We have previously covered First Solar (NASDAQ:FSLR) in April 2023, with the stock trading with a massive baked-in premium, mostly attributed to its US-based operations and zero reliance on polysilicon. Its strategic decision is naturally prudent, entirely bypassing any potential geopolitically linked supply chain disruptions and human rights risks.

Thanks to the Biden administration’s ambitious goal of net zero emissions in the electricity sector by 2035, the US regulators are on track to approve up to 48 solar projects through 2025, with a total planned capacity of up to 29.59 GW then. This cadence further explains the optimism witnessed in its stock prices thus far.

The Made-In-US Solar Investment Thesis Is No Longer As Compelling

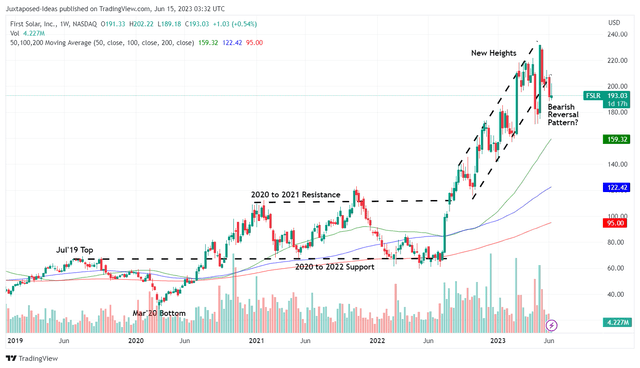

FSLR 5Y Stock Price

TradingView

At the time of writing, FSLR has recorded a tremendous rally of +203.6% since the June 2022 bottom of $60s. Otherwise, an impressive climb of +498.9% since the March 2020 bottom of $30s. Nonetheless, the stock seems to have hit a bearish reversal pattern over the past few weeks, suggesting that the optimism may have stalled.

The stock was previously riding the buoyancy surrounding its fully integrated supply chain in the US, naturally explaining the massive expansion in its backlog to 71.6 gigawatts (+5.7% QoQ/+96.7% YoY) by the latest quarter. Most notably, the ASPs on the backlog also improved to $0.293 per watt (+1.7% QoQ/ +8.5% YoY).

In addition, FSLR recorded FQ1’23 revenues of $548.29M (-45.3% QoQ/ +49.4% YoY) and expanding gross margins of 20.4% (+14.4 points QoQ/ +17.3 YoY) by the latest quarter, thanks to its expanding ASPs. It also guides exemplary FY2023 revenues of $3.5B (+34% YoY) and adj EPS of $7.5 (+ 1929.2% YoY) at the midpoint.

Due to the robust demand for US-manufactured solar products, FSLR built in certain amendment/ adjuster clauses into their contracts as well, potentially allowing an additional revenue of up to $0.02 per watt, or a total of $0.7B between 2025 and 2027.

Combined with its expansion plan in Ohio/ Alabama in the US and overseas in India, the solar company expects to deliver a total ramped-up output of approximately 13.5 gigawatts by 2025, up from 9.1 gigawatts in 2022. These developments were highly optimistic indeed, since it indicates that its capacity has been sold out through 2026.

However, FSLR’s bullish investment thesis may, unfortunately, have been dismantled by the relaxation of the Inflation Reduction Act’s guidelines on domestic content to only 40%. This reversal apparently allows solar developers to claim up to 40% in tax credits, despite “the system’s panels containing cells made entirely with Chinese materials.”

The solar company’s backlog/ top and bottom lines may also face volatility from many Chinese producers’ diversification to Mongolian locations, entirely bypassing the Xinjiang trade ban and potentially allowing the import of cheaper polysilicon moving forward.

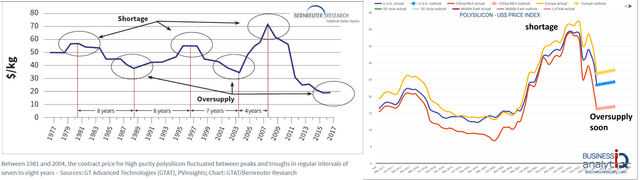

Intervals In Polysilicon Prices Since 1981

GTAT, Bernreuter Research, Business Analytiq

For example, polysilicon spot prices have already declined to $12.62 per kg by June 7, 2023, down by -67.8% from the pandemic heights of $39.22 per kg in November 2022 and nearing pre-pandemic levels of $12s per kg in 2019. This is attributed to the massive supply likely to flood the global market through 2024, a similar historical cadence that has been observed since 1981.

Most of the supply will likely come from China, with their top six domestic producers expanding their total polysilicon capacity to approximately 1.5M MT by 2024, nearly double China’s production of 827K MT in 2022 and more than quadruple from 342K MT in 2019.

Therefore, assuming that non-Xinjiang polysilicon is able to find its way into the US market, we suppose FSLR’s ASPs may potentially moderate from henceforth.

Then again, with approximately 90% of its contracted backlog structured as “firm purchase commitments,” investors need not fret about the impact for the next few years. In addition, the US Polysilicon spot prices remain healthy at $24.25 per kg at the time of writing, potentially differentiating the company’s ASPs against China’s lower spot prices of $10.64 per kg at the time of writing.

This is on top of FSLR’s recycling program, allowing 90% of its semiconductor material (including cadmium telluride) to be recycled up to 41 times. With 500 megawatts of recycling capacity in the US by the end of 2023 and more planned moving forward, we suppose the company may continue to boast a geopolitically secure supply chain, despite the rare earth status.

So, Is FSLR Stock A Buy, Sell, or Hold?

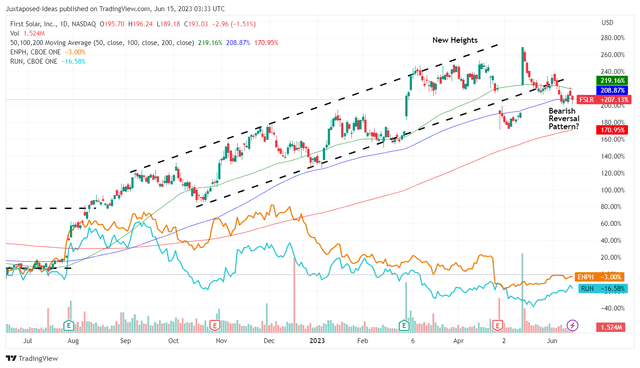

FSLR 1Y Stock Price

TradingView

However, our belief remains that FSLR’s rally has likely tapered, with all of the backlog and top/ bottom line optimism already baked in. At best, the stock is likely to trade sideways from current levels, if not moderate, as witnessed with Enphase (ENPH) and Sunrun (RUN) over the past few months.

In the long term, the solar company’s prospects remain excellent, though there may be minimal upside potential from current levels to our price target of $200. This is based on market analysts’ FY2024 adj EPS projection of $13.38 and its normalized P/E valuations of 15x.

Therefore, while FSLR may record an improved top and bottom line at a CAGR of +25.6% and +94.3% through FY2026, respectively, the expansion may moderate from henceforth once the backlog is fully digested.

As a result, we prefer to rate FSLR as a Hold (Neutral) here, due to the potential volatility. Meanwhile, investors that have ridden this rollercoaster from June 2022 levels of $60s may want to take some gains here to rebalance their portfolio.

Read the full article here