Summary

Readers may find my previous coverage via this link. My previous rating (published in mid-October 2023) was a buy, as I believed Fox Corporation (NASDAQ:FOXA) had potential for continued growth, driven by its digital strategy and content leadership. Additionally, relative valuation against peers suggested that FOXA was cheap. I am reiterating my buy rating as FOXA’s digital strategy is progressing really well, with significant visible room ahead to continue growing. While there are visible headwinds, I believe these headwinds are not structural and will not be present in FY25.

Financials / Valuation

FOXA reported an alright 1Q24 with consolidated revenue totaling $3.21 billion (flat y/y), driven by Affiliate revenue of $1.74 billion and Advertising revenue of $1.2 billion. Consolidated adjusted EBITDA came in at $869 million. By segment, Television revenue came in at $1.78 billion, driven by Advertising revenues of $910 million, driven by strong Tubi performance (more below). Television also reported an EBITDA of $351. For Cable Networks, revenue came in at $1.37 billion and EBITDA at $607 million.

How the 1Q24 results fit into FOXA performance over the last year: total revenue grew 0.5% over 1Q23 and 6% sequentially. On EBITDA performance, the $869 million in EBITDA performed poorly vs. last year, down 20.4% but improved sequentially from 4Q23.

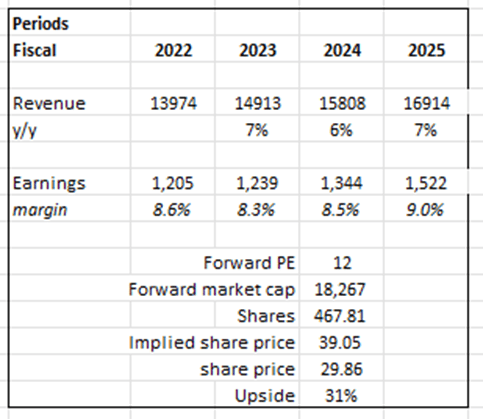

Based on author’s own math

Based on my view of the business, FOXA should improvements in the next few quarter’s growth to meet my FY24 expectations. However, the cadence of growth is tough to estimate given the mixed of tail and headwinds between Tubi and y/y comps effect.

Nonetheless, I believe the current share price remains attractive. Given the visible headwinds ahead, I am revising my FY24 growth outlook downwards modestly, but expect growth to recover in FY25 as the headwinds (as mentioned below) are all a matter of timing. FY25 will be a year when growth will face a normalized comp in FY24. On the other hand, I have revised my margin expectations upwards to 9% in FY25 as I gain more confidence that FOXA’s digital strategy (Tubi) is progressing very well, with significant room to further penetrate. Since the underlying infrastructure (dollars spent on maintaining Tubi) is largely fixed, additional advertising revenue should see a high incremental margin, thus driving margins upward.

My relative valuation method remains the same, which is to compare against Paramount Global (PARA). I continue to believe that FOXA deserves to trade at a similar forward earnings multiple to PARA, which is also FOXA historical 10-year average, as I expect FOXA to grow faster than PARA (consensus expects PARA to grow 4% over the next 12 months) and that FOXA has a higher margin than PARA.

The key metrics I will track are Tubi’s progress (revenue growth vs total view time, and number of users) and consolidated advertising growth pace.

Comments

The 1Q24 results proved that FOXA is finding success in its digital strategy. The key highlight was strong growth in Tubi. After reaching 64 million users in February, Tubi saw a surge of 10 million users since then, and in September surpassed 74 million monthly active users [MAUs]. At first glance, it appears like a bad thing that the total view time growth rate of 65% is still outpacing the revenue growth rate of 30% for Tubi. In my opinion, this shows that FOXA has a significant opportunity to improve its ad revenue in the long run. As I said in my previous post, there is still a lot of room for improvement when it comes to advertising monetization because the service isn’t using all of its ad inventory (as evident by the spread between revenue growth and total view time). One more thing to keep in mind is that both metrics show that Tubi is still growing at a very fast clip, albeit revenue was up 47% and TVT up 65% from the previous quarter.

Aside from Tubi momentum, FOXA’s consolidated advertising revenue continues to perform very strongly. FOXA reported consolidated advertising revenue of $1.2 billion ($910 million from Television and $290 million from Cable Networks), despite the tough competition faced from last year’s political advertising tailwinds. The key point from management’s remarks is that advertising revenues are running slightly ahead of last year, excluding the political impact of last year. Driving this growth are financial services, automobiles, and retail sectors, while being offset by the betting, wagering, and entertainment sector. The way I see it, if we look at the elements driving advertising revenue, the key drivers are all major parts of the economy, and the fact that advertising revenue can grow means that underlying business health remains healthy.

That said, I am also cognizant of the bearish narrative that advertising revenue could see deceleration in the near-term (2Q24). The narrative is that FOX network and stations are going to face tough comps due to the political cycle, the Men’s World Cup in 2Q23, and softness in direct response pricing. Also, this year’s World Series was short and attracted a smaller national audience, which should have a negative impact on advertising revenues. In my opinion, these are not structural weakness as they are a matter of timing. Once we get into FY25, all these headwinds will not be present anymore. Especially with the softness in direct response pricing, it will lap next month, so the impact is not going to be huge for 2H24. As such, I think investors should use this to size/time their purchase, but should not impact the long-term outlook of the business.

Risk & conclusion

The upcoming headwinds might be worse than I expected, especially if FOXA sees worse-than-expected cord cutting. Also, the retail spending environment is constantly at the mercy of the fed further increasing rates. Given the discretionary nature of FOXA’s products, a recession will be bad for FOXA. To end off, I am reiterating my buy rating for FOXA due to the progress of its digital strategy, notably with Tubi’s substantial user growth. I have adjusted my FY24 growth expectations slightly downward due to foreseeable headwinds, but still anticipate a rebound in FY25. I also adjusted my margin assumption upwards to reflect the strength and progress of FOXA’s digital strategy.

Read the full article here