Back in October, I upgraded Etsy (NASDAQ:ETSY) to “Buy,” nothing that while the stock had been pummeled this year, that the company had made progress increasing the number of active buyers on its platform, as well as gaining traction in international markets. With the stock up over 25% since then, let’s catch up on the name.

Company Profile

As a refresher, ETSY operates several online marketplaces that connect buyers with sellers. Its largest and best known is Etsy.com, which specializes in the sale of crafts, handmade goods, and vintage items. It also owns Reverb, a musical instrument marketplace, and Depop, which is focused on fashion.

ETSY breaks out its revenue into two primary categories. Marketplace revenue is made up of listing fees, transaction fees, and payment processing fees. Services revenue, meanwhile, consists of things such as shipping labels, on-site advertising, and other services.

Earnings, Outlook, & Restructuring & New Competition

Ahead of its Q3 earnings reported in November, I said I expected ETSY to surpass top- and bottom-line estimates (it did that), but to take a cautious view on Q4. Thus far, that looks to be the case.

At the time of its Q3 report, ETSY guided for GMS to decline by low single digits, but warned if trends worsened it could decline by mid-single digits. It estimated a 20.8% take rate, and adjusted EBITDA margin of between 26-27%.

In mid-December, the company updated that guidance when it announced a restructuring. It projected GMS to fall between -2% to -1%, with revenue to grow 2-3%. It also upped its EBITDA margin guidance to 27-28%.

As for the restructuring, the company will lay off 11% of its Etsy marketplace workforce, taking a $25-30 million charge in the process. The company said the restructuring would lead to meaningful operational efficiencies and cost savings and/or cost avoidance.

Increased competition has been a concern with investors with regard to ETSY, and the company addressed some of that at a NASDAQ conference earlier this month, with CEO Joshua Silverman saying:

“Temu has come out of nowhere to be like $14 billion in sales. So they’re taking a little bit of share from everyone. We have no evidence to suggest that they are disproportionately impacting Etsy. They’re impacting all e-commerce players, and we don’t see any evidence that they’re disproportionately impacting Etsy. But in a world where consumer wallets are constrained, that $14 billion has to come from somewhere. I think the bigger impact that we are seeing right now for Etsy is that Temu and Shein and in particular Temu appears to be investing a lot in performance marketing, and it’s not obvious that they have much of an ROI lens on their spend. So they appear to be spending a lot of money to acquire customers who may not have very large wallets and may not be very loyal. So we’ll see how that strategy of spending a lot to acquire customers for whom the lifetime value is uncertain. I’m not sure how that’s going to play out for them. We’ll see. But we are not a growth at all cost company, and we’ve never been that way. We have a very strong ROI lens on every dollar we spend, and we look at every dollar we spend on employees, on marketing and say, is that delivering good returns, is that making the marketplace better in a way that delivers values for seller, buyers and for our shareholders. And so to the extent that they are bidding up keywords in the performance marketing auctions, we are not going to follow a race to the bottom there.”

ETSY’s Q3 earnings and Q4 guidance were pretty much as I expected when I upgraded the stock. It beat on both the top and bottom lines and issued what looks will turn out to be cautious guidance, given that it already gave a more positive outlook later in mid-December. With the GMS and revenue guidance, it is also important to remember that it now excludes Elo7, which was divested.

Overall, ETSY continues to make nice progress adding buyers, once again reaccelerating growth in the quarter. Active Etsy Marketplace buyers increased 4% to 92 million. That was an acceleration from the 1% growth it saw in Q1 and 3% growth it saw in Q2. It also saw U.S. buyers increase for the first time in 7 quarters. Another focus was on bringing back lapsed buyers. For Q3, the company reactivated 6 million lapsed buyers, a 19% year-over-year increase. This was a similar result to Q1 and Q2.

Its performance with Etsy Ads also shouldn’t be overlooked, as that is adding some nice growth as well. I also like that the company has finally stemmed the decline in loss of habitual buyers. Habitual buyers decreased -6.5% year over year to about 7.0 million, but was flat sequentially.

In not the easiest of macro environments and coming out of a pull-forward period of demand from the pandemic, the company has done a really nice job under the circumstances.

Competition is certainly a risk. Temu is growing fast and at all costs, while the TikTok Marketplace appears to be using a similar grow at any cost strategy. Even craft store Michael’s has come out with a competing online marketplace called MakersPlace.

The emergence of Temu, owned by PDD (PDD) has been rapid, and the Chinese firm is looking to win over U.S. consumers at seemingly any cost. TikTok Marketplace has also taken the U.S. by storm, and with its popular social media platform and huge deals, it too is quickly racking up sales. This is something investors in ETSY and other online retail names will have to monitor to see if these Chinese upstarts have an impact on them. However, I agree with ETSY management that buying customers through huge deals doesn’t necessarily make them sticky customers, and they surely aren’t profitable customers.

So far though, ETSY has been more than holding its own versus this new competition. For my part, while I recognize the risk, as of now I feel comfortable with this new risk.

Valuation

ETSY stock currently trades around 14.1x the 2024 consensus EBITDA of $791.4 million and about 12.5x the 2025 consensus of $889.1 million.

It trades at a forward PE of nearly 14x the 2024 consensus of $4.80 and just over 13.2x the 2025 consensus of $5.53.

Revenue growth is expected to be nearly 6% in 2024, and then grow around 9-13% a year over the next few years thereafter.

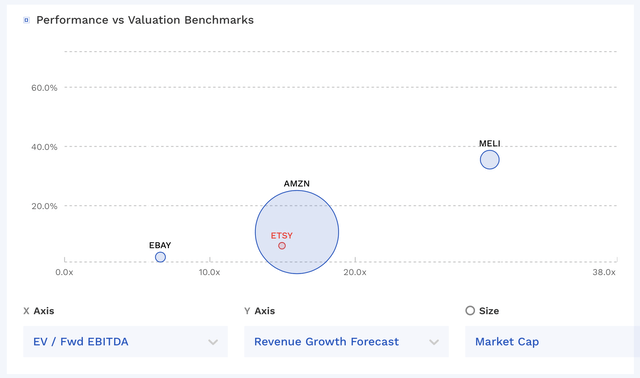

ETSY trades at towards the middle of the pack vs other marketplace stocks, trading at a premium to the likes of eBay (EBAY) and at a discount to Amazon (AMZN).

ETSY Valuation Vs Peers (FinBox)

In valuing ETSY, I’d place around a 15x multiple of 2025 EBITDA to get to fair value. That would give it a target of about $100. That is the same as my prior target.

Conclusion

ETSY is doing a good job in my view, and being able to grow its active buyers in the current environment is impressive. It’s also worth noting that the platform has also been attracting more sellers, despite a much-ballyhooed price increase in 2022.

International markets remain an opportunity, as does increasing user frequency and drawing more men to the platform. So far, my thesis seems to be playing out, while the remaining upside to my $100 target keeps it in “Buy” territory.

The biggest risks to the stock are a slowing consumer, as well as any pressure from increased competition. As long as the economy holds up though, I think ETSY should have a pretty good 2024.

Read the full article here