company writes:

(…) maintain our competitiveness in the integrated hydrocarbon chain and increase gas supply, offshore exploration (…)

On average, between USD 5,200 and USD 6,000 million are expected to be invested annually by 2040. Between 2022 and 2024, organic investments are expected to be in a range between USD 17,000 million and USD 20,000 million (between COP 65 and COP 76 trillion), of which 69% is expected to be allocated to projects in the upstream segment, focused on domestic exploration in the Piedemonte Llanero and the Mid-Magdalena Valley basins, and the Colombian Caribbean offshore, with international exploration in the United States and Brazil.

Investor presentation

So if an average of $5.5B per year is to be spent on oil and gas combined, according to the slide above, about 4 trillion COP ($1B) for gas leaves about $4.5B for oil. That doesn’t sound like a small amount, but we can see the company’s strategic shift when you look at the numbers on the right side of the slide, which add up to over $10B for renewables, decarbonization, and so on.

Financial Progress & Valuation

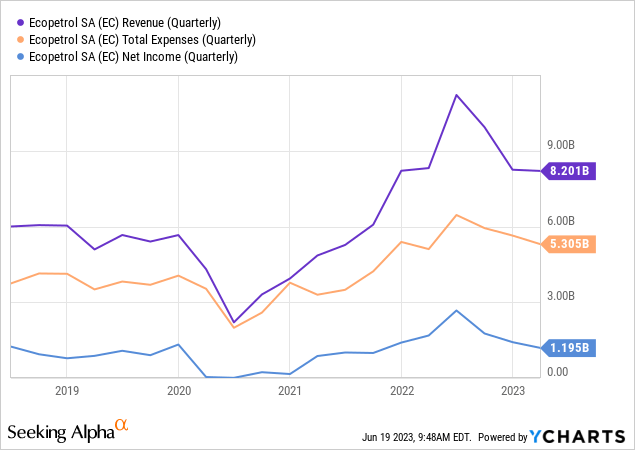

First, a short overview over a longer period for revenues, expenses, and net income. Like all companies in the sector, Ecopetrol has experienced a boom year in 2022.

YCharts

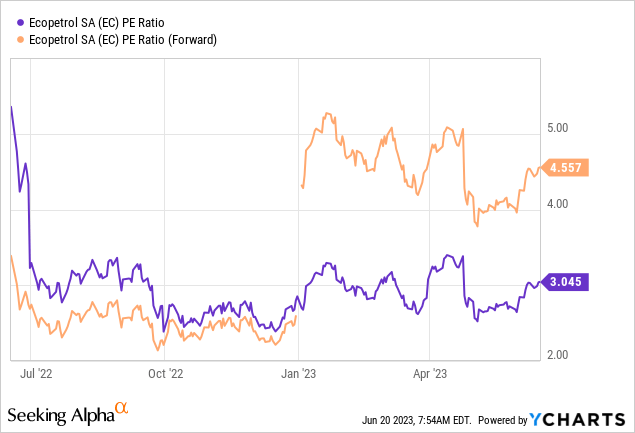

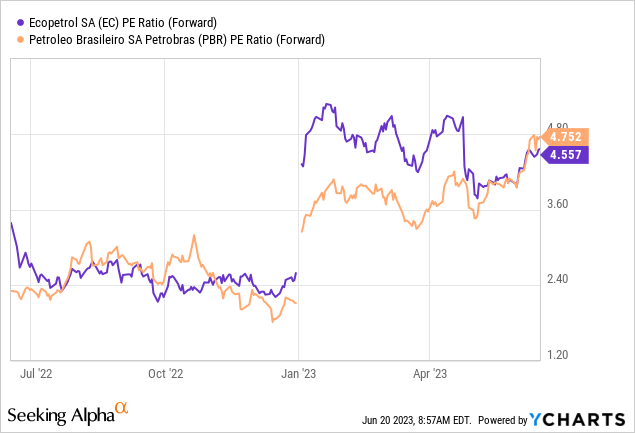

The company is currently valued at an enterprise value of $52B. The market cap is $21.68B, and the total debt is about $25B. The P/E and forward P/E ratios are shown below.

Ycharts

Compared with Petrobras, both are currently valued almost equally.

YCharts

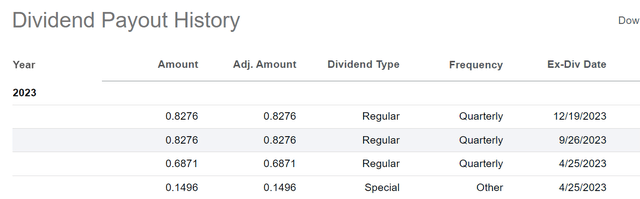

Regarding the dividend, the plan is to pay out 60% of net income as a dividend. This year’s dividend is based on 2022 earnings and will be distributed in three equal payments, so we can already see the future distribution on Seeking Alpha. Probably these figures are not quite correct as the dividend was originally declared in Colombian pesos, and the 11,860 COP would currently correspond to even $2.84, more than stated here.

Seeking Alpha

On the current share price, this corresponds to a yield of about 28%, and those who buy the shares now could still receive two dividends this year. Next year’s dividend will be based on 2023 results and is likely to be significantly lower, if only due to the much lower oil prices this year.

Risks

One current development in several South American countries is the left political orientation and the higher state influence that goes along with it. An excellent article on Seeking Alpha describes this company’s political situation and dangers well.

I’m not arguing that this is a bad investment, I am arguing that this is one that you should skip over if you are not looking to play roulette with your money. Ecopetrol is a company that is now in the hands of allies of a former communist rebel and at the mercy of his political whims. While it’s certainly possible that Petro could wake up tomorrow and decide that he wants to do a complete 180 on his energy policies, I think that this is highly unlikely. For those looking to invest in oil, I would suggest you forget the dividend here and look for a company with actual growth potential as there are many out there.

Ecopetrol Now At The Mercy Of New Left-Wing Government, And Exploration Restrictions

More info is also available in this article.

How radical is Petro’s plan on oil exploration? For critics, Petro’s oil policy amounts to “economic suicide.” Many warn his plan to boost agriculture and tourism won’t be enough to make up for lost oil export earnings, potentially leaving a big hole in public finances. Analysts have predicted a significant devaluation of the peso against the dollar as a result of falling investor confidence in Colombia.

No Oil Producer Wants to Be the First to Give Up the Fuel. Except Gustavo Petro’s Colombia

The President does not want to issue new licenses to explore new oil wells, but the processing of already issued licenses remains allowed. However, Ecopetrol needs new wells and further exploration because the existing oil reserves only have a lifetime of 8 more years. There may be some additional future production from licenses that have already been issued. But the thing about oil is that the production rate decreases towards the end of the well’s life. For Ecopetrol, this would mean that less and less oil is produced each year. However, this development could still be a few years away. At least in 2023, the production rate should be slightly higher than in 2022, as shown above.

The market had similar concerns in the case of Petrobras, but nothing concrete has materialized (at least so far). With every day that passes, the chances are higher that, in the end, it was all political talk, but the Brazilian government of President Lula will change much less than one might have feared. The Brazilian government has a significant share in the company and earns tens of billions annually in dividends and taxes (the same is true for Ecopetrol and Colombia). I am still invested in Petrobras and do not intend to change anything here. See here my latest article on the company. By the way, Lula even commented on his Colombian counterparty and his plans.

As part of his campaign, Petro vowed to immediately stop issuing new permits for oil exploration—a big deal in a country where oil makes up 40% of exports and 12% of government income. Petro also called on Lula, who could become his most important regional ally, to join him. So, would he?“ Look, Petro has the right to propose whatever he wants,” Lula said, smiling and shaking his head as if we were discussing an eccentric old friend. “But, in the case of Brazil, this is not for real. In the case of the world, it’s not for real.

No Oil Producer Wants to Be the First to Give Up the Fuel. Except Gustavo Petro’s Colombia

There is also currency risk, as the company declares its income and dividends in Colombian Pesos, which are later converted into Dollars. Currency fluctuations are always a risk and also an opportunity at the same time.

Another risk for shareholders looking for high dividends is that the company reduces distributable income by investing in renewable energies. I have nothing against renewable energies, but they need years to return the invested money. The same applies to hydrogen, or it is even worse: hydrogen has not even proven itself on a large scale, unlike solar.

Investor presentation

Conclusion: A bit risky

Ecopetrol is cheaply valued, but at the peak of its political risk, Petrobras was priced even lower than EC right now. Overall, I think Petrobras is also the better investment: the president of Brazil does not seem to be as extreme as that of Colombia. In addition, the shift towards renewable energies and hydrogen is not yet as visible at Petrobras. It may also come here, but it is not quite the case yet. The strange thing is that the president is so much against oil, but the company itself wants to expand its production until 2030. This contradiction is not a pleasant environment for investors.

Furthermore, the hydrogen plan may be just money-burning. I am not yet convinced of hydrogen’s benefits and economic feasibility. And I’m even less convinced about areas like CO2 capture.

The company looks like the dividend king on paper, but next year the dividend should be significantly lower due to the fall in oil prices. How much net profit will be left after those significant CAPEX numbers for all kinds of new energy is also unclear. So investing at this point seems a bit risky, and I think Petrobras is a more attractive investment.

Read the full article here