Investment Thesis

Franklin Covey (NYSE:FC) is a highly attractive business in an overlooked industry. FC is a global company that sells training courses with a mission to “enable greatness in people and organizations everywhere.”. Back in 2016, the firm launched All Access Pass, or AAP for short, shifting away from a transaction-based business model to SaaS. This clever move by management has allowed them to increase retention rates, margins, and top-line growth. AAP is capital-light and very easy to scale.

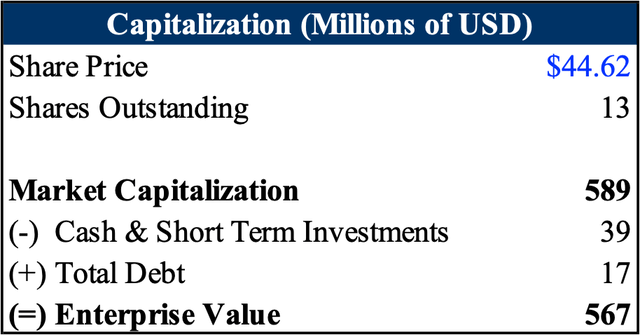

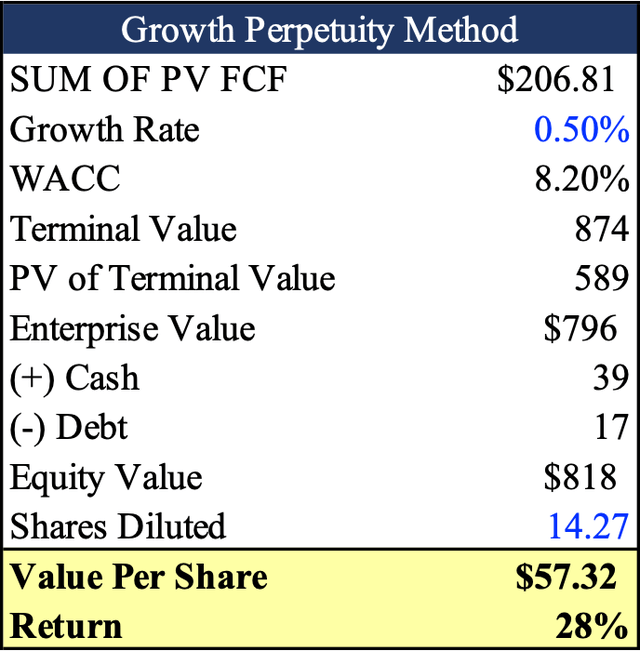

The company’s capital allocation has also been sound in the past few years, continuously deleveraging the balance sheet, reducing total debt from $38.7 million in 2016 to $17 million as of the latest quarter, purchasing 9% of the outstanding shares in the past six quarters, and making some tuck-in acquisitions. My DCF valuation indicates a value of $57.32 per share, which equates to a 28% return from the current price of $44.62.

Created by the author

All Access Pass

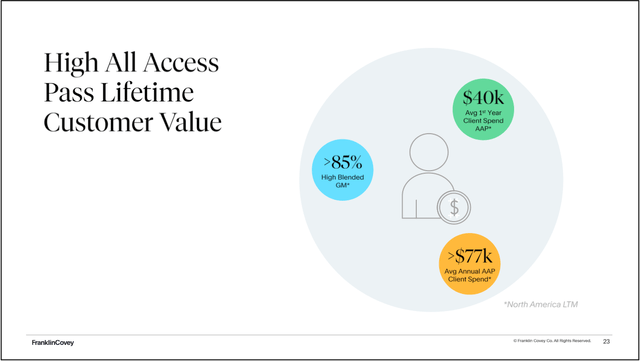

Prior to AAP, FC had multiple delivery methods, such as onsite presentations, client facilitators, public workshops, and more. In short, most of the offerings were delivered in person. Post-AAP launch, most of the company’s content is provided through a subscription. Customers are charged on a per-seat basis, and with an AAP, they are allowed to access most of the company’s library. The average first-time client spends $40k in AAP, and the average annual client spend is $77k. AAP revenue retention remained well above 90 percent in 2022. With Fortune 100 and 500 companies as clients, the firm’s content is translated into many different languages. Customers can also use individual concepts from any of FC’s well-known offerings to create a custom solution to fit their needs.

Company’s presentation

According to a report by Statista, more than 60% of U.S. companies hire a third-party company to train their employees, and 31% of U.S. companies expect to increase funding for management and supervisory training. I believe there is still room for growth for AAP, not just based on the report by Statista but because the company can come up with new offerings and cross-sell to its customers. Plus, Fortune 100 companies don’t have the time to train their employees, so if they want to promote someone to a certain role who didn’t have the chance to attend college and get a specific degree, they will use offerings provided by companies such as FC to make sure they are ready.

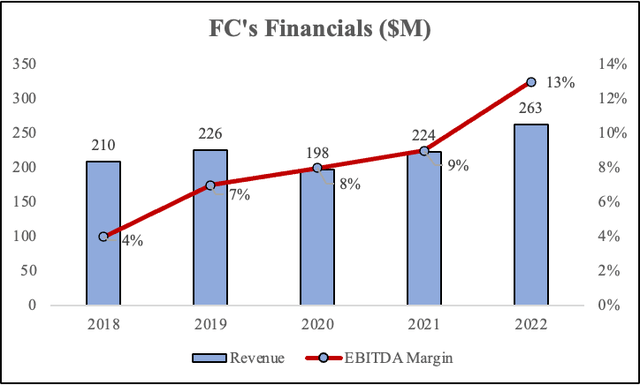

The shift to a SaaS business hasn’t only increased customer stickiness, but it has also improved the company’s financials by making the business capital-light, with recurring revenue and enhancing margins. As you can see below, this transition has improved the firm’s margins significantly over the past few years (more than tripling EBITDA margins).

Created by the author

Capital Allocation

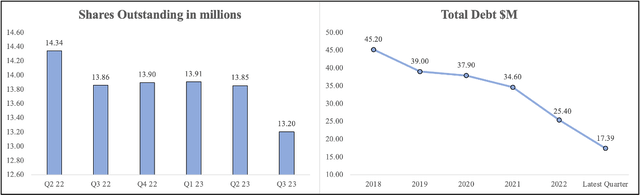

As you can see from the graph below, the company has been continuously paying off its debt over the years, going from $45 million in 2018 to $17.39 million as of the latest quarter (Q3 23), a 62% decrease. Not only has the company significantly deleveraged its balance sheet, but it has also bought back shares, reducing total outstanding shares by 9% in the past six quarters. As you can see below, the total shares outstanding were 14.34 million in Q2 22 and 13.20 million in Q3 23.

Created by the author

I believe actions like this are possible due to the shift to AAP, which has enhanced margins and increased cash flow generation. Free cash flow has grown at a CAGR of 22% in the past five years. FC also acquired Strive Talent in April 2021, a San Francisco-based technology company that developed and markets an innovative learning deployment platform. This acquisition will enable seamless integration and deployment of content, services, and technology. The firm will fully roll out the new capabilities of Strive in early fiscal 2023. This will add value to current clients and attract new ones.

Company & Industry Overview

Franklin Covey is a multinational firm that focuses on improving organizational performance. It specializes in offering time management and effectiveness training to people and businesses through online courses as well as in-person seminars and events. It offers leadership, execution, productivity, trust, sales performance, customer loyalty, educational improvement training, and consulting services. Most of the company’s revenue is derived from the United States. No client represented more than 10% of revenue. The number of clients has increased from 214 in 2018 to 300 on August 31, 2022. The company derives revenue from three segments: the enterprise division (74%), the education (24%) division, and others (2%).

The industry in which FC operates (the training industry) is highly fragmented and includes a wide variety of training and service providers. Although the industry isn’t protected by high barriers to entry, I think FC’s intellectual property, brand image, and high production quality will allow them to stand out from others. Considering that FC has Fortune 100 and 500 companies as clients, I believe the quality of production is among the highest out there. Some competitors include SkillSoft, Coursera, Udemy Business, Harvard Business Publishing, Cornerstone, Workboard, and more.

Valuation

I arrived at a fair value of $57.32 per share using discounted cash flow analysis. I model revenue to grow at a CAGR of 9% from 2023 to 2027. I derived about a third of my revenue estimate by looking at some consensus estimates (FactSet), and for the rest, I assumed the growth momentum would carry on but not at the same pace.

I believe most of the future growth will stem from the additional sales professionals the company expects to hire in fiscal 2023, the new and refreshed content and solutions launched, and the new Impact Platform, which is built on Strive. I project EBITDA margins to increase by 280 basis points from 2022 to 2027 underpinned by continued margin enhancement.

Using a discount rate of 8.20%, I discounted the future free cash flows, which amounted to ~$207 million. Using a terminal growth rate of 0.50%, I arrived at an equity value of $818 million.

Created by the author

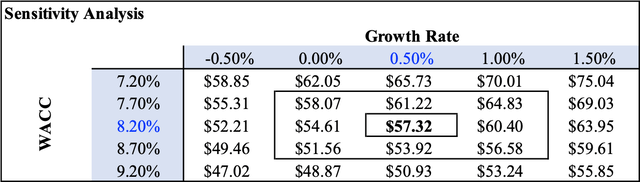

Below is a sensitivity analysis of what the share value would be if one were to use a different WACC or Growth rate.

Created by the author

Risks

The most significant risk to FC I would say there is competition. Although the company is protected by intellectual property, if a competitor came up with similar content to FC’s and offered clients lower prices, that could damage revenue.

An economic downturn can hurt the company. In 2008, revenue declined by 20%. I believe the shift towards AAP has created customer sickness; however, one has to consider such circumstances.

Conclusion

The takeaway is that FC is a small-cap company in an overlooked industry. The firm generated over $200 million in revenue in 2022, which isn’t very easy to do when selling training courses. One of its offerings has more than $2 billion in sales (7 habits of highly effective people). The addition of sales professionals in fiscal 2023 and the launch of new solutions and content will provide the company with more opportunities for growth.

My valuation indicates a 28% upside, considering the long-term earnings power of the firm. Competition is a risk to consider because the training industry is highly fragmented with solid players, and there aren’t a lot of barriers to entry. I believe what really differentiates the companies is the quality of their content.

Read the full article here