I’ve had more comebacks than Frank Sinatra. – Louis Walsh.

On Twitter, I recently alluded to the idea that I think there are three “fat pitch” trades coming up. The first is a small-cap surge beyond what we’ve already seen to suck in more bulls. The second is the return of real risk-off, where Treasuries get bid and equities broadly fall. The third is the return of emerging market momentum.

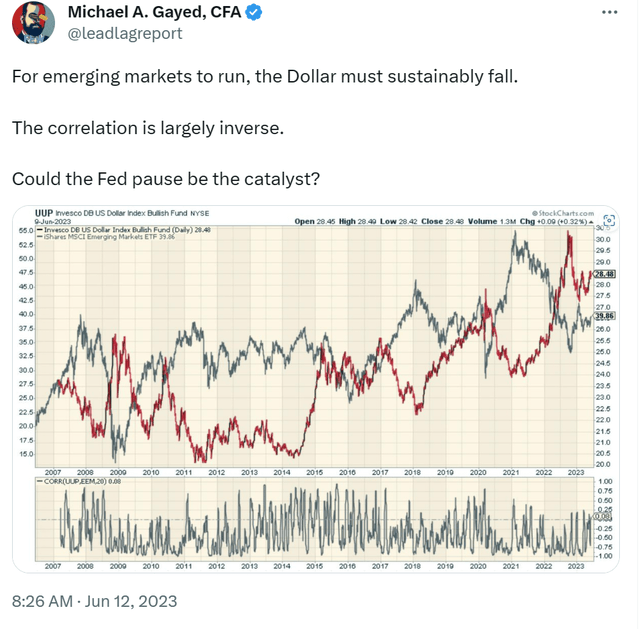

I want to focus on emerging markets (“EM”) here, which have been like volatile cash for over a decade, going nowhere. The primary driver for this potential resurgence is the anticipated halt in Federal Reserve rate hikes, which would, in turn, exert downward pressure on the U.S. dollar and subsequently benefit foreign assets. In this article, we will explore the various factors that contribute to this potential outcome and analyze the performance of the emerging markets ETF, iShares MSCI Emerging Markets ETF (NYSEARCA:EEM), in response to the trend in the U.S. dollar and interest rates.

The Impact of the U.S. Dollar on Emerging Markets

A strong U.S. dollar generally has adverse effects on emerging market economies. When the dollar (UUP) appreciates against other currencies, the costs of dollar-denominated debt for these countries increase, making it more difficult for them to service their loans. Furthermore, a stronger dollar can lead to capital outflows from emerging markets, as investors seek more attractive investment opportunities in the U.S.

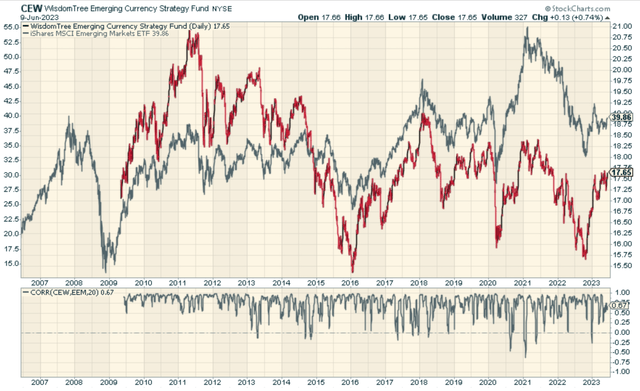

Conversely, a weaker U.S. dollar can be beneficial for emerging markets. As the value of the dollar decreases, emerging market currencies (CEW) strengthen, making it easier for these countries to service their dollar-denominated debt. A weaker dollar also promotes capital inflows into emerging markets, as investors search for higher returns outside of the U.S. Additionally, a weaker dollar can boost commodity prices, which generally benefits emerging market economies that are heavily reliant on commodity exports.

StockCharts.com

The Influence of Interest Rates on Emerging Markets

Rising interest rates in the U.S. can lead to tighter financial conditions in emerging markets. Higher U.S. interest rates can encourage capital outflows from emerging markets, as investors seek higher returns in the U.S. This can lead to currency depreciation and increased borrowing costs for emerging market governments and corporations. In the worst-case scenario, this can result in a higher risk of default for countries with high levels of foreign-denominated debt.

As the Federal Reserve moves closer to stopping its rate hikes, emerging markets stand to benefit from the downward pressure on the U.S. dollar. This could lead to a rebound in capital inflows to emerging markets, boosting their currencies and easing borrowing costs. Additionally, a halt in rate hikes could alleviate concerns about tighter financial conditions in emerging markets, reducing the risk of defaults.

This could result in a double whammy of performance as emerging market currencies rising alongside emerging market stocks means two sources of return – from the asset and the currency both moving in the same direction.

StockCharts.com

Investing in Emerging Markets ETF: EEM

The iShares MSCI Emerging Markets ETF is a popular investment vehicle for gaining exposure to a broad range of emerging market equities. The fund tracks the MSCI Emerging Markets Index, which includes large- and mid-cap stocks from 26 emerging market countries.

It’s been a horrible performer post Quantitative Easing 3 relative to U.S. markets because we were in a zero-interest rate policy framework. The price ratio of SPDR® S&P 500 ETF Trust (SPY) to EEM looks horrendous. I wonder if now the dynamic is about to finally favor an immense relative rally, with most investors having given up on investing overseas.

StockCharts.com

Conclusion

As the Federal Reserve moves closer to halting its rate hikes, emerging markets stand to benefit from the downward pressure on the U.S. dollar and the easing of financial conditions. Investors seeking exposure to these markets can consider the iShares MSCI Emerging Markets ETF as a means of gaining broad exposure to a diverse range of emerging market assets.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here