The online marketplace Etsy (NASDAQ:ETSY) hasn’t had a good start to 2024, with an almost 6% decline in share price. In fact, in yesterday’s trading, it was among the top 10 S&P 500 (SP500) fallers yesterday, which prompted me to look at it. This is a continuation of the trend from the past year (see chart below). Here I take a closer look at it to figure out whether the decline will continue in 2024 or whether there’s a chance for a price uptick anytime soon.

Price Chart (Source: Seeking Alpha)

Slowing sales growth

A look at the company’s numbers reveals that there’s a very good reason for weakening investor faith in the stock, even though there’s no discernible reason why it was down yesterday in particular. Its gross merchandise sales [GMS], which is the total payout for customers as distinct from the revenue attributable to the company, have contracted in the first nine months of 2023 (9M 2023) by 1.4% year-on-year (YoY). What makes this worse is that it’s a continuation of the trend from last year.

While Etsy’s revenues have done better, with an 8.4% increase, as seen in context, this figure is underwhelming too. While it can be tempting to attribute it to a post-pandemic slowdown in online sales growth, that’s not entirely true.

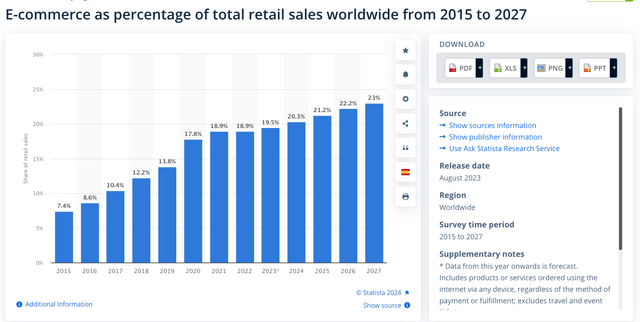

Even before the pandemic, in 2019, the company saw a 35.6% revenue increase. To be fair, in absolute terms, there’s unlikely to be much difference between the extent of the increase in 2023 and that in 2022. But considering that the share of online shopping has likely risen for good (see chart below), ideally, Etsy’s absolute revenue increase should be bigger too.

This then suggests that the company is likely losing market share to growing competition. In fact, answering a question during the last earnings call, it acknowledged that Chinese online marketplaces, like Temu of PDD Holdings (PDD) were impacting the market.

Source: Statista

Further, the company’s fourth quarter (Q4 2023) projections are disappointing too as it continued to expect a softening GMS. It said, “GMS for Q4 2023 is currently estimated to decline in the low-single-digit range on a year-over-year basis.”. The next year could also be challenging with its big US market, accounting for 55% of its GMS, expected to slide into a slowdown after having seen surprisingly resilient growth this year.

Restructuring underway

This has been enough reason to get Etsy’s management into action. Last month, the company decided to undertake restructuring, as it let go of 11% of its workforce to focus on what it calls its “Vital Few” projects.

Regarding the outcomes, it says that a “more agile team would enable us to properly focus on our key growth priorities, move bold and fast, and maintain a sustainable cost structure”. This includes changes in the leadership, with the consolidation of payment and fulfilment functions under products, as well as operations and markets under the same head. However, how far and how soon this impacts the company’s numbers remains to be seen.

Margins and market multiples

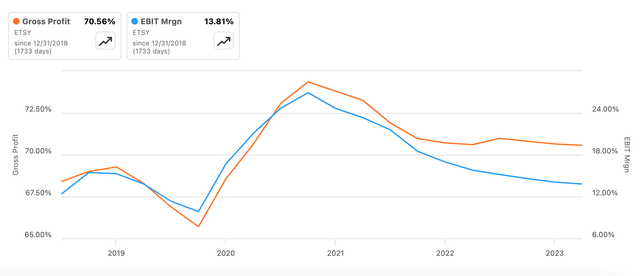

To give Etsy its due credit, its margins have been resilient. The gross profit margin has largely sustained at over 70% for 9M 2023. Sure, the operating margin has dropped to 13.8% from the average of 17% over the past five years. However, the average is skewed to the upside because of the uptick in online shopping during the pandemic. In 2019, the operating margin was at 11.3%, so the current levels are still an improvement.

Gross and Operating Margin (Source: Seeking Alpha)

The net income picture looks even better, as the company has overcome its loss last year on account of an impairment charge related to the acquisition of Depop and Elo7, to report an 11.8% margin. The non-GAAP measure of the adjusted EBITDA margin also came in at 27.2% for 9M 2023, just a bit below the 27.8% levels in the corresponding period of the previous year. While the company does expect the margin to correct in Q4 2023, it’s only 26-27%.

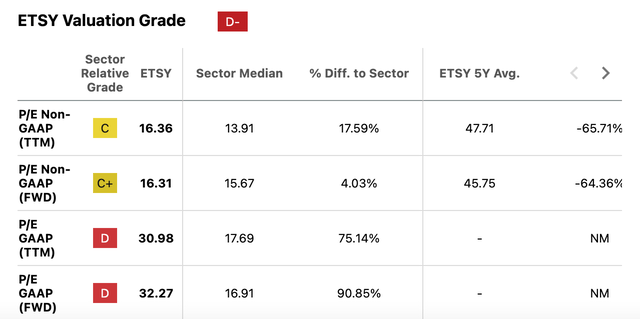

These do translate into decent non-GAAP multiples. Its forward non-GAAP price-to-earnings (P/E) ratio of 16.3x for 2023 and 15.7x for 2024. This compares to a 15.7x forward ratio for the consumer discretionary sector. In fact, these figures are actually attractive compared to the five-year average of 45.8x. But I’d take this positive comparison with a pinch of salt. It covers the COVID-19 period, which saw its price rise to unexpected highs.

Source: Seeking Alpha

Further, there’s a huge disconnect between non-GAAP and GAAP figures. The forward GAAP P/E is at 32.3x, which is way ahead of the consumer discretionary sector. It might still be justifiable if its peers were trading at similar levels. They aren’t. eBay (EBAY) for instance, has a ratio of 9.4x. Even Temu owner, PDD Holdings (PDD), is trading at 28.5x.

Both eBay and PDD are trading at similar levels on a non-GAAP basis as well. Averaging their P/Es indicates that while there’s a small upside for Etsy from a non-GAAP perspective, there’s a significant downside from the GAAP point of view.

What next?

My takeaway from a look at the market multiples is that even if we discount the current high GAAP forward P/E as ascribable to the impact on income from one-off events, the non-GAAP forward P/E doesn’t indicate any significant upside either.

Further, it’s hard to make a case for Etsy for 2024 as well. Its GMS figures are discouraging and are expected to continue contracting in Q4 2023 as well. With the US market expected to soften this year and rising competition, it remains to be seen whether Etsy’s guidance for the year will be any different.

It has put an action plan in place, with a sharper focus on key areas and some organisational restructuring. Its margins are also strong so far, and with fairly muted inflation levels now, can continue to remain so.

However, these aren’t enough to justify buying Etsy. At best, I’d wait for the 2024 guidance to assess how well (or not) it expects to do. Its earnings-related guidance in particular can be indicative of where the stock can be in a year. Until then, I’m going with a Hold rating.

Read the full article here