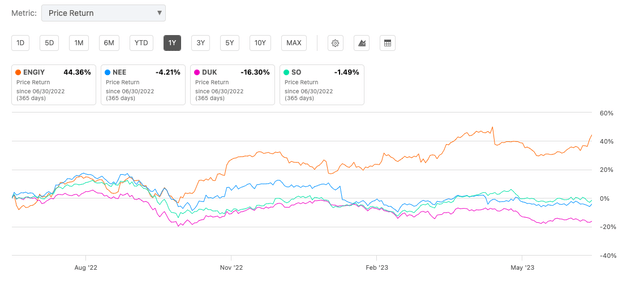

French utility company Engie SA (OTCPK:ENGIY) will post its half-year results later this month. There are several things to get excited about regarding this company. They are on their way to a strong financial year; management has significantly raised its guidance for FY23. Furthermore, the company has gained a major long-term growth opportunity through a renewed contract for two nuclear reactors in Belgium that extended operations by another ten years. The news positively impacted the stock, rewarding investors with 6.06% returns over the last five days. Comparing Engie to the larger US-based utility peers, we see it is the only stock to reward investors with positive returns of 44.36% over the last year.

One year price returns (SeekingAlpha.con)

Although I’m also cautious of Engie’s low EPS of $0.06 TTM and the one-time €4.5 billion charge the company will take on through its renewed nuclear contract. This company is making serious momentum in alternative energy solutions that are in growing demand. Furthermore, nuclear reactors contribute more than one-third of Belgian’s nuclear capacity and are known to generate super profits. Therefore, I maintain a bullish stance ahead of the first-half earnings results on this financially and strategically strong utility stock.

Company updates

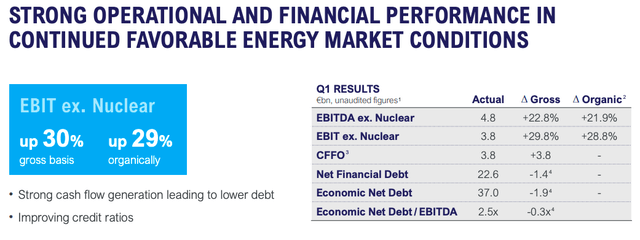

Since my previous article on Engie in December 2022, the stock has rewarded investors with returns of 10.24%. Over the last week, the stock price has jumped on the news of the nuclear extension reaction deal and Engie raising its 2023 earnings guidance. Furthermore, the company has grown its renewable energy projects by adding 13 wind and seven solar projects across the globe, including France and Peru. There are currently 71 active projects, adding to the 5.5 GW of energy under construction as of the end of March 2023. The company aims to have 50 GW of installed renewable energy by 2025. EBIT, not including nuclear, grew YoY by 29% to €3.8 billion due to strong performance from its GEMS and renewable segments.

Q1 2023 Results (Investor presentation 2023)

On top of Q1, the company continued to generate positive results in April and May, resulting in the raised guidance for FY2023. The forecast for net recurring income, which was previously in the range of €3.4 and €4 billion, has increased to €4.7 to 5.3 billion. EBIT, excluding nuclear, which was previously in the range of €6.6 and €7.6 billion, has risen to a range of €8.5 to €9.5 billion. Half-year results will be announced on Friday, 28 July 2023, at 10.00 CET 2023; interested individuals can access the conference here.

Half-year conference 2023 (Engie.com)

Engie versus US based utility peers

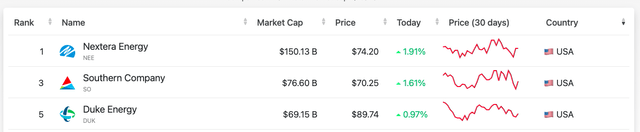

In my previous article, I give an overview of Engie and compare it to the three largest utility companies in the USA based on market cap.

US based utility peers (companiesmarketcap.com)

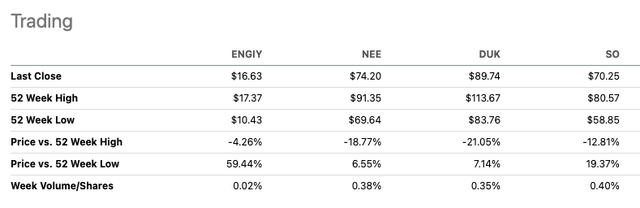

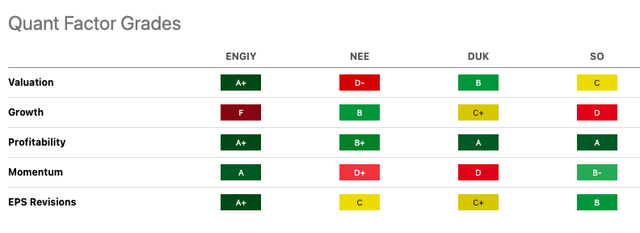

Firstly, Engie is much cheaper than its US peers and rated as a more desirable stock if we consider SeekingAlpha’s Quant rating system valuation. Engie is trading at around $16.63 per share with an A+ valuation. We compare this to NextEra Energy (NEE) at $74.20 with a valuation of D-, a B for Duke Energy (DUK) at $89.74 and a rating of C for Southern Company (SO) at $70.25.

Stock price versus peers (SeekingAlpha.com) Quant Factor Grading (SeekingAlpha.com)

Balance sheet

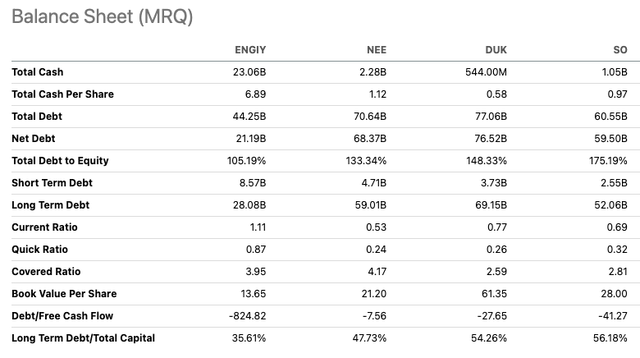

The company currently has $23.06 billion in cash and a healthy balance sheet with a current ratio of 1.1, indicating sufficient liquidity. Despite a high total debt-to-equity ratio of 105.19%, the company performs better than its larger competitors.

Balance sheet relative to peers (SeekingAlpha.com)

Valuation

Engie has an attractive FWD price-to-earnings ratio of 7.24, which falls well below its peers and the utility sector median of 17.52. The stock is trading close to its average price target of $16.68 and is rated as a Hold by various analysts. We can see that historically the stock was trading much higher but has stayed within the $20 mark since 2015. However, Engie’s position within the European energy market and across the globe has strengthened over the last two years due to the hunt for alternative energy sources and the recent renewed interest in nuclear energy. The company has aggressively been following a renewable and low-carbon energy acquisition strategy that is gaining due to the benefits to countries of self-sufficiency amidst an ongoing energy crisis.

Stock trend to date (SeekingAlpha.com)

Risks

Engie is a global energy player whose operations are highly influenced by geopolitical factors such as regulatory changes. We had seen the company renew a contract for nuclear, which seemed unlikely only two years prior, when the EU intended a nuclear phase-out. Further regulatory changes, such as the windfall tax and the EU government’s attempt to reduce energy bills, can continue to play a significant role in the company’s operations in the future, with adverse effects. Furthermore, natural elements such as extreme weather can impact the supply available due to its growing capacity on renewable energy sources such as wind and solar.

Final thoughts

Engie has been successful in expanding its business by prioritizing renewable and low-carbon energy sources in strategic regions. Its strong results and ongoing performance have led to a significant raise of its full year guidance for 2023. Furthermore, the company gained huge momentum from reversing what would have been a nuclear phase-out by 2025. Its renewed contract to extend the use of Belgium’s nuclear reactors by ten years could lead to a major long-term upside. Therefore, investors may want to take a bullish stance on this stock, critical to resolving the ongoing European energy crisis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here