Following the end of COVID supply chock and European energy crisis, energy stocks have largely retreated this year, underperforming the broad market. However, energy companies that have reaped massive profits from the energy rally are now in much stronger financial position than before, while being underpriced as energy prices now slightly relieve. Among them, natural gas is deemed as the most critical energy source to ensure energy security while enabling climate transition. With the expectations for high natural gas demand in the upcoming winter, I believe that First Trust Natural Gas ETF (NYSEARCA:FCG) has a strong medium-term prospect as supply continues to remain at steady levels.

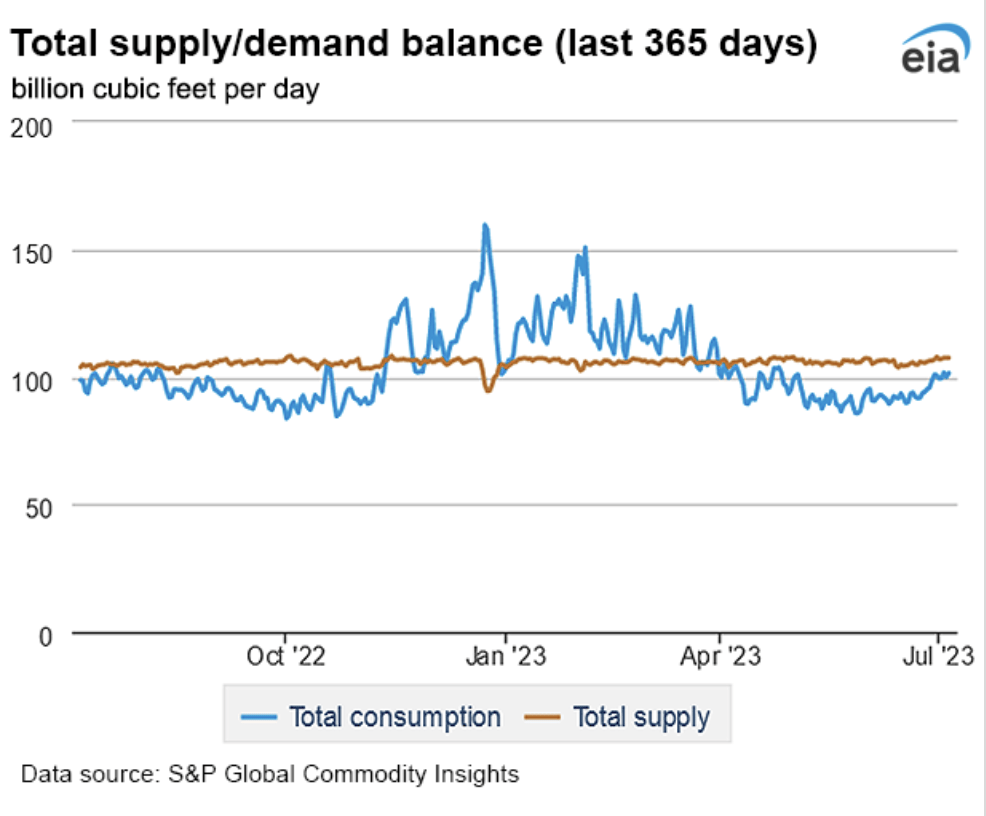

EIA

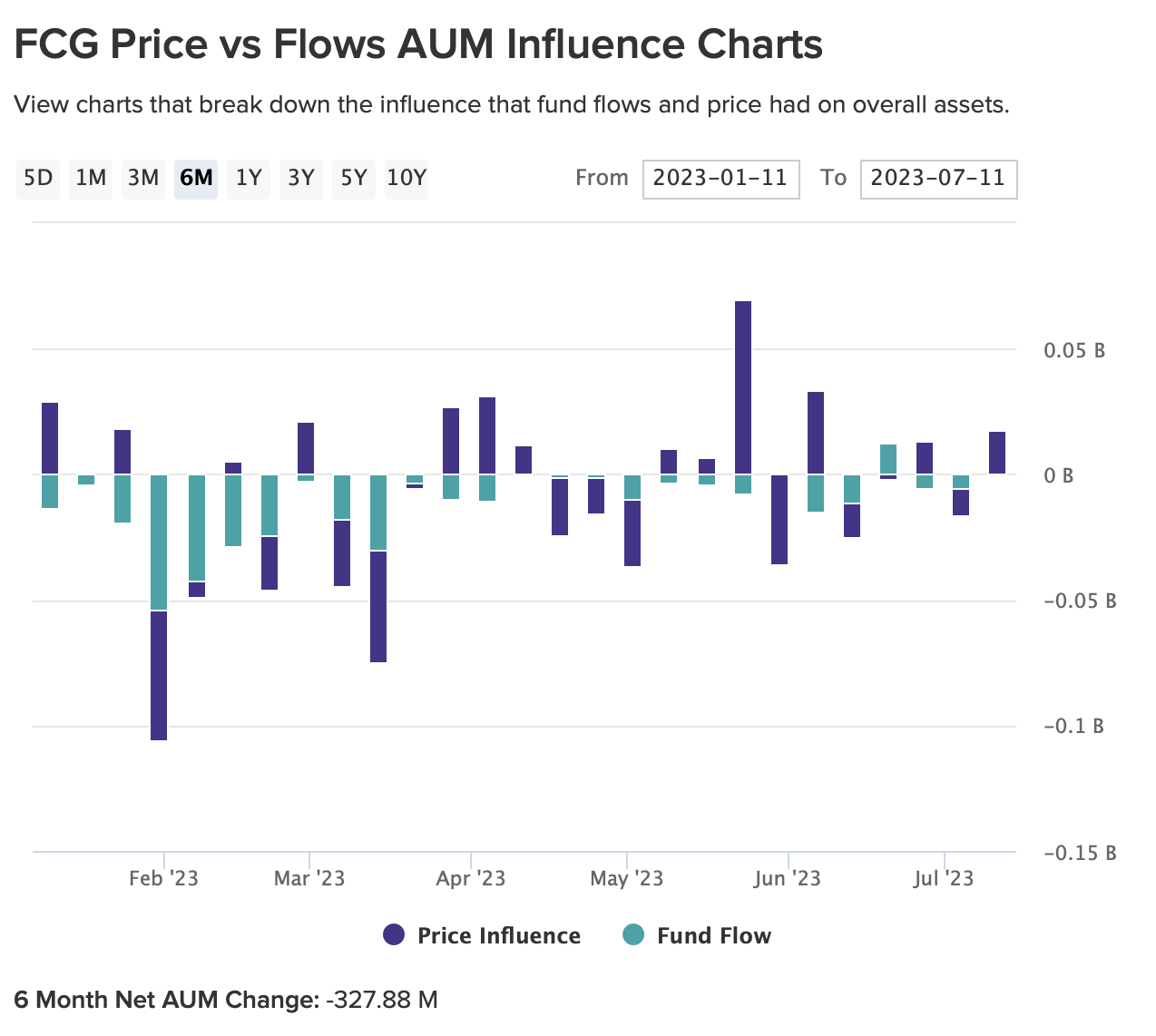

As an introduction, FCG aims to track the ISE-Revere Natural Gas™ Index, which has exposures to mid and large cap companies that “derive a substantial portion of their revenues from midstream activities and/or the exploration and production of natural gas”. Despite my optimism, many investors have not shared the same opinion as outflows of the fund have been significant this year – as many are looking to cash out from large profits gained from previous year’s return.

ETF Database

Performance Review

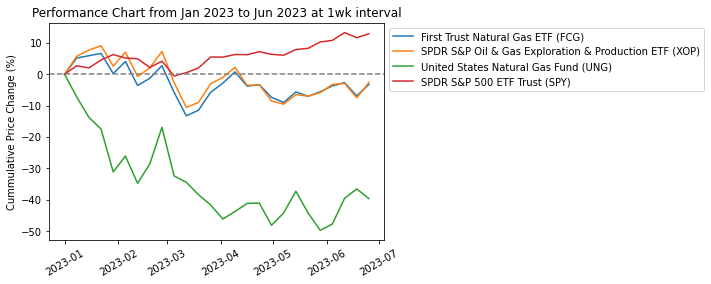

Looking at its performance, FCG has tracked very closely to its peer, XOP, while both remain in the negative territory year-to-date, as compared to ~17% gains by SPY so far. UNG is included in the analysis below as it represents the natural gas price.

Author, Yahoo Finance

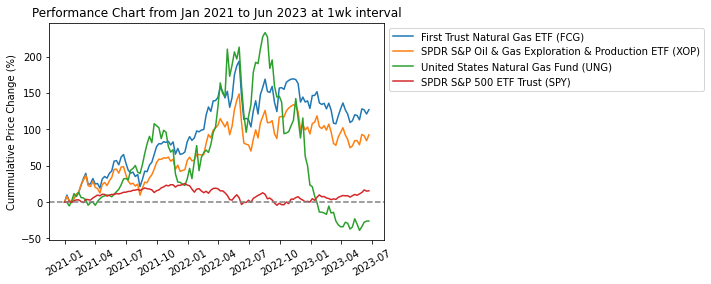

However, FCG has significantly outperformed the broad market (“SPY”) since January 2021 when energy began to rally following energy supply shocks triggered by Covid and the Ukraine war. It is also worth highlighting that FCG also outperformed XOP by a substantial margin for having focused exposure in the natural gas segment – demonstrating the strong investor’s perception on the role of natural gas.

Author, Yahoo Finance

Risk Analytics

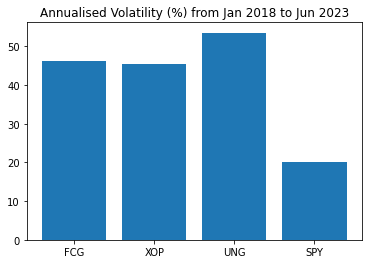

However, FCG is highly volatile, which is indeed a trait of energy stocks. While it has similar annualized volatility as XOP, they are more than twice as volatile as SPY, which make them subject to potentially great downside risks.

Author, Yahoo Finance

Author, Yahoo Finance

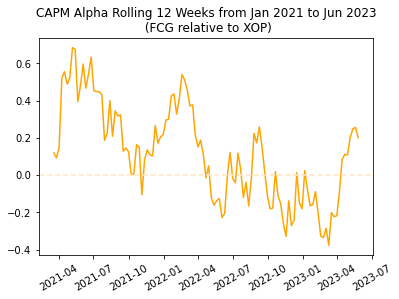

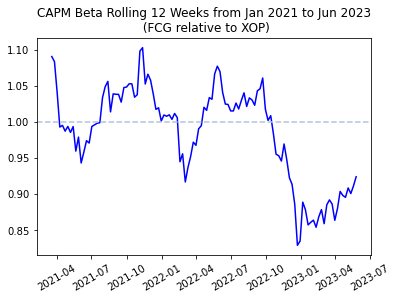

Relative to XOP, its rolling Alpha has been significantly trending positively in recent months – which indicates its outperformance over XOP. Meanwhile, the rolling Beta is also trending upwards but at a slower pace below 1. This may signal a greater risk-adjusted excess return for FCG over XOP, which is critical for investors seeking for energy sector exposures.

Author, Yahoo Finance

Author, Yahoo Finance

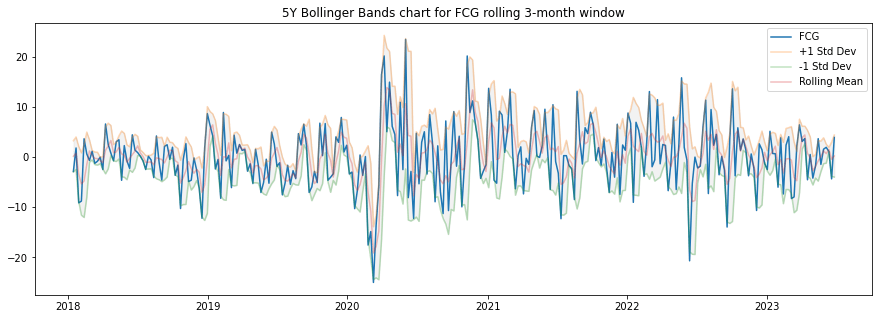

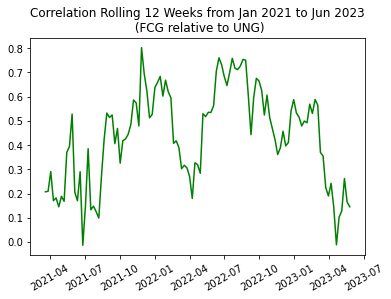

One thing to note is also that FCG does not always correlate well with UNG (the price of Natural Gas itself) as illustrated on the chart below, where the current level of correlation is only at around 0.15. This is because gas equities have their gas sold being priced through long-term contracts, which are often insensitive to real-time changes in natural gas which may be highly volatile.

Author, Yahoo Finance

Fundamental Deep Dives

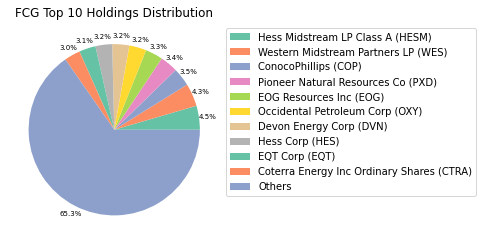

Diving into the stock specifics of FCG, it is quite decently diversified where its top 10 holdings take up roughly 35% of the total fund weight.

Author, Yahoo Finance

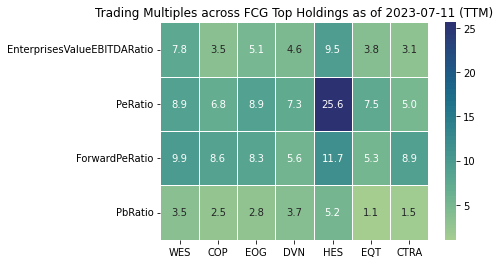

FCG is currently trading at a P/E ratio of 5x, as compared to SPY at around 23x and XOP at around 4.5x. Looking across its top holdings with larger cap, valuations are generally sound, but company such as HES is significantly more expensive than the rest, which is worth monitoring.

Author, Yahoo Finance

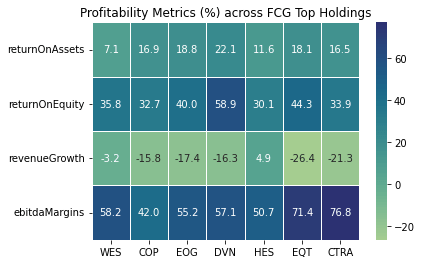

As mentioned, these natural gas stocks are highly profitable with high energy price, despite expecting negative revenue growth as long-term energy prices gradually fall to average levels. The higher valuation pointed out by HES earlier can also be attributed to the positive revenue growth from the company, which is definitely an outlier for the sector now.

Author, Yahoo Finance

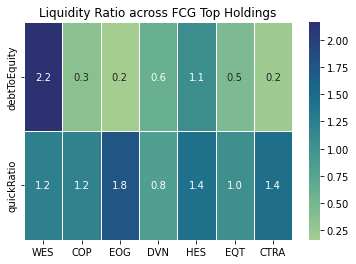

Liquidity generally looks well for most issuers where debt to equity ratio is not high, and where it is high (>1), the quick ratio remains above 1 which is crucial for one’s solvency.

Author, Yahoo Finance

Adding on to the overview of fundamentals, midstream companies are also expected to provide elevated capital returns, as companies de-leverage, reduce capital spending, and maintain high growth rates through brownfield expansions. The acknowledgement by investors and regulators that natural gas is not an enemy but a friend and partner to the energy transition story is also critical in ensuring healthy investments to the sector.

Conclusion

With that, I’m bullish for FCG over the medium term given the expectations on elevated long-term demand driven by energy transition, improving fundamentals of the underlying stocks within the energy segment, and superior risk-adjusted excess return over its broad energy sector peer index.

Read the full article here