What Happened

Despite a more than 10% relief rally spurred by a cooling CPI report this week, First Solar Inc. (NASDAQ:FSLR) has faced downward pressure on its stock, experiencing a 30% drawdown since early September amid an overall slowdown in the demand for solar energy. Despite this, the company’s recent earnings results have proven to be resilient. Specifically, FSLR has maintained its FY2023 revenue guidance, even after a big shortfall in revenue estimates for 3Q FY2023. This suggests a potential upswing in top-line growth for 4Q.

In my prior article, I issued a “sell” rating, contending that I sought a more favorable entry point, considering that the stock had already priced in most of the growth tailwinds anticipated in the future during its relentless rally over the past year. I now find the risk and reward proposition for FSLR appealing at its current level, despite my belief that weakened solar demand will persist into 1H FY2024. Therefore, I have upgraded the rating to buy from sell to account for its multiple contraction and earnings resilience while maintaining caution regarding near-term macro conditions.

Resilient Earnings Growth

3Q23 Press Release

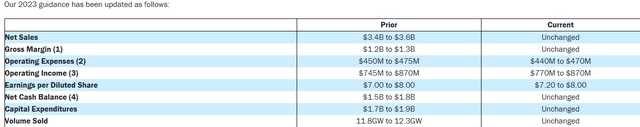

FSLR recently released its 3Q FY2023 earnings, which exhibited a mixed performance. The company’s bottom line demonstrated robust growth momentum, propelled by substantial margin expansions in previous quarters. According to the earnings call, this growth is primarily attributed to higher module ASPs and reduced sales freight costs, leading to additional credits from the Inflation Reduction Act. We saw its GAAP EPS has experienced a strong growth of 57% QoQ from the previous quarter, significantly surpassing consensus by 22.5%.

However, there is a slowdown in revenue. Despite achieving a 27.4% YoY growth, the revenue declined by 1% on a quarter-over-quarter basis. During the earnings call, the management explained that the deceleration in revenue was partly a result of a slight reduction in the volumes of modules sold, offset by an increase in ASPs. Despite the lower-than-expected revenue growth in 3Q, the company reiterated its FY2023 revenue guidance, indicating a substantial rebound in sold volumes anticipated in 4Q FY2023.

Total Backlog Sold Out Through 2030

3Q23 Presentation

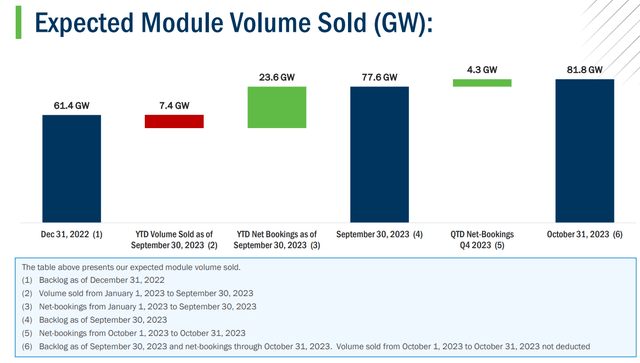

As shown in the chart, FSLR’s current backlog stands at 81.8 GW. In 3Q FY2023, the company added new contracts of 10 GW, reaching a total backlog of 77.6 GW. Additionally, there is an ongoing accumulation of 4.3 GW in backlog recorded during the month of October. The backlog has been entirely sold out through 2030, including India, and up to 2026 excluding India. Some investors are convinced that FSLR’s recurring revenue is firmly secured, implying that its future revenue can be easily anticipated, even in the face of a potential slowdown in solar demand. However, this isn’t always the case.

While drawing parallels to the order cancellation at SolarEdge (SEDG) may not be very appropriate, it’s still worth considering. During SEDG’s 3Q FY2023 earnings call, the management explained:

“We received a large amount of requests to cancel or push out orders. We should note that while these orders are technically binding on our distributors, the nature of our relationship with these customers assess that we accommodated most of these requests.”

Therefore, it remains uncertain whether the contracts are fully committed with no cancellation clause, and whether the backlogs won’t be terminated during the ongoing slowdown in solar demand.

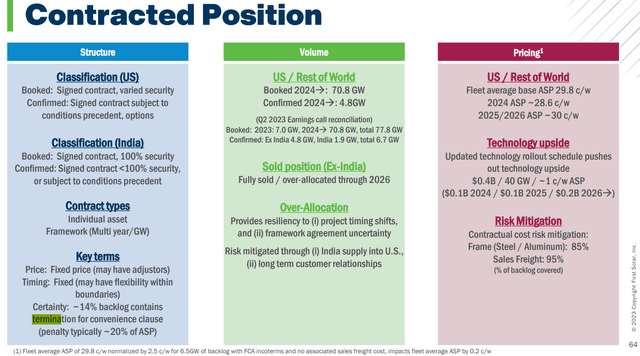

14% of Total Backlogs Can be Cancelled

FY2023 Investor Day

During the FY2023 Investor Day, it was revealed that 14% of the total backlogs are subject to a termination for convenience clause. In the event that customers choose to cancel the contracts, they are obligated to pay a penalty equal to 20% of ASPs. In addition, during the 3Q FY2023 earnings call, when an analyst raised concerns about the risk of potential contract breaches, the CFO discussed the cancellation policy:

“86% of our alt scenario development that put themselves in a very difficult position because they have ongoing to see a contractual breach, which will make it very hard for them to seek financing and tax equity for a project going forward. But for the vast majority of our backlog, there is no ability to terminate for convenience.”

Despite the argument that 86% of contracts would incur more financial burdens in the event of termination, there appears to be a lack of direct addressing of the potential challenges associated with breaking contracts in a distressed market. Currently, we find ourselves in a highly uncertain period characterized by a slowdown in solar demand coinciding with a looming recession in FY2024. In my opinion, I doubt that all 86% of contracts are entirely secure for the company. Therefore, the company’s recurring revenue may have more volatility, potentially revising its growth expectations. However, the company has been maintaining a negative balance of net debt (positive cash) to navigate a potential slowdown, alleviating concerns about solvency risk for FSLR.

Valuation

Seeking Alpha

According to Seeking Alpha Valuation, FSLR is currently trading at 30x P/E non-GAAP TTM, higher than the sector average. However, considering its anticipated earnings growth over the next four quarters, the stock is valued at 16.7x P/E non-GAAP fwd, which is significantly below the sector average. This suggests an expectation of robust earnings growth, as evidenced by a favorable PEG non-GAAP fwd of 0.44. Furthermore, the chart indicates that its EV/Sales TTM currently stands at 4.12x, trending downward from the 2021 peak. If we factored in its total revenue over the next four quarters, the multiple would come down to 3.74x, which, in my opinion, is attractive given its current growth trajectory.

Conclusion

In summary, FSLR is facing a challenging macro backdrop, marked by a significant 30% stock decline since early September amidst a broader slowdown in solar energy demand. Despite this headwind, the company exhibits resilience through strong earnings growth, margin expansions, and a continued increase in its backlog. In terms of the valuation, FSLR is trading at a lower P/E non-GAAP Fwd of 16.7x and PEG non-GAAP Fwd of 0.44, signal a strong earnings growth. Meanwhile, the company maintains a healthy balance sheet with negative net debt. Therefore, I have upgraded the stock to a buy from sell, expressing confidence in FSLR’s ability to navigate the current sluggish demand. However, uncertainties still persist regarding the safety of contracts amid a distressed market and the potential FY2024 recession. Any unforeseen cancellations of backlogs due to macro uncertainties could impact the company’s growth expectations and, consequently, its valuation.

Read the full article here