Japanese stocks have been this year’s surprise outperformer, with the benchmark Nikkei 225 up over 25% YTD. While earnings growth has contributed to the rally, the other major driver has been corporate governance reforms by the Tokyo Stock Exchange (TSE) and their implications for shareholder value unlocking. Even at this relatively early stage, we’ve seen significant improvements on the capital return front, with another wave of share buybacks and dividend hikes announced through the July-September earnings season.

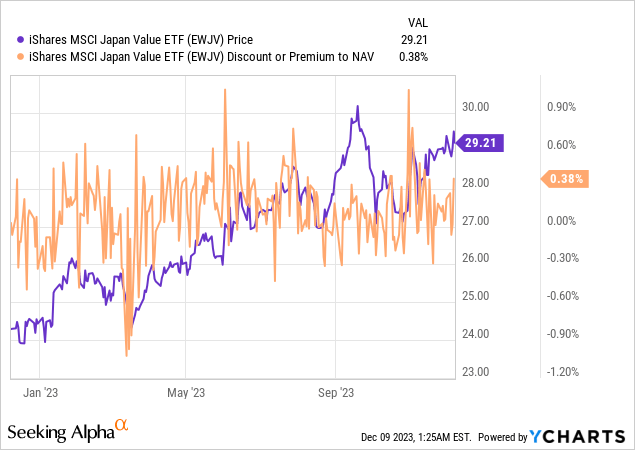

For investors looking to ride the TSE-led reform theme into 2024, when more corporate actions are due to take place, the iShares MSCI Japan Value ETF (NASDAQ:EWJV), which imposes a P/B-based stock selection criteria, offers a low-cost way to gain exposure. The issue, though, is that earnings haven’t quite kept pace with this year’s valuation re-rate. As a result, the EWJV portfolio is now priced at a slight premium to book and, more importantly, above the TSE’s 1x P/B target. With the Bank of Japan (‘BoJ’ or the Japanese central bank) also poised to normalize after years of ultra-loose monetary policy, EWJV could bump up against some valuation headwinds ahead. Overall, I remain neutral here.

iShares MSCI Japan Value ETF Overview – Low-Cost Japanese Fund Focused on Value

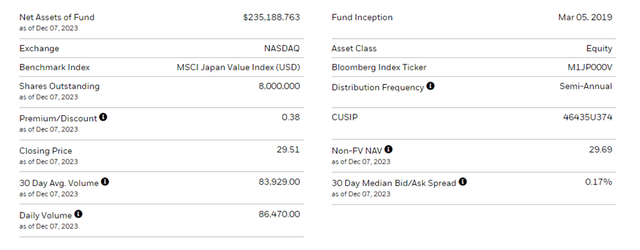

The US-listed iShares MSCI Japan Value ETF tracks a basket of large and mid-cap Japanese equities via the MSCI Japan Value Index. Unlike most other Japan ETFs, EWJV incorporates a multi-pronged value filter in its stock selection comprising 1) price to book value, 2) twelve-month forward price to earnings, and 3) dividend yield. This approach hasn’t quite matched the traction of Blackrock’s flagship iShares MSCI Japan ETF (EWJ), with net assets well below EWJ at $235m. The fund makes up for any liquidity shortfalls, though, with a far lower expense ratio at 0.15% (vs. 0.5% for EWJ).

iShares

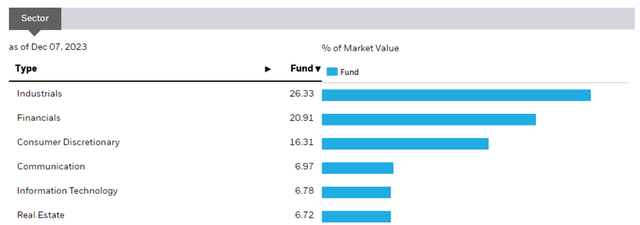

By virtue of its strict value criteria, EWJV maintains a narrow 138-stock portfolio – well below the 226 holdings for EWJ. While both funds skew toward the export-oriented Industrials sector (26.4%) at the very top, EWJV notably deviates in its overweight allocation to Financials (20.5%) and underweight to Health Care (2.9%). The rest of its major allocations, Consumer Discretionary (16.4%) and Information Technology (6.8%) are broadly in line with other large-cap Japan ETFs. Despite its smaller portfolio size, the fund’s added Financials allocation makes it one of the most defensive US-listed Japanese ETFs, with a beta of 0.5 vs the S&P 500 (SPY) and a return standard deviation of 15.0%.

iShares

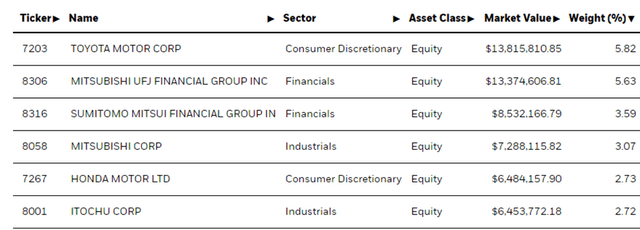

While EWJV’s largest holding, automotive leader Toyota Motor (TM), mirrors other Japanese large-cap ETFs, there are some notable differences below the line. For one, its outsized exposures to banking giants Mitsubishi UFJ (MUFG) and Sumitomo Mitsui Financial Group (SMFG) – in line with its Financials sector overweight. Perennially low P/B stocks like Mitsubishi Corporation (OTCPK:MSBHF) and Honda Motor (HMC) also feature prominently in the portfolio over high multiple tech stocks like Sony (SONY), Keyence (OTCPK:KYCCF), and Tokyo Electron (OTCPK:TOELY). The fund’s valuation multiple filter also means its portfolio is priced a few turns lower than EWJ at ~12x earnings and 1.1x book. As stocks trading at low multiples also tend to have more stable income streams, EWJV maintains a higher distribution yield through the cycles (currently 2.4% on a trailing twelve-month basis).

iShares

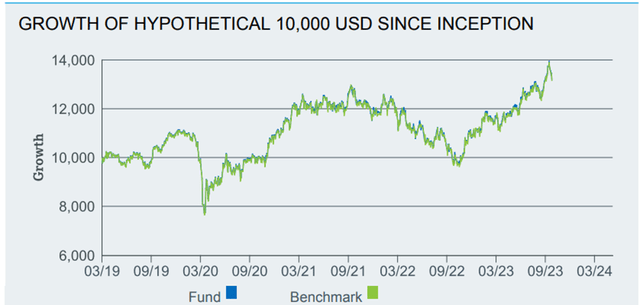

iShares MSCI Japan Value ETF Performance – Translating Value into Returns

EWJV has been the pick of the unhedged Japanese ETFs this year, notching a +21.7% year-to-date total return (vs +16.2% for EWJ). In turn, the fund’s rate of compounding since inception now stands at +6.2% in annualized market price and NAV terms. Over the last one and three years, the fund’s NAV has also been very strong at an annualized +35.3% and +10.3%, respectively. Despite its shorter operating history, EWJV’s focus on value appears to have paid off, having firmly outpaced EWJ’s returns across all timelines – while also maintaining a much lower expense ratio and tracking error.

iShares

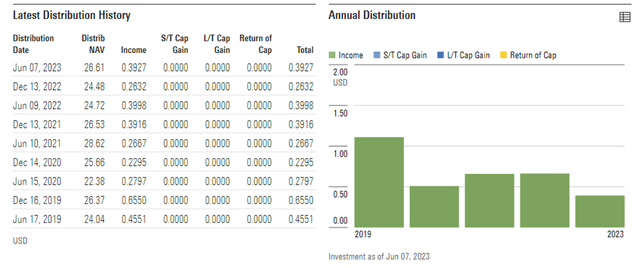

The distribution is also the pick of the US-listed Japan ETFs, with last year’s $0.66/share payout equating to an overall yield of >2% (vs <1% for EWJ). With the fund’s H1 2023 distribution pacing in line with last year’s levels, helped by a TSE-led push for higher capital returns for its constituents, expect more of the same from the year-end distribution. Hence, investors looking for stable income and don’t mind taking on the FX-related swings associated with unhedged exposure to Japanese equities will find a lot to like here.

Morningstar

A Unique Play on Japanese Corporate Reforms

Investors in Japan are set to walk away with great returns this year. Next year might be a different story, however. On the one hand, there is a multi-year TSE reform tailwind that could well reshape Japan’s previously shareholder-unfriendly corporate governance for good. In the near term, for instance, unwinding excess cash positions via buybacks or dividends will unlock quite a bit of shareholder value.

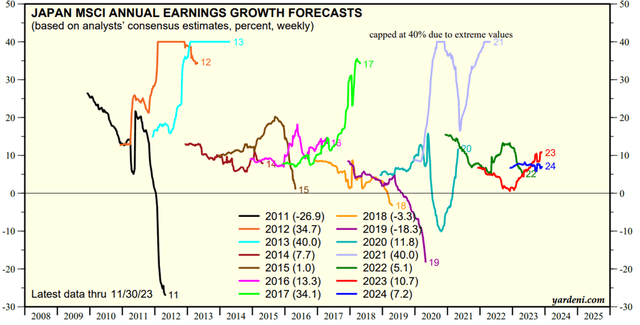

Yet, the widespread re-rating of Japanese large-caps this year, including in the value-focused EWJV portfolio, indicates these positives may already have been priced in. In fact, EWJV is now priced at a slight premium to book, limiting its leverage to a TSE-led reform theme focused on closing book value discounts. In contrast, underlying earnings growth isn’t running as quickly (high-single-digits % next year per consensus estimates), leaving room for a de-rating should future quarterly results disappoint and as monetary policy normalizes next year.

Yardeni

Read the full article here