Investment Thesis

Exela Technologies, Inc. (NASDAQ:XELA) has been a subject of debate among investors. The company operates primarily in the customer service industry, supported by a workforce of 15,000 employees, the majority of whom are low-wage customer support agents. The company faces many challenges. High on the list is its debt burden, which has left the company highly leveraged and scrambling to find a sustainable path forward.

Any share price appreciation is likely to be met with an equity offering of the same magnitude, leading to a dilution of existing shareholders’ stakes. In the past, XELA has capitalized on the retail investor frenzy, using the inflow of cash from meme-traders to pay off debts. The unfortunate outcome is that these retail investors – the Reddit folks – have paid dearly for their misguided investment decision.

This cycle will likely continue, with retail investors pouring money into XELA, only for the company to use these funds to service its debt. The result will be ongoing dilution and a downward trend in share price, intermitted by occasional spikes driven by meme trading.

By the time XELA manages to repay its debt, if ever, the share price will likely have declined multiple times over (due to the reverse stock splits), potentially wiping out equity. Alternatively, bondholders could take over the company, which, again, leaves equity holders knocked out.

Given these factors, I prefer to wait until this cycle plays out before considering investing in XELA. After all, it’s better to let the Reddit crowd foot the bill for XELA’s debt repayment rather than risking my own hard-earned money.

Operations and Strategy

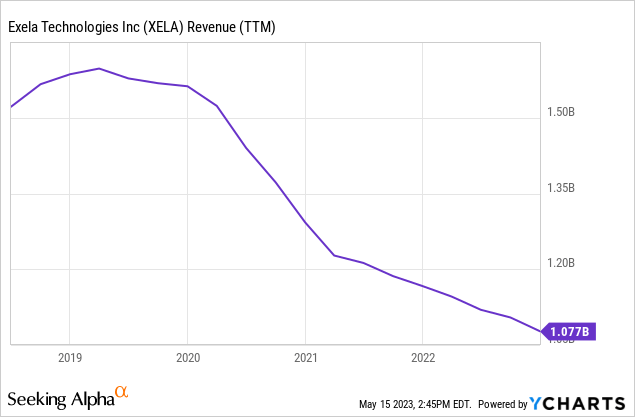

In an attempt to alleviate its financial pressures and keep pace with industry trends, XELA has been transitioning its business model towards software and cloud-based services. Yet, despite the promise of this strategic shift, the results have been, to put it mildly, disappointing. This attempt has yet to lead to a material change in business, leaving investors questioning the management’s ability to steer the company in the right direction.

The company’s bread and butter – customer service – is characterized by low margins and high variable costs and is becoming outdated in today’s digital world. The rise of chatbots and other AI-driven customer service solutions poses a significant risk to traditional call centers. These technological advancements not only offer cost-saving but also provide 24/7 service, something human-operated call centers struggle to match.

Management argues that the company’s established relations with customers give it a distinct advantage when marketing new technologies. However, this argument falls flat when considering the current financial situation. Simply put, XELA needs more cash to invest in developing or adopting these new technologies. It’s an impasse; the company needs to innovate to bring in money, but it requires more financial resources to do so.

Debt Service

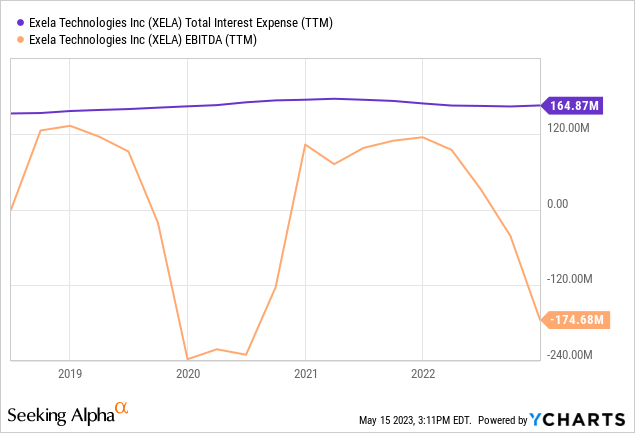

Last week, XELA reported its Q1 results, indicating the depth of the company’s debt woes. With $1.1 billion in interest-bearing debt on its books, of which $136 million is due in the coming twelve months, XELA is clearly in a precarious position. The interest expense alone is a staggering $45 million per quarter, a figure the company is struggling to meet given its current cash flow. The company’s interest expense is higher than its EBITDA “Earnings before Interest, Tax, Depreciation, and Amortization.”

To stay afloat, XELA has resorted to a desperate strategy that would raise eyebrows in any financial circle. Despite its shares trading at a meager 3 cents (before the reverse split), the company is issuing new shares just to service its debt. This high-risk gamble raised $69 million in Q1 2023, just enough to cover its interest payments. However, this strategy has catastrophic consequences for equity holders. The continuous dilution of shares, particularly when they’re trading at historic lows, is like a punch to the gut of any investor. It’s a cycle that is doomed to repeat itself until the company manages to somehow manage to pay off its staggering debt.

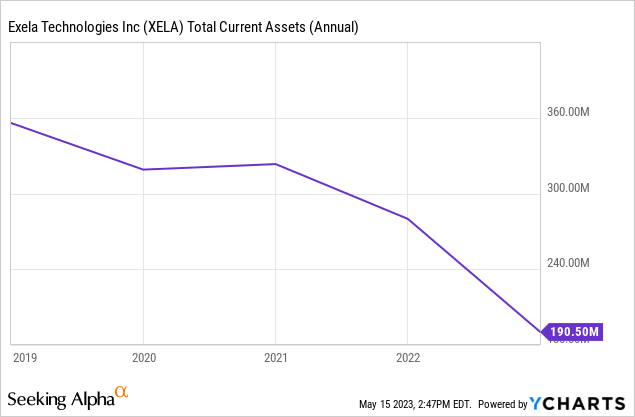

XELA’s liquidity position also appears in a precarious condition. The company’s cash and cash equivalents decreased from $15 million in December 2022 to $9.9 million in March 2023, indicating dwindling liquidity. Additionally, the firm’s current ratio, a key liquidity indicator computed by dividing total current assets by total current liabilities, is approximately 0.42x, well below the general benchmark of 1x. This means the company will struggle to meet its short-term obligations unless retail investors give it more cash.

In essence, XELA is trapped in a vicious cycle of debt and dilution. Unless a significant change occurs, the company’s future look bleak, and equity holders are set to bear the brunt of this financial catastrophe.

How I Might Be Wrong

While my analysis leans heavily towards the bearish side, it’s important to acknowledge potential scenarios where my assessment might be proven wrong. For example, a successful transformation and scaling of high-margin services, such as DrySign (digital signatures) or xbp (treasury as a service) and other cloud-based services could eventually lead to higher margins and improvements in free cash flow, helping reduce the debt burden.

Another aspect to consider is XELA’s relationship with B. Riley Financial, Inc. (RILY), a boutique investment bank known for its work with distressed companies. RILY’s expertise could be instrumental in helping XELA navigate its current challenges. The relationship between RILY and XELA is complex. Not only does RILY underwrite XELA’s equity offering, but it also holds a significant amount of its debt. While RILY’s interest in XELA might incentivize the investment banker to work hard for XELA, one should note that RILY is facing its own challenges in part due to its exposure to the likes of XELA.

In any case, I don’t believe that either the company’s cloud transition or its relationship with RILY provides the much-needed cure for XELA’s deep financial troubles.

Summary

The situation at Exela Technologies, Inc. remains dire. The company’s towering debt burden and perpetual dilution of shareholder equity continue to erode its financial stability. The company’s current strategy seems to be fueled by retail investors, the Reddit crowd, who unknowingly serve as cannon fodder, a lifeline for XELA’s debt obligations rather than shareholders. This cycle of raising equity to repay the debt will likely continue until the debt is cleared, all at the expense of these retail Exela Technologies, Inc. investors.

XELA’s endeavor to shift its business model towards software and cloud-based services has failed to deliver the anticipated financial turnaround. The company’s core operations – traditional customer service centers, are threatened by emerging technologies such as AI-powered chatbots. This risk is compounded by XELA’s lack of financial resources to invest in new technologies, effectively trapping the company in a financial deadlock.

The company’s financial woes were further highlighted in its Q1 2023 results, with a staggering $1.1 billion in interest-bearing debt and a rapidly depleting cash position. The struggling business is resorting to risky maneuvers such as issuing new shares at historically low prices just to pay interest. This raises a red flag, particularly given that the only analyst present in the Q1 2023 earnings call was Zach Cummins from RILY, an investment bank known for dealing with troubled companies and which also happens to be a lender and investment banker to XELA.

Adding to the company’s troubles, XELA’s ticker plunged by 40% following a stock split announcement. This significant decline is not currently reflected on the Seeking Alpha platform due to temporary issues with SA’s data vendor, misleadingly showing an 11,400% appreciation. However, I imagine brokerage accounts with live data should reflect the stock decline accurately.

Given these circumstances, XELA appears to be trapped in a relentless cycle of debt dilution. The company’s future prospects look grim unless there is a significant breakthrough, and even then, the journey to recovery would likely be a challenging one. For those observing the situation, it may be prudent to exercise caution and wait for clearer signs of stability before considering any involvement with XELA.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here