When I think of the unique selling points for the London based luxury e-commerce company Farfetch (NYSE:FTCH), two key ones come to mind. The first is its presence in the lucrative luxury segment. And the second is its presence in the promising e-commerce market. Marry the two and we have a winner at our hands.

Or do we? The last time I wrote about it, in October 2022, I had given it a Hold rating. Among other things, this was based on the fact that the stock had already fallen so much in the past year, there appeared to be no worse time to sell it. Except that it was. Since then, the stock has fallen by another 25.8%

Source: Seeking Alpha

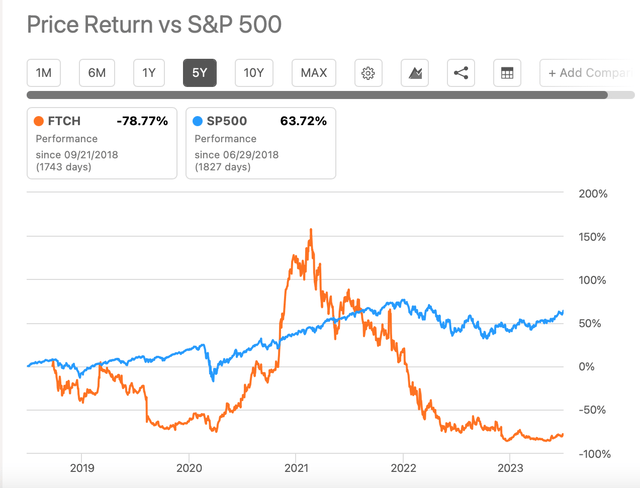

High Beta, Poor Returns

It is not like FTCH has been in a free-fall since then, though. In November, it spiked to gain over 30% from the time I wrote. And by the second half of December, it had fallen by 50% from its October levels. It has continued to see fluctuations since, though not quite as dramatic. The point remains, however, that the stock has been extremely volatile over the past months. And this is just an extension of an ongoing trend. The fact that in February 2021, it was at 831% of its current price puts the extent of volatility into context.

The high beta associated with it makes me uncomfortable as an investor. This is even more so since its 5-month beta value at 2.95 is also higher than comparable stocks. For example, Burberry (OTCPK:BURBY), also a London based luxury company, has a value of 1.24 and the German Zalando (OTCPK:ZLNDY), a leading fashion e-commerce company, has one of 1.68. This indicates that FTCH doesn’t look attractive from both the luxury or the e-commerce perspective. There are more reliable stocks to buy in both categories.

The high risk associated with FTCH has translated into pretty poor returns at the stock markets. Not just in the past five years (see chart below) but also over the last three years, where it has fallen by 65.3% and the past year, which has seen a decline of 15.6%.

Source: Seeking Alpha

Revenue Growth Comparatively Weak

I don’t mean to be all too harsh on FTCH, though. 2023 has been good for it, with significant 37% gains. The question now is if it can sustain this increase, or whether it is likely to continue fluctuating wildly. And to assess this, I now look at its fundamentals.

As a loss making company, the key metric for Farfetch is revenue growth, which has picked up in the first quarter of 2023 (Q1 2023) to 8.1% year-on-year (YoY) after a muted 3% increase in 2022. I would be willing to overlook 2022’s weak growth as a post-pandemic correction, but even in the years before COVID-19 lockdowns happened, the company was consistently growing by 50-70%.

What Holds It Back?

So what’s holding growth back now from reaching its former heights? In its discussion of the gross merchandise value [GMV] in its latest release, which incidentally showed virtually no YoY growth, besides a negative currency impact, it was affected on account of its key markets. It mentions “continuing headwinds from the suspension of trade in Russia”, where trade ceased only at the end of Q1, 2022. Russia, for context, was its third-largest market earlier. It also mentions “demand has not yet fully recovered” in China, which is its second-biggest market.

While the base effect from Russia will not be there from next quarter onwards, giving hope of better performance, I find it hard to get on board with weak demand in China. The first quarter incorporates the Lunar New Year period in the country, which saw a surge in retail sales. In fact, retail sales have continued to be robust since, too. Further, luxury companies like LVMH (OTCPK:LVMUY) and Richemont (OTCPK:CFRUY) have reported a return of demand from China in the quarter. So if Farfetch has missed this party, it’s worth wondering why. I am also concerned about what it indicates for its prospects for the remainder of the year, as the Chinese recovery is no longer looking as robust as it was predicted to be after the removal of COVID-19 restrictions. At the same time, the US economy is expected to remain weak this year.

The Outlook and Market Valuations

The company, though, is optimistic, with expectations of a 19.5% growth in GMV. Analysts to expect robust revenue growth, the consensus for which is a shade higher than the company’s GMV growth expectations, at 20.5%. Revenue growth is expected to pick up, particularly in the second half of the year, likely on a positive base effect and some return of demand. But going by the signs so far, I wouldn’t be surprised by a downward revision to the forecasts.

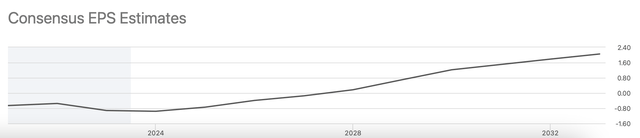

There is less optimism on the EPS front, though. After two years of raking in net profits, the company swung back into losses in 2022 and is expected to continue being loss making until 2027. So, as far as market valuations go, then, only the price-to-sales (P/S) applies to FTCH.

Source: Seeking Alpha

The trailing twelve months [TTM] P/S is at 1x has declined quite a bit from the 1.4x it was at the last time I checked. But it is still slightly higher than that for the consumer discretionary sector at 0.87x. It isn’t enough to merit a decline, but it does indicate that the stock is fairly valued. That the forward P/S at 0.86x, is close to that for the sector at 0.89x, also confirms this.

What next?

This of course leads to the next big question, what’s next for FTCH? Let’s do a quick recap. Farfetch has seen a pickup in revenue growth in Q1 2023, though it remains low from historical standards. Still, it is optimistic about the year ahead, and so are analysts. Its market valuations indicate that it is fairly priced already, though.

Going by its weak past performance and its high beta, I’d take that as a sign not to rush into buying FTCH right now. In fact, I would watch for the next quarter’s earnings to see if its growth can be sustained, especially as there are signs that China’s growth might cool off and the US, its biggest market, is seeing a slowdown already. I reiterate my Hold rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here