Editas Medicine (NASDAQ:EDIT) stands at the forefront of biotech innovation, harnessing the power of CRISPR-Cas9 gene editing to pioneer groundbreaking advancements in medicine. One of these cutting-edge therapies is the company’s Sickle Cell Disease (SCD) and beta-thalassemia (TBT) candidate reni-cel (EDIT-301), which has produced impressive data thus far in its development. However, the competitive landscape of gene-editing therapies for SCD is strengthening with three leading contenders.

- reni-cel by Editas Medicine

- Casgevy by Vertex Pharmaceuticals (VRTX) and CRISPR Therapeutics (CRSP)

- Lyfgenia by bluebird bio (BLUE)

Casgevy and Lyfgenia were recently approved by the U.S. FDA, whereas reni-cel is still moving through the regulatory pathway. Although reni-cel shows promise in SCD and TBT, investors should be aware of the other two gene therapies that have a head-start in what could be a highly congested market.

I intend to provide a brief background on Editas Therapeutics and their SCD and TBT programs. In addition, I discuss the Vertex/CRISPR and bluebird bio therapies. Finally, I deliberate on how the competition’s gene therapy products have impacted my EDIT bull thesis.

Background On Editas Therapeutics

Since their inception a decade ago, Editas Therapeutics has become a pioneer in the gene editing arena. Dedicated to leveraging the avant-garde CRISPR-Cas9 technology, the company specializes in developing therapies for genetic disorders. This cutting-edge tech enables precise modification of genes, offering unparalleled possibilities for treating several genetic diseases.

Editas is actively exploring gene editing therapy for hemoglobinopathies, Reni-cel, targeting SCD and TBT.

reni-cel Status

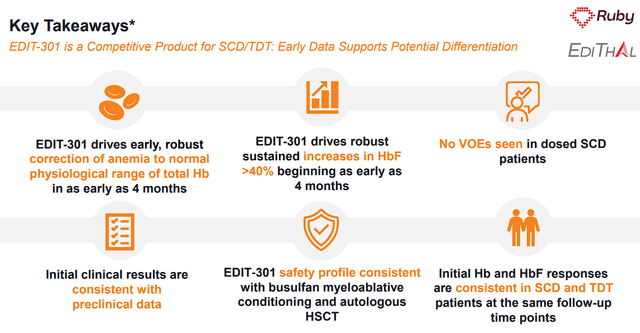

Recent safety and efficacy data from Editas Medicine’s RUBY and EdiTHAL trials for reni-cel (renizgamglogene autogedtemcel), once known as EDIT-301, present a promising outlook. All 17 patients across both trials validated reni-cel’s well-tolerated safety profile, consistent with myeloablative conditioning with busulfan and autologous HSC transplant. The absence of SAEs related to the treatment provides reassurance regarding reni-cel’s safety.

In the RUBY trial for severe SCD, reni-cel showcased significant efficacy, with treated patients not experiencing vaso-occlusive events (VOEs) post-infusion, marking a substantial improvement in their quality of life. Patients with at least five months of follow-up not only maintained a normal hemoglobin level but also exhibited a fetal hemoglobin level over and above 40%, emphasizing the potential of reni-cel as a durable and transformative cure for severe SCD.

Editas Therapeutics Ruby Trial Takeaways (Editas Therapeutics)

In the EdiTHAL trial for TBT, early and robust increases in total hemoglobin and fetal hemoglobin in patients with more than one month of follow-up are encouraging. The rise in total hemoglobin surpassed the transfusion independence threshold of 9 g/dL, indicating a potential shift towards independence from regular transfusions. These outcomes underscore the broad applicability of reni-cel across different hemoglobinopathies.

The positive neutrophil engraftment within one month and platelet engraftment within 1.6 months post-reni-cel infusion are critical aspects of the therapy’s efficacy. Moreover, patients with more than two months of follow-up confirmed positive neutrophil engraftment within one month. The continuous positive arc of total hemoglobin and fetal hemoglobin levels in patients with varying follow-up periods adds to the stability and sustainability of reni-cel’s effect.

The company expects to provide clinical updates around mid-2024.

Room For Reni-Cel Sickle Cell Disease?

As I previously mentioned, both Casgevy and Lyfgenia have already been approved by the FDA for SCD. So, Editas is behind Vertex/CRISPR and bluebird at the moment in SCD, but this might not be a race to be first, but more of a clinical battle to see who is best. Let’s review some of the clinical data from these programs to determine who might produce the best results for patients dealing with SCD.

Vertex Pharmaceuticals, in collaboration with CRISPR Therapeutics, developed Casgevy using CRISPR-Cas9 technology to edit the patient’s own hematopoietic (blood) stem cells (HSCs). The goal is to correct the genetic mutation responsible for SCD, addressing the root cause. Editas is also utilizing CRISPR-Cas9 gene-editing technology for its sickle cell therapy, involving the modification of the patient’s HSCs to fix the genetic mutation-producing SCD. LYFGENIA, developed by bluebird bio, is a gene therapy designed to address sickle cell disease by permanently introducing a functional β-globin gene into a patient’s HSCs. So, both Vertex/CRISPR and Editas Therapeutics use CRISPR-Cas9 technology for gene editing in their sickle cell therapies, while bluebird takes another route.

Editas Medicine’s reni-cel shows promising results, particularly in the RUBY trial, with patients achieving normal hemoglobin levels, and being free of vaso-occlusive events (VOEs) post-infusion. Both of these bode well for a potential approval in SCD.

Casgevy (exa-cel) by Vertex and CRISPR Therapeutics stands out for its robust outcomes in both SCD and TBT trials. The high percentage of SCD patients meeting the primary endpoint of freedom from VOC for at least 12 consecutive months is noteworthy.

bluebird bio’s Lyfgenia (lovo-cel) therapy might have an edge with long-term data through five years, providing valuable insights into its sustained efficacy. The stable production of anti-sickling adult hemoglobin, along with the elimination or reduction of VOEs, suggests a durable impact on the underlying cause of SCD.

In considering these analyses, factors such as long-term safety profiles, and individual patient responses become critical in determining the optimal therapy. While Casgevy stands out with a larger patient cohort and robust clinical outcomes, Lyfgenia’s long-term data provides a compelling narrative for sustained efficacy. The limited data from reni-cel necessitates further exploration to ascertain its comparative efficacy and safety. However, as reni-cel progresses through regulatory assessments and additional trials, we could see it edge out the current approved therapies. However, I am convinced the winner in SCD and TBT will require ongoing confirmatory trials and collaboration with healthcare professionals. Then again, it may turn out all three are worthy of consideration and providers will need to determine which therapy is best tailored to individual patient needs and individualities.

Considering The Price

The approval of Casgevy and Lyfgenia for SCD brought attention to the growing list of million-dollar medicines, priced at $2.2M and $3.1M, respectively. These prices underscore the importance of making these curative treatments accessible, raising accessibility concerns, especially for Medicaid-covered patients. So, if Editas can gain approval with little-to-no edge in the clinic, they could price reni-cel under Casgevy and Lyfgenia to gain an edge on the commercial side.

License Deal With Vertex

Editas recently announced they have entered into a license agreement with Vertex, granting Vertex a non-exclusive license for Editas’ Cas9 gene editing technology. This tech license is intended for use in ex vivo gene editing medicines targeting the BCL11A gene, specifically for SCD and TBT, including CASGEVY.

As a result, Editas believes their cash runway has moved into 2026. In addition, Vertex’s deal with Editas appears to be a concession that Editas has a legitimate edge in the CRISPR-Cas9 patent/IP battle.

Risks To Consider

As with any investment, it’s crucial to acknowledge potential risks. Regulatory hurdles, unforeseen safety issues, and the evolving ethical considerations surrounding gene editing technology could pose challenges. Competition in the biotech sector is fierce, and the success of Editas’ therapies is not guaranteed. Not only would Editas have to deal with Casgevy and Lyfgenia on the market, but potentially some of the other SCD gene therapies from Beam Therapeutics (BEAM), and Sangamo Therapeutics (SGMO) (waiting for a partner for Phase III).

Another risk to consider is the established drugs from Pfizer (PFE), which acquired the market leader in sickle cell disease, Global Blood Therapeutics. At the time of the acquisition, Global Blood Therapeutics’ flagship product was Oxybryta, which works by inhibiting the polymerization of hemoglobin S, preventing the formation of the characteristic sickle-shaped cells. However, it is not a gene therapy, which could make it a more attractive therapy for some patients or providers who are not comfortable with gene therapies.

Last but not least… intellectual property battles. The legal battle between Editas Therapeutics and CRISPR Therapeutics revolves around the ownership of crucial patents related to the CRISPR-Cas9 technology. The primary matter of contention is the foundational intellectual property connected with the gene-editing system.

The patent landscape for CRISPR technology is complex, involving a run of legal disputes and settlements. Initially, there were disputes between the Broad Institute/MIT, where Feng Zhang, a researcher, was awarded patents related to CRISPR-Cas9, and the University of California, where Charpentier and Doudna conducted their research.

However, the conflict has now shifted to a new battleground, with Editas Therapeutics and CRISPR Therapeutics locking horns over specific patents that Editas obtained from the Broad Institute/MIT. The nature of the dispute involves the interpretation of claims within these patents and their overlap with CRISPR Therapeutics’ own innovations and IP. Although Editas has had some victories with patents and their license deal with Vertex, I don’t see this IP battle having a clear winner and coming to a comprehensive conclusion anytime soon. Berkeley can still file appeals, and European patents appear to be still undecided. Since Vertex/CRISPR just received approval for their CRISPR-Cas9 therapy, Editas and the Broad Institute might be taking legal action to claim some rights to Casgevy, I must consider this to be a serious risk for EDIT investors and will be a source of volatility for the foreseeable future.

Considering these risks, I am giving EDIT a conviction level of 3 out of 5 and the ticker will remain in the Compounding Healthcare “Bio Boom” speculative portfolio.

Impact On My EDIT Thesis

Editas Therapeutics holds immense promise as a pioneer in the gene editing field, offering investors a unique opportunity to participate in the future of medicine. With a robust pipeline and strategic collaborations, Editas is well-positioned to capitalize on the growing gene therapy market. Although Vertex/CRISPR and bluebird bio have a head start, I believe Editas still has an opportunity to prove that reni-cel can match, or possibly outperform in the clinic. I believe the recent SCD and TBT data points to reni-cel being at least competitive at the moment. If not, the company could offer a more competitive price, which would bring support from payers. Even if Editas is not able to compete in the market, an approved gene editing product would at least validate the company’s platform technology.

Therefore, I don’t see the Casgevy and Lyfgenia approvals to have a dramatic impact on my EDIT bull thesis. Although it will be a tough road, I believe Editas still has an opportunity to be a major player in SCD, TBT, and numerous other genetic disorders.

Moreover, Editas has a healthy cash position to push their current pipeline and regulatory activities. In terms of cash, the company finished Q3 with $446M compared to $480M at the end of Q2, which had their cash runway going “into the third quarter of 2025.” However, the Vertex license deal moved the runway into 2026.

While risks exist, the potential rewards for investors make EDIT an intriguing prospect in the rapidly evolving landscape of gene therapy.

My Plan

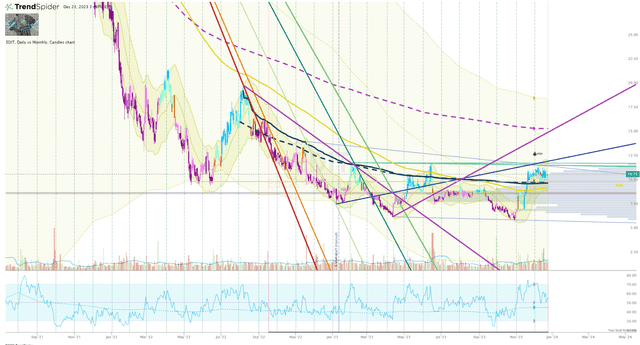

The approvals of Casgevy and Lyfgenia forced me to revisit my dormant EDIT position to find that the ticker is in better shape than I thought it would be. Looking at the Daily Chart, EDIT is showing a nice setup from a double-bottom and is trading above the anchored-VWAP from the August 2022 high.

EDIT Daily Chart (Trendspider)

In addition, the share price broke out of several long-term downtrend rays and is bullish on the Go-No-Go indicator. So, EDIT’s technical rating is improving… unfortunately, it is trading above my Buy Threshold, so I am going to hold off on adding to the position at this time. However, I am going to set a respectable buy order right on my Buy Threshold. If that order is filled, I will set sell orders at my Sell Targets in order to book some profit and move my EDIT position into a house money status for a long-term investment.

Read the full article here