Mr. Market can sometimes be very fond of growth companies but can be very cruel at other times. Things can go from one extreme to the other in a flash, leaving investors insufficient time to react. This is the biggest risk of investing in growth stocks. And this is what happened to fuboTV Inc. (NYSE:FUBO). After debuting on the NYSE in 2020 at an IPO price of $10, fuboTV stock shot through the roof to reach a high of over $60 in December 2020. Things started going south afterward, and the company has lost most of its market value since then. At the depressed stock price of around $2, I believe Mr. Market has been too harsh on fuboTV given that the company has made commendable progress in recent quarters to lower its cost base while positioning itself to make the most of the changing dynamics of the global sports streaming landscape. In the first part of this two-part analysis, I will focus on the macroeconomic outlook for fuboTV. In the second and final part which will be published next week, I will discuss the valuation of the company, the effectiveness of recent strategic decisions, and the challenges faced by the company.

Secular Changes In Sports Streaming Preferences

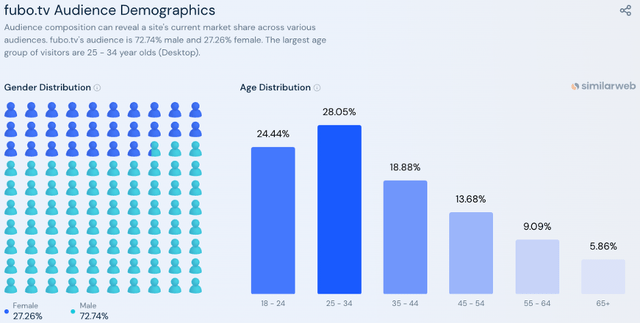

At its core, fuboTV is a sports streaming platform. This is the company’s selling point. It is no surprise that the majority of fuboTV subscribers are young males. Gender and age distribution stats for fuboTV website visitors confirm this.

Exhibit 1: Demographics of website visitors

Similarweb

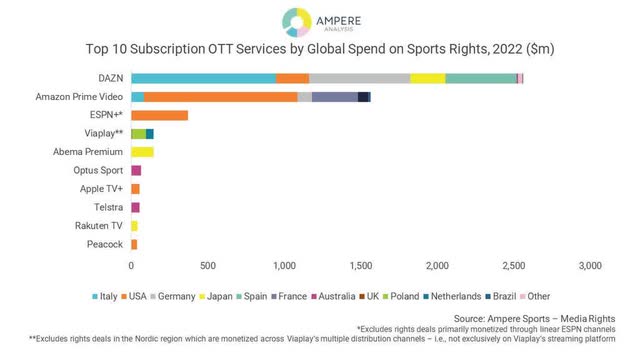

fuboTV was launched with the aim to benefit from the cord-cutting movement by filling the gap in the OTT sports streaming market. Sports streaming is arguably one of the strongholds of cable and satellite TV service providers, and this niche has been the only bright spot for TV networks in recent years. However, over the last couple of years, there has been a marked improvement in OTT sports streaming penetration aided by the wide coverage of live sporting events and the production of high-quality original content centered around sports events and sporting personnel. OTT streaming platforms have been keen to allocate billions of dollars to acquire sports streaming rights in recent years, which underpins the growing demand for OTT sports streaming. According to Ampere Analysis, OTT platforms will spend $8.5 billion on sports rights this year, registering a stellar 64% growth from 2022. This projected investment in sports rights will account for 21% of total sports rights spending in 2023, up from just 13% in 2022.

Exhibit 2: Spending on sports rights by OTT service in 2022

Ampere Analysis

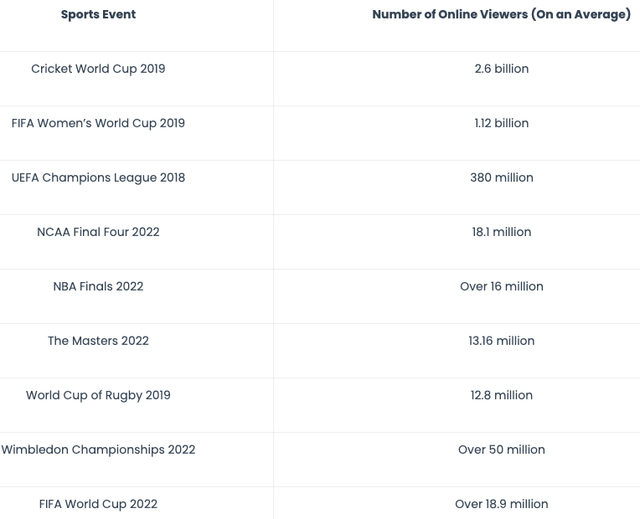

The increasing number of online sports viewers and the increasing investments committed by streaming companies to acquire rights to live sporting events has created a virtuous cycle that continues to tilt the odds in favor of OTT sports streaming. The rising number of sports fans who are resorting to watching their favorite sporting events through online channels has created a massive addressable market opportunity for advertisers as well. Attracting advertisers will be a big win for streaming companies, including fuboTV.

Exhibit 3: Number of online viewers for selected live sporting events since 2019

Muvi

There are multiple reasons behind the increasing popularity of OTT sports streaming.

- OTT platforms allow users to play on-demand replays, match highlights, and interviews.

- Streaming platforms are giving much-needed flexibility to sports fans to watch their favorite sporting events from anywhere.

- The rollout of 5G has removed a major barrier that limited live sports streaming by minimizing the chances of video buffering.

- The increasing smartphone penetration has created an economic ecosystem centered around these devices.

In the next few years, the sports streaming market is likely to benefit from technological advancements that enable an even better viewing experience for sports fans. Therefore, I believe this market is still in the very early stages of its growth story, which leaves room for growth for all existing players but at the same time for disruption by a new player as well.

The Competitive Landscape Does Not Leave Room For A Moat

The sports streaming landscape has become fiercely competitive in recent years. Companies of different sizes and scales are trying to get a share of the sports streaming pie, pushing the cost of acquiring streaming rights higher on a global scale. Major players in this industry include:

- General entertainment companies looking to expand their audience by offering sports streaming/broadcasting.

- Regional sports networks with traditional broadcasting and OTT streaming capabilities.

- OTT streaming platforms.

- Big tech companies such as Apple, Inc. (AAPL) with ambitious goals to venture into the sports streaming market.

- Specialized streaming platforms operated by sports teams and leagues.

The intensifying competition in the sports streaming market is a boon for sports leagues as companies are now willing to pay substantially higher fees compared to five years ago to acquire streaming rights. This is a positive development for sports fans as well. However, up-and-coming streaming platforms will find it difficult to build long-lasting competitive advantages, or an economic moat, in this market environment. fuboTV, as a young streaming company, faces this challenge today.

Some of the recent streaming deals for live sporting events highlight the staggering amounts being paid by major players in this sector to acquire streaming rights.

Exhibit 4: Recent live sports streaming rights deals

Deloitte

As a long-term-oriented investor, I prefer to invest in companies that are enjoying competitive advantages or at least on the right track to enjoying such advantages in the long run. For now, I believe none of the companies in this sector are guaranteed to enjoy long-lasting competitive advantages.

Takeaway

fuboTV is a young company trying to establish its presence in a relatively young, fast-growing market that is rife with competition. A thorough understanding of the industry landscape is a must for any potential fuboTV investor. Our findings indicate the long-term macroeconomic outlook for fuboTV is promising, but the company is far from enjoying competitive advantages. For this reason, investors will have to seek a meaningful margin of safety before investing in FUBO as things can still go horribly wrong for the company if it fails to win and secure market share in the sports streaming industry amid the intensifying competition. I am bullish on the long-term prospects for the company, but an investment decision can only be reached after carefully building a valuation model with conservative estimates that account for the risks faced by the company. Stay tuned for the second and final part of this analysis for a discussion of the company’s valuation and prospects.

Read the full article here