Some energy firms have faced big declines in earnings in 2023, being victims of their own success in 2022, when energy prices rose, and major logistical changes gave rise to much higher revenues and profits.

In particular, Equinor ASA (NYSE:EQNR), with its close proximity to Europe and the UK, was a major beneficiary of those circumstances in 2022.

Company Profile:

Equinor ASA, an energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and petroleum-derived products, and other forms of energy in Norway and internationally. The company was formerly known as Statoil ASA and changed its name to Equinor ASA in May 2018. Equinor ASA was incorporated in 1972 and is headquartered in Stavanger, Norway. – Seeking Alpha.

Equinor’s operations are managed through operating segments, which are:

- -Exploration & Production Norway (E&P Norway)

- -Exploration & Production International (E&P International)

- -Exploration & Production USA (E&P USA)

- -Marketing, Midstream & Processing (MMP)

- -Renewables (REN).

Production & Prices:

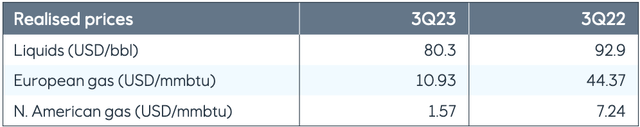

Realized gas prices were down around 75%, and even more in the U.S. Management guided to ~1.5% production growth in 2023.

Organic CapEx for Q1-3 2023 was $7.2B. Management maintained its guidance of $10 to $11B for 2023, and expects to be in the lower end of this range.

EQNR site

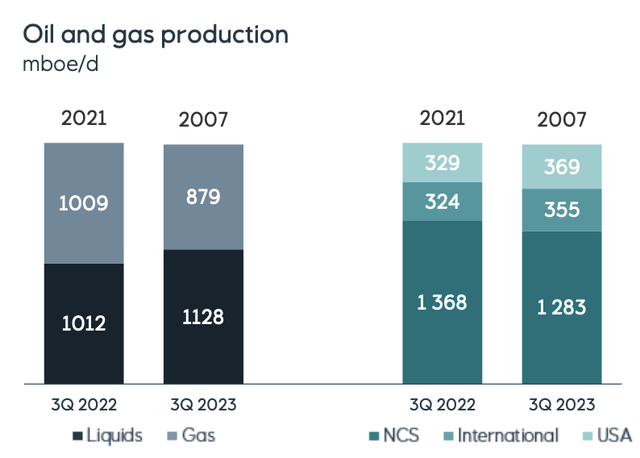

Liquids production rose 11.5% in Q3 ’23, while Gas production fell 13%. Overall production fell 6% in Norway, rose 12% in the U.S., and also rose 9.6% in EQNR’s International operations. Management guided to ~1.5% production growth in 2023.

EQNR site

In 2023, EQNR has had tough comps vs. 2022, which was a banner year for many energy companies, particularly those who benefited from Europe’s switching its supplies from Russia.

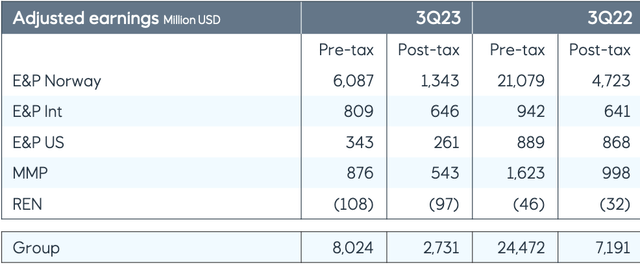

Adjusted Earnings fell 71% for E&P Norway; 14% for E&P International; 61% for E&P US; 46% for MMP, while Renewables’ loss deepened from -$46M to -$108M.

As detailed below, EQNR pays hefty taxes on its Norwegian earnings.

EQNR site

Cash Flow:

Even with prices much lower in 2023, EQNR is poised to deliver on its annual cash flow projections:

“Year-to-date, we have a strong cash flow from operations after tax of $17 billion. This corresponds well to what we said at our Capital Markets Day in February, when we expected to deliver on average $20 billion annually all the way to 2030. We are on track with our delivery this year.” (Q3 ’23 call)

Earnings:

Trying to find a bright spot in these comps reminds us of a standard bio on underperforming baseball players’ baseball cards – “Fred has a lifetime batting average of .138 – he also dances the tango.”

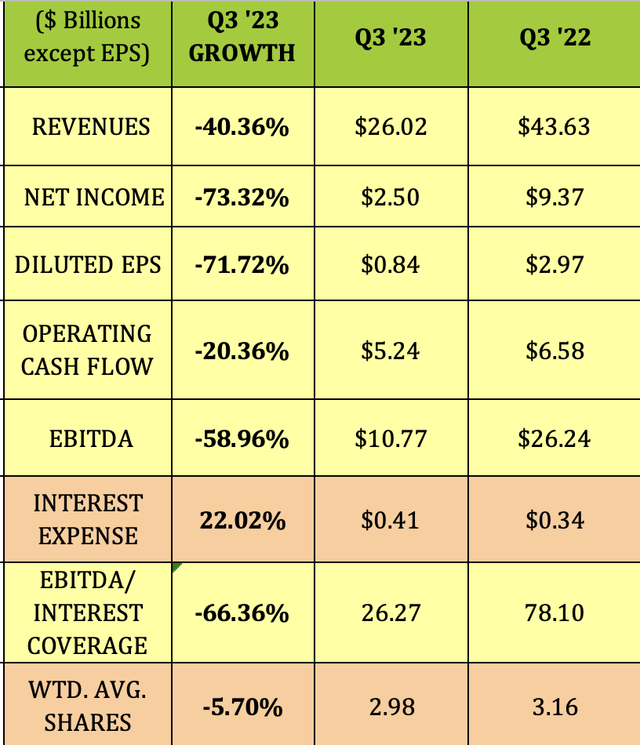

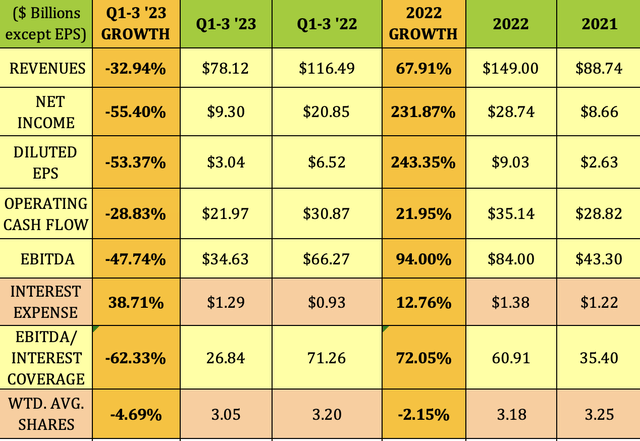

But maybe the bright spot is staring us in the face – yes, the % declines are huge, BUT, EQNR still had $26B in Revenues, $2.5B in Net Income, $10.8B in EBITDA, and covered its Interest expenses by over 26X.

Hidden Dividend Stocks Plus

Looking back further also shows big declines, but also reveals very large amounts of Operating Cash Flow, Net Income, EPS, EBITDA, and Interest coverage. Meanwhile, the share count decreased by 4.7%, via EQNR’s share buyback program.

Hidden Dividend Stocks Plus

Recent Developments:

“In early October, we saw first power at the Dogger Bank, the world’s largest offshore wind farm. When fully complete, its 3.6-gigawatt capacity with 277 turbines will produce enough energy to power the equivalent of 6 million British homes.”

“The offshore wind industry is also experiencing challenges with inflation, higher interest rates, and supply chain bottlenecks. Our petition to New York for price adjustment of projects on the U.S. East Coast was denied together with similar petitions from many other developers. Based on this, we have taken a $300M impairment on the U.S. East Coast projects.” (Q3 ’23 call).

However, New York subsequently came out with a 10-point plan which calls for further consultations with developers, which may open the door for improved financials.

EQNR has several oil and gas projects in development with a low breakeven of $35 per barrel and internal rate of return on 30%. “We are growing towards 2026, and we will keep the same level all the way to 2030.” (Q3 call)

Dividends:

As mentioned above, EQNR also has a share buyback program. The 4th and final tranche of the buyback program will be $1.67B, in line with management’s 2023 forecast of $6B. Coupled with its dividends, EQNR is delivering a total capital distribution of ~$17B in 2023.

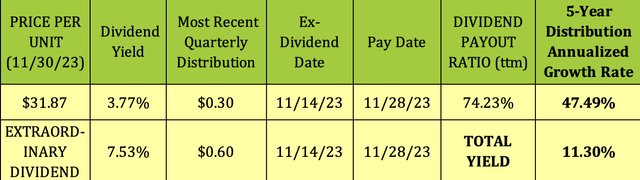

Based upon Q3 earnings, EQNR declared its 4th straight $.90 total payout, comprised of a base dividend of $.30, and a special dividend of $.60. This was also based upon its large cash balance. At its 11/30/23 $31.87 price, EQNR yielded a total of 11.30%.

Hidden Dividend Stocks Plus

“Capital distribution is something that we are using currently to distribute cash that we have on the balance sheet to drive a more efficient capital structure of the company. And I’ve also said that we will continue to use that as one of our tools to achieve that going forward.” (Q3 call.)

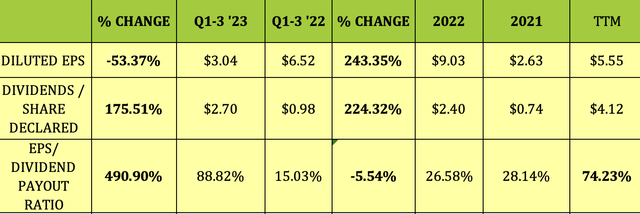

The EPS/Dividend Payout ratio rose to 88.82% in Q1-3 ’23, vs. 15% in the previous year. Then again, EQNR started Q3 ’23 with ~$42B in cash and investments.

Hidden Dividend Stocks Plus

Taxes:

While Norway imposes a 25% withholding tax on dividends received by foreign investors, there is a tax credit on foreign taxes paid that you can take on your U.S. tax return. However, you should consult your tax advisor for more info on this matter.

Profitability & Leverage:

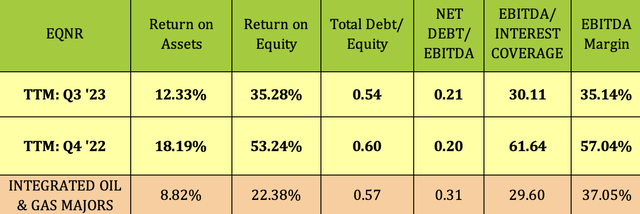

EQNR’s lower Net Income has translated into much lower profitability so far in ’23. However, ROA and ROE remain higher than Oil Majors averages. It has low debt leverage, with Debt/Equity improving, and Net Debt/EBIITDA remaining below the industry average.

EBITDA Margin fell from 57% to 35%, roughly in line with the industry average, as was Interest coverage.

Hidden Dividend Stocks Plus

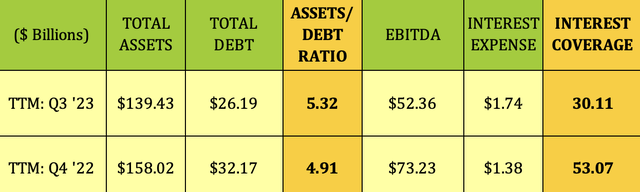

Debt & Liquidity:

As of 9/30/23, EQNR had cash, cash equivalents, and financial investments of $40.2B, and an Asset/Debt ratio of 5.32X, up from 4.91X at 12/31/22. Interest coverage was a robust 30X.

Hidden Dividend Stocks Plus

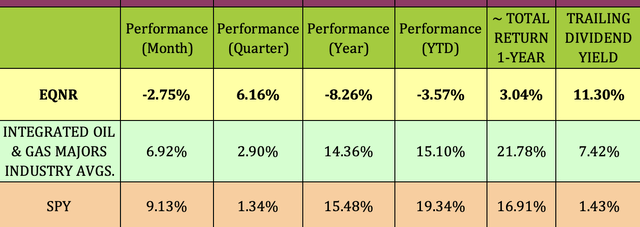

Performance:

Its tough 2022 comps have put a damper on EQNR’s performance so far in 2023, and over the past year, although it did outperform its industry and the S&P over the past quarter.

Hidden Dividend Stocks Plus

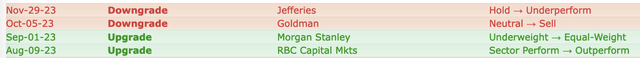

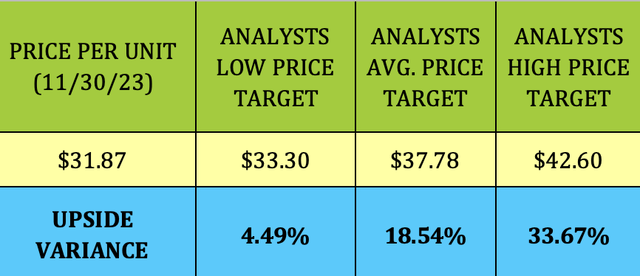

Analysts’ Price Targets:

EQNR received 2 downgrades in October-November from Goldman and Jefferies, to Sell and Underperform, respectively. It received 2 upgrades in August-September from RBC and Morgan Stanley, to Outperform and Equal Weight, respectively:

fnvz

At its 11/30/23 price of $31.87, EQNR was 4.5% below analysts’ low target of $33.30, and 18.5% below their $37.78 average price target.

Hidden Dividend Stocks Plus

Valuations:

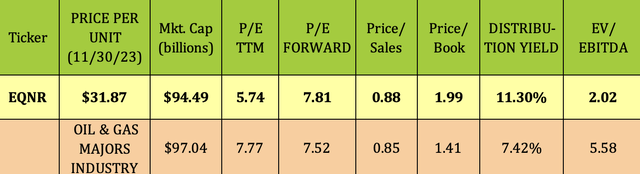

While EQNR’s trailing P/E is much lower than average, its forward P/E and P/Sales are somewhat higher than average; and its P/book is also higher.

The biggest undervaluation is in its EV/EBITDA, which is less than half of the industry average.

Hidden Dividend Stocks Plus

Parting Thoughts:

We’ll continue to hold our shares of Equinor ASA. While we don’t intend to add new shares at this price level, we may add new shares if the price goes lower into the $20’s. At $31.87, it was ~30% above its 52-week low, and ~11% below its 52-week high.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Read the full article here