About two months ago, before the Q3, 2023 earnings data were released, I wrote an article on Essential Properties Realty Trust (NYSE:EPRT) indicating that the Stock is undervalued relative to the underlying fundamentals.

There are a couple of factors, which substantiate the notion of attractive fundamentals:

- Diversified portfolio across the board. EPRT portfolio is comprised of more than 1700 properties that are spread across 48 states. The properties themselves are nicely distributed across many sectors such as restaurants, car washes, medical services, entertainment and health & fitness. Tenant-wise EPRT is also diversified having over 360 tenants with Top 10 comprising only ~17% of the total leases portfolio.

- Robust portfolio. In terms of the occupancy, EPRT’s portfolio is also strongly positioned. As of Q2, 2023, 99.9% of the portfolio was occupied with the overall rent coverage ratio of 4.1x. Plus, all of these leases (on a weighted average basis) are structured for a ~14-year period, providing an embedded layer of safety.

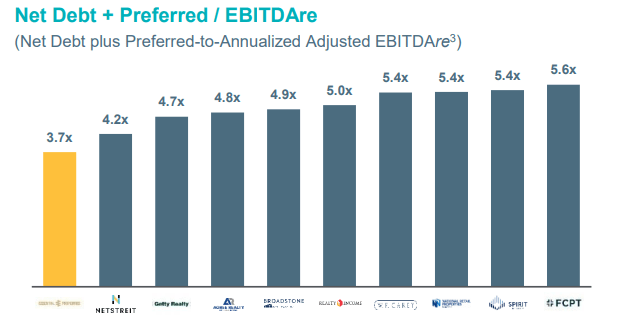

- Strong balance sheet. EPRT’s financial position is also sound. The Net Debt / Annualized Adjusted EBITDAre stands at ~4x, which is one of the lowest levels in the sector. The most critical element in the context of EPRT’s financial position is that first debt maturities are set to kick in only in 2026, which warrants both visibility and additional safety for EPRT’s cash flows. This is especially beneficial considering the weighted average interest rate of 3.4%.

Because of the strength of the fundamentals, rather distant debt maturity profile, and a conservative FFO payout (~63%) we could easily view EPRT as a strong player in the M&A market that could take the advantage of relatively depressed property prices stemming from real estate owners, who experience financial difficulties in this high interest rate environment.

While the aforementioned fundamentals are there and in a very solid position, the valuation seems, in my view, too low, especially if compared to the sector average. Before Q3 results when I issued a buy rating on EPRT the multiple was ~ 6% below the that of the closest peers.

Now, there has been some convergence and as a result the EPRT trades just in line with the overall sector (i.e., REIT Free Standing segment) at P/FFO of ~13x. So the questions is whether EPRT is still attractive enough to consider going long.

Thesis update

Let’s now take a look at the most recent quarterly results and the underlying operating performance.

The key thing is that the portfolio remained very healthy with the unit level rent coverage at 4x and a same store rent growth at 1.2%. The occupancy remained resilient as well, with almost no empty buildings (99.8%).

The most recent activities in the M&A end have not affected the lease structure. For example, the weighted average lease term, as of Q3, 2023, stood at closest to 14 years with ca. 5% of rent expiring until 2027.

In my opinion, one of the key drivers, which caused EPRT multiple to go up a bit and reach the sector average, was the released AFFO guidance for 2024. EPRT has estimated its 2024 AFFO per share to land within $1.71 to $1.75 range, which translates to a 5% growth (assuming mid-point).

This is a rather rare situation when a REIT is able to provide so positive outlook despite the restrictive interest rate environment.

An important caveat in relation to the AFFO estimate is that the estimate itself excludes the assumption of incremental M&A activity in 2024. In other words, if EPRT succeeds in finding additional deals where the cap rates justify the cost of financing, there could surely be some further tailwinds for the AFFO figure.

In my opinion, this is the key catalyst for EPRT share price to move up beside any favourable dynamics in the monetary policy space.

So, let me provide my thinking on EPRT’s M&A prospects over the foreseeable future.

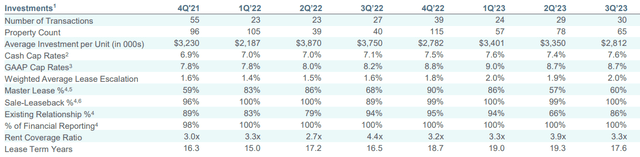

First of all, in Q3, 2023 data we see that EPRT has had one of the most active quarters in terms of the number of transactions made.

EPRT Investor Relations

During Q3, EPRT acquired 65 properties that were structured as 100% sale-leaseback transactions at a weighted average cash cap rate of 7.6%. Plus, as usual, these deals came with embedded rent escalators of ~2% and very long lease terms of ~17.6 years. To me, this signals that EPRT is still both keen and able to source new opportunities.

Second, by listening to the most recent earnings call, we can clearly notice a continued commitment by EPRT’s management (Pete Mavoides – President and Chief Executive Officer) to transact:

Yes. And listen, I would add, we see a great market to invest, and we’ve been driving cap rates up, and we are actively engaged with our relationships to deploy capital at accretive spreads. And so we are no – by no means sitting on our hands and not taking advantage of the dislocation in the capital markets. On the contrary, we see a great opportunity for us to put capital to work at accretive spreads.

Third, after rather active quarters in the M&A segment, EPRT’s balance sheet is still of a solid quality and could be considered as one of the safest in the freestanding REIT segment.

EPRT Investor Relations

One of the main reasons why EPRT has successfully kept the balance sheet strong despite the significant volume of acquisitions is the combination of the retained FFOs (due to ~64% FFO payout) and opportunistic divestitures.

Lastly, the total liquidity at the end of Q3 totaled to ~$990 million, up $356 million from $634 million the prior quarter. In the context of the prevailing market cap level of $3.7 billions, having this huge pile of liquidity enables EPRT to focus even further on the external growth opportunities in a market, which is increasingly providing more attractive cap rates.

The bottom line

While EPRT’s valuation has converged to the sector average, thus no longer providing any discount, investors have to understand that it has been purely a fundamental-driven movement. The fact that EPRT is able to communicate so solid AFFO guidance at this stage is a clear testament of the inherent stability and predictability of its portfolio (i.e., the cash flows).

In my opinion, we should see a further upside from EPRT stemming from incremental transactions at attractive cap rates. The fact that EPRT has accumulated even larger liquidity position and that the Management has clearly communicated its interest to play on its strengths (i.e., the balance sheet capacity) in a market that is becoming more and more attractive, should warrant a positive surprise to the communicated AFFO guidance.

It is still a buy, in my view.

Read the full article here