Soft-landing has been promoted as a solution to the economy’s ills. Let me ask a simple question. Which ones does it solve?

Dueling mandates

There is nothing in the history of soft-landings that would make any of us think that the soft-landing strategy is a rabbit being pulled out of the hat to solve our inflation problem. The Fed, since it adopted its new framework late in 2020, has been walking on eggshells to try not to upset the unemployment rate in any way and to return it to cycle lows before it – like a postal carrier – attends to its appointed route. The Fed put its monetary policy duty of seeking a stable price level on hold while it dots the ‘I’ and crosses the ‘T’ on full employment, even as inflation ran rampant. It should be clear that the Fed has a labor market full-employment bias to its policymaking as it attends to its dual mandate. But the duel is over; the labor market objective has won.

But did the Fed pull a rabbit out of its hat anyway?

Despite this criticism, the Fed has managed to see the inflation rate fall steadily. Its targeted PCE headline is at 2.6% (Y/Y) and the core rate is at 3.2%, also year-over-year. So has the Fed ‘done it?’ The short-term inflation gauges are in even better shape!

Maybe it has, and maybe it hasn’t

This insightful headline (joke) sets the stage for a more complete discussion of where we are and what lies ahead. Historically soft-landings have been easier on the unemployment rate and not very productive in reducing inflation rates. These are important considerations if you are an investor trying to discern if the Fed has ‘done it’ or if this is some sort of Pyrrhic victory.

There has been a lot of discussion about how there has been a supply shock in this cycle, not a demand shock, that has lifted inflation. Yet there have been mounds and mounds of fiscal spending and record smashing money growth. So, I have a tough time rejoicing that supply chains are repaired, and I really wonder how anyone really knows that. For firms to reorient their global supply chains takes a great deal of effort and time. Is that really fixed? Already?

And, then there is this, the belief that a soft landing can obviate the need for recession. My perusal of history suggests that such a belief is a complete and utter fairy tale. Here is why: Recessions break the back of inflation. They create economic dislocations. The unemployment rate rises. All that creates a natural opportunity for firms to rethink and alter their strategies. Economic dislocation breaks inflation expectations. In contrast, with a soft-landing, there is no telling if expectations are reset since there is nothing cathartic that happens. Will a moderately elevated real interest rate without the cathartic jolt of recession behind it work? We may be about to find out. Behavioral economics has taken a look more closely at these sorts of things. And if we look at human behavior, people have a challenging time breaking habits without a motivating reason, a health scare, to stop smoking or to diet successfully. How many people quit smoking out of pure logic compared to those with a life shaking scare?

While many economists are patting themselves on the back for sticking with the soft-landing view, I would offer this chart.

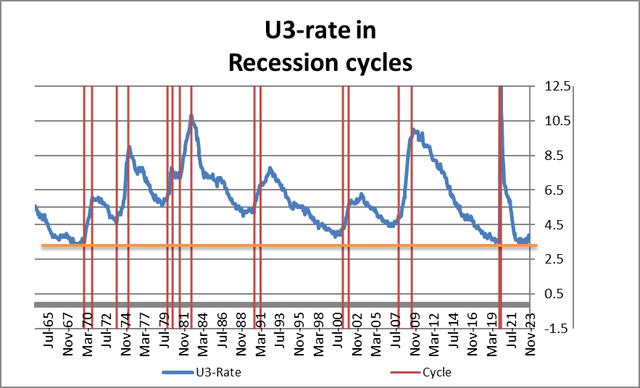

Chart 1

Unemployment rate history (Haver Analytics; FAO Economics)

A low unemployment rate is strongly correlated with the onset of recession. Note: there is no inflation on this chart and no Fed funds rate. Also note how the unemployment rate currently is historically low. The Fed is shooting for a soft landing to preserve the unemployment rate at/near a level it has historically been unable to hold.

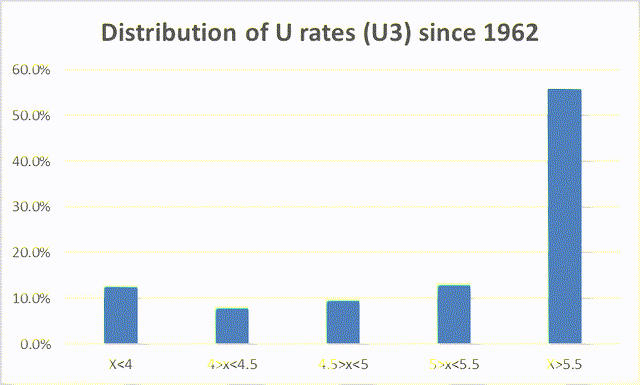

Chart 2

unemployment rate by duration at levels (Haver Analytics and FAO Economics)

Since 1962 the U3 rate has been below 4% only 12.8% of the time. It has been above 5.5% fully 55.9% of the time. It is wise for the Fed to try to make this low rate endure and to risk inflation progress to do it.

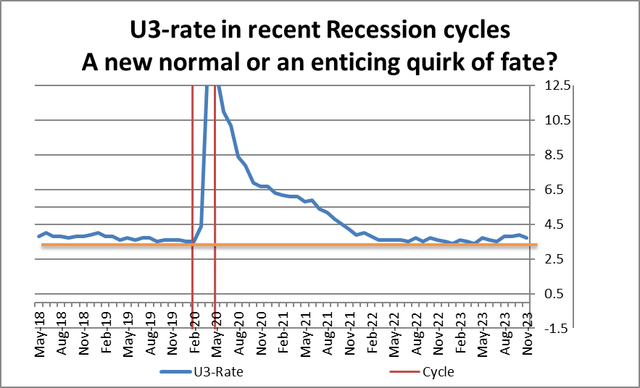

Chart 3

Recent unemployment rate trends (Haver Analytics and FAO Economics)

Or maybe that’s the wrong way to look at it! Since 2018 the unemployment rate has been below 4% about 64% of the time. Is this low rate now the new normal? And remember, the rate only rose because Covid jacked the unemployment rate way up. Chart one documents what a long time it took for the unemployment rate to come down after the Great Recession. Part of the Fed’s policy error in 2021-2023 has been the overly rapid recovery in the unemployment rate back to its lowest levels. The Fed did not expect that and that was one reason it offered guidance that misled the banking system so badly.

However…

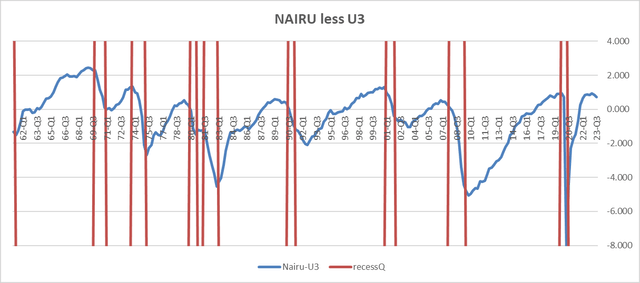

Chart 4

Gap Between NAIRU and U3 unemployment rate (Haver Analytics and FAO Economics)

Chart 4 shows the unemployment rate in a different environment. Here I look at the unemployment rate subtracted from estimates of NAIRU. What is clear here is that excessive low unemployment (NAIRU less U3 – values above zero on this chart) presage recessions. In fact, below-NAIRU unemployment rates presage all recessions except for the second early 1980 double-dip recession. Extra low unemployment EVEN MORE THAN INFLATION is STRONGLY correlated with the onset of recession. I do not offer it here, but this also works to look at the ratio of NAIRU to U3. In that case, a NAIRU rise more than 10% above U3 seems to trigger a recession signal. All this suggests that tight labor market conditions are a real problem for the economy – even more of a problem than the one they might create with wages filtered through a Phillips Curve. While everyone is celebrating firms solving their supply chain problems, firms still have a significant labor supply problem, and it is a serious issue and remains unattended.

One thing I have been writing about in this cycle is that soft-landings do not solve problems. They merely extend the period of peril. By that I mean that if a recession is somehow avoided by some clever interest rate manipulation when that is ‘done’ (whatever ‘done’ means) the economy is still at full employment and in a situation in which inflation pressures remain intense. Recessions break that cycle and create slack. Soft landings do not and are inevitably followed by rising inflation and usually a real recession.

Soft-landing is a place-holder

A soft landing is a postponement strategy not a solution strategy. Only in the mid 1990’s did a soft-landing lead to a drop in the inflation rate and that was because of the onset of the Asian debt crisis, not because of anything monetary policy did. And when that ended inflation rose, and we had another recession. In the mid-1960s the Fed aborted a tightening, avoided recession, but after stopping its tightening in December of 1966, inflation dipped but then rose and all the time remained higher than it has been pre-tightening! This episode led to the 1969-70 recession, referred to by some as a soft-landing sort of recession – one in which the inflation rate did not fall. The Fed cut rates too much in that recession’s recovery and reignited even more inflation that ramped up and led to the recession of 1973-75.

Biding time…

In summary, soft landings do not really solve problems, they postpone them. And this now is a political strategy. Democrats do not want the Fed solving the inflation problem ahead of the 2024 election (raising rates sharply) but if inflation can be damped and contained for a period, the Fed can then go after inflation after November of 2024. But let’s not confuse this with an optimal economic strategy. Because whatever the strategy is, it is not that.

Read the full article here