Investment thesis

On January 31, I started coverage of the FedEx (NYSE:FDX) stock with a bullish “FedEx: Blue Chip Traded At Discount” article. The investment thesis aged well with a more than 20% increase in stock price since then. Today I would like to update my thesis given updates on the company’s performance and changing underlying assumptions for valuation. I like the management’s commitment to improving profitability and current valuation, but current headwinds discourage me from reiterating a Buy rating, so I am neutral on the stock now.

Recent developments

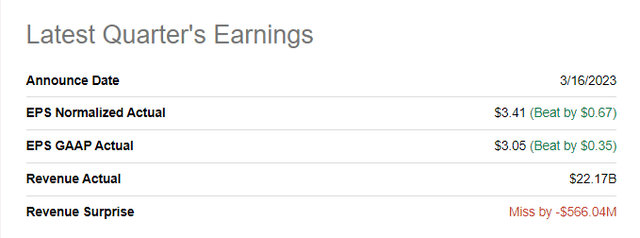

The company released its latest quarterly earnings on March 16, missing more than half a billion dollars in revenue but substantially beating on EPS.

Seeking Alpha

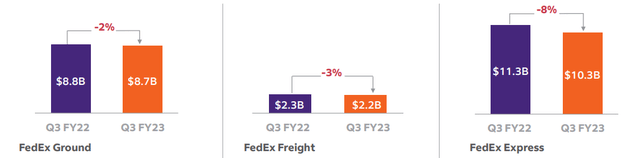

Overall, quarterly revenue of $22.2 billion demonstrated a 6% decline YoY and about 3% decrease sequentially. Revenue showed a reduction across the whole transportation segment, with yield improvements not sufficient to offset declining volumes.

FedEx

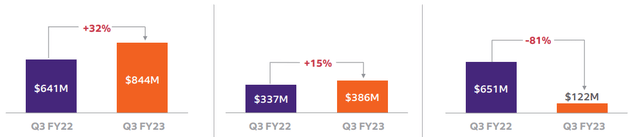

Gross margin remained flat YoY, and operating margin shrank more than one percentage point to 5.72%. The weakness in operating margin came from FedEx Express, with operating profit dropping significantly from $651 million to $122 million. On the contrary, both Ground and Freight demonstrated solid double-digit growth in operating profits.

FedEx

The stock did not plunge on softening earnings release because of the raised FY 2023 guidance from the management. Management now expects adjusted EPS of $13.80-$14.40 versus its prior outlook for $12.50-$13.50 per share, which is notable, especially given the challenging macro environment.

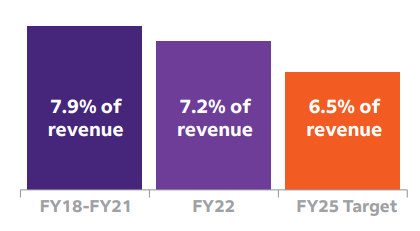

I consider the management’s focus on improving profitability metrics as a very positive sign for investors. The company expects to achieve total $4 billion cost reductions by the end of 2025. According to the latest earnings presentation, I see that it is doable given $1.2B of total enterprise YoY cost savings in Q3 FY23 latest earnings presentation. The management plans to drive cost optimization mainly by reducing the frequency of flights, suspending Sunday operations, and cutting corporate expenses. The management also reiterated its plan to improve capital allocation primarily by optimizing CapEx.

FedEx

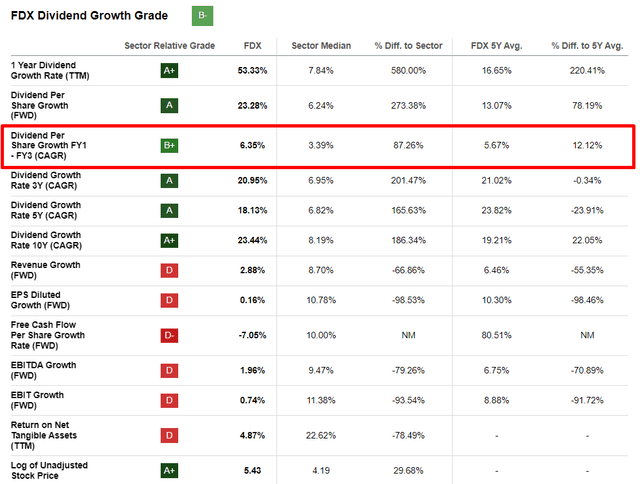

On April 5, the company increased its quarterly dividend by 10% to $1.26 with a forward yield of 2.23%. Overall, the FDX’s payout ratio is 27%, and the balance sheet is relatively strong, meaning that there is still plenty of room for dividend hikes in the upcoming quarters.

The same day FDX also outlined its cost-saving plan. Apart from $4 billion in savings by FY 2025, the company also aimed to add $2 billion by FY 2027. The company matches its cost structure with a weakening demand outlook. Management is planning to consolidate operations under a more simplified organizational structure, according to Raj Subramaniam, the CEO:

This organizational evolution reflects how we represent ourselves in the marketplace – focused on flexibility, efficiency, and intelligence. This combination will allow us to provide customers with even greater value, offering the most advanced data-driven insights to help them make smarter decisions for their business.

Overall, I look positively at the management’s initiatives to deliver more shareholder value via improved profitability and dividend hikes together with stock buybacks.

Valuation update

FDX has been paying dividends to shareholders constantly over the two last decades, therefore I think that the Dividend Discount Model [DDM] valuation approach would be appropriate.

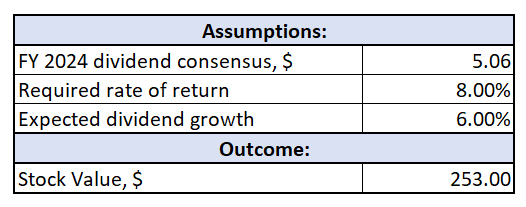

I want to update my latest valuation estimates given updated underlying assumptions. First of all, Fed funds rates continue to climb up, and the moment when the Fed pauses, or stops is still uncertain. Thus, I would like to increase WACC I used previously by one percentage point to 8%. But, dividend consensus estimates also increased with the dividend growth rate, so everything needs to be recalculated. Consensus estimates expect FY 2024 dividend to be at $5.06 per share, and the dividend growth rate I perceive to be conservative to use for valuation is 6%.

Seeking Alpha

Incorporating all the mentioned assumptions together gives me a stock fair value at about $253 per share, which is 14% higher than the current level.

Author’s calculations

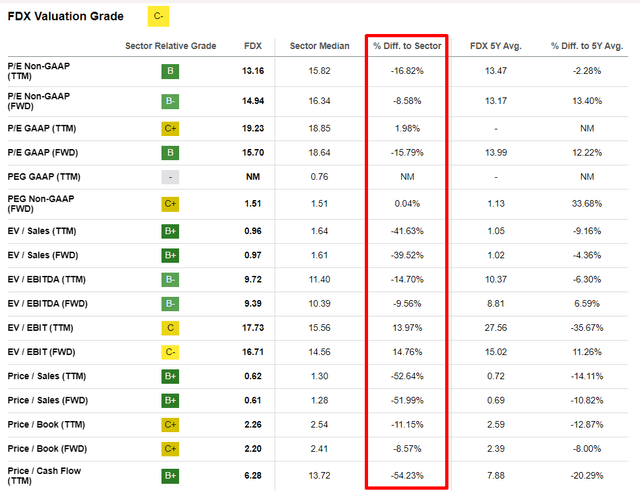

To cross-check my calculations, I usually look at the Seeking Alpha Quant valuation grades, which have been useful for me. According to the chart, FDX stock has a rather low “C-” grade, which indicates that the stock might be slightly overvalued. I usually prefer to compare current multiples to a company’s 5-year averages, but here I would like to compare to the sector median.

Seeking Alpha

Compared to sector median instead of 5-year averages seems to fly in my opinion because of the management’s strong commitment to improving profitability with the help of cost optimization. In terms of comparison to the sector, the median FDX stock seems cheaper than it should be.

Overall, I believe there is still attractive upside potential for the FDX stock.

Risks update

Many adverse changes to the macro environment have happened since my previous article on FDX went live.

First and most obvious is the possible credit crunch, given the severe problems regional banks are facing. And the regional banks’ crisis is far from over, according to The Wire. The credit crunch will mean less funds available for spending, which will inevitably continue to put pressure on FDX’s transportation volumes and increased yields do not fully offset a drop in demand, as we have seen in recent financials.

The second significant risk, which is also apparent, is the possible recession with the probability of happening significantly above zero. According to Ed Hyman from Evercore, a recession is coming this summer and will last until mid-2024, Evercore chairman Ed Hyman said. Recession will also severely hit demand, which will put unfavorable pressure on the FDX’s financials.

The third risk that I see is the U.S. debt ceiling issue with Janet Yellen threatening that Treasury might run out of cash as soon as June 1. I have no doubts that the U.S. will not default on its debt and the ceiling dilemma will be solved, but there is a high probability that governmental spending will be optimized as well. That said, there is less room for the government to increase soft landing probability using fiscal tools to manage economic growth.

Bottom line

I believe that FDX stock still represents an interesting and attractively valued investment opportunity. But current headwinds in the macro environment are strong and risks of a hard landing are elevated in my opinion. Under these circumstances, I prefer to wait on the sidelines and give the stock a neutral rating.

Read the full article here