Introduction

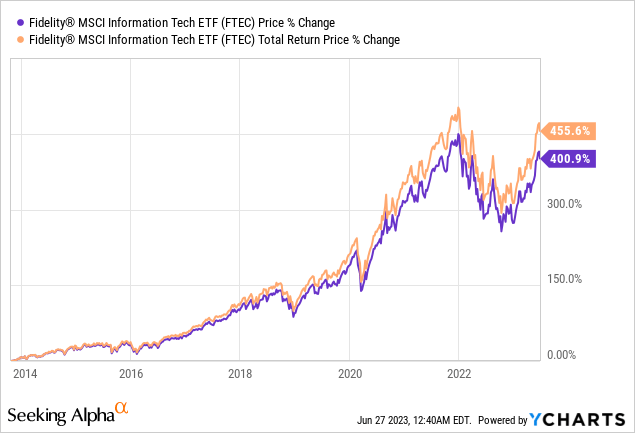

Back in April 2020, we wrote an article analyzing the Fidelity MSCI Information Technology Index ETF (NYSEARCA:FTEC). At that time, we recommended investors buy this fund, especially after a massive stock market decline in March 2020. The fund has since registered a total return of over 135%. However, we are in a much different environment now with persistent inflation and elevated interest rates. We think it is time for us to analyze FTEC again and provide our analysis and recommendations.

ETF Overview

FTEC invests in large-cap technology stocks in the U.S. Most of the stocks in FTEC’s portfolio have strong growth characteristics. Its top holdings have also consistently delivered a high return on equity to its shareholders in the past and should continue to do so in the future. The fund is expected to continue to benefit from several important technology trends. However, its shares appear quite expensive especially after the rally in the first half of 2023. Given this uncertain macroeconomic environment, we think investors should wait for a better entry point.

YCharts

Fund Analysis

FTEC has rallied in H1 2023 but still down from the high reached in late 2021

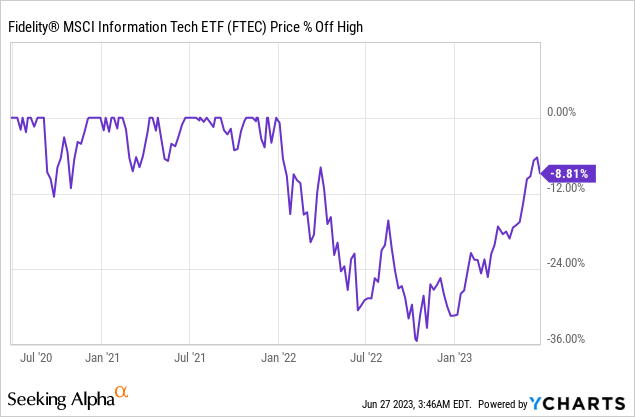

FTEC has declined sharply in 2022 since reaching its peak in late 2021. In fact, the fund has lost more than 36% of its total value from peak to trough in 2022. This was much greater than the S&P 500’s 25% loss. The decline was primarily due to the Federal Reserve’s aggressive monetary tightening policy to combat inflation. As inflation has gradually fallen, FTEC has rallied in the first half of 2023. In fact, the fund has rallied over 36% since the trough in October 2022 but its fund price is still down 8.8% from the peak reached in late 2021.

YCharts

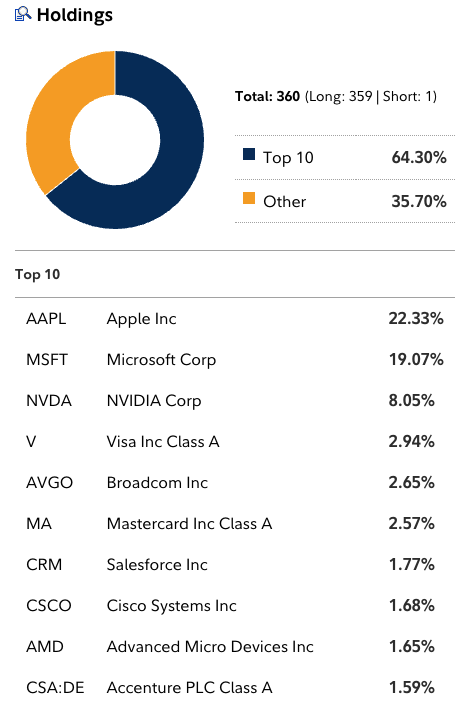

FTEC’s top 10 holdings represents nearly two-thirds of its portfolio

Although FTEC owns a total of nearly 360 stocks, its top-10 holdings represent 64.3% of its total portfolio. This is because the fund uses a market-weighted approach and hence stocks with higher market-caps are assigned with much larger weightings. As can be seen from the table below, Apple (AAPL) and Microsoft (MSFT) represent 22.3% and 19.1% of FTEC’s portfolio respectively.

Fidelity

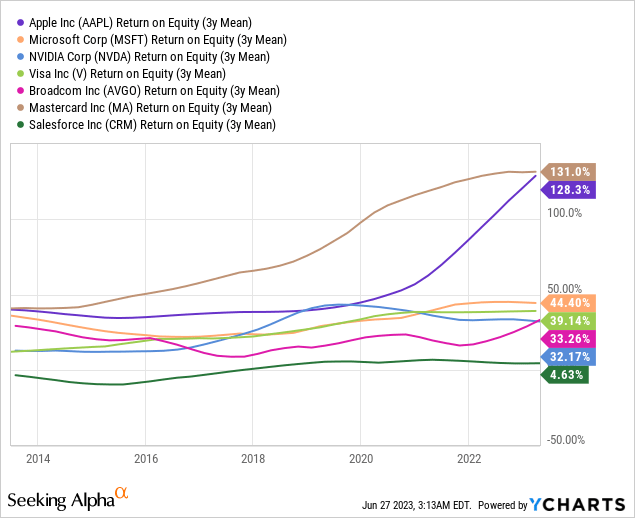

While concentration risk is high, we do not see this as a big problem. In fact, most of its top 10 stocks can return cash to investors through dividend increase and/or share buybacks. As can be seen from the chart below, its top 6 stocks have a return on equity above 30% in the past 10 years and should continue to do so in the future as many of these companies also have share buybacks in place. It should provide strong support for FTEC’s fund price.

YCharts

FTEC is riding on several important secular growth trends

About 62% of FTEC’s portfolio belongs to large-cap growth stocks. Therefore, the fund has a strong growth characteristic. FTEC’s strong growth profile should continue in the next decade thanks to several important technology trends. These trends include digital transformation, electric vehicles, edge computing, cloud computing, Internet of Things, artificial intelligence, etc.

For many software stocks in FTEC’s portfolio, the good news is that the global software market size is expected to grow from $55.52 billion in 2022 to $117.64 billion in 2030. This represents a compound annual growth rate of 8.7%. For reader’s information, software stocks represent about 33.3% of FTEC’s portfolio.

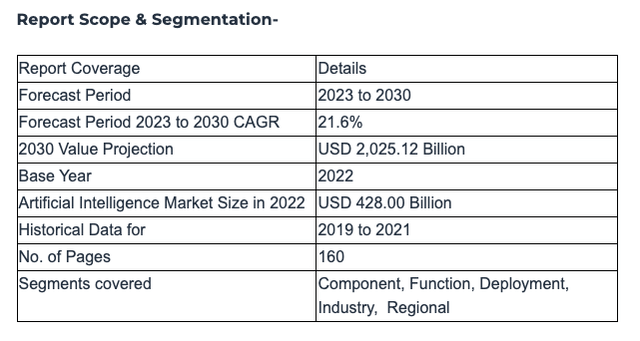

Another good news for stocks in FTEC’s portfolio is the growth of artificial intelligence applications in many different industries. In fact, according to Fortune Business Insights, the global artificial intelligence market size is expected to grow from $428 billion in 2022 to $2,025 billion in 2030. This represents a CAGR of 21.6%. We believe many stocks in FTEC’s portfolio will benefit from this trend. For example, semiconductor companies such as NVIDIA (NVDA) will greatly benefit from this trend. In addition, other software companies can also implement AI features in their software services.

Fortune Business Insights

FTEC is trading at an expensive valuation

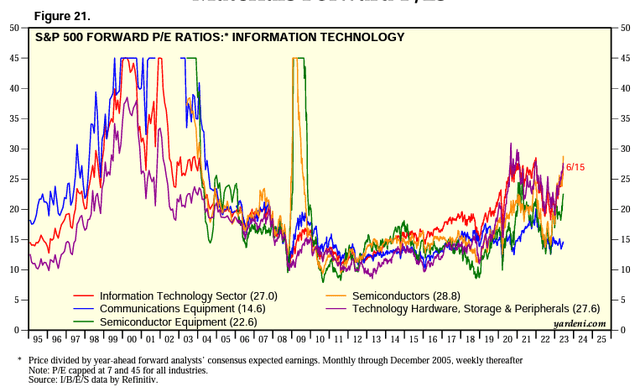

It is an arduous task to check the valuation of each stock in FTEC’s portfolio and figure out whether the fund is expensive or not. However, since 81% of FTEC’s portfolio are large-cap technology stocks, we will look at the valuation of the technology stocks in the S&P 500 index. As can be seen from the chart below, information technology sector in the S&P 500 index has an average forward P/E ratio of 27.0x. This is towards the high end in the past 25 years (not including the 2000 Internet Dot Com bubble). Similarly, valuation of semiconductor stocks in the S&P 500 index is also quite high. Therefore, we think technology stocks are generally overvalued.

Yardeni Research

Should you invest now in this environment?

Given the fact that the Federal Reserve is going to keep the rate elevated for longer to successfully combat inflation, its rate is likely not going to drop until after 2023. Therefore, the likelihood of the economy falling into a recession is high. In this environment, we do not think the rally in the first half of 2023 is sustainable as the stock market usually bottoms not before the recession but during the recession. Hence, we do not think investors should be rushing in to buy any stocks right now.

Investor Takeaway

FTEC owns a portfolio of mostly large-cap growth technology stocks. We think this fund is a good long-term core holding as stocks in its portfolio should benefit from several long-term growth trends. However, given its expensive valuation and the current uncertain macroeconomic environment, we think investors may want to wait on the sidelines.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here