Main Thesis / Background

The purpose of this article is to discuss the broader equity market as we begin 2024. Specifically, I want to talk about the concerns I have after a rock star 2023. While there is plenty to be optimistic about, I am leaning towards the belief that the market is getting a bit ahead of itself in pricing in more gains.

Professional analysts – as well as retail investors – have all turned decidedly bullish. While this can be “good” for further momentum, it also sets my alarm bells ringing that the contrarian in me often sees as a good moment to start rotating against the herd. While I’m rarely an outright seller in the markets, I do tend to hold back on deploying new cash (I am a working professional) when I feel the risk-reward backdrop is not favorable. That is the type of environment I see right now, and I will explain why in detail below.

“Analysts” Are Bullish – Is That A Good Thing?

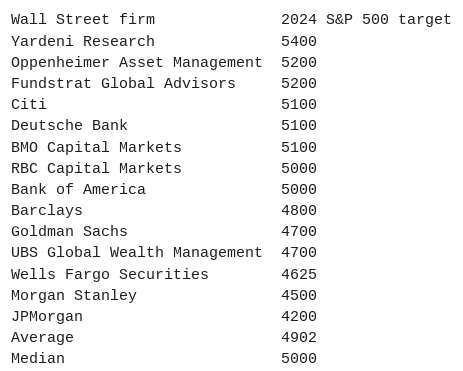

To begin, let us take a look at where the “experts” expect 2024 to take us. The long and short of it is – the outlook is very bullish. After being caught off guard a bit over last year, analysts seem in a hurry to play catch-up. Price targets for the S&P 500 have been bumped up consistently across many banks, funds, and institutions to the point where the S&P 500 is expected to finish the year well above where it is now:

Price Targets – S&P 500 (By Institution) (Morningstar)

Great news – right?

Well, that depends. Specifically on how right these analysts usually are. In my opinion, professional analysts tend to be more reactionary than proactive. What I mean is, good news happens and they increase their targets. Bad news gets announced, and out come the downward revisions. So on, and so on…

Don’t believe me? Well, just look at the 2023 consensus. Coming into the new year there was quite a bit of pessimism given the poor market performance, persistently high inflation and interest rates, and growing calls for a recession. But the net result was an astounding climb higher for the S&P 500. In fact, we ended last year well above the Wall Street target, as shown below:

Analysts Got It Wrong In 2023 (Bloomberg)

If you are thinking “wow, they got it wrong” – you would be absolutely correct.

But as fun as it is to poke fun at the professionals or “smart money” (as they refer to themselves), what constructive message can we take away from this? For me, it means that finding any merit to the general consensus should be done with the utmost care. The consensus for 2023 was way off, so the consensus for 2024 could be too.

That doesn’t mean run for the hills and sell-off everything because analysts are bullish. But it does mean to stay disciplined, pick your spots carefully, and don’t make any major money moves based on headlines or what you see from talking heads on TV. They are often not spouting recommendations or price targets with your interests in mind.

Retail Investors Are Optimistic Too

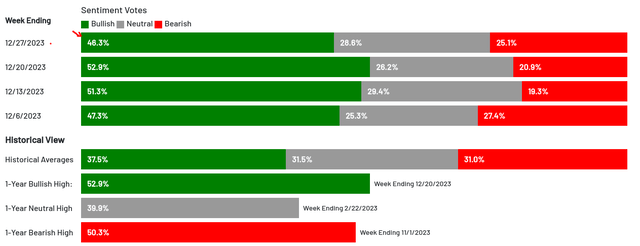

And it isn’t just professional investors or analysts who are entering 2024 on a high note. The same can be said for retail investors, who turned decidedly bullish in December and have held that sentiment right up to the new year:

Retail Sentiment (AAII)

Similar to the above paragraph, this is concerning to me. It seems that, similar to analyst forecasts, retail investors begin to turn bullish or bearish after we have seen big moves. Just look at the timing illustrated in that graphic. In early November, bearishness was at a 1-year high. And what happened in November and December? That equity market (and bond market) rallied strongly! Now, after weeks of gains, retail investors are overwhelmingly bullish. That strikes me as being “late to the game” and is fundamental to why I do not want to get overly aggressive here or chase profits. Markets have a way of evening out, and retail investors have a way of getting too bullish at the wrong time.

Valuations Are Stretched (For Large-Cap Tech)

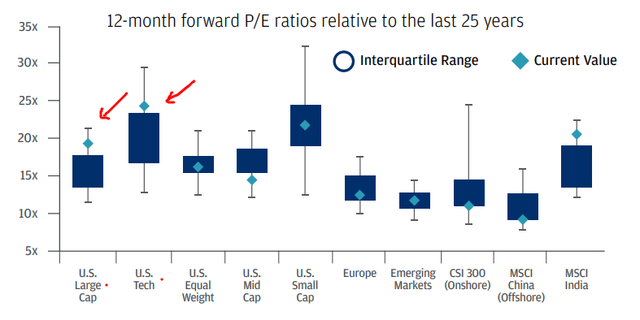

Expanding on the above discussion, a key reason why I find some of the optimism difficult to reconcile is because of where we are starting the year off in terms of valuations. Simply put, US stocks (as measured by the S&P 500) are quite expensive. This is because the S&P 500 as a benchmark is filled with large-cap US companies – and are heavily exposed to the Tech sector. This thematic idea has been a big winner in 2023, but that has not come without a cost. The net result is that these ideas (large-caps, Tech) have seen their valuations shoot higher. They are sitting well above their longer-term norms, which should illicit some level of caution:

Forward P/E (By Thematic Areas) (World Bank)

This is paramount as to why I am getting more cautious on large-cap, Tech, and growth themes in the US for the moment. They are all very pricey, and that warrants some level of caution going forward in my opinion.

The good news is there are plenty of alternatives if one is concerned about valuations. Many emerging market (“EM”) nations have sharp discounts to the U.S. and, for those who don’t want to take on the geo-political risks that come with EM investing, developed markets trade at a discount to the U.S. too. Even for those who want to stay closer to home, there are plenty of thematic plays offering a better value. Small caps, Energy and Financial shares, and equal-weight ETFs are all viable options for those concerned with rising P/Es across the S&P.

**I own the Invesco QQQ Trust ETF (QQQ) and Vanguard S&P 500 ETF (VOO) for growth. I also own the Invesco S&P 500 Equal Weight ETF (RSP), the iShares MSCI Canada ETF (EWC), iShares MSCI Australia ETF (EWA), and the iShares MSCI United Kingdom ETF (EWU) for international diversification.

Inflation Is Still Historically Elevated

Digging further into the macro-environment, readers are likely to remember that much of Q4’s surge in equity prices was driven on the backdrop of lower inflation readings and the expectation for Fed cuts in 2024. If this occurs it is certainly bullish for stocks (all other things being equal). So there is some positivity to take away from it.

But my concern is that markets are too optimistic. After all, if the Fed sees a weakening economy and a need to cut interest rates, then “all other things” are not equal. That bad news dynamic could limit the amount of rallying the equity market can realistically do, even with lower interest rates as a tailwind.

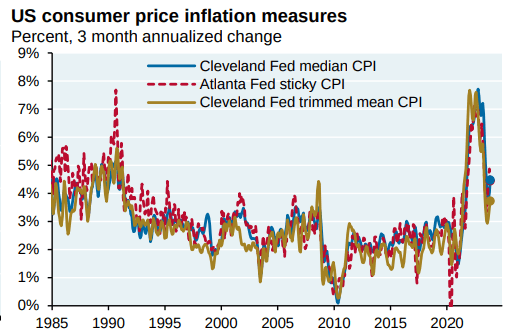

Beyond that, I personally think the market is getting ahead of itself in pricing in Fed rate cuts. Chairman Powell has not suggested rate cuts any time soon, yet some traders are suggesting they could come as early as March. That seems premature to me for a fundamental reason. This is that inflation remains elevated among the historical average from the past twenty years:

US Inflation Measures (JPMorgan Chase)

With this backdrop, I don’t see a compelling argument for the Fed to start cutting rates. Has progress been made? Absolutely. But more work remains to be done. Even if we do see some cuts in 2024, it won’t be as early as March or as aggressive as the market expects in my view. This means investors are setting themselves up for some disappointment. With equity levels where they are, it won’t take much in terms of bad news to send prices lower.

Bottom-line

We have seen a little bit of weakness to kick-off the year and I have some suspicions there will be more of that to come. While markets were rallying hard across both equities and bonds in Q4 last year, I see a backdrop that suggests things got a bit carried away. Large-cap US stocks are priced for perfection, while inflation remains elevated, and the herd looks to be entirely on the side of the bullish case. All of these factors add up to support a more contrarian approach at the moment. This means I will be only selectively buying in the weeks and months ahead and will take advantage of 5% yields on cash instruments while I wait for a better opportunity to present itself.

Read the full article here