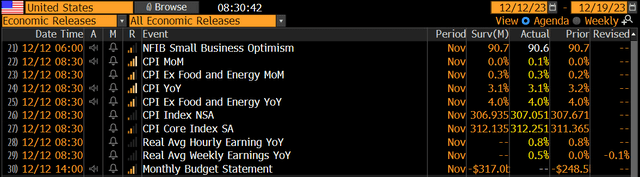

The November CPI came in a touch hotter than expected at +0.1% month-over-month. Core inflation was right on the forecast at +0.3% compared to October. On a year-on-year basis, Headline CPI is now +3.1% while the ex-food and energy rate is +4.0%, unchanged from October – both matching economists’ expectations.

The CPI figure itself printed modestly above estimates on both the Headline and Core rates (307.051, 312.251), while real average hourly earnings are now seen at +0.8% over the past 12 months. Real average weekly earnings jumped to +0.5% from a downwardly revised –0.1% reading in October, an improvement for U.S. workers.

CPI Comes In Mostly In Line, Headline a Touch Warm

Christian Fromhertz

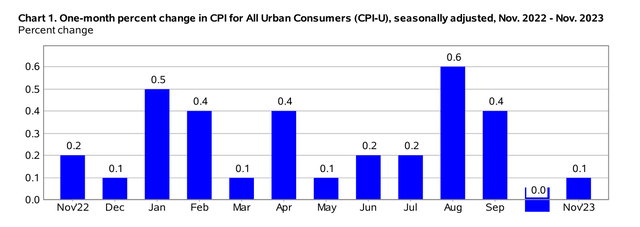

Headline CPI Ticks Up 0.1% in November, Up From October’s 0.0% Print

BLS

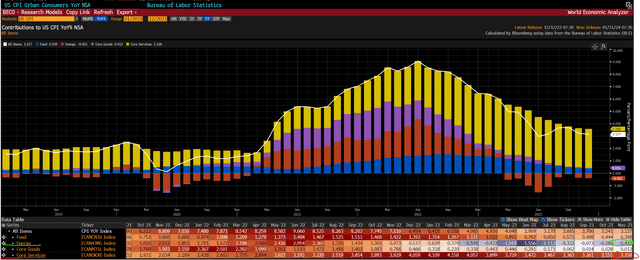

CPI Contributions

@BlacklionCTA

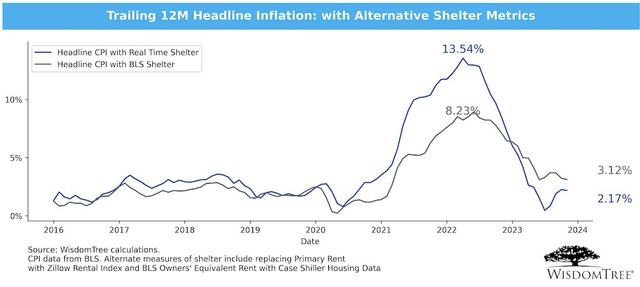

YoY CPI Near 2.2% Using Real-Time Shelter Metrics

Jeremy Schwartz

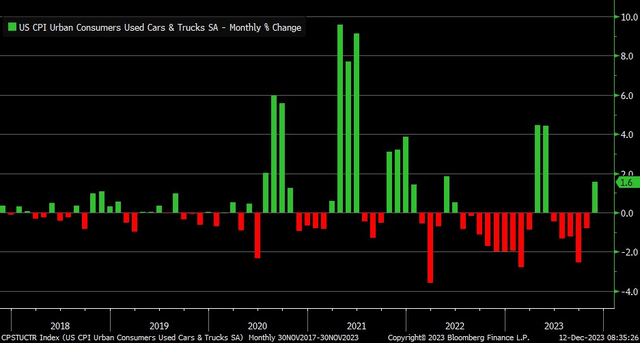

The eyebrow-raising line item in the November CPI report was that used car prices actually rose 1.6%, the first monthly climb since May. The Manheim Used Vehicle Value Index has been showing clear signs of easing prices in the used car market, so that slice of the CPI report is questionable, in my view.

Lower vehicle prices in the months ahead should help support the case for lower CPI rate trends, along with lagging shelter price indicators continuing to soften. Of course, lower energy prices may also be a near-term factor, offsetting the rise in car prices.

Used Car & Trucks CPI Jumps For the First Time in 6 Months

Liz Ann Sonders

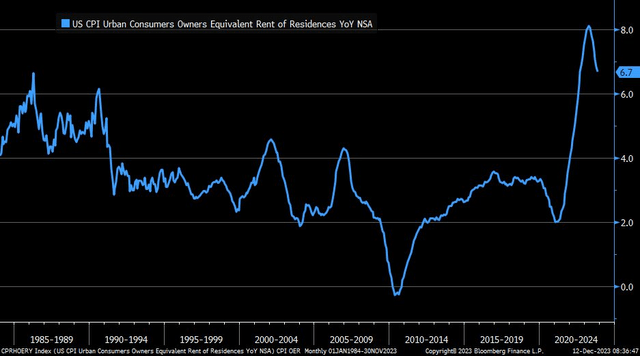

Owners’ Equivalent Rent CPI Rate Coming Down, Further To Go

Liz Ann Sonders

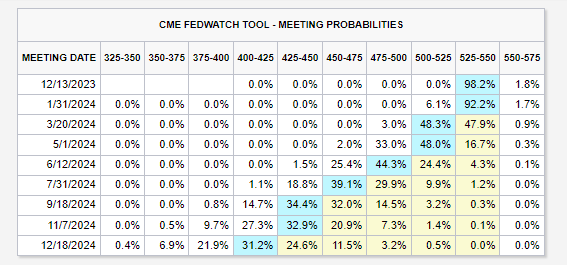

In the minutes after the data release, equity futures dipped slightly while interest rates increased just modestly. Expectations for the first Fed rate cut remain in March, possibly being pushed out to May, but the difference is negligible.

First Rate Cut Expected in March or May

CME FedWatch Tool

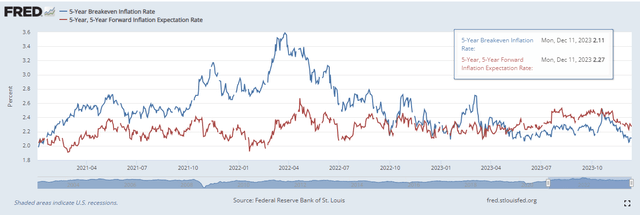

Overall, the inflation trends keep on improving. Take a look at what bond traders expect – both the 5-year breakeven inflation rate and the 5y5y (measuring the 5-10-year period) show consumer prices rising about 2.2% per year over the next decade. That is very close to the Fed’s target. Today’s CPI report will not change that market forecast very much.

Breakeven Inflation Rates Suggest Tame Inflation in the Years Ahead

St. Louis Federal Reserve

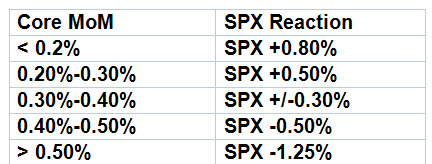

Based on Goldman Sach’s S&P 500 CPI Day performance matrix, U.S. large caps are expected to rise about 0.3% based on the 0.28% monthly jump in the monthly Core CPI rate.

Goldman’s S&P 500 CPI Day Performance Matrix

Goldman Sachs

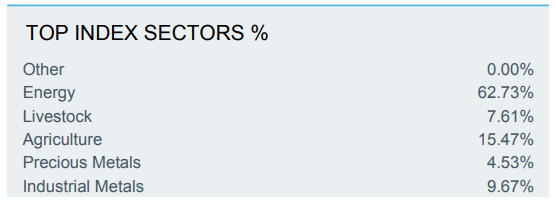

Commodities In Focus: GSG

Among the many drivers of normalizing inflation rates is undoubtedly the drop in commodity prices over the past 18 months. The iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:GSG), which seeks to track the results of a fully collateralized investment in futures contracts on an index composed of a diversified group of commodities futures, including energy, industrial and precious metals, agricultural, and livestock markets, can be used to diversify a portfolio and express a view on commodities, according to iShares.

GSG is a moderate-sized fund with just under $950 million in assets under management, and it does not pay dividends. The annual expense ratio is elevated at 0.75% due to its active commodity futures management, continuously buying and selling contracts. Share price momentum has been lackluster lately and it has been a somewhat volatile fund according to its aggregate risk metrics. Still, liquidity is robust, with average daily volume close to 900k shares and a median 30-day bid/ask spread of just five basis points.

GSG Commodity Exposure

iShares

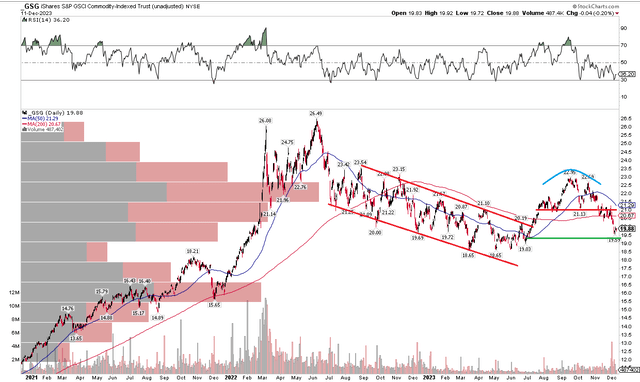

The Technical Take

Price action and momentum are paramount when analyzing commodities. There are no P/E ratios or earnings growth outlooks to determine. Notice in the chart below that GSG has put in some interesting patterns in the last year. First, a stubborn downtrend off the June 2022 peak finally ended with a bullish breakout in Q3 this year, but a bearish reversal pattern then took place. Take a look at the head and shoulders rounded top formation over the last handful of months – a breakdown under the $21 neckline led to a decline toward the mid-$19s just recently. I see support at the measured move price objective of that pattern near $19.30, and that level has confluence with the breakout point from the mid-2022 through the mid-2023 downtrend.

Still, with a long-term 200-day moving average that is flat, there is no real trend here. Additionally, the RSI momentum oscillator at the top of the graph remains in bearish territory, bouncing here and there off the 30 spot. On the volume front, a recent spike on a share price drop is concerning. Moreover, a high amount of volume by price in the $20 to $23 zone could be problematic for the bulls in the months ahead.

Overall, there are mixed signals here, and I see support in the high $18s (the 2023 low) while $23 is resistance.

GSG: Bearish Downtrend Breaks, Key Support Near $19

Stockcharts.com

The Bottom Line

Following this morning’s non-dramatic CPI report, I have a hold rating on GSG as inflation trends continue to moderate. I see intriguing technical developments in commodities, but we need more evidence of a bullish reversal in iShares S&P GSCI Commodity-Indexed Trust ETF to support a long case.

Read the full article here