In a volatile market such as this year’s, investors are rewarded for constantly monitoring their positions and going in and out of stocks as valuations and fundamental conditions change. I continue to believe major indices will finish out the year relatively flat to where they are today: but going overweight on certain choice stocks will be the key to beating the markets.

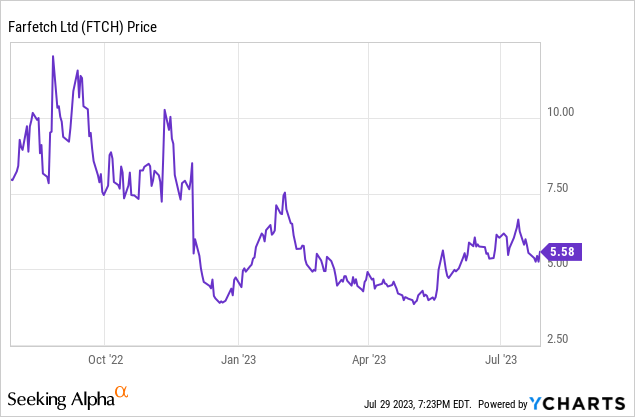

Farfetch (NYSE:FTCH), the British fashion e-commerce company, has had a whirlwind of a year. Down initially like most other e-commerce companies, Farfetch has had a number of unique challenges, including and especially softer demand from its most important market, China. But as GMV returned to slight growth in the first quarter of this year, and with comps set to ease, it’s a good time to re-assess the bull case in this stock.

I was bearish or cautiously neutral on Farfetch for most of 2022 as the company’s demand started to sink. But now with momentum building behind the company ever since Farfetch started to rally in May, I’m now bullish on the stock and think there is more runway for this rebound rally to continue.

The bull case for Farfetch revisited

Before we get into some short-term drivers behind Farfetch’s recent outperformance, here’s a reminder of the core appeal to Farfetch from a long-term perspective:

- The company has cracked a niche that Amazon can’t break into. Amazon, though widely regarded as the cheapest and most convenient e-commerce site, has for years fought off a reputation as being cluttered and reliant on flashy promotions. Farfetch’s niche in the luxury space is well-protected against encroachment, so in the long run the company has plenty of room to grow.

- Good mix of platform and first-party businesses. On top of its pure e-commerce commission model, Farfetch also operates a portfolio of successful luxury brands, including Off-White. These high-price tag brands operate at elevated gross margins (>50%), and contribute meaningfully to Farfetch’s bottom line.

- High-profile partnerships. Fashion is all about the brands and collaborations of the moment, and high-profile/limited-time collabs have stoked plenty of excitement since the pandemic began. The company’s stature has elevated it to the ability to strike partnerships with giant names, including Richemont, Ferragamo, and the Neiman Marcus group.

- Farfetch optimized for cost during its downturn. Farfetch has significantly reduced its headcount in the expectation of an extended recession, which will make the company more profitable in the long run. It’s also now relying far less on demand generation/promotions to drive growth, improving the company’s order contribution margins.

GMV is back in growth mode

After several painful quarters of decline, Farfetch is back to showing both GMV and revenue growth.

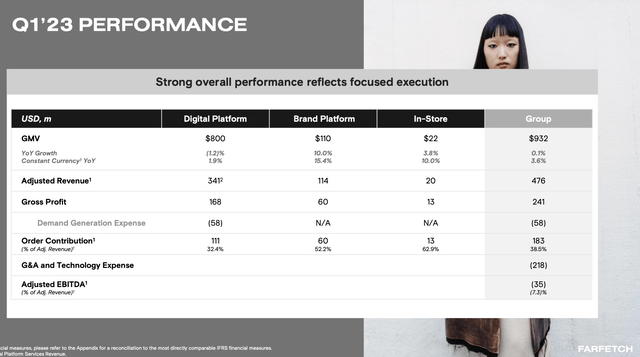

Farfetch key metrics (Farfetch Q1 earnings deck)

The chart above shows Farfetch’s key results during the fiscal first quarter (March). Group GMV of $932 million grew 0.1% y/y, or 3.6% y/y adjusted for currency movements. On a constant-currency basis, all three of Farfetch’s key segments: its digital marketplace (third-party) business, its owned brands, and its physical store locations (Browns) saw growth. First-party sales in the brand platform and in-store businesses, in particular, saw double-digit FX-neutral growth.

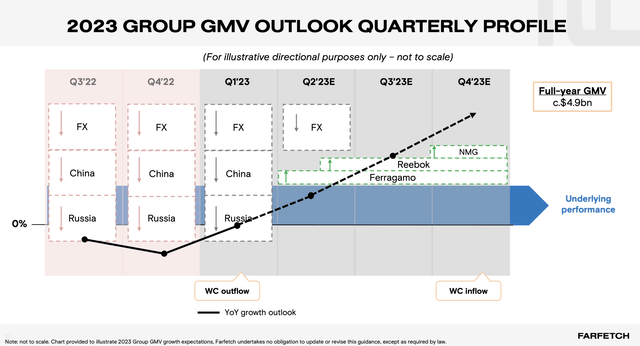

Something else to look forward to: comps are about to get easier, plus there are additional tailwinds to fuel growth in the remainder of the year. New partnerships from Ferragamo, Reebok, and Neiman Marcus are poised to contribute to incremental revenue and GMV growth.

Farfetch growth trajectory (Farfetch Q1 earnings deck)

As seen above, the past several quarters – including Q1 – saw heavy headwinds from currency movements, the start of macro-driven demand slowdowns in China, and the exit from Russia. Excluding China and Russia, Farfetch’s marketplace order count actually grew 18% y/y. Starting in Q2, Farfetch will start to lap these easier comps, and in Q3, FX headwinds (a four-point drag to Q1 GMV) should also ease.

And specifically on China – it’s not just that comps are easing, but Farfetch is also citing a turnaround in fundamental performance in this key luxury market. Per CEO Jose Neves’ remarks on China on the Q1 earnings call:

With respect to China, we saw a marked improvement in Q1 Mainland China GMV. While still in decline, it was to a lesser extent than in Q4 2022. And I’m pleased to share that performance has continued to ramp up as we expected, with GMV back to growth quarter-to-date.

I have just spent a week in Mainland China and Hong Kong, and I am very excited by what I witnessed. Not only does the country seem to be back to normal with a lot of positive energy, it is also clear that the appetite for luxury is very strong. This makes me even more enthusiastic in light of what Farfetch has built in this market.

I believe we are the only western companies succeeding at a multi $100 million scale in online luxury in China. In fact, very few Western Internet companies have been able to find a strong product market Fit in China. Yet Farfetch, thanks to the unique dynamics of the luxury industry, our continued investment in localized operations over the past eight years, and an amazing team on the ground has created a very differentiated platform for luxury brands to reach their Chinese customers digitally.

China is expected to represent more than 25% of the luxury industry by 2030, and with Mainland China at less than 10% of our overall business. This means we have significant potential for further growth as our recovery in this market accretes positively to our overall 2023 plans.

We are also delighted to see our internationalization efforts pay off in other key luxury markets, including in Latin America, and the Middle East where GMV grew strong double digits in Q1.”

Less promotional reliance is leading to expectations for profit growth

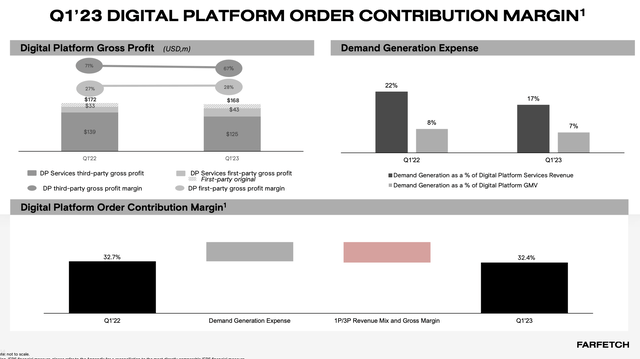

It’s worth noting as well that Farfetch is relying far less on demand generation in order to drive its orders. The chart below shows that demand generation expense as a percentage of digital platform revenue has dropped to 17%, five points lower than 22% in the year-ago quarter.

Farfetch order contribution (Farfetch Q1 earnings deck)

This has helped to offset lower average order values ($566 this quarter, down -10% y/y from $632 in the prior-year Q1, in part driven by FX) and allowed order contribution margins to stay roughly flat at 32.4%, within 30bps of the prior year.

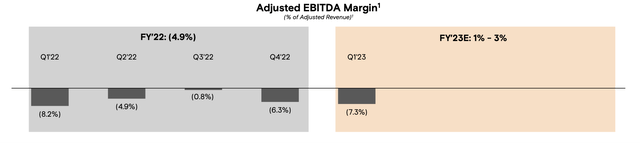

Note as well that opex reductions have helped Farfetch drive 90bps of adjusted EBITDA margin improvement to -7.3% in Q1, which is seasonally the worst quarter of the year. For the full year, Farfetch is expecting to generate positive adjusted EBITDA at a 1-3% margin range, which at the midpoint represents seven points of adjusted EBITDA improvement year over year.

Farfetch adjusted EBITDA expectations (Farfetch Q1 earnings deck)

Key takeaways

It’s a great time to go long on Farfetch just as the business is starting to bottom out from a y/y trends perspective and new partnerships are set to kick in and provide a boost to revenue. And in particular, Farfetch’s commitment to delivering positive adjusted EBITDA should help to turn the narrative around in this stock. Look for a buying opportunity here.

Read the full article here