Dear readers/followers,

Equity Residential (NYSE:EQR) is a residential REIT very similar to AvalonBay Communities (AVB), yet for some reason it seems to be less talked about here on Seeking Alpha. I find it strange because Equity Residential enjoys a significant advantage in today’s market. (Spoiler alert – it has to do with significantly lower development risk).

Last time I covered the stock I argued that buying quality REITs, such as EQR, is a strictly better strategy that “waiting it out” in short term treasuries. You can check out that article here. Since then, the stock price has moved about 10% higher and the company has released their Q2 2023 results so it’s time for an update.

Equity Residential – location, location, location

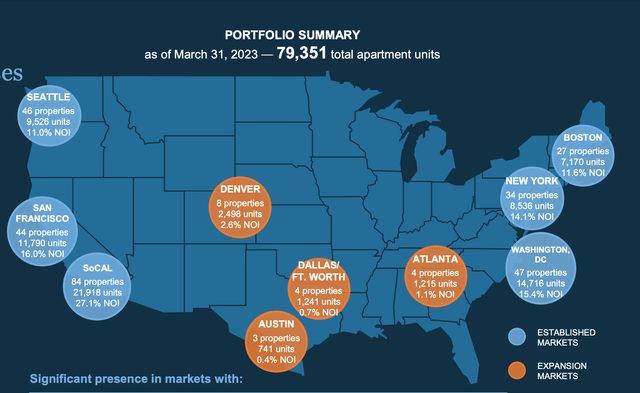

EQR owns and operates nearly 80,000 apartment high quality units across the country with an average monthly rent of $3,000. Their focus has traditionally been on legacy markets on both coasts where 95% of revenue is generated to this day. The remaining 5% comes from faster growing markets such as Denver, Atlanta, Dallas and Austin. Unsurprisingly, management has jumped on the “Sunbelt train” and plans to increase their exposure to the Sunbelt to 20% – a decision which I’m not particularly thrilled about.

EQR Presentation

If you’ve been following me for a while, you know that I’m a little more bullish on A-Class multifamily in legacy markets than in the Sunbelt. The reason is simple – lower valuations and more favorable supply-demand dynamics.

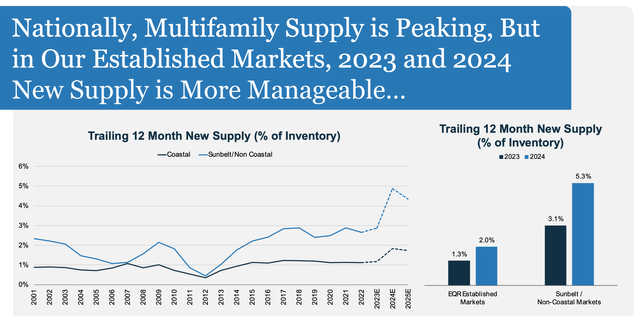

While new construction in the Sunbelt has been booming, delivering record amounts of new space to the market (up to 5% of total inventory per year), new supply in legacy markets has been much steadier under 2% of inventory. Since near term deliveries are highly visible, we know that this won’t change in 2023 or 2024.

EQR Presentation

Moreover, with new development starts down 35% YoY due to higher construction and financing costs and a tighter credit market, it’s almost certain that new deliveries will remain low (well below 2% of inventory) until at least 2026.

Of course, the question we have to ask ourselves is if the demand will be there to absorb this supply (as low as it is). Personally, I have no doubt that it will. In fact I see the risk of over-supply in the Sunbelt as a much bigger threat.

There are a couple of reasons why I’m confident that EQR will have no shortage of tenants:

- Despite headlines, there is still job growth in legacy markets and California remains by far the #1 place for tech.

- Housing in legacy markets is as unaffordable as ever which will lead to a large number of tenants by necessity

- Young people today are also choosing to rent for longer because of lifestyle choices

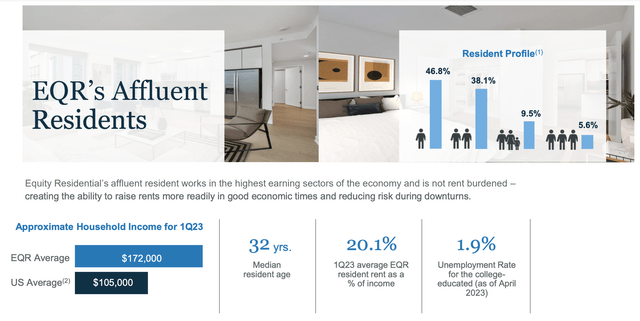

And Equity Residential has some of the highest income tenants of all residential REITs with an average household income of $172,000, which gives the REIT the ability to raise rents aggressively during the good times and makes for steadier cash flows during the bad times. For new residents, rent accounts for a very healthy 20% of their income, on average.

EQR Presentation

Latest Results

EQR’s latest results were quite good.

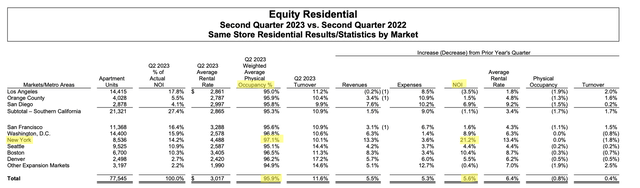

Overall occupancy has dropped slightly to 95.9% as a result of working through delinquencies in Los Angeles. But as management has stated on the earnings call, the long-term impact of replacing vacant units with paying residents will significantly outweigh the short-term drop in occupancy.

Same-store NOI for the quarter increased by 5.6% YoY. The top performer has been New York, which many investors have completely written off as dead not too long ago. NOI in New York has increased by over 20% YoY, while occupancy exceeded 97% for the first time since before Covid.

On the West Coast, Los Angeles was the worst performer with a 3.5% YoY drop in NOI, largely as a consequence of bad debt due to large rental relief receipts in the second quarter of 2022. The impact of this, however, is going to be short-lived and without bad debt, QoQ growth in LA would have been 5%.

EQR Presentation

As a result, management has increased their full year guidance ever so slightly. They expect a year-end occupancy of 96% with same store NOI growth of 5.9%.

Beyond rent increases, the REIT has a history of growing through acquisitions and development. The transactional market has been slow lately, but during the second quarter EQR still managed to acquire two properties at very reasonable cap rates. One in Denver at a 5% cap and one in Atlanta at a 6.6% cap.

On the development front, the company has over 2,500 units under construction due for completion mainly next year. EQR’s development division is quite unique compared to most other residential REITs so I want to spend some time here.

While most other REITs rely on an in-house development team, EQR partners with third-party developers. This significantly lowers the development risk, but also reduces upside as profit is shared between EQR and the developer.

I like this strategy a lot, especially in today’s uncertain market, because it allows EQR to only develop new properties when it economically makes sense as opposed to having a large overhead and developing at all times, because otherwise the team would have no work to do. Essentially it reduces EQR risk during bad times.

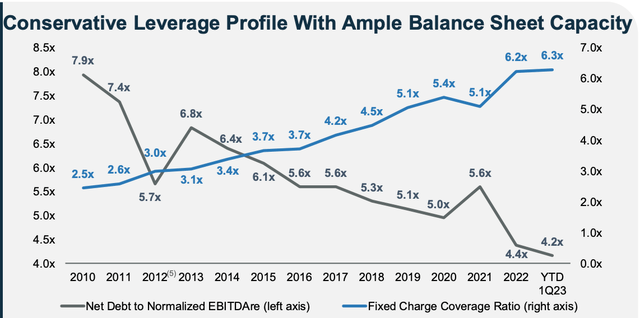

Equity Residential also maintains one of the best balance sheets of all REITs with an A- rating and an all-time low leverage of 4.2x EBITDA. The only downside is that they have an $850 Million maturity due later this year. Luckily, the interest rate risk of refinancing has been hedged by a $450 Million 10-year swap at 2.9%.

EQR Presentation

Valuation

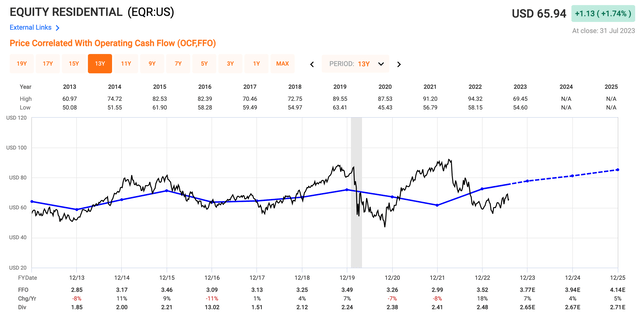

EQR trades at 18x FFO and an implied cap rate of 5.3%. That’s by no means cheap but sits somewhat below AVB’s 18.5x and below EQR’s historical average of 20x.

Continuing to value the company at 20x FFO yields a price target of $85 by 2025. That’s upside of 30% over two and a half years.

On top of that, investors will earn a solid dividend which yields 4.0% and is well covered.

Between the dividend and price appreciation, I expect EQR to return 10%+ easily which is why I continue to rate the stock a BUY here at $66 per share.

FAST Graphs

Read the full article here