Analyst day events are a great opportunity to gain a better understanding of a company’s direction. They often feature multi-year outlooks and deeper discussion of business strategy than would be available in shorter form content or quarterly reports. The magnitude of content drop often has a big effect on market price, and data center giant Equinix (NASDAQ:EQIX) was no exception.

SA

Equinix dropped from over $900 to just over $700 in the hours and days following their analyst day event.

This article will examine the fresh data and strategy discussion from Equinix with an aim to determine:

- Why the stock crashed

- If Equinix is opportunistic at its reduced price

Quick overview of Equinix and its direction

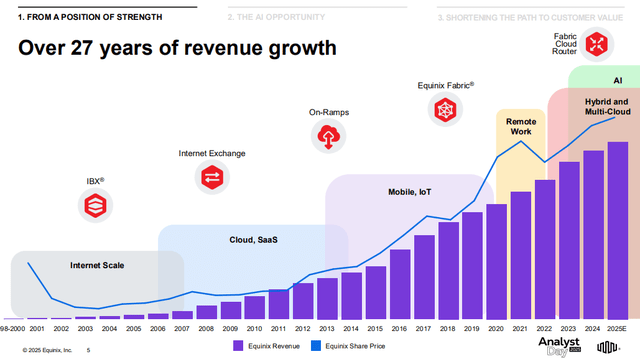

Equinix is the leading global data center REIT with significant ownership in just about every internet hub in the world. The company has used its unmatched scale to offer cross-connection and access in a way that competitors cannot. It has been quite successful, as the company shows in its presentation, with revenue and share price rising in tandem for decades.

EQIX

Data centers growth has been driven by each phase of tech buildout since the dawn of the internet, and it is broadly anticipated that AI will be the next phase of explosive demand.

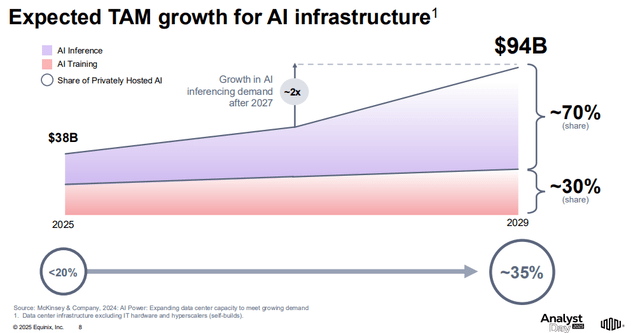

So far, most of the AI buildout has been related to training of the AI itself, but Equinix expects the balance of spending to shift toward AI inference.

EQIX

Between AI and ongoing business with cloud and networking, EQIX sees a $250B total addressable market.

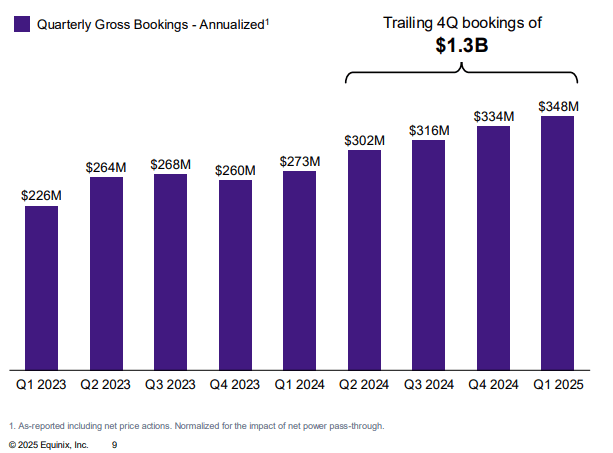

Equinix put together some nice charts on various operating performance metrics, some of which were previously not disclosed. Bookings look solid through 1Q25.

EQIX

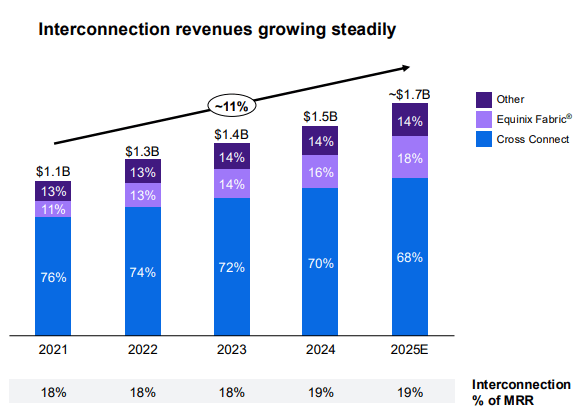

Interconnections are also performing well with an 11% CAGR.

EQIX

In my opinion, it is Equinix’s interconnection ecosystem that separates them from their data center peers. Not only do interconnections boost revenue, but they make it far more difficult for customers to leave, thereby promoting sticky tenancy.

Interconnections make a data center more than just a building designed to certain specifications. The buildings themselves can be replicated by just about any well capitalized developer. The difference between a freshly built data center of a competitor and an Equinix data center is that the Equinix property has a vast array of key tech players with whom to interconnect.

Forward growth and IRRs

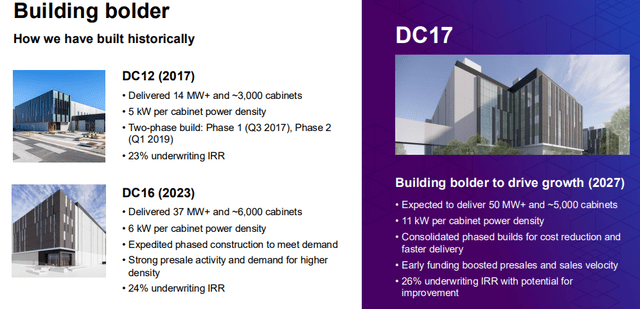

Like its peers, Equinix has built many data centers and achieved strong IRRs on their projects. The upcoming DC17 is massive at 50MW and 5000 cabinets.

Analyst Day Event

Notably, the cabinet power density is very high, which is increasingly in demand for more advanced uses. EQIX is anticipating a 26% IRR, which is fantastic.

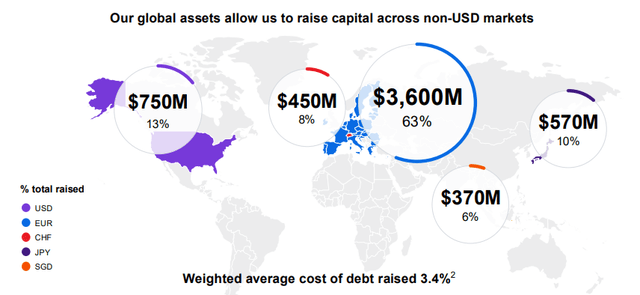

While not explicitly stated, this is a levered IRR and therefore bolstered by Equinix’s extremely low cost of capital. One of the benefits of being a global company is access to capital throughout the world. This allows Equinix to raise capital wherever it is the cheapest, such that their weighted average cost of debt is 3.4%.

EQIX

With interest rates extremely high in the USA relative to other parts of the world, we believe they will continue to target Europe or other low interest rate countries for their debt raise.

In addition to the international aspect, Equinix has a reduced cost of debt capital due to low overall debt ratios on their balance sheet and an investment grade rating (BBB).

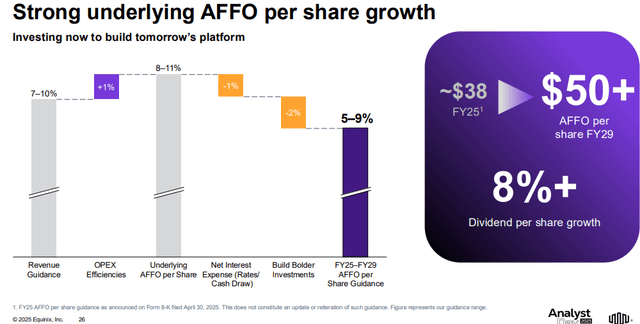

Finally, toward the end of their presentation, Equinix gave growth guidance going out to 2029.

EQIX

Specifically, they called for 5%-9% annual growth in AFFO/share, with acceleration toward the higher end after 2026.

Overall, I thought it was a strong presentation. Growth plans are well aligned with thoroughly documented demand drivers from AI and just data growth in general. Their capex plans have excellent underwritten IRRs which we have little reason to doubt because EQIX has achieved similar IRRs in the past and generally does not overpromise.

So with all the positivity and growth, why did the stock drop almost 18% in just 2 days?

Why the market may not have liked the Analyst Day Event

I obviously cannot read the mind of those selling EQIX stock, but in examining the almost 4-hour presentation, there are 2 areas which I believe may have disappointed the market:

- Continued elevated churn

- Lower than hoped growth

Keith Taylor, Equinix’s CFO, discussed persistent churn:

“Churn had been annoyingly high and it has been. And why is that, Well, I think there’s a few reasons. I mean we all know them, but I’ll repeat them. I think the macro conditions have been very, very difficult at times. I think our ability to curate growth and optimize IBX is where we effectively demarket a customer to bring in more capacity for customers that are growing with us, put a lens on basically our churn as well. And then the bankruptcies, there are a number of bankruptcies”

One of the analysts present at the meeting, Eric Luebchow of Wells Fargo Securities, asked them to quantify the churn:

“You touched on churn a little bit how it’s been elevated compared to the previous Analyst Day. Could you maybe touch on is the expectation still that 2% to 2.5% range? And anything you’re doing to try to drive that to the lower end of the range over the next couple of quarters? Any visibility you have into that?”

EQIX’s CEO Adaire Rita Fox-Martin confirmed the 2.0%-2.5% range.

That is quite a bit of churn, and the timing of Equinix’s drop intraday on June 25th seemed to correspond to around the churn discussion. The intraday drop (circled below) came right at the end of the trading day and discussion of churn was late in the meeting.

SA Charting

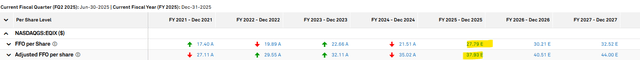

I suspect the market was also disappointed in the AFFO growth guidance of 5%-9% annually through 2029. That is a decent growth rate, but arguably disappointing for a company that was trading over 30X FFO.

Equinix has since rebounded slightly to $786 at the time of writing, which represents significantly lower multiples than where it was trading just a week ago.

S&P Global Market Intelligence

Specifically, it is trading at:

- 28.2X current year FFO

- 20.7X current year AFFO

Is Equinix stock opportunistic at the now lower price?

At 20.7X AFFO, I think Equinix is obviously a good deal, but before we use that multiple, there are some adjustments that need to be made.

It is quite unusual for a REIT to have higher AFFO than FFO, so the 28X FFO multiple tells us that the 20.7X AFFO figure probably isn’t real. Any time AFFO is higher than FFO in a REIT, it is worth checking the reconciliation in the supplemental or 10-Q.

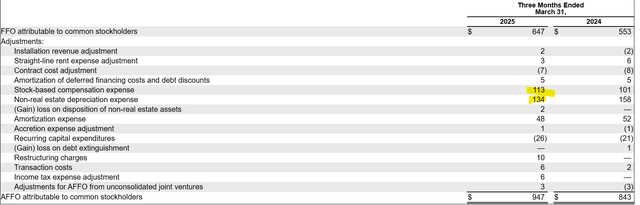

Sure enough, the 10-Q shows some addbacks that I would consider unfair.

10-Q

EQIX adds back stock comp and non-real estate depreciation, both of which I would consider real expenses.

Stock comp directly dilutes shareholders, and the non-real estate equipment does actually depreciate in value.

As such, I’m inclined to think the true multiple is much closer to the 28X FFO rather than the 21X AFFO.

With these adjustments, EQIX is certainly not a value stock, but it is still cheap relative to where it has been trading and may be cheap relative to its growth prospects.

Our take on EQIX

I think the market’s response was overly harsh. While the headline churn and growth forecast numbers are disappointing, they look much better once we dig deeper.

Regarding churn, much of the churn is voluntary and driven by EQIX.

Equinix’s CEO describes the intentional churn below.

Adaire Rita Fox-Martin President, CEO & Director:

“I think when we look at our churn data, I mentioned earlier the notion that within our existing footprint today, the teams work hard to harvest capacity. And sometimes that means that at a point in a customer contract, we might take a customer and offer them maybe a different location in order to move a customer in who would have a premium price associated with that particular piece of capacity. When you look at that, that obviously is something that has an impact on some churn that is initiated by Equinix, right, because we believe there’s a pricing premium that we could command.”

Churn is often scary because it can indicate a lack of demand. If a tenant is leaving because they no longer want the space, that is a bad sign. However, the churn discussed above is Equinix actively causing a tenant to leave so as to sign a higher revenue new tenant to the same space.

It gets labeled as churn and the market has reacted to it as churn, but that is not the right word for it. This is an upgrade to revenue and something that only happens when demand for space is high relative to supply of data centers.

As such, I do not find the churn concerning.

Regarding the growth outlook, 2 percentage points of growth are scheduled to be lost to investments in pre-profit future growth, such as DC17. Once again, this is a good thing masquerading as a negative.

That is simply the timing of developments. It takes a while to build a 50MW data center and during construction it is not generating revenue despite lots of capital being invested. While it is a drag on near-term AFFO growth, I think it is clearly a positive overall with a projected IRR in the mid-20s.

Removing the impact of development timing drag, I see growth as 7%-11% rather than the stated 5%-9%.

The Bottom Line

I think the massive drop in EQIX stock following analyst day was a misinterpretation of what was overall a strong outlook. We bought shares on the dip and anticipate it to recover to pre-analyst day pricing.

Read the full article here