It didn’t take long for the Fed to release a slew of speakers to start the damage control from the FOMC press conference disaster on December 13. Whether the damage has been contained is yet to be seen because the Fed has already made its biggest mistake, which was to show its cards too soon.

But the Fed’s mistake may come back to being a blessing in disguise, making one wonder if the Fed was using its “Fedi” mind tricks to get the market to do exactly what it wanted: drain excess liquidity once and for all.

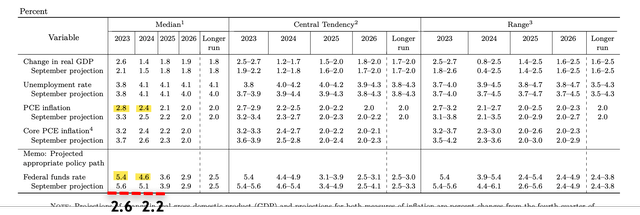

While it may seem a big blunder, the Fed’s dot plot for 2024 tells us a few things: real rates will remain restrictive in 2024. As noted previously, nominal rate cuts do not equal the same degree of “real” rate cuts. While the nominal rate appears to price in more than three rate cuts, 80 bps, in 2024, the change in the real rates is less than two rate cuts, 40 bps, in 2024. So, while rates are going down in 2024 in both cases, the restriction in policy is only subtle.

FOMC

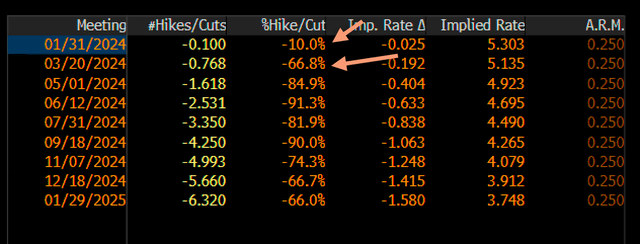

But of course, the market, as in the collective, not just the stock market, took this to mean that the Fed pivoted and was caving in. This led to Fed fund futures, pricing in a 10% chance of an actual rate cut by the January 2024 meeting and a nearly 70% chance of a cut by the March 2024 meeting as of Friday.

Bloomberg

Of course, the Fed, at this point, sent out John Williams of the New York Fed and Raphael Bostic of the Atlanta Fed to push back on rate cuts occurring so soon. Bostic, known for looking for pauses in the rate hiking cycle as early as September 2022 and has been one of the more dovish members, noted that the first-rate cuts wouldn’t likely occur until the third quarter of 2024. That does speak volumes as to how far off-market pricing might be. Friday finished with Chicago Fed President Goolsbee throwing a new wrinkle into the market, expressing concern over a rising unemployment rate as the labor market cools.

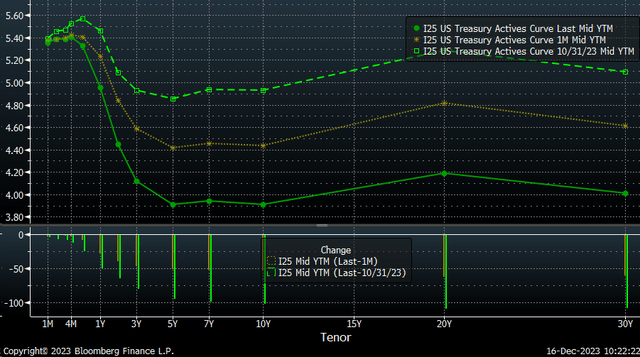

It is clear, though, that the Fedi mind tricks have hit the market where it may matter most because if the Fed is going to start cutting rates, then the days of getting a 5.3% rate for doing nothing may be coming to an end, for those using the Fed’s reverse repo facility over the past couple of years to get easy money for handing over their excess liquidity to the Fed. If the Fed cuts rates in 2024, then that means that the rate that the Fed pays at the reverse repo facility, which is currently at 5.3%, will be going down, too. It means that days of getting rates at 5.3% are nearing an end, and this is happening as rates across the yield curve are falling.

On October 31, one could have gotten a 1-year Treasury for around 5.45%; now, the best one can do is get a 6-month Treasury for about 5.31%, just above the overnight rate. It probably means that banks parking money in the repo facility will start scrambling for whatever rates they can above that 5.3% floor.

Bloomberg

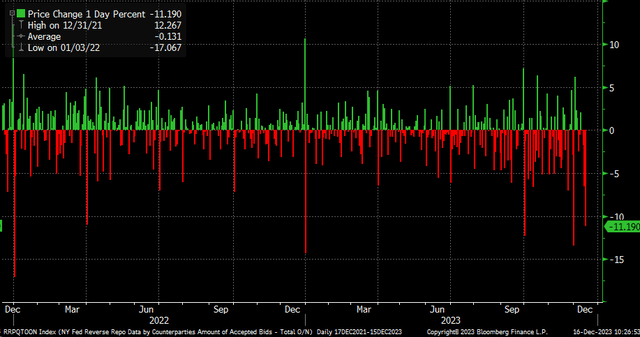

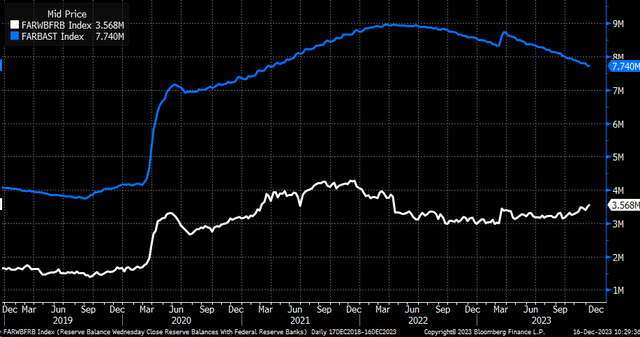

That is probably why the reverse repo facility has plunged since the Wednesday meeting. On December 13, the repo facility was around $825 billion; as of Friday, it was down to $683 billion, a fairly big drop in just two days.

Bloomberg

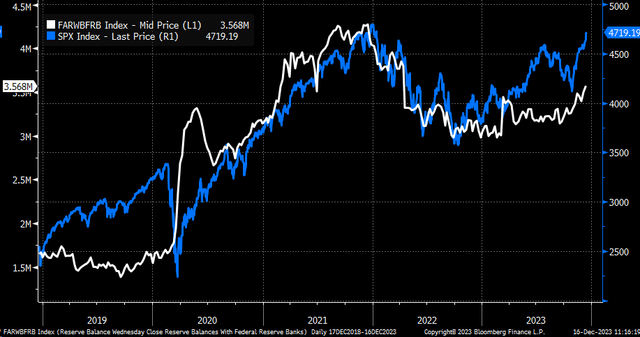

While this may mean that the reserve balance climbs in the short term, once the repo facility is at its floor or completely drained, quantitative tightening will begin to have a meaningful impact, tightening financial conditions. One of the reasons why reserve balances have been increasing this year is that the repo facility has been dropping. This has offset a lot of the effects of quantitative tightening.

Bloomberg

But with the repo facility at the lower bound, daily changes will be minimal as the Fed continues to shrink its balance, causing reserves balance to drop. As the reserve balance begins to drain and is no longer offset by fluctuations in the repo facility, a deleveraging process such as what was witnessed in much of 2022 will likely manifest itself again in 2024 until the Fed ends its QT process.

Bloomberg

Powell reiterated the message of draining reserve balances until such a time when reserves are judged to be somewhat above levels consistent with ample reserves. The message on where that could be seems vague. Still, it has been noted that when reserves reached 7% of nominal GDP in the fall of 2019, it created funding pressure in the overnight market. Estimates currently suggest that level could end up being 10 to 12% of nominal GDP, suggesting that the reserve falls to around $3 trillion or lower.

We will never know whether the Fed knowingly or accidentally accelerated the drainage of the reverse repo to the facility. But if the projections of the dot plot stand and the market fear rate cuts, the facility will drain quickly. While that may provide a short-term boost in liquidity, it won’t last for long because as the Fed balance sheet shrinks over time, so will all of that excess liquidity.

The hilarious part, of course, would be if the Fed doesn’t cut rates as aggressively as the market is pricing, and the Fed was bluffing the entire time about cutting rates while achieving its goal of draining the balance sheet.

Read the full article here