Thesis: undervalued considering the massive supply coming online soon

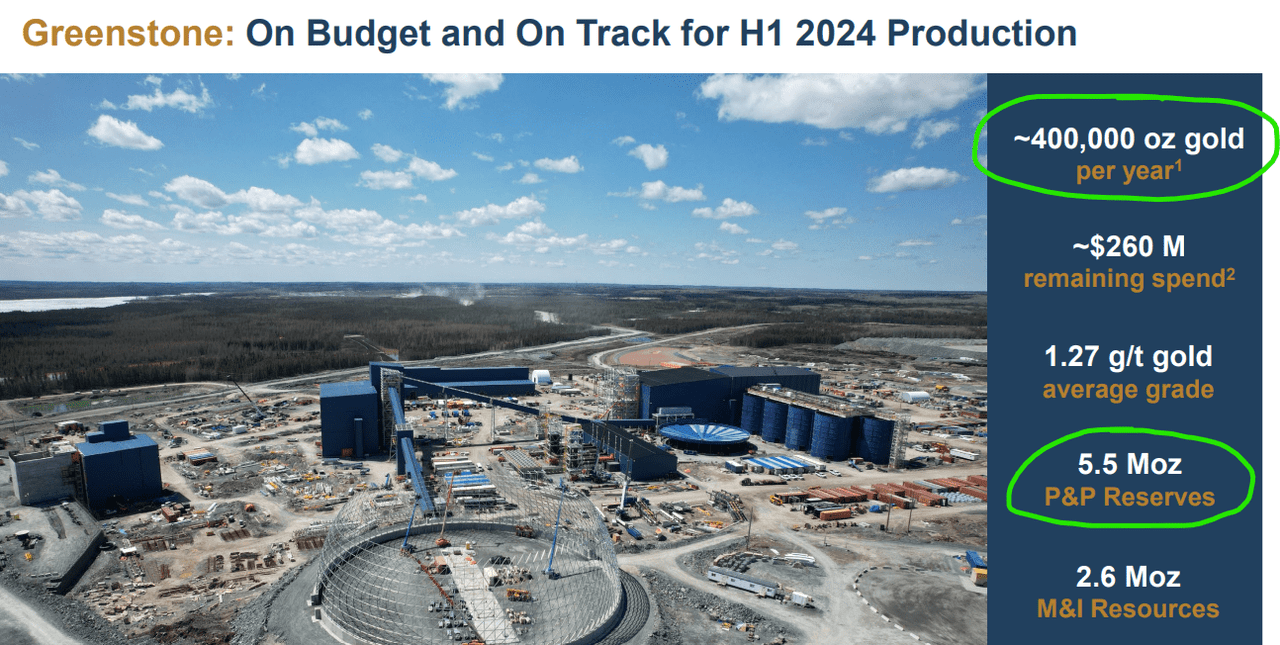

We think that Equinox Gold (NYSE:EQX) is substantially undervalued, as the market is not assigning much value to the upcoming supply that is coming online between 2024 and 2025. The company is seeing considerable developments at its existing mines, but the majority of new supply will come from its flagship project: Greenstone. This would rise to be the biggest gold mine in Canada, able to produce roughly 400,000 oz of gold per year for the 14 years of the mine’s life. This accounts for up to 5 Moz of reserves throughout the years.

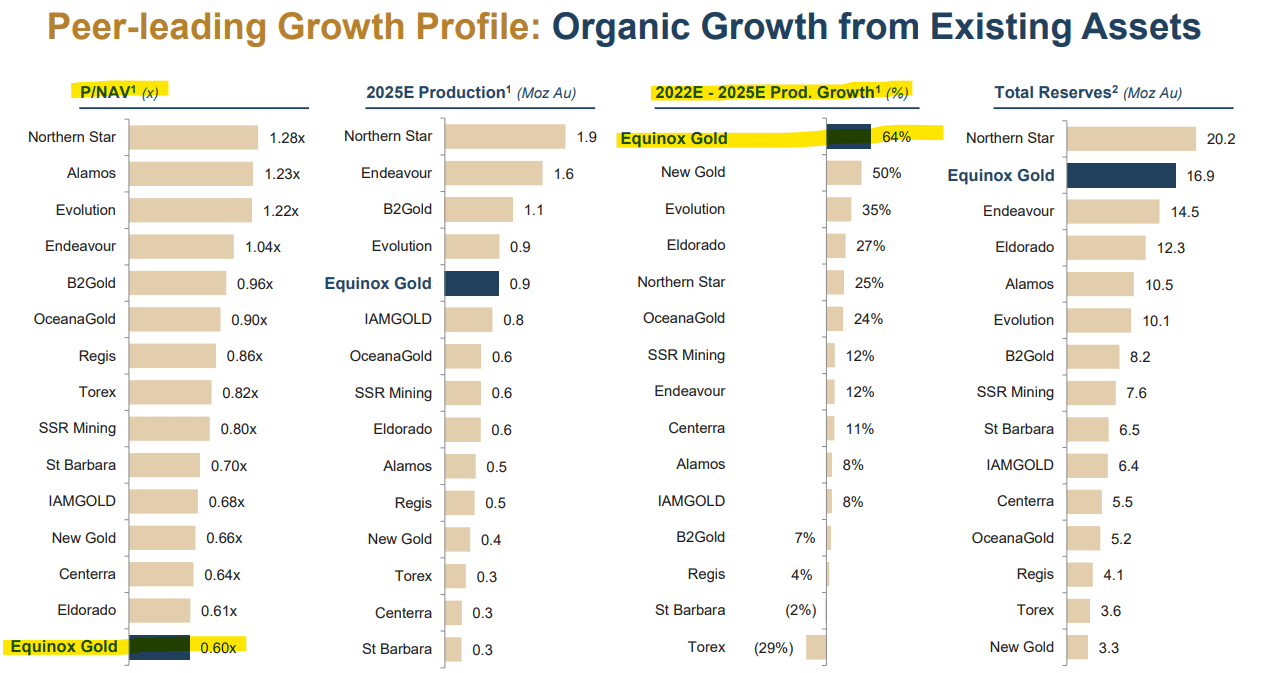

EQX Comps Comparison (EQX Presentation)

However, the market seems not to care much about the growth prospects in terms of revenue and cash flows for the next two years. Much of the focus is probably on the high capex that EQX has been sustaining over the last three years, which was to fund the Greenstone development (which alone requires more than $1.2 billion of Capex). We think that as these capex needs will slow down, and cash generation will start to pick up aggressively, the valuation on both P/NAV and P/FCF multiples will become much more generous.

Overview of the incoming supply and profits

As shown before, the production growth for the next 2 years should be above 60%. This is coming from several mines expanding their production, but mainly from the additional 400k oz from Greenstone.

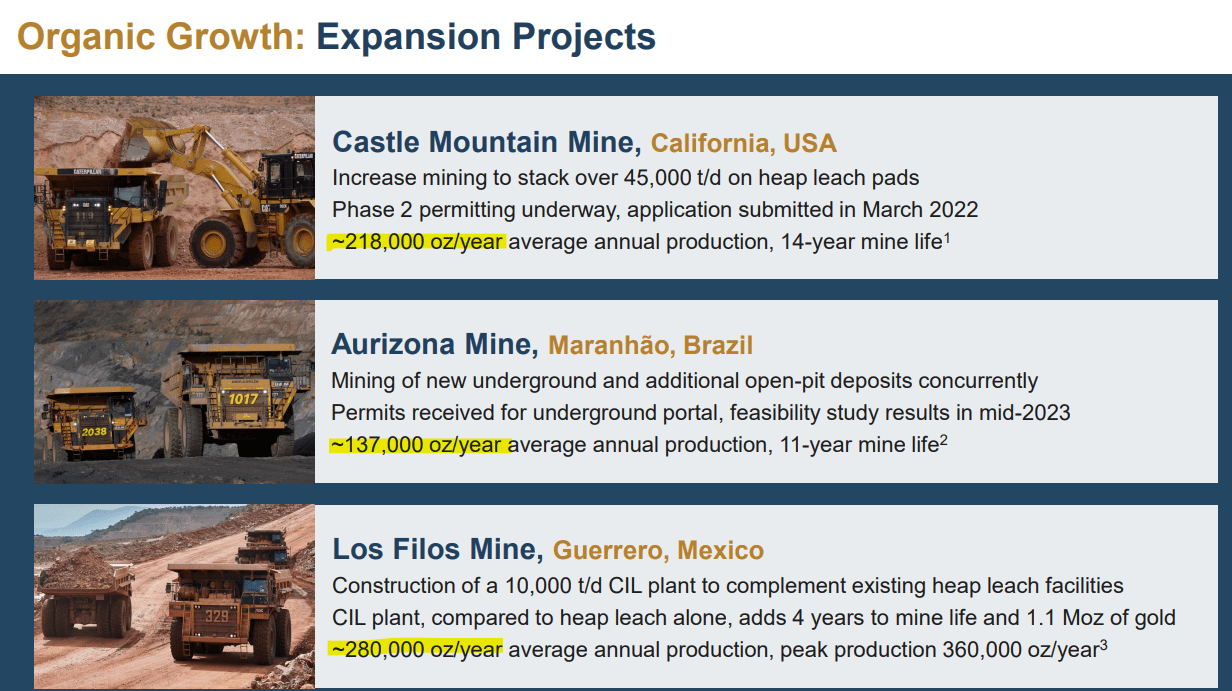

Production Expansion (EQX Presentation)

To give some perspective, these three mines expanding will contribute to a total of 380-400k oz per year when they reach a total output (around 2025). Greenstone alone looks like this:

Greenstone Project (EQX Presentation)

The project will add somewhere around 400k oz alone from the first half of 2024 when it starts production. This means that by the end of 2024, EQX will have production in the order of 1 Moz of gold per year. With a clear pathway to reach 1.3-1.4 Moz after 2025 with the expansion of the other smaller mines.

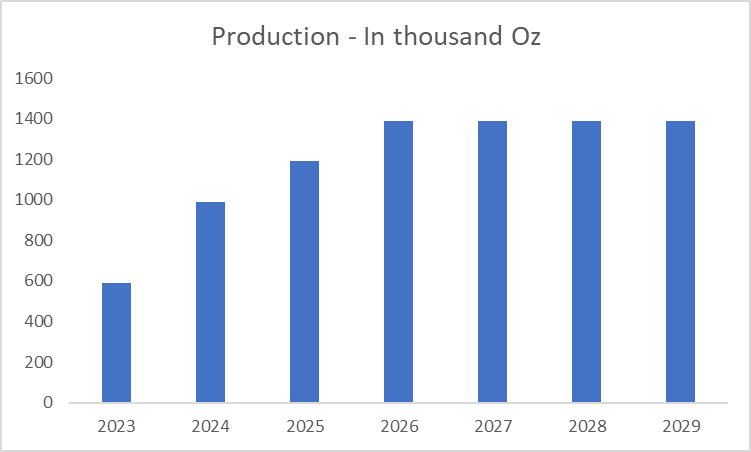

EQX Forecasted Production (Author’s estimates)

This is our expectation for production going into the next growth phase of the next two years. Assuming that the full potential of the Greenstone project is satisfied in 2024, and then expansion on the other mines is reached between 2024 and 2026, we can estimate peak production of around 1.4 Moz by 2026.

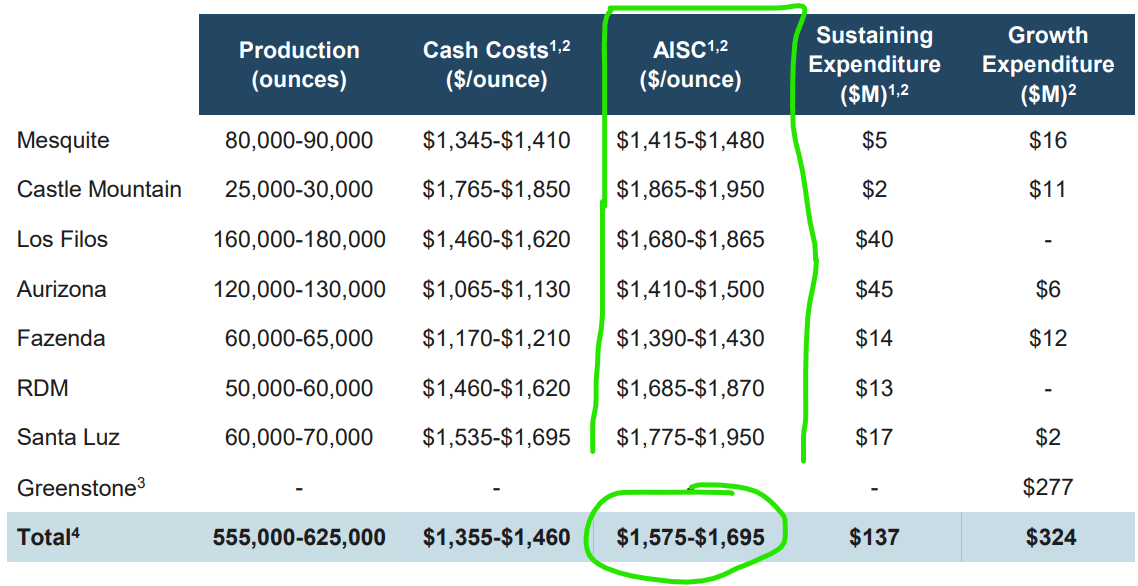

EQX Relevant Metrics (EQX Presentation)

This is on the other hand, what costs look like. We use the AISC (All-in Sustaining Costs) per ounce metric. We notice that this figure is between $1,575 and $1,695 per ounce, and in our model we input $1,600 which is within the range.

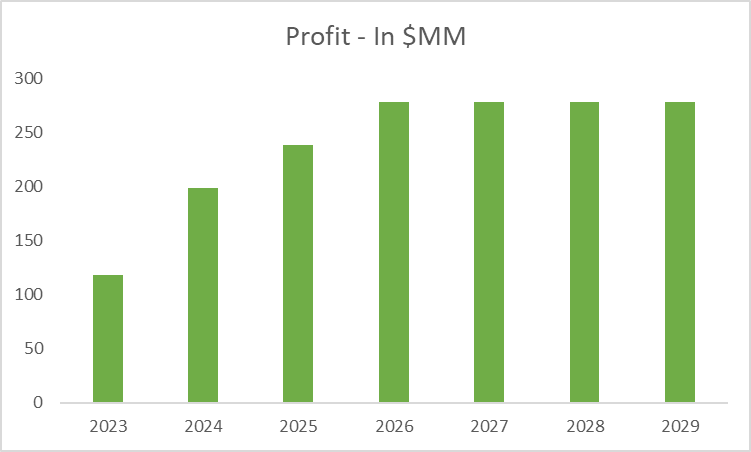

EQX Forecasted Profits (Author’s estimates)

And these are the profits. We expect close to $280 million of pure profits after Opex and Capex (growth and sustaining capex) after 2026, as the majority of growth Capex will be sustained before that period. We think that given the 14 years of mines life, and close to 20% FCF yield just 3 years from now, this shows how compelling the opportunity is at the current valuation.

Risks: execution is what divides success from failure

With mining companies, there are some common (somewhat “systemic”) risks that we can meet in virtually every investment: exploration risk, and execution risk. In the case of the former, we are dealing with pre-production companies that incur in large exploration costs that may yield nothing. This is not something we have with Equinox, as that phase is completely de-risked. However, we are still exposed to execution risk.

As many projects are entering key expansion phases, it is mandatory to believe the company’s own projections on (1) timing, (2) costs, and (3) feasibility. There are permits to obtain (regulation risks), and many different moving parts in expanding a mine that needs to be methodically coordinated. This means that delays (the time value of profits is reduced), and higher-than-expected costs. This may eventually reduce the NPV of Equinox projects, and this is why it is so important to us to buy this at a generous discount, which we believe is here already.

Valuation: discovering EQX fair price

While, as we discussed, there is some risk while executing a plan, we probably have a greater deal of visibility into the company’s future cash flows in the mining sector.

We will be referring to our own estimates disclosed before, using estimated production and the AISC disclosed by the company.

The other big assumption is, of course, the price of gold. We are very aware that by getting exposure to a gold miner, we are indirectly taking a directional position of “long gold”. This means that the NPV of the project will be a function of the price of gold, and we are willing to show three different scenarios that differ based on the price of gold per ounce:

-

Base case: 10% discount rate, $1850 price of gold, and $1600 AISC per ounce, we get to an NPV of equity of around $2.2 billion. This translates into a fair value per share of $7.2, with an upside potential of more than 40% from the current price per share of $5.

-

Best case: 10% discount rate, $2000 price of gold, and $1600 AISC per ounce, we get to an NPV of equity of around $3.4 billion. This translates into a fair value per share of $11, with an upside potential of more than 120% from the current price per share of $5.

-

Worst case: 10% discount rate, $1750 price of gold, and $1600 AISC per ounce, we get to an NPV of equity of around $1.3 billion. This translates into a fair value per share of $4, with a downside risk of around 20% from the current price per share of $5.

We do not want to assign probabilities to each scenario, as forecasting the price of gold for the next 14 years is really an impossible task. What we aim to do here is give a snapshot of what investors should expect from an NPV perspective, and merge this with their own expectations and view on having exposure to the price of gold for a prolonged time.

Conclusion

Equinox Gold Corp is sitting at an exciting inflection point at which production growth should soon accelerate along with cash flow generation. The market seems to be very reluctant, despite the main projects being de-risked and (massive) supply ready to come to the market as soon as next year. Our assumptions on production volume and AISC suggest a range of fair values on the upside between $7 and $11 per share, and a downside risk to $4 per share, based on the price of gold in the future.

Read the full article here