Introduction

Almost perfect execution, one-of-a-kind earnings visibility, a strong shield from global changes in the economy, and a growing target audience of ultra-high-net-worth individuals are all bundled together as the reasons making Ferrari N.V. (NYSE:RACE) a unique asset in my portfolio.

Usually, I write about Ferrari once a quarter. However, this time, after the earnings preview I shared on Seeking Alpha, I feel compelled to update my view on the company because during the last earnings call following the release of the Q3 earnings report a major change in Ferrari’s business model was finally unveiled.

My bull-case

My first article ever on SA was on Ferrari (Ferrari: Literally Firing On All Cylinders). Since then the stock has gone up 70%, not counting dividends. And even though Ferrari currently finds a place among Wall Street’s 20 most overbought stocks I have no plan on selling any shares, but I am actually always looking for opportunities to add to my position. Moreover, I even believe the rally we have seen after the last earnings report is well deserved, as Ferrari talked about some changes that will make it even more profitable.

In short, my bull-case on Ferrari hinges upon the following pillars:

- Ferraris are unique cars in a niche and a league of their own with perhaps only one true competitor: Lamborghini. And yet, Ferrari’s iconic logo and cars are craved by many around the world.

- Ferrari’s target market of high-net-worth individuals is growing around the world.

- Demand for Ferraris is growing, but Ferrari protects exclusivity by sticking to the rule of restrictive volumes. As Enzo Ferrari once put it: Ferrari will always sell one car less than the market demand.

- This business model has many advantages for the company. It gives high visibility on upcoming orders, making it easier to plan investments and purchases, it strengthens Ferrari’s pricing power, and it makes customers feel almost “elected” if they happen to finally get their car delivered to them.

- The launch of the Purosangue has been a game-changer for the company, pushing revenues and margins up.

In the meantime, Ferrari’s market cap has grown up to the point it was recently added to the Euro Stoxx 50 Index (SX5E), making it one of the 50 largest companies in Europe.

How Ferrari’s business model is evolving

We have already seen how an important part of Ferrari’s bull-case is its predictability. The company and its shareholders know more or less what is down the pipeline for the next two years (Ferrari’s order book already covers the entire 2025). This is because there is so much demand for Ferraris, but the company keeps its volumes low exactly to preserve its exclusivity and push up both demand and prices.

Now, in recent years, Ferrari has actually increased its volume by 72% since its IPO. At the same time, revenues have gone up 79%. For the fiscal year we are about to end, my forecast is an increase of 5% in shipments to around 13,900 units. I actually expect revenues to be €6 billion.

Ferrari Investor Relations Webpage

However, while Ferrari’s top-line growth is quite impressive for a well-established company, what catches even more my attention is how fast the company has increased its profitability. Adj. EBITDA has increased by 137% and this year it is expected to be above €2.25 billion (over a 38% margin), which would lead to a 2x in EBITDA since the IPO.

Ferrari Investor Relations Webpage

I don’t want to overload the article with graphs, but if we consider adj. EBIT growth, Ferrari went even faster: 159% growth since 2019 from € 473 million to €1,227 million. This year, Ferrari’s guidance – which I expect Ferrari will actually beat – sees the adj. EBIT at €1,570 million (at least 26.5% margin). This will lead to a 232% growth since the IPO.

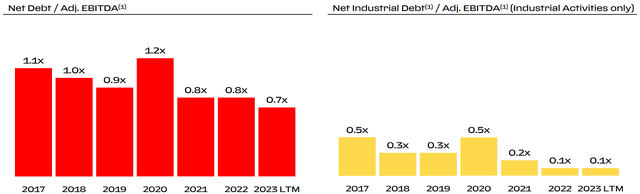

Ferrari has indeed switched mode, becoming a true cash cow, whose profits have also been used to make the company’s balance sheet as healthy as possible. Leaving aside the debt linked to financing activities, the industrial debt has been reduced by almost 75% from €797 million in 2015 to €207 million in 2022. As of September 30, 2023, industrial net debt was €233 million. Considering the company’s EBITDA and the fact that it is expected to generate around €1 billion in free cash flow this year, this debt is almost ridiculous.

Ferrari Investor Relations Webpage

Considering the company’s EBITDA and the fact that it is expected to generate around €1 billion in free cash flow this year, this debt is almost ridiculous, making it a company with almost no leverage, which is quite an achievement considering it is, in any case, an automaker (though we can argue if Ferrari truly belongs to this industry).

Ferrari Q3 2023 Results Presentation

The overall picture we have seen shows us two main drivers of Ferrari’s growth: top-line expansion mainly linked to increased volumes and extreme focus on efficiency which led to margin expansion.

But some investors have started wondering how far can Ferrari expand its production before it loses the exclusivity appeal it currently enjoys. Will the company stop around 15,000 vehicles per year? Will it go up to 20k or even 25k? So far the company has not given an answer when analysts have asked about this issue. Clearly, if Ferrari guided for a final roof for its shipments, investors would very quickly make some calculations and end up understanding how much we can expect from the company. However, Ferrari has stuck true to what its founder said: there is no real roof to protect shipments. The company just needs to deliver one car less than the market demand. This means that while demand grows, so can Ferrari’s volumes.

However, in the last earnings call, I believe Ferrari’s CEO Benedetto Vigna did unveil what the future of Ferrari will be. The company won’t need to push up volumes as much as it did in recent years.

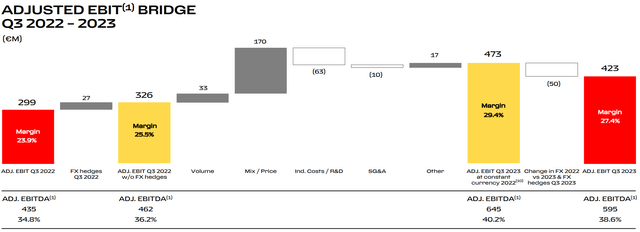

To explain what I mean, let’s start with a graph: the adj. EBIT bridge from Q3 2022 to Q3 2023. We see Ferrari’s EBIT in Q3 2022 was €326 million, while this year it was up by €97 million to €423 million. What led to this increase? Volume contributed with €33 million, which is around a third of the net increase. But the real jump up came from mix/price €170 million. So, the other 66% came from a more profitable sales mix and from pricing power.

Ferrari Q3 2023 Results Presentation

In a footnote of this slide, Ferrari explains what mix/price meant in Q3: “enriched product mix, sustained by the Daytona SP3, 812 Competizione and SF90 families, as well as country mix driven by Americas, higher personalizations and pricing”.

Among all these factors, what is the most important one? If we scrutinize the last earnings call transcript, we find out that two words were repeated 20 times: mix and personalization.

Now, regarding mix, Ferrari has always tried to introduce both range models, whose lifecycle in the market is between 3-5 years, and several special series and limited edition models that are usually available for no more than 3 years. These are incredibly high-margin ones, with numerous personalizations. From this business line, Ferrari has learned how profitable personalizations can be even for its range of models. And it has started to expand its personalization offerings for each of its models.

High personalizations were discussed by Ferrari’s CFO Antonio Piccon, who openly admitted they generated remarkable double-digit growth in revenues. We even came to know how much personalizations contribute to the overall revenues:

Personalizations further increased in absolute value in the quarter and reached approximately 19% in proportion to revenues from cars and spare parts mainly driven by paint, leverage and the use of carbon.

At the same time, Mr. Vigna did warn analysts that “the speed of growth order book will not be the same as in the past” for the simple reason Ferrari is sold out with clients “eagerly taking everything the company offered them”. Ferrari has also the ability to work with its customers on pricing not only when the order is sent, because throughout the time the customer waits for the car, Ferrari engages with the customer to give updated prices and work on personalizations. In this way, Ferrari won’t sell cars in 2025 with 2023 pricing.

Hearing the company was sold out seemed to concern a few analysts about future growth. So Mr. Vigna had to finally be completely clear about Ferrari’s new focus:

It’s true that we are sold out. But I would say that the thing that we see is not happening as originally we planned at the beginning of the year. I mean, it’s going better than we plan. It is the personalization.

Ferrari kept on being shy regarding its future and kept on guiding for 17% of revenues from personalizations. At the same time, during the call, it was pointed out that personalization is seeing strong momentum into Q4 and 2024.

Valuation

After the report, I became even more positive Ferrari will post full-year revenues very close, if not even over €6 billion, €1 billion of which should come from personalizations alone. With Purosangue sales set to make up around 20% of shipments next year, we can expect margins to increase again YoY. I now think a 40% adj EBITDA margin is in sight. Considering a deceleration in deliveries growth, we can forecast 2024 with 14,000 shipments with an average selling price of at least €450k. This lead to €6.3 billion in revenues as the minimum goal to achieve. This should lead to €2.5 billion in EBITDA and a net income of around €1.4 billion. This lead to EPS of at least €7.67 which makes the company currently trade at a 2024 fwd PE of 47. This is high. There is no way around it. But what investors are betting on is not only 2024 but a continuous streak of profitable years. Ferrari is a long-term story. Though I am not buying at current prices, I have also to say it is very hard to pick up Ferrari’s shares at a discount. The stock rarely dips. So, while the stock currently seems a hold, the overall picture for continuous growth seems to be intact and actually strengthened by what we covered in the article. My suggestion is to dollar-cost average in the stock.

Read the full article here