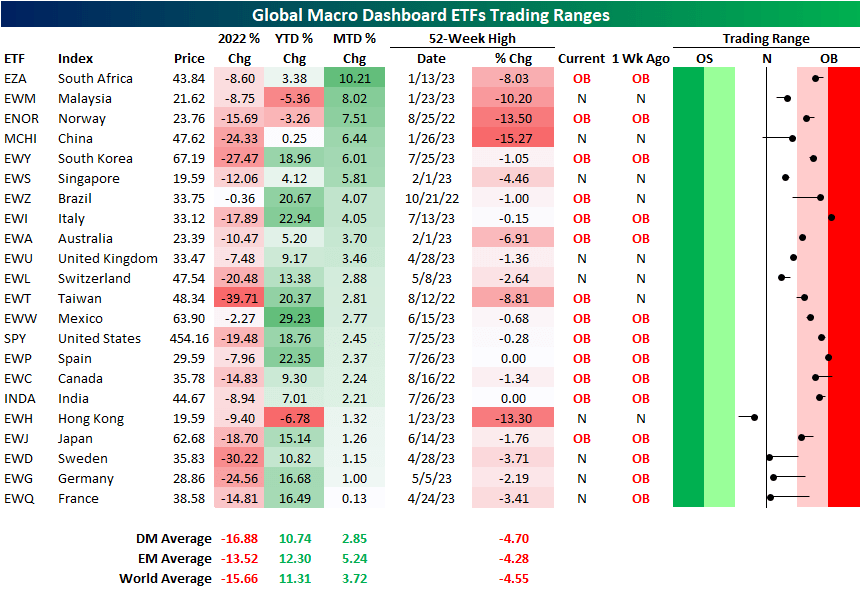

Today, we published our most recent Global Macro Dashboard which provides a high level summary of 22 major economies. Taking a look at those same countries’ stock markets via US traded ETFs, 2023 has seen broad rebounds in equity prices across the globe.

At the moment, the average country ETF is 4.55% away from a 52-week high after posting a double-digit YTD gain. Based on developed and emerging countries, there has been some divergence.

Both last year and again this year, emerging market equities have seen modest outperformance relative to developed markets. That has also been the case in July, with an average gain of 5.24% for EM countries versus a 2.85% rise for their developed market peers.

South Africa (EZA) is up the most month-to-date with a 10.2% gain, while France (EWQ) is up the least with a gain of just 13 bps so far in July.

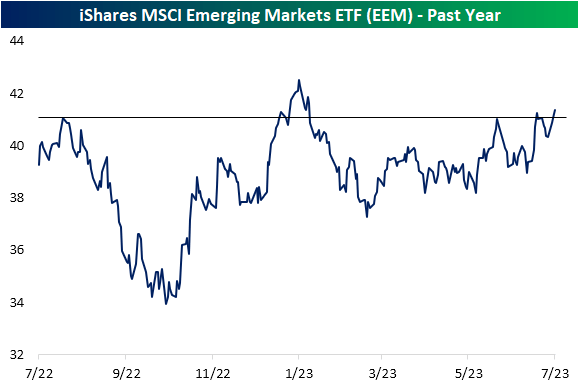

From a technical perspective, the gains in emerging markets – proxied by the iShares MSCI Emerging Markets ETF (EEM) – have resulted in a move above resistance at some of the past year’s highs.

As shown below, earlier in the spring and again only a couple of weeks ago, EEM attempted to retest the levels from last summer unsuccessfully. Today, EEM is back above those levels, with the next resistance to watch being the January high at $42.50.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here