The Internet’s global influence during the past couple of decades remains unmatched. The internet also gave rise to the now-powerful e-commerce industry, which continues to gain traction in 2023. The Internet and e-commerce have a uniquely strong presence in East Asia, especially in China. Despite this space’s room for growth, geopolitical tensions and domestic instability have provided said industries with an uphill battle in the near term. I believe that internet and e-commerce assets in East Asia will soon see record volatility and dampened profit margins. For these reasons, I rate the EMQQ The Emerging Markets Internet & Ecommerce ETF (NYSEARCA:EMQQ) a Sell.

Strategy

EMQQ tracks the EMQQ Emerging Markets Internet & Ecommerce Index. This index consists of emerging market securities that derive most of their revenues from companies involved in e-commerce and the Internet. Such companies are primarily involved in the provision of Internet services, online retail, digital marketing, and online marketplaces. The same institutions must have a market capitalization of at least $300mm and a three-month average daily turnover of no less than $1mm.

EMQQ is rebalanced semi-annually, ensuring that the most liquid securities take primary spots in the fund and that those with lesser liquidity are promptly sold. Investors might also want to consider trading costs and tax inefficiencies created by this rebalancing schedule. Furthermore, this aspect may also contribute to EMQQ’s high expense ratio, as depicted below.

Seeking Alpha

Holdings Analysis

EMQQ dabbles mainly in consumer cyclical and communication stocks, reflecting this fund’s focus on online sales and internet applications. These two sectors comprise all but a quarter of the total sector composition.

Seeking Alpha

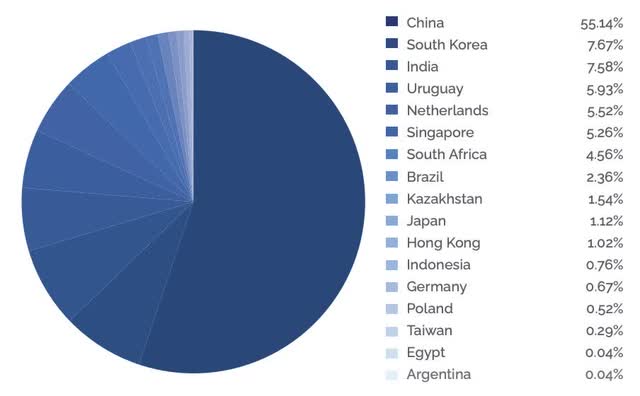

This ETF’s holdings reside mainly in China, which houses over half of the total holdings. Non-Chinese regions are abundant and quite dispersed in this ETF. On this note, not one of these countries comprises more than 7% of the geographical breakdown in EMQQ.

EMQQ

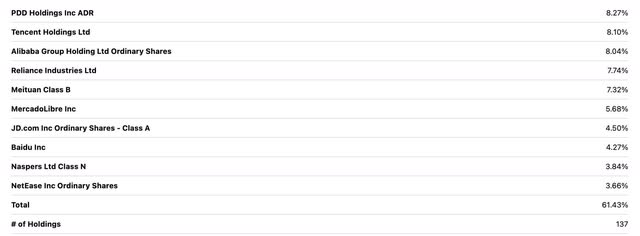

The top three holdings in EMQQ are all Chinese e-commerce giants and account for almost a quarter of this ETF. The top 10 holdings make up over 60% of EMQQ. Despite its numerous holdings, investors should realize that only a few stocks in EMQQ actually have the propensity to push the needle in the long term.

Seeking Alpha

Currency Fluctuations: The United States Vs. Emerging Markets

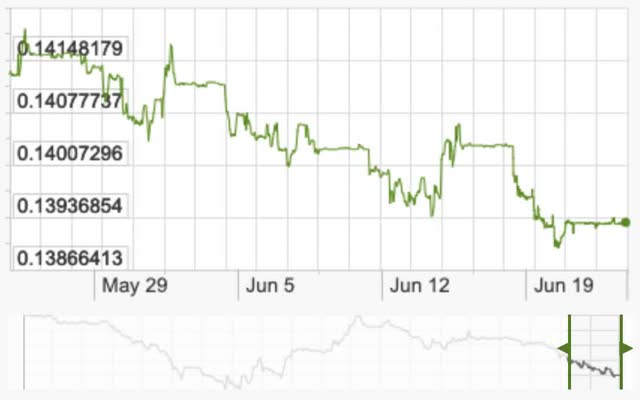

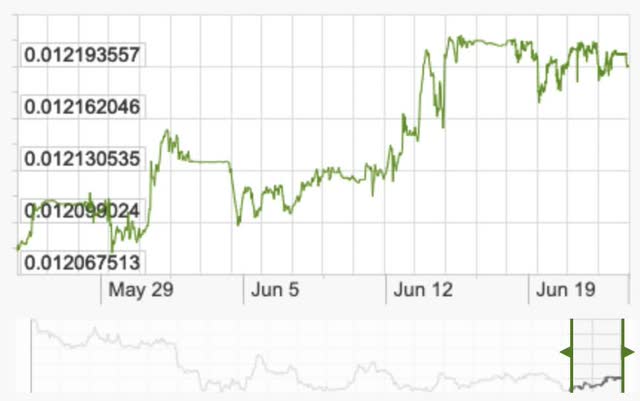

The United States Dollar has weakened in recent times after Jerome Powell’s recent testimony. The United States Dollar is still somewhat strong compared to both the Chinese Yuan and the South Korean Won, the currencies of the two most represented nations in EMQQ. Below is the exchange rate of Chinese Yuan to United States Dollars.

X-RATES

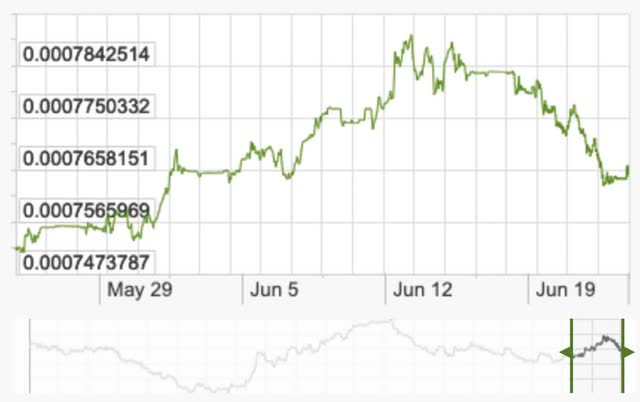

Below is the exchange rate of South Korean Won to United States Dollars. Though it has not consistently declined like the Chinese Yuan, the South Korean Won has dipped in recent times, and my stance remains bearish.

X-RATES

Evidently, East Asian emerging markets may be struggling similar to the United States. I, therefore, believe EMQQ and similar funds aren’t yet the go-to assets even as the United States economy takes a downturn. Alternatively, the Indian Rupee is getting progressively stronger than the United States Dollar.

X-RATES

Investors that wish for a narrower exposure to the economy in India should consider the iShares MSCI India ETF (INDA).

The Rise of E-commerce in China and How It Has Reflected In The United States

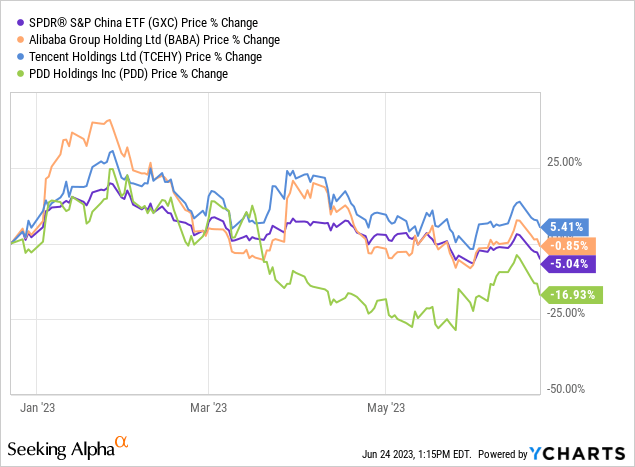

E-commerce in China has been doing somewhat well compared to the rest of the economy. Alibaba (BABA) and Tencent (OTCPK:TCEHY) have outperformed the broader market slightly, while PDD Holdings Inc. (PDD) has had a much harder time.

I believe PDD’s relatively poor performance is attributable to its narrower, niche focus on agriculture, while Alibaba and Tencent provide a broader range of products.

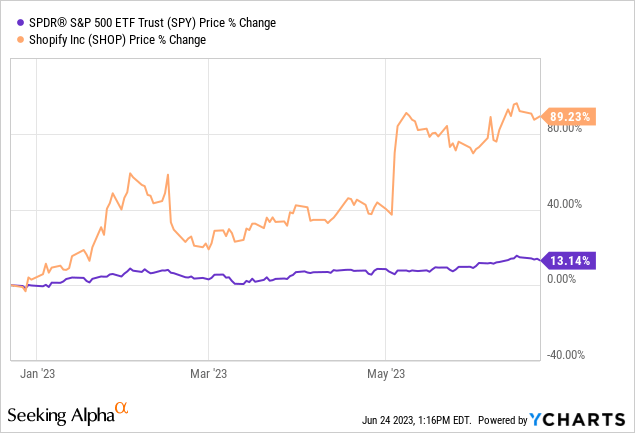

Alibaba is also gaining traction in the United States with the rise of business models like dropshipping. Dropshippers often rely on outsourcing from names like Alibaba and Aliexpress which offer cheap products in bulk. Such businesses involve reselling the same products at higher prices and sometimes reaping generous profits. Dropshipping has exploded in popularity since the COVID pandemic due to its low barriers to entry and its solely-remote nature. I believe this trend has contributed significantly to growth in Shopify (SHOP) thus far and could provide the same fuel to Alibaba and Tencent in the coming periods.

Long-Term Concerns and Threats

Ethical Dilemmas

The Internet has enhanced both business and everyday life since its inception by creating new avenues for public influence and digital marketing. The internet at the same time became associated with misinformation, hate, and scamming by many people. As the internet gets more advanced and acquires more regular users, it could simultaneously become a hotspot for hackers and other online entities with ill intentions. This risk could become quite serious when also considering geopolitical risks between China and the United States, and how the internet could become a vessel for espionage and other online attacks.

Censorship

China has the most censored internet environment in the world. This could in the near future, hurt the profitability of internet ETFs with heavy exposure to China. This could unfold as fewer users worldwide have access to Chinese internet companies and services. In the long term, those outside of China may become increasingly uninterested in such heavily-censored media when more unfiltered alternatives exist, and allow for a more seamless browsing experience. This could greatly hurt the returns of EMQQ.

Conclusion

As the United States economy approaches treacherous territory, I believe many will resort to emerging market funds. However, these same investors may realize soon after that many emerging economies continue with their own struggles. I plan to closely watch the economies of both the United States and China in the future in gauging the quality of EMQQ down the road. I still don’t believe now to be the time for emerging markets, as the overall risk trumps the potential rewards. I rate EMQQ a Sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here