Introduction

I’m sure some readers will have read the headline of this article and immediately thought that it was too bombastic or exaggerated. So I want to begin this article by explaining why I don’t think this is the case, and why I think it’s important for Estee Lauder (NYSE:EL) investors (or potential investors) to understand why it is not unreasonable to expect this stock to not surpass its all-time high price of $374.20 within the next 10 or 15 years without the aid of something like reverse stock splits, a major corporate structure shake up, or inflation doing the work.

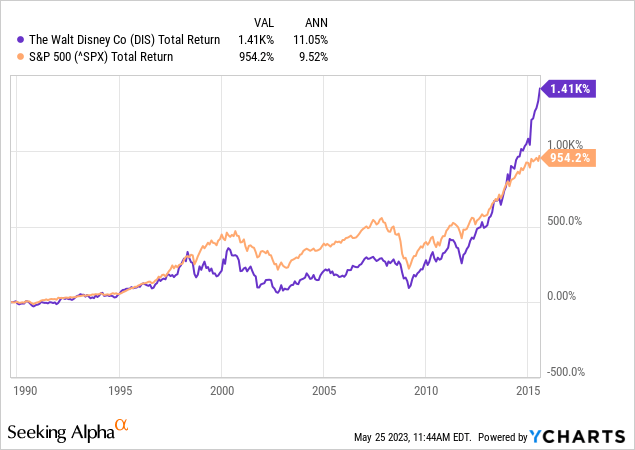

Let me begin with a couple of examples. They will be from different industries, but it’s not the industry that is important. It’s the idea that a business’s long-running positive historical winning streak can’t end with stagnation and decline. My first case is Disney (DIS). In the 25 years or so leading up to August 2015, Disney stock returned 1,410% for an impressive +11.05% CAGR.

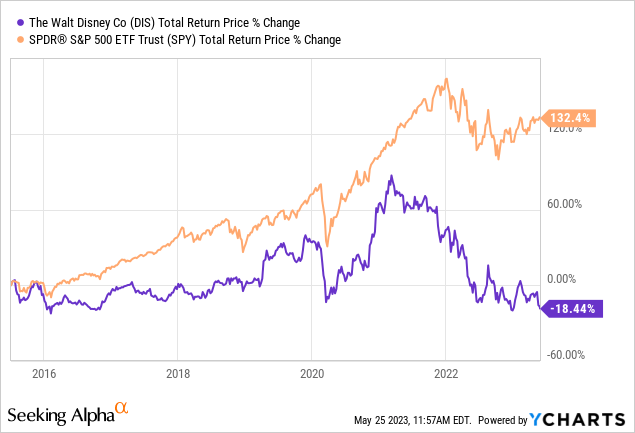

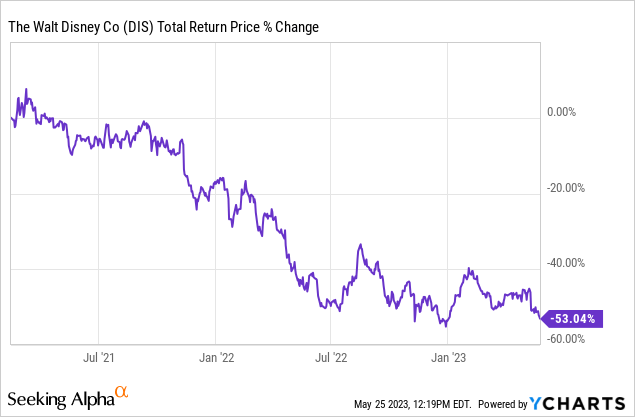

I remember at this time most investors considered Disney stock a sure bet based purely on its brand and past stock performance. In the calendar year 2015, for example, I counted 94 “Buy” rated articles on Disney stock on Seeking Alpha compared to a single “Sell” rating article by J Mintzymyer titled “Time To Short Disney: Horrendously Expensive And Misunderstood”. His article generated 10x the normal number of comments on the average Disney article that year. For the record, I’m a long-only investor, so “Sell” ratings for me just mean that if I owned the stock I would be a seller, and not necessarily a short-seller. Since J’s article nearly 8 years ago, here is how Disney stock has performed compared to the S&P 500.

It underperformed the S&P 500 the entire time period and has produced negative total returns after 8 years. This was foreseeable to investors willing to look past historical performance and brand reputation. Disney’s past and popularity were not able to save the stock from a lost decade (or more)

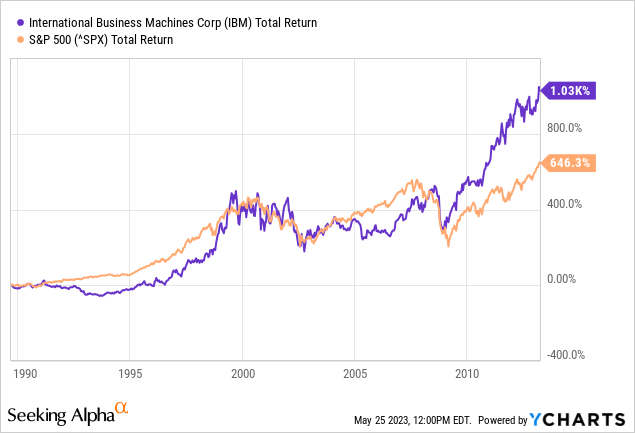

Next, let’s take the case of IBM (IBM) on 4/1/2013, about 10 years ago.

Again, over a nearly 25-year period, IBM stock returned over 1,000%, far outpacing the S&P 500. At this point, even Warren Buffett was long the stock. For 2013 I count 86 “Buy” ratings for IBM compared to 9 “Sell” ratings, roughly 10-to-1, but it’s important to point out there were people who understood the dangers near the top despite IBM’s fantastic historical record. Here is how IBM stock has performed since.

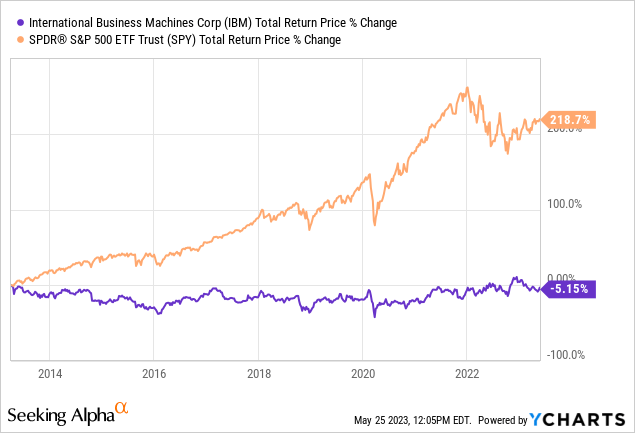

After a full decade, IBM’s total returns are -5% compared to a +218% rise in the S&P 500.

If an analyst would have written an article in 2015 on Disney or 2013 on IBM and stated they were likely to be lower 8 or 10 years later it would not have been an overstatement. I realize Disney stock did have positive returns for part of this period during the streaming bubble a couple of years ago. I warned personally about that on my YouTube channel on February 15th, 2021 in a “Sell Disney” video. Maybe sometime in the very far future, it can recover because they have good intellectual property and parks, but a lost decade from those crazy highs should be expected.

Disney has lost more than half its value since that video. My point is that warning investors about the likelihood of never recovering old market cap highs is totally reasonable and not an overstatement.

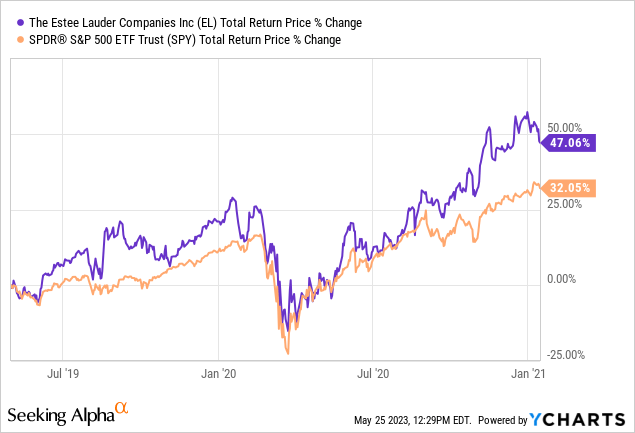

With that context, let’s get back to Estee Lauder and why I think it could be a lot like IBM and Disney stock. I’ve written one previous Seeking Alpha article on Estee Lauder which was a “Hold”, and produced one YouTube video, which was a “Sell” for the stock. Let’s review those. Whenever I’m overly negative on a stock, I naturally get a lot of skepticism from readers that think I’m a perma-bear or hater or short-seller of the business, but my April 30, 2019 “Hold” article “Estee Lauder: A 10-Year Full-Cycle Analysis” hopefully shows that my ratings for Estee Lauder are dispassionate, and I’m just sharing my interpretation of the data at any given time. A couple of years after the “Hold” article, on January 16th, 2021 in a video titled “How To Measure Stock Portfolio Results”, I explained why Estee Lauder stock was a “Sell” based on valuation. Here is how the stock performed between the “Hold” and the “Sell” pieces:

For most of this period, the stock performed about the same as the S&P 500, with an additional flourish at the end which sent it into overvalued territory. I consider this a good “Hold” call.

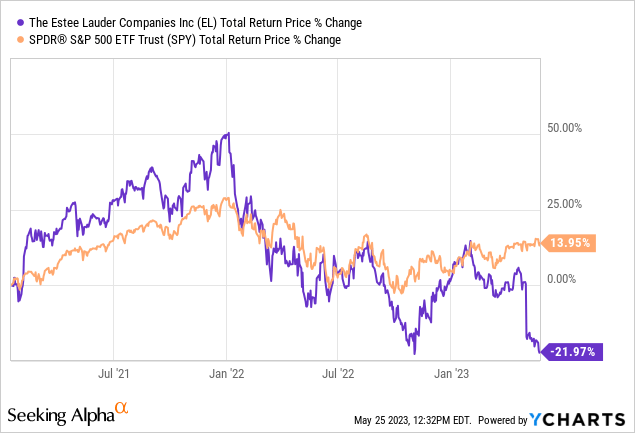

Since the “Sell” video, here is how Estee Lauder has performed.

We are starting to see some of the overvaluation being priced into the stock in the past 18 months after being crazy overvalued at the beginning of 2022. The stock is now almost -50% off those highs, and I don’t think the price is going back to those highs in any kind of reasonable time period. The rest of the article will explain why.

Estee Lauder’s Historical Earnings Cyclicality

The valuation method I use for Estee Lauder first checks to see how cyclical earnings have been historically. Once it is determined that earnings aren’t too cyclical, then I use a combination of earnings, earnings growth, and P/E mean reversion to estimate future returns based on previous earnings growth and sentiment patterns. I take those expectations and apply them 10 years into the future, and then convert the results into an expected CAGR percentage. If the expected return is really good, I will buy the stock, and if it’s really low, I will often sell the stock. In this article, I will take readers through each step of this process.

Importantly, once it is established that a business has a long history of relatively stable and predictable earnings growth, it doesn’t really matter to me what the business does. If it consistently makes more money over the course of each economic cycle, that’s what I care about – numbers over stories.

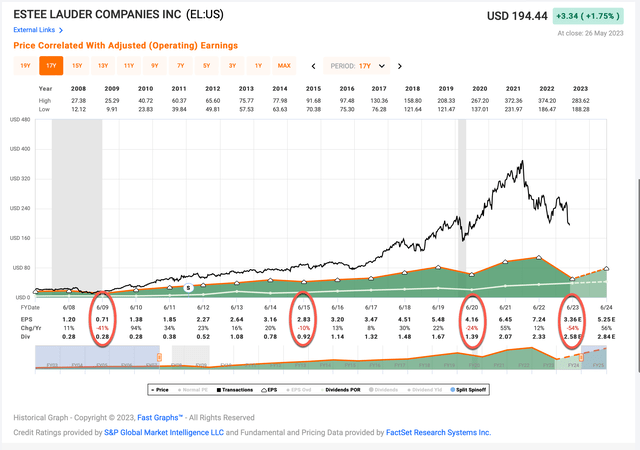

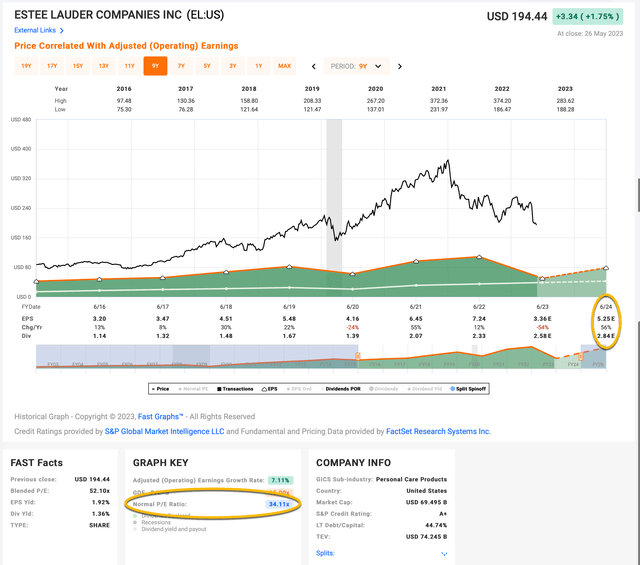

FAST Graphs

Since about 2003, EL has only had 4 years of negative earnings growth. All of them except this year came during times of economic weakness or recession. In 2009, earnings fell -41%, in 2015, which was an industrial recession, earnings fell -10%, and during the COVID recession they fell -24%. I consider these sorts of earnings declines, which were all less than -50%, moderately cyclical. Moderately cyclical businesses can be valued using earnings as long as the negative growth years are taken into account. If the earnings were more cyclical, then I would use a different sort of analysis rather than one based on earnings and earnings growth.

The current earnings decline this year should stand out as very different from previous downturns. First, it should be noted that for two years, post-COVID, earnings fully recovered in 2021 and 2022 and were higher than the pre-COVID high in 2019 of $5.48 per share. So, excuses like travel restrictions, COVID lockdowns, etc., don’t explain 2023’s earnings decline. Whenever a business changes from a less cyclical business to a more cyclical one or has big, unexpected earnings declines it should start to send up some red flags for investors.

Because this is ultimately going to be a bearish article, I am going to give Estee Lauder the benefit of the doubt and assume analysts are correct to project 2024’s earnings recovering to $5.25, which is a huge 56% increase from this year’s expected earnings. If Estee Lauder’s stock looks unattractive, even with optimistic assumptions, my hope is my estimates will be both more accurate and more convincing.

Market Sentiment Return Expectations

In order to estimate what sort of returns we might expect over the next 10 years, let’s begin by examining what return we could expect 10 years from now if the P/E multiple were to revert to its mean from the previous economic cycle. For this, I’m using a period that runs from 2016-2023.

FAST Graphs

Estee Lauder’s average P/E from 2016 to the present has been about 34.11 (the blue number circled in gold near the bottom of the FAST Graph). Using 2024’s forward earnings estimates of $5.25 it has a current P/E of 37.04. (I want to stress here how generous I’m being using 2024’s expected earnings. The P/E using this year’s earnings is actually about 52.10.) If that 37.04 P/E were to revert to the average P/E of 34.11 over the course of the next 10 years and everything else was held the same, Estee Lauder’s price would fall and it would produce a 10-Year CAGR of -0.82%. If EL fails to increase earnings next year, the mean reversion CAGR would be much lower.

Business Earnings Expectations

We previously examined what would happen if market sentiment reverted to the mean. This is entirely determined by the mood of the market and is quite often disconnected, or only loosely connected, to the performance of the actual business. In this section, we will examine the actual earnings of the business. The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: the first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so the Earnings/Price ratio). The current earnings yield using 2024’s earnings expectations is about +2.70%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $2.70 per year on my investment if earnings remained the same for the next 10 years.

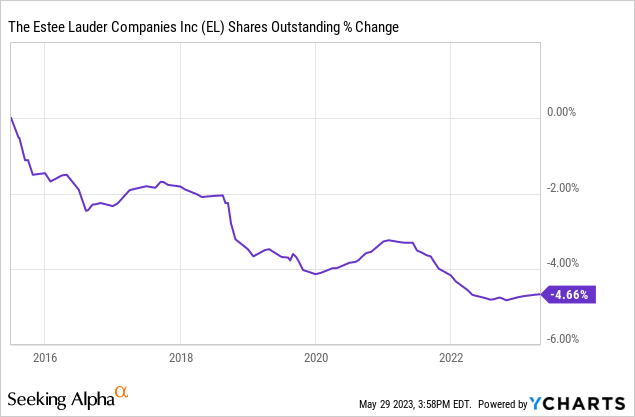

The next step is to estimate the company’s earnings growth during this time period. I do that by figuring out at what rate earnings grew during the last cycle and applying that rate to the next 10 years. This involves calculating the historical EPS growth rate, taking into account each year’s EPS growth or decline, and then backing out any share buybacks that occurred over that time period (because reducing shares will increase the EPS due to fewer shares).

During this time period, Estee Lauder bought back about 5% of the company. I will make adjustments for these buybacks along with the -24% earnings growth decline in 2020 and the -53% decline in 2023. However, I will also assume 2024 earnings growth has actually occurred, so there will be some recovery off the bottom. When I do all that I get an overall earnings growth rate estimate from 2016-2024 of +5.70%.

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought Estee Lauder’s whole business for $100, it would pay me back $2.70 plus +5.70% growth the first year, and that amount would grow at +5.70% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $137.09 including the original $100. When I plug that growth into a CAGR calculator, that translates to a +3.23% 10-year CAGR estimate for the expected business earnings returns.

10-Year, Full-Cycle CAGR Estimate

Potential future returns can come from two main places: market sentiment returns or business earnings returns. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years for Estee Lauder, it will produce a -0.82% CAGR. If the earnings yield and growth are similar to the last cycle, the company should produce somewhere around a +5.70% 10-year CAGR. If we put the two together, we get an expected 10-year, full-cycle CAGR of +2.39% at today’s price.

My Buy/Sell/Hold range for this category of stocks is: above a 12% CAGR is a Buy, below a 4% expected CAGR is a Sell, and in between 4% and 12% is a Hold. With a +2.39% 10-year CAGR expectation, that would make EL stock a “Sell” at today’s prices, even using generous estimates for 2024.

More Reasons For Caution

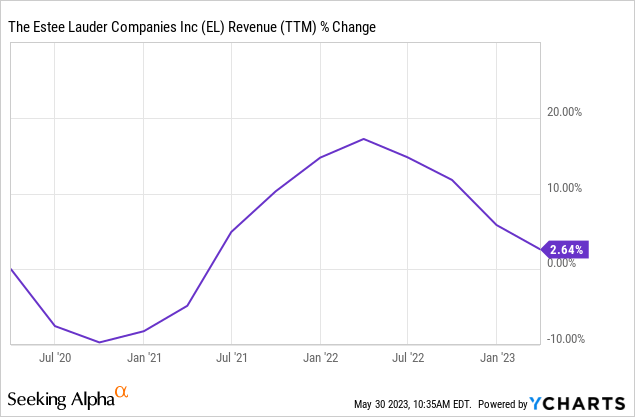

I have a few additional metrics that I keep close tabs on for businesses that might be on track for stagnation or decline over the medium and long term. The key metric that tends to cut through a lot of noise is simply the 3-year cumulative revenue growth. If this metric is negative while we aren’t in an obvious deep recession, that is a sell signal if I own the stock. If this metric is low (positive, but single-digit level) that is usually enough for me to avoid the stock if I don’t already own it.

The three-year cumulative revenue growth for EL is barely positive at 2.64% and trending down. It is very rare for a business to have this metric turn negative and produce above-average medium-term returns unless the business is known to be deeply cyclical.

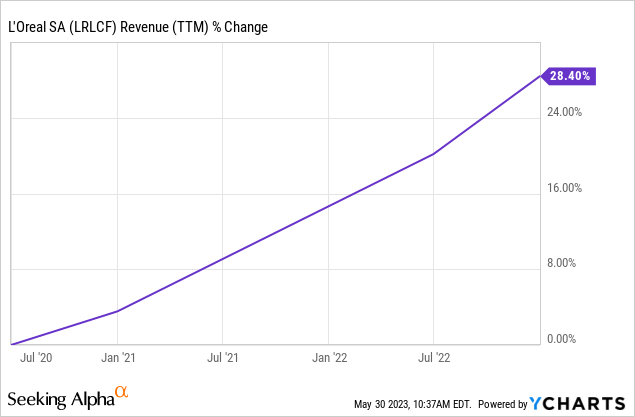

We can tell this isn’t an industry-wide issue because L’Oreal (OTCPK:LRLCF) is showing strong revenue growth over this same time period. Competition appears to be at least a contributing factor to Estee Lauder’s struggles. Additionally, the US is not in a recession yet. Consumers are still spending, so this doesn’t explain Estee Lauder’s difficulties either. It also means if the US does go into recession within the next 12 months, there is likely more downside risk to EL’s earnings. It’s not like the economy is troughing in the US right now.

A significant portion of EL’s earnings and revenues come from China, and this is certainly an explanatory factor for part of these struggles. But what doesn’t make sense to me is that EL’s earnings had two years in a row of post-COVID recovery. There can’t be any doubt that China is more open now than it was at this time last year, or the year before. The one thing that has changed since last year is Russia’s invasion of Ukraine, China’s tacit backing of it, and the West’s response. I don’t know enough about the internal workings of the Chinese economy to speculate on precisely how this, along with other interventions by the Chinese government in their economy, has affected Estee Lauder’s business, but I think it’s fair to speculate some sort of negative effect is occurring. It might be indirect, simply because China’s economy is struggling, or there could be a more direct link.

There is increasing evidence that relations between China and the US are deteriorating. Whether that will continue, I don’t know. But I do think that unlike when a recession occurs in the US, which I feel comfortable assuming will be a cyclical event and will recover eventually, it’s much harder to say that about a foreign company doing business in China. The US government will always have incentives and a desire to pull its own economy out of a recession. Can we really say China will have a strong desire for foreign businesses to make money in China for the benefit of foreign investors? I’m not so sure.

Conclusion

In my last Estee Lauder “Sell” video two years ago, I based my analysis simply on the very high valuation. The stock is down more than -20% since then. Now the valuation remains elevated even using generous 2024 earnings assumptions, but there are additional risks from competition both big and small, as well as geopolitical risks. This combination has a much higher likelihood to produce poor returns over the medium and long term. Some investors might be tempted to look at Estee Lauder’s $374 stock price high in 2022 and think it has the potential to get back to those levels. I think the odds of that sort of recovery happening in the next decade are extremely unlikely.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here