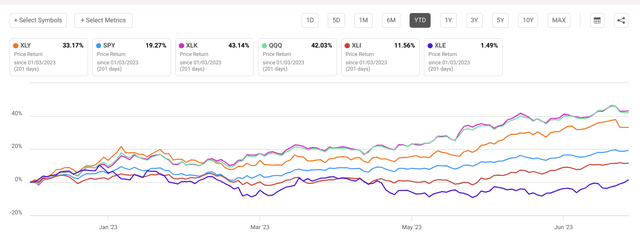

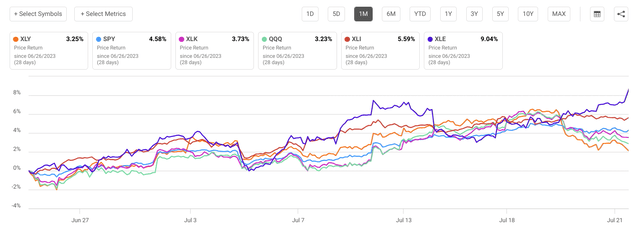

Ford (NYSE:F) has had a terrific run over the past few months, as has the wider Consumer Discretionary sector. The rally that was supposedly only “led by the Magnificent Seven” broadened out recently, and Ford, in particular, saw a pretty prolific run.

The stock gained around 30% in a month before retreating after a few bad news catalysts, including price cuts. One thing to consider is that Ford could also conduct price raises to compensate for higher material costs. Falling inflation and ungumming supply chains are of particular relief for the capital-intensive and global auto industry.

Seeking Alpha

Seeking Alpha

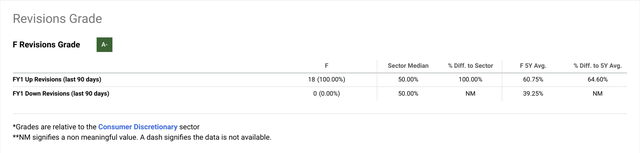

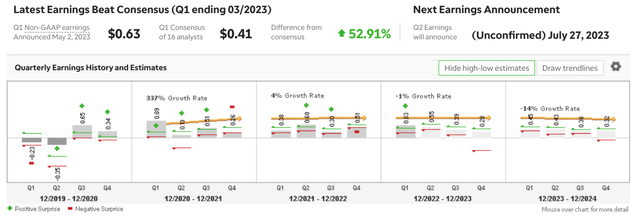

As you can see, Discretionary led on a YTD basis but has since pulled back on a 1-month basis as Defensive sectors caught a bid and apprehension about markets continues, particularly amongst institutional investors. Ford went up quite a bit, but let’s also remember it has a pretty solid record on earnings recently, and the upward revisions on EPS have been substantial.

Seeking Alpha

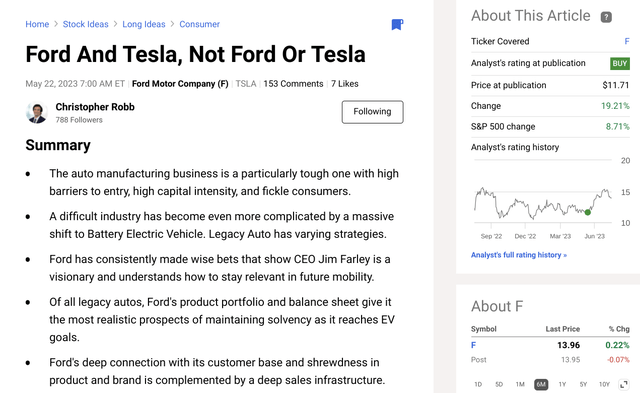

I recommended Ford on May 22nd this year in an article called Ford and Tesla, Not Ford or Tesla (TSLA). Ford is a tricky company to understand, but ultimately it is one with many unique resources and brilliant people. Increasingly, Ford’s strengths seem somewhat congruent with the tides of our times.

Seeking Alpha

One of the points I made in the article is that looking at the choice of Ford and Tesla through a confrontational lens is not something we should do as shareholders. If we invest in a thematic trend as profound as the second major transformation of mobility, it would be hubris to think we could now identify who will be dominant ten years later.

There are too many unknowns, despite which brands and personalities appeal to us personally. Autonomous driving, for instance, was the hottest trend in the EV sphere, but technological setbacks have since dulled the focus on it.

Seeking Alpha

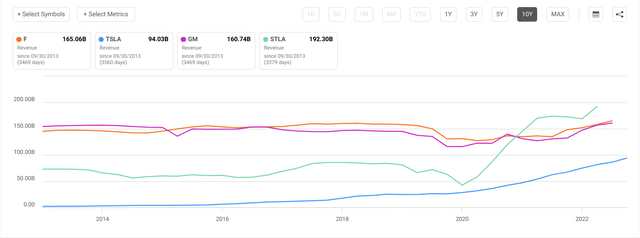

From a thematic perspective, you want to own the most substantial companies with the best prospects in terms of revenue and growth. Despite the awkward aspects of turning around a 120-year-old company with an incredibly risky and capital-intensive pivot to new technology, Ford has proven so far that it should not be underestimated.

The Bull Case for Ford

Ford’s initial models have been competitive, and their second-generation models will likely be significantly improved, but it is a long haul. I don’t advise Ford for short-term investors; you must allow the strategy time to play out because there may be volatility in the transition.

Seeking Alpha

For long-term shareholders like me, price weakness, including any around earnings reports, is an opportunity to accumulate and lock in a better yield.

Remember also, Ford’s massive revenue allows it to expand margins when Tesla’s margins are having trouble. As I said in my last article on Ford:

Furthermore, there have been setbacks in the autonomous driving plans of many of Silicon Valley’s best and brightest, notably for Tesla. Generally, the technology for full autonomy (level 5) is much further away than initially imagined by some optimists. I think this generally favors old-guard auto, and I think Ford is currently the best of old-guard auto.

The call I made on Ford has done well. One Seeking Alpha Contributor has made a good case for taking your profits and putting them to work elsewhere. Despite the fact the stock was up over 30% at times and was outperforming the S&P 500 by a lot more than it is today, I still have stuck with this stock for the following reasons:

- Despite struggles with its first-generation EVs, Ford’s adopting a bold strategy and is doing a lot correctly. The Auto business isn’t a winner take all business, and I think Ford has a high probability of having a seat at the table in 10 years.

- Despite awful financials that can be daunting, volatile, and hard to understand, they occur entirely for a great reason; a Herculean effort to remain competitive.

- Ford is a 120-year-old company with a CEO who cut his teeth at a former rival and is leveraging everything on being a leader in a future technology yet to be fully imagined.

- The advantages of Ford are underappreciated. It has a massive engine to fund this expansion in the form of an incredibly successful internal combustion business that also serves as a practical safety valve.

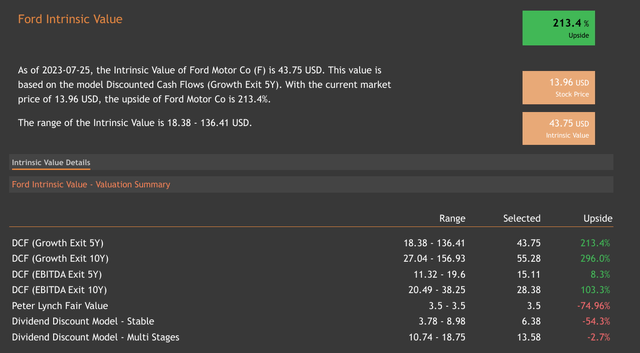

- The firm is still intrinsically undervalued despite a substantial runup. As you can see below, it has pulled back from recent highs, and analyst estimates have been trending upward.

As you can see below, the stock is still intrinsically valued despite the significant and rapid price appreciation. After a strong earnings report last quarter, management kept guidance the same, which could mean the company could clear a low bar.

This is particularly given the economic strength and wages now firmly outpacing inflation. Ford’s assumptions may prove pessimistic if we aren’t at the end of the cycle.

valueinvesting.io

The auto manufacturing industry is a particularly grueling and unforgiven one. But Ford proves it is still a country for “old men.” I mean this metaphorically since Ford’s corporate lifetime had now exceeded any human being that was part of a company or even alive when the company’s transformational product and processes redefined commercial life and raised the quality of life for billions of people.

What to Watch in Ford’s Upcoming Earnings

Ford has had volatile earnings and is losing money on many current EV models. This is why there was a lot of apprehension and a big sell-off on recent price cuts. It is also why there can be significant fluctuations in earnings. They can be positive and negative.

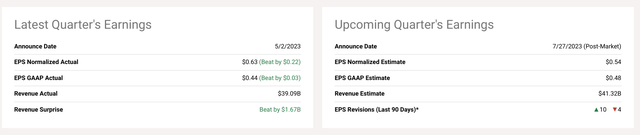

TD Ameritrade

- Ford Blue, the internal combustion profit driver of the company, was the reason for the outperformance last quarter. It is unlikely Ford could beat expectations without significant strength in this segment.

- Watch for improvement in the rates of losses on EVs and whether or not inventories are piling up. Improvement in these areas could help the stock.

- Ford Credit is a crucial part of Ford’s empire, and in good times it can be a talisman; in bad times an albatross. A strong consumer could lead to better performance here.

Last quarter, the firm performed exceptionally, and the continuing economic strength despite mounting pessimistic expectations and sentiment is a good indication that the firm’s strength could continue.

Seeking Alpha

The strength of the consumer will be a significant focal point of the earnings for the entire sector. Ford has a chance to outperform expectations and conservative guidance if the US avoids a recession and achieves the fabled “soft landing” many investors have been hoping for. If we avoid a recession and start another cycle, the firm will likely perform well despite its tumultuous transition.

Risks and Where I Could Be Wrong

Ford is an old company, but it has decided not to go quietly into the night. For that reason, despite the firm’s age, it must be called a risky company in a risky business. I always like to call the auto and airline industries bankruptcy dodgeball or bankruptcy hunger games. Ford is better equipped for this fierce competition than you might think.

The firm can hang its hat on the laurels of being one of only two auto manufacturers to have never gone bankrupt, but still, the high-risk path it has chosen could strip it of that hallowed distinction.

valueinvesting.io

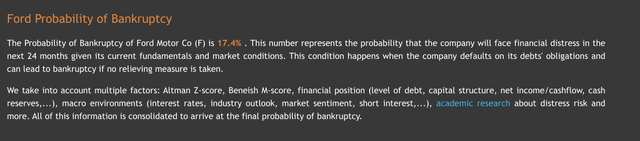

Of course, you think of Ford’s sprawling footprint, though, and you may think it is one UAW strike away from bankruptcy. However, using a respected methodology, it can be discerned that Ford, at 17.4%, has less chance of going bankrupt than peers GM and Tesla.

valueinvesting.io

However, if I am incorrect and a recession emerges, Ford will likely be in trouble. If there is weakness in Ford Blue due to a recession, then my bullish stance could be proven painfully wrong. Another mounting risk for Ford is the prospect that labor negotiations go south, particularly given the untoward and adversarial tone of the UAW in the run-up to negotiations.

Furthermore, any of the following risks could derail my thesis and result in adverse price movement in Ford:

- Monetary policy lag and QT cause a rapid reversal of economic conditions.

- Debt-strapped companies start to buckle under the weight of higher rates, causing higher unemployment than predicted by the SEP.

- Inflation returns.

- Fed policy error.

- Escalation of geopolitical tensions.

Ford is a hardy company that has been through a lot. It is vulnerable due to the extraordinary maneuver it pulls off, but extraordinary maneuvers also produce extraordinary victories.

Conclusion

I remain committed to the bull case for Ford I articulated in late May. While I suspect, there could be an earnings beat similar to last quarter on persistent economic strength and a tough-as-nails US consumer, Ford could miss expectations and show continued deterioration in key EV metrics.

Even if this less optimistic outcome occurs, I will still be purchasing more of the stock on weakness unless the outcome is extraordinarily dire. One of the reasons I feel comfortable owning Ford is Jim Farley’s vision and leadership. There’s always a lot of he-said-she-said at Ford. Still, I think Farley has proven himself a scrappy competitor and think he will eventually deliver his historic company to a highly competitive position in the next chapter of mobility.

Revisions have been favorable and suggest Ford could have some strength brewing under the hood. The company did not raise guidance last time, and while the caution taken by management was prudent and practical, it also created an opportunity to beat expectations.

Read the full article here