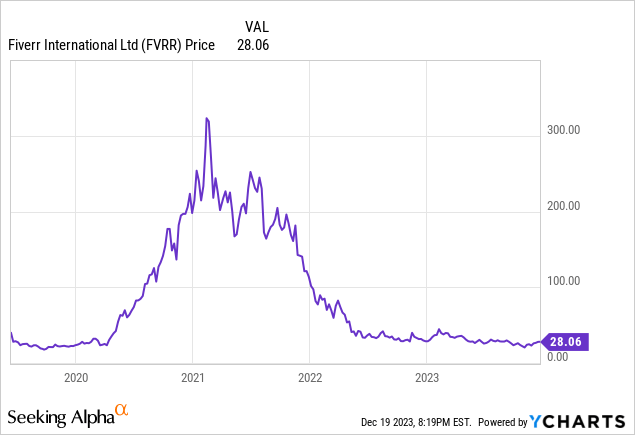

Fiverr (NYSE:FVRR) was once the darling of the gig economy, epitomizing the potential of online freelance marketplaces. Its stock price rose over 10x during the pandemic as remote work and income diversification drove freelancer demand. However, Fiverr has since lost over 90% of its peak value as growth has slowed and competition has emerged.

Origins And Business Model

Launched in 2010, Fiverr built a marketplace for freelance services priced at just $5 per job. This unique model quickly attracted buyers and enabled all sorts of freelancers and underemployed workers to monetize their skills online.

Today, Fiverr serves over 4 million active buyers and offers an extensive catalog of digital services across 8 categories like graphics, digital marketing, writing, video and more. The website is no longer restricted to jobs for just $5. Sellers can list gigs with custom pricing, delivery times and packages. Fiverr charges sellers 20% commissions and buyers additional service fees.

Pandemic Growth Spurt

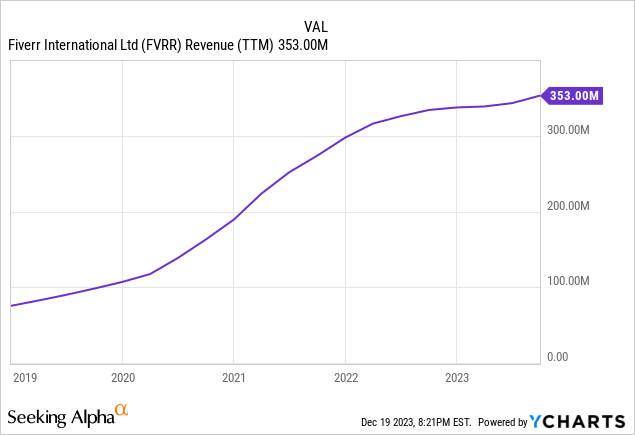

Fiverr was perfectly positioned to benefit from pandemic trends like remote work, e-commerce growth, and income diversification. As such, the company saw a significant boost in activity and so did the stock price. Annual revenue surged from $107 million in 2019 to $190 million in 2020 to $298 million by 2021. Strong top-line growth and improving efficiency pushed Fiverr’s stock price above $300 by February 2021, more than 10x its 2019 IPO price.

Warning Signs Emerge

Growth began decelerating in 2022 as the world started to adapt to post-pandemic normalcy. Fiverr’s revenue only grew 13% YoY in 2022 which was a huge disappointment. Growth has further slowed in 2023 and is now projected at just 6-8% for the full year.

While revenue growth has slowed, Sales & Marketing costs have continued increasing, reaching $121 million in the first 9 months of 2023. This spending spree aims to attract higher-value buyers, but it has not yet proven successful at accelerating growth. As a result, despite nearing profitability in 2021, Fiverr returned to loss-making in 2022. This is a key part of the investment/bear thesis for Fiverr stock. The company continues to spend on marketing but growth simply hasn’t materialized.

AI Competition

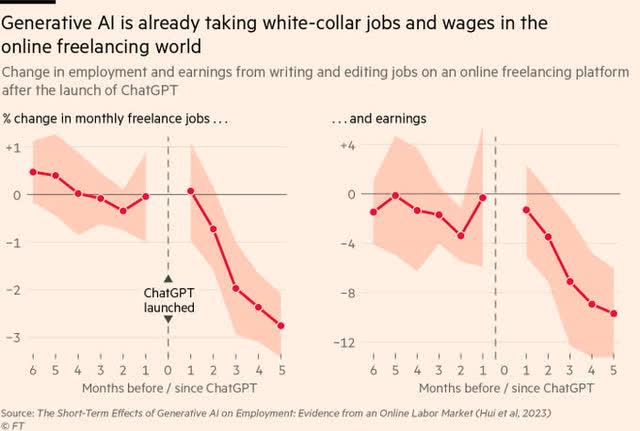

One reason why growth isn’t coming is the sudden explosion of generative AI. AI tools like ChatGPT can be used to replace many of the jobs listed on the marketplace. Midjourney which can autonomously produce images, logos and graphic designs makes for an easier and cheaper option than going through Fiverr. Crucially, early data is coming in and it already shows AI taking a bite out of the earnings of Fiverr sellers, specifically in writing and editing. As reported by the Financial Times, earnings from online writing and editing jobs have fallen almost 10% since ChatGPT was launched. Moreover, AI capabilities are rapidly advancing in quality. AI is not an existential risk for Fiverr but it can act as a heavy weight on the company’s growth and total addressable market.

Financial Times

Reasons For Optimism

Despite those challenges, there’s a case that AI can in fact provide some benefits for Fiverr. Indeed, CEO Micha Kaufman has repeatedly said that he thinks AI can be a net positive for the business. If history is any guide, new technology should displace rather than replace jobs.

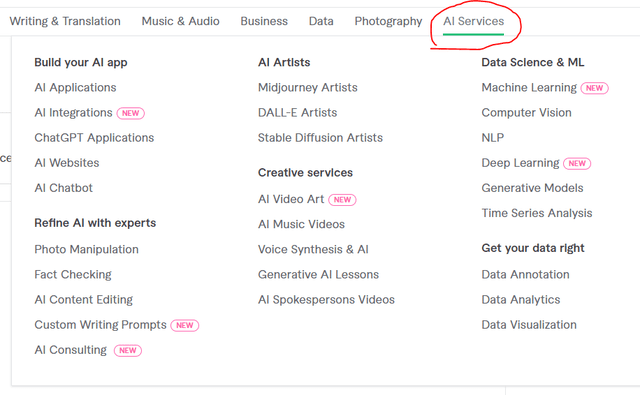

While services like search engine optimization, editing, content creation and logo design may be crushed by artificial intelligence it’s highly likely that other jobs will take their places. Think services like prompt engineering, model building, or fact checking. AI tools need supervision and they increasingly need people who are skilled at using them. In fact, AI jobs are already appearing on the Fiverr marketplace with a new section devoted entirely to AI.

Fiverr website

As such, the most important issue for Fiverr is not the existence of AI tools but the general trend regarding online freelance work. To that end, Fiverr looks to be in a good position. The total addressable market for online freelance work was estimated to be $1.5 trillion and growing at 16% annually. Whether you agree with those estimates, there’s no doubt that Fiverr is only capturing a small piece of the pie.

Furthermore, Fiverr is an asset-light platform business model with 82% gross margins. This allows for significant operating leverage. More jobs matched translates to a higher rate of profit flowing to Fiverr. Equally, that is why revenue growth is so important to Fiverr’s business. Without growth, the company has no hope of taking advantage of the operating leverage within its business model.

To its credit, Fiverr is still spending and investing to drive that growth. And it’s rolling out upmarket products like Fiverr Pro and Fiverr Enterprise to better serve higher-value clients. If these products gain traction and AI impact is manageable, Fiverr could still digitally transform how freelance services are bought and sold.

Valuation

Ultimately, Fiverr is a company in a challenging position and growth is the key issue. However, if growth does arrive, Fiverr stock can become an excellent investment since the valuation is more than reasonable.

Based on an analysis of Fiverr’s business model and financials, as well as margins of other mature online marketplaces, a realistic net income margin for Fiverr as a mature company could be in the 10-15% range. A few key points to consider:

- As an online marketplace connecting freelancers and clients, Fiverr benefits from strong network effects – more providers attract more buyers and vice versa. This allows marketplaces like Fiverr to scale revenue rapidly once critical mass is achieved.

- However, the cost of revenue is high, as Fiverr spends significantly on marketing/sales to acquire users and has to incur costs to vet/monitor providers, process transactions, etc. In 2021, Fiverr’s gross margin was 83% but operating expenses were 75% of revenue.

- Mature online marketplaces such as eBay (10% net margin), Etsy (18% net margin) and Upwork (8-12% in recent years) achieve high profitability at scale as revenue growth outpaces marketing and tech spend.

- Fiverr has guided to long-term 15-20% revenue growth and over 20% operating margin. Given their high growth investments in R&D and S&M currently, a steady-state net margin of 10-15% seems reasonable as those costs normalize.

Back Of Envelope Valuation

Right now the company has a market cap of just over $1 billion. With $130 million of cash and equivalents, $581 million of investments and $455 million of long-term debt, the enterprise value is only $814 million. And that means Fiverr stock is valued at 2.3 times revenue but under 16 times EBITDA and under 13 times free cash flow.

If Fiverr can get its growth up to 15% per year, it could hit $710 million in annual revenue by 2028. And if it can get to a 15% net income margin, the company could potentially hit $110 million of earnings. Give the stock an 18 times multiple and you get a market cap of $1.92 billion which works out to an investment return of 12.4% per annum. That seems like a reasonable, if not, spectacular return.

Final Thoughts

Fiverr’s outlook depends greatly on the scope of AI disruption. But there’s evidence that AI can at least be net-neutral for the business. Meanwhile, Its current $1 billion valuation is not oppressive and provides room for expansion so long as Fiverr can re-ignite growth. Fiverr is a leading platform and it can still benefit from the growing trend of online freelance work. Based on a reasonable acceleration in growth, the stock can also provide reasonable returns for investors.

Read the full article here