FET Will Keep It Steady

I have been discussing Forum Energy Technologies (NYSE:FET) in the past, and you can read the latest article here. But the company’s order booking accelerated in Q3. In the international market, it recovered, particularly in coiled tubing. The primary mover in recent times has been the Variperm acquisition, which complemented its differentiated products and technologies in the artificial lift product portfolio.

However, demand for its products and services from the pressure pumpers was low in Q3 following decreased well completion activity. As a result, the company’s stimulation and intervention sales declined. Nonetheless, I expect the company to improve its cash flows remarkably in the coming quarters as the acquisition strengthens its operating margin and opens new geographical markets. The stock is relatively undervalued versus its peers. However, the lack of any imminent thrust in the drilling and completion industry and the long payback period of the offshore industry will warrant the “hold” rating to continue in the short term.

Industry Drivers And Outlook

The management anticipates that given the current trend, the US rig and frac spread count in Q4 will remain below Q3 due primarily to operators’ budget exhaustion. While the US rig count has visibly decreased in 2023 (down by 19%), the frac count has been relatively resilient (6% down). Internationally, however, the rig count can make a modest comeback. The international rig count has increased (8.5% up) until now.

During Q3, capital equipment demand from the pressure pumpers was low following lower well completion activity. As a result, the company’s stimulation and intervention sales declined. On the other hand, the company’s shipments of coiled tubing and project revenues increased sharply in Q3. The demand growth primarily emanated from the Middle East region. As a result of a relatively steady energy market, FET’s revenue and adjusted EBITDA can remain flat. Its free cash flow can range between $45 million and $55 million.

Variperm Acquisition And Benefits

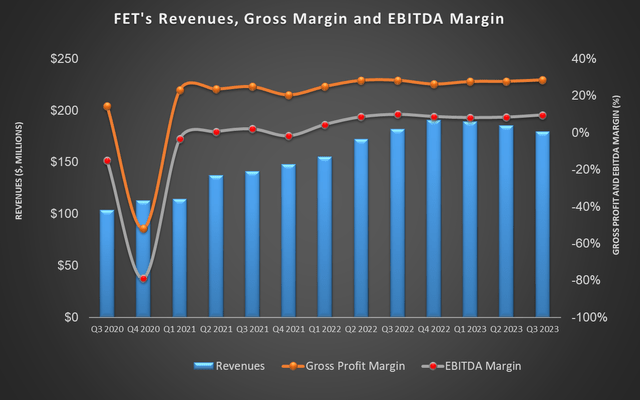

FET’s revenue and margin

In November, FET agreed to acquire Variperm for ~$195 million. This strategic acquisition complements FET’s differentiated products and technologies in the artificial lift product portfolio. Variperm is a key manufacturer of sand and flow control products. It has a strong large-cap operator customer base and manufacturing bases in four locations. The company primarily focuses on increasing customer adoption in Canada, international markets, and offshore. FET’s global distribution network should complement its market expansion strategy, primarily in the artificial lift product family.

The acquisition is expected to increase FET’s scale and profitability. The combined entity see revenue rising by 17%. It will have an EBITDA of $121 million and increase EBITDA margins to 14%, a sharp increase from the 9.5% margin for FET in Q3. The transaction will also be accretive to its earnings and cash flow metrics. Operating cash flow can increase remarkably by 2.9x, while free cash flow can improve by 84%. Also, the mix of cash and equity in the transaction financing will help maintain conservative net leverage and strong liquidity.

New Orders

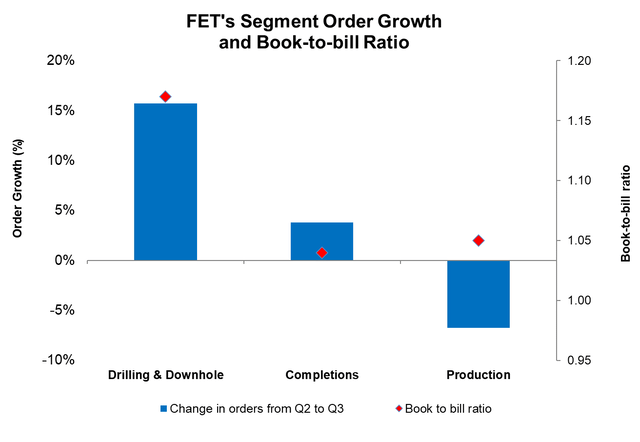

FET’s Filings

FET’s order book swelled in Q3 in two of its segments. In the Drilling & Downhole segment, its new orders grew by 15.7% from Q2 to Q3. In Completions, it increased by 4%. However, in Production, it declined by 6.7% during this period. Investors should note that in all segments, its book-to-bill ratio improved to 1.1x in Q3, which suggests a rise in revenue visibility in the coming quarters.

Recent Challenges

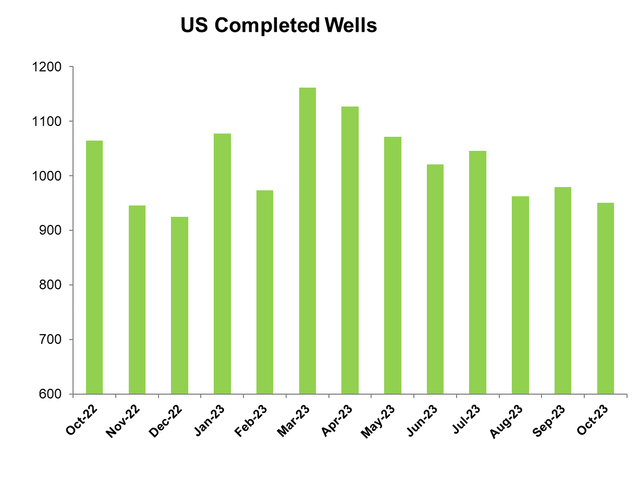

EIA DPR

In 2023, the US completed well count decreased by 12% until October. This adversely affected FET’s stimulation and intervention revenues, which declined by $14 million from Q2 to Q23. Over the past couple of quarters, many pressure pumpers idled fleets. As a result, the purchases of consumable products and demand for stimulation equipment slowed. This primarily affected power ends, manifold trailers, hoses, and radiators. I do not think the environment will improve in Q4. In 2024, however, I expect a reactivation of frac spreads and a rise in completion activity, leading to higher demand for these products.

Q3 Performance Analysis

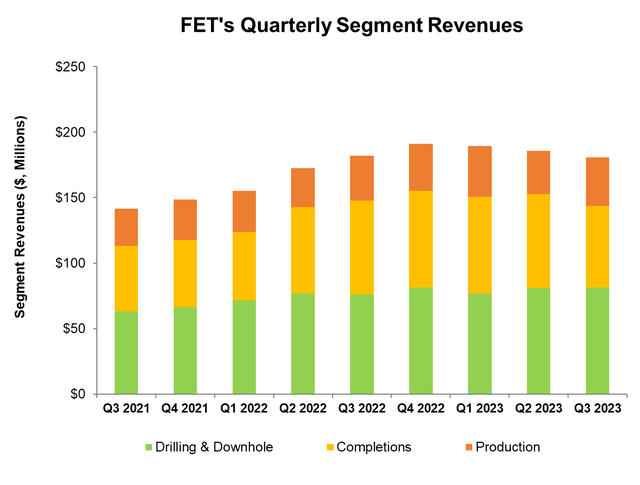

FET’s Filings

In Q3, FET’s revenues declined marginally (by 2%) compared to a quarter ago. During the quarter, we saw a sharp decline in capital equipment demand from the pressure pumpers following lower well completion activity. The factors primarily affected the stimulation and intervention product line in the US. Outside of the US, the company’s revenues increased due to significant project revenues and shipments for coiled tubing. The gains were primarily recognized in the Middle East region.

Despite the fall in revenue, the company’s gross profit remained resilient. This was due to the company’s policy of keeping the pricing steady, and it did not sacrifice margins for volume. FET’s utilization increased and resulted in cost savings initiatives. As a result, the company’s free cash flow increased by $24 million in Q3.

Cash Flows And Debt

The company’s cash flow from operations remained negative in 9M 2023 but improved significantly compared to a year ago, due primarily to a year-over-year revenue rise. FET’s management expects free cash flow to range between $45 million and $55 million in 2H 2023.

FET’s liquidity stood at $192 million as of September 30, 2023, while its debt-to-equity was 0.31x. During Q3, in connection with the Variperm acquisition, the company amended its ABL credit facility, increasing the revolving commitments from $179 million to $250 million. Plus, it extended the maturity date to September 2028. Its balance sheet is robust with sufficient liquidity, a proper mix of stock and cash consideration, and a seller term loan.

Why Do I Keep FET’s Rating Unchanged?

I already identified in my previous iterations how FET was slowly diversifying away its focus from North America to international geographies. Its backlog strengthened as in international offshore and it booked new and refurbished ROVs. The company also added innovative products like next-generation iron roughneck and greaseless cable systems. The company’s working capital improved due to the tightening of the supply chain. I wrote:

Its US revenues can decline in the near term, while higher international and offshore sales can mitigate most of the adverse effects. Its drilling technologies and downhole technologies backlog increased handsomely in Q2.

During Q3, the company’s stimulation and intervention sales declined. However, higher coiled tubing and project revenues in the Middle East region partially offset the fall. The most noticeable change in Q3 was the Variperm acquisition, which complemented FET’s differentiated products and technologies in the artificial lift product portfolio. The acquisition also amended its ABL credit facility, increasing the revolving commitments. It now has a robust balance sheet with sufficient liquidity. So, I continue to assign my “Hold” rating.

Relative Valuation

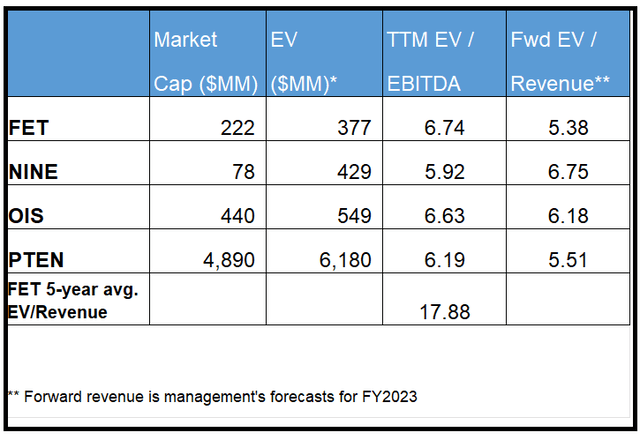

Author created and Seeking Alpha

FET’s forward EV/EBITDA multiple contractions versus the current EV/EBITDA is steeper than its peers, typically resulting in a higher EV/EBITDA multiple. I have used the management’s EBITDA forecast. So, its adjusted EBITDA is expected to rise more sharply than its peers in the next four quarters. However, its current EV/EBITDA multiple (6.7x) aligns with its peers (NINE, OIS, and PTEN). So, the stock is slightly undervalued compared to its peers at this level.

The stock is trading at a steep discount to its past five-year average. If it trades at the past average in the medium term, it can climb 2.6x from the current level. However, given the structural changes in the US energy market over the past few years, I do not see the stock trading anywhere near that average. Still, it has a considerable potential upside in the medium term.

What’s The Take On FET?

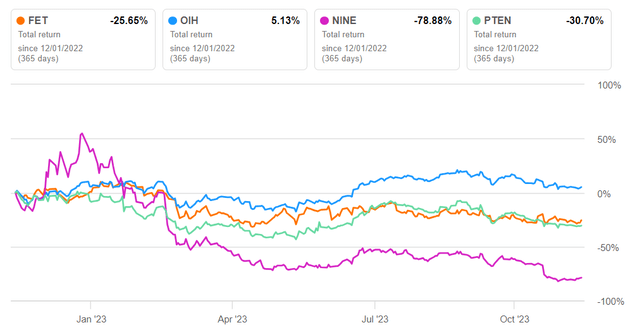

Seeking Alpha

During Q3, lower completion activity prompted capital equipment demand to fall. As a result, the company’s stimulation and intervention sales declined. However, the slowdown mostly affected North America, while its international business kept going strong. The recent strategic acquisition of Variperm complemented FET’s offerings in the artificial lift product portfolio. The transaction will likely be accretive to its operating margin and cash flow metrics.

Its order booking also strengthened in Q3. Also, the company’s liquidity improved as it amended its credit facility and extended maturity. I do not see the drilling and completion market turning around soon in North America. While the resurgence of offshore projects is encouraging, with their long payback period, I think the realization of the benefits can stretch to a medium-term horizon. So, I reiterate my “Hold” call.

Read the full article here