Investment thesis: Ford’s (NYSE:F) recent admission that it is losing money on EVs puts a dent in its otherwise successful launch of EV models that seem to be appealing to the US consumer market. Its plan to speed up the transition of the company from ICE-powered vehicles to EVs is not a positive in my view either. Coupled with the overall increasingly negative outlook on the economy, I am switching my position on Ford stock from a buy to a hold. I may use any temporary upswings in Ford’s stock price to reduce my position.

Ford’s latest numbers and the EV profitability issue.

On the surface, Ford’s Q1 results were fine. Its unit sales increased 9% compared with the same quarter in 2022. Net income came in at $1.8 billion for the quarter, which compares well, to a net loss of $3.1 billion in the first quarter of 2022. Revenues also increased by 20% for the same period to $41.5 billion. Looking at its profit margin, it is about 4.3%, which is somewhat thin. This is where some questions arise in regard to Ford’s EV segment profitability.

In some ways, Ford did all investors as well as other segments of the public a huge favor by providing segmented data on its Q1 results. One of the biggest questions that needs to be answered in the next few years in my view, is whether legacy carmakers can transition from their core ICE business to EVs while ideally maintaining some profitability in order to make the transition sustainable. We know that Tesla (TSLA) has achieved this, mostly through a strategy of selling high-priced EVs.

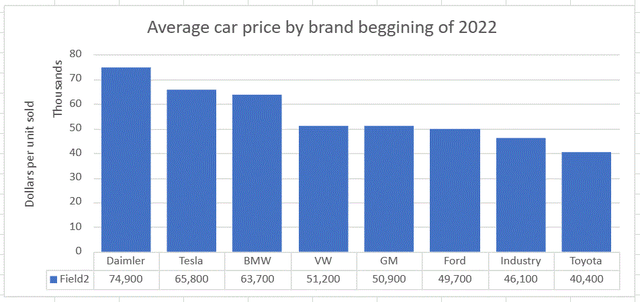

Data source (Inside EVs)

As we can see, Tesla’s average sale price per unit tended to mirror that of European luxury brands such as Mercedes (Daimler) (OTCPK:MBGYY), or BMW (OTCPK:BMWYY). That was what saw Tesla’s profit margins for 2022 come in at over 15%. With the deep discounting that Tesla initiated this year, profit margins are likely to shrink significantly. Once full-year results will come in for 2023, it will provide us with yet another glimpse in regard to where EVs need to be in terms of price in order to be able to provide consumers with a useful vehicle in terms of range and so on, while also making a profit.

Mercedes and BMW can certainly match Tesla’s strategy of selling high-priced EVs, since they are already mostly selling vehicles in the same price range. It is a different situation for Ford, as well as GM (GM) and VW (OTCPK:VWAGY). These companies built a reputation as middle-class auto brands and as such they will have to try to sell EVs that middle-class consumers will be able to afford, not only in the US but also in Europe where the middle class has far less buying power, as well as elsewhere around the world.

Ford is by no means at the point where it is trying to sell most of its EVs to the middle class. The Mach-E Select, which is the cheapest version has a starting price of $43,000, which ends up being far more in most cases. The Ford Escape by comparison has a MSRP starting price of $28,500. At some point, in theory, as Ford continues to reduce ICE vehicle sales and increase EV production, it will have to strive to offer EVs at comparable prices that the middle class can afford, with a hopefully comparable level of consumer utility in terms of range and other factors.

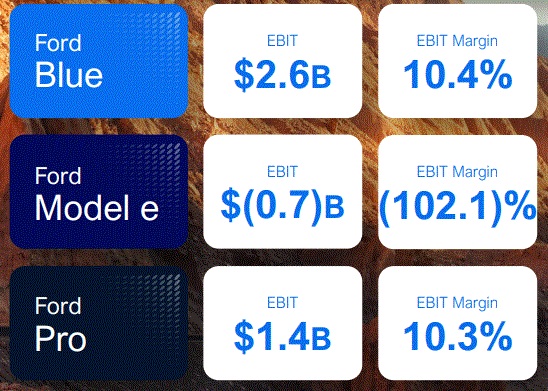

Ford

As we can see, in the latest quarter, Ford’s EV sector (Model e) has been less than effective in terms of producing a profit. And this is even as it is more or less emulating Tesla in selling EVs overwhelmingly into the luxury segment of the market price-wise, with the more expensive Mach-E and the electrified F-150 vehicles making up the bulk of its EV sales. Ford’s current personal vehicle lineup is mostly the Mach-E and the F-150 Lightning in terms of EVs.

One of the interesting aspects of Ford’s Q1 report is the intent to sell as many as 2 million EVs per year by 2026, meaning that nearly half of all of Ford’s vehicle sales will be EVs by then. To make this happen, it will have to start selling far lower-priced EV vehicles. As we can see right now, it is not even able to make a profit on high-priced EV sales. A lot of it has to do with the costs of ramping up production. Ford has been projecting a positive EBIT of 8% by 2026, which at the moment the market seems to regard with some skepticism.

I have no doubt that scaling up production and establishing supply lines will drive down costs significantly. At the same time, Ford cannot hope to continue to exclusively target the high-end part of the EV market, since it is a middle-class brand. It is highly questionable therefore that Ford will be able to switch to selling affordable EVs in high volumes, on the back of savings that will come from ramping up production.

Short-term auto market turbulence due to recessionary fears.

Putting aside longer-term considerations in regard to Ford’s outlook in the face of what is arguably the greatest technological shift in the global auto industry for over a century, there are the shorter-term considerations that mostly have to do with the economic outlook for this year and next.

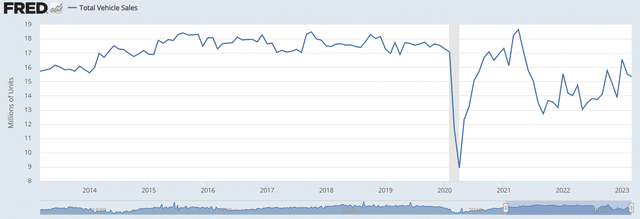

Federal Reserve Bank of St. Louis

As we can see, after a sharp rebound in car sales after the COVID shock, US car sales settled into what seems to be a new normal sales range in the 13 to 16 million units sold per year range, compared with a steady sales pace in the 17 million unit/year range in the 2015-2019 period.

It remains to be seen what impact higher interest rates as well as a potential banking crisis that might be unfolding will have on US auto sales. It is also unclear where the EU economy is headed going forward, where Ford has a significant market share. Sales trends in China are also uncertain, with geopolitical risk now being a significant additional factor that may affect sales of foreign automakers like Ford going forward. At this point, downside risks to sales and profits clearly outweigh any potential for upside surprises. Arguably, downside risks may outweigh the odds of the current forecast for the year coming to fruition.

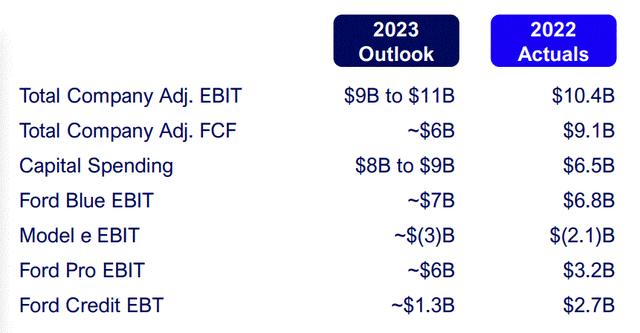

Ford

At the moment, there is no way of telling how the banking issues will play out, or how much of a reduction in consumer willingness to borrow or even to purchase major items with cash might take place. Higher interest rates make borrowing far more unappealing and for some people even unviable. Declining consumer confidence, due to perceived economic upheaval, such as the possible collapse of more banks, may also play a role in consumers deciding to forego major purchase decisions, such as buying a new car.

Even though monthly car sales are already running at a low annualized rate of about 15 million, things could get far worse going forward, given all the negative factors that could potentially impact consumers this year and perhaps next. Furthermore, the emerging banking crisis has the potential to impact other parts of the world. Ford’s domestic as well as international sales could take a significant hit in the coming months and perhaps years as a result.

Investment implications:

The latest quarterly results led to some sensational statements in regard to Ford’s EV profitability. Some estimates put the loss on each and every car sold at $58,000. It is an overly simplified conclusion that tells us very little about the actual profitability of its EV sales. There are ramp-up costs within the segment which distorts the picture. There was a massive decline in Ford’s EV sales for the quarter, also related to changes being made to its production facilities in order to accommodate higher production going forward.

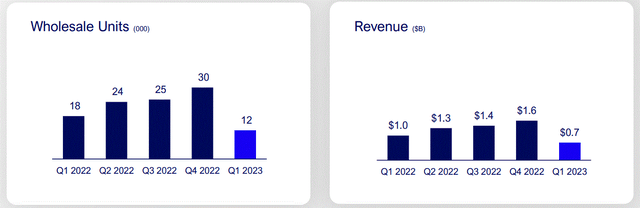

Ford EV sales & revenues (Ford)

If one looks at the results for the fourth quarter of last year, when 30,000 EVs were sold, the loss per EV narrows to $20,000 per unit sold in EBIT terms, which is perhaps a more accurate picture. Even this picture is still distorted by all the extra ramp-up costs, which will keep the segment in financial losses for years to come. The wild card remains whether or not Ford will be able to make a profit on its EV segment once the ramp-up costs will end. It is a very important question that needs answers because, within just a few years, Ford intends to try to make anywhere between a third and half of all cars EVs.

A few years back, I wrote an article entitled “In Age Of EVs, Income-Based Range Inequality Will Become The Norm”. It deals with perhaps the most profound aspect of this ongoing shift from ICE to EVs. For the first time since the dawn of the age of the automobile, the driving range of a car, therefore the level of mobility that it has to offer will be directly tied to the price tag of the car. That is, once ICE-powered cars become unavailable, or nearly unobtainable for most consumers, as many policymakers would like to have it in the future. I personally believe that it will become a social barrier to the implementation of such policies, once the public becomes more acutely aware of the implications.

For this reason, I am not entirely on board with Ford’s accelerated path toward displacing its ICE-powered vehicle sales with EVs. I do not see it as being compatible with Ford’s traditional branding as a car for the middle class. I am therefore not as enthusiastic about Ford’s overall EV strategy as I have been in the past, which made me more optimistic about Ford’s overall long-term prospects, as I pointed out in previous articles. I saw Ford’s EV strategy in the past as a reason to invest in its stock. I still see value in its approach, with the likes of the Mach-E continuing to experience healthy levels of consumer demand. I also see a chance that it will over-invest in EV manufacturing capacities, getting ahead of market demand for those EVs, which is a very real risk. That will be the case, especially if Ford will attempt to sell its middle-class customer base city EVs with limited range. If that will be the case, the odds are that it will become a poor investment choice for Ford, which will also make Ford an underperforming investment choice for the long term.

Read the full article here