The Extra Space Storage (NYSE:EXR) is a relatively large REIT carrying over $35 billion in market cap. EXR is also one of the five publicly traded self-storage REITs in the U.S. making it a niche player in the context of more conventional peers, which operate in the office, retail, residential and similar sectors.

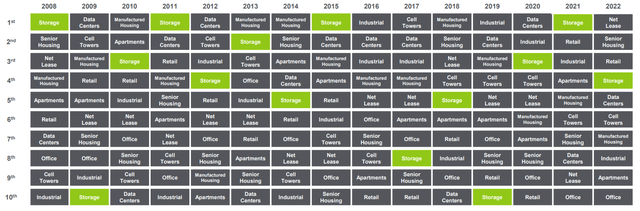

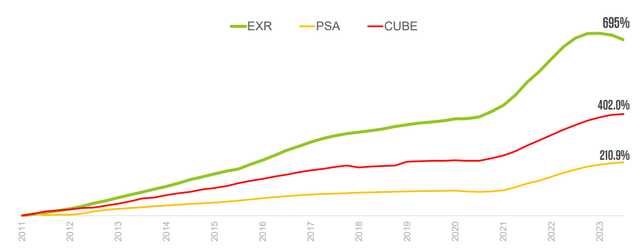

Now, if we think about the self-storage REIT sector as such, it is worth underscoring the fact that in many of the previous years it has delivered superior returns relative to the other types of commercial real estate properties. In fact, counting from 1999, self-storage ranks as the top performing sector from the cumulative total return perspective.

EXR Investor Presentation

One of the key drivers behind this has been the combination of secular tailwinds (e.g., increased preference towards smaller and more efficient properties) and a relatively immature sector in terms of the institutional capital and well-managed asset stock.

EXR Investor Presentation

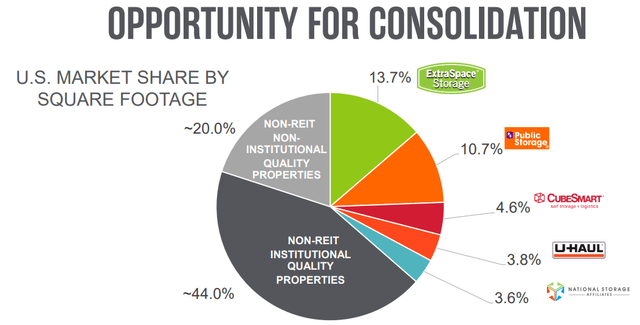

Despite the recent growth and an increased recognition of self-storage companies, the market is still fragmented with a significant potential for further growth.

So, let me know explain why I think that EXR is an attractive vehicle from which to go long the self-storage “asset class” and at the same time enjoy potential benefits from idiosyncratic or company specific performance.

Thesis

The first thing that we have to appreciate is the state of EXR’s balance sheet. To capitalize on the prevailing tailwinds and really capture some of the unexplored market share, it is critical to have a sound balance sheet that could allow it to access cheap sources of capital.

As of Q3, 2023, EXR had an investment grade balance sheet and a net debt to EBITDA ratio of 5x, which is a clear indicator of incremental financial capacity to assume additional leverage in order to make accretive M&A moves.

If we look at the current weighted average interest rate of EXR we will notice a bit elevated interest rate level of ~4.4%. It is elevated in the context of most of the investment grade REITs, which before the surging interest rate environment had issued longer dated bonds (or loans) at fixed rates that are considerably below the current market level cost of financing.

However, while these levels introduce more pronounced headwinds for EXR currently, it also implies that on a go forward basis, EXR will experience less painful consequences of refinancing the maturing borrowing. In other words, the rate of change effects in terms of the cost of financing that is embedded in the books will be relatively mild. Plus, we have to keep in mind the trajectory of SOFR in 2024, which if it materializes according to the consensus estimates, should provide an additional benefit for EXR to expand in a less expensive manner.

The second element, which contributes to EXR’s ability to grow is the level of retained cash generation, which currently stands at 20% of the underlying FFO generation. At first this might seem a bit too low to accommodate a material expansion. Yet, there are two important caveats here:

- The consensus estimate for the FFO growth over the next couple of years stands at high single digits, which will essentially boost the overall pie from which to both distribute dividends and retain cash for new investments.

- The recent consolidation of Life Storage REIT is projected to finally unlock synergies, which will already provide a boost to the cash flows in Q1, 2024.

Now, once we have established that EXR has the financial capacity to invest in new opportunities, it is worth mentioning that currently it is also a great time to buy EXR.

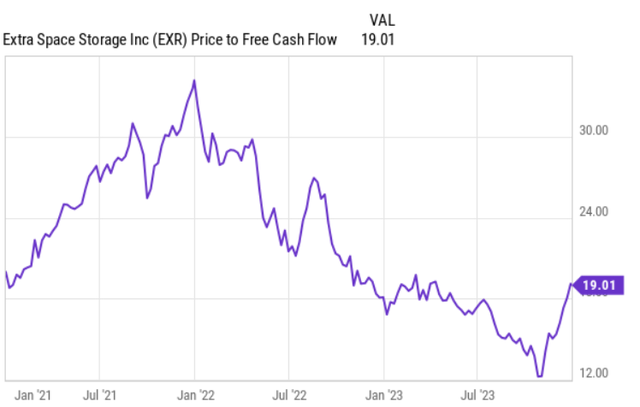

Namely, EXR’s valuations are quite depressed compared to the 3-year historical norm.

YCharts

On a TTM price to free cash flow basis, EXR trades at 19x, which is low not only looking at the recent history, but also if we compared to the COVID-19 period, when the overall REIT sector got significantly hammered.

There are a couple of reasons for this, but the two most critical ones are higher interest rates and a normalization in core FFO growth.

The former component is, as we can imply from the market expectations, clearly transitory and sooner or later should take of the pressure off EXR.

The latter component is also, in my view, transitory and mostly driven by extremely difficult comparables stemming from record years in 2021 and 2022, when the rent growth was registered at 11.2% and 18.4% levels, respectively.

EXR Investor Presentation

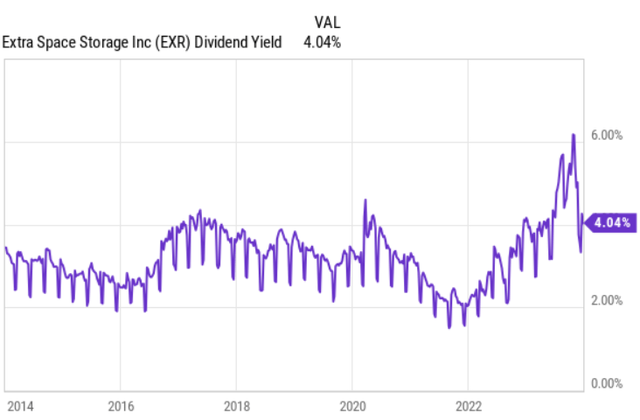

As a result, we can also see EXR’s dividend revolving around historically attractive levels.

YCharts

The bottom line

In my opinion, investors should definitely pay attention to EXR due to the exposure to a fundamentally attractive sector in conjunction with a sound balance sheet (and cash generation) that should enable attractive and sustainable growth in the future.

Moreover, the fact that EXR is down relative to the historical multiples and currently offers a yield of 4% renders the investment story even more attractive.

y

Read the full article here