Introduction

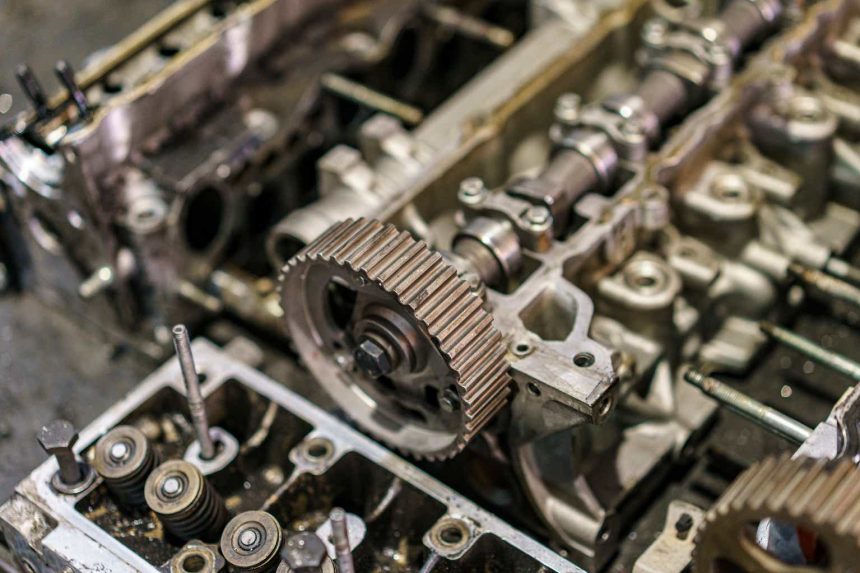

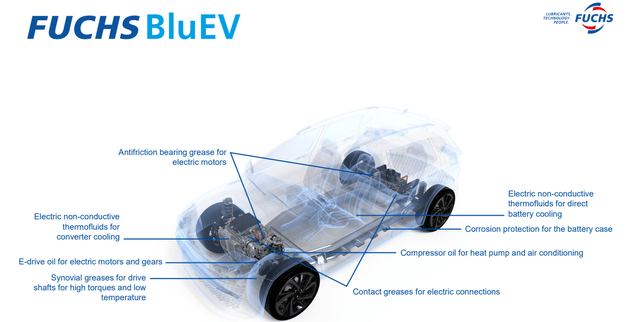

Fuchs SE (OTCPK:FUPBY, OTCPK:FUPEF, OTC:FUPPF) is the new name of Fuchs Petrolub, a large German manufacturer of lubricants and functional fluids for the automotive sector. The company hasn’t missed the electric vehicle (“EV”) boat: some of its newest applications are specifically geared towards electric vehicles, with, for instance, thermal fluids for cooling and antifriction bearing grease for electric motors.

Fuchs Investor Relations

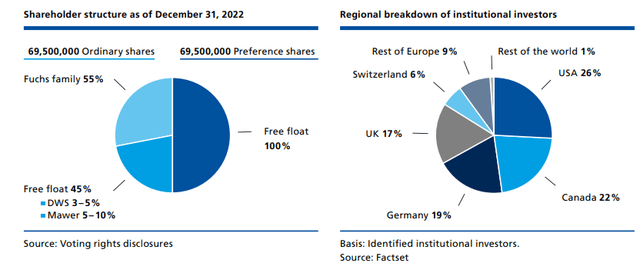

Fuchs has two classes of shares outstanding: the ordinary shares and the preferred shares. The preferred shares are more liquid and trade with FPE3 as their ticker symbol. There were 69.5M ordinary shares and 69.5M preference shares issued (but Fuchs has been buying back stock, so the net share count will decrease), and only the former have voting rights. That’s why the Fuchs family, which only owns just over a quarter of the economic value of the company, still calls the shots, as they have a majority stake in the ordinary shares with voting rights.

Fuchs Investor Relations

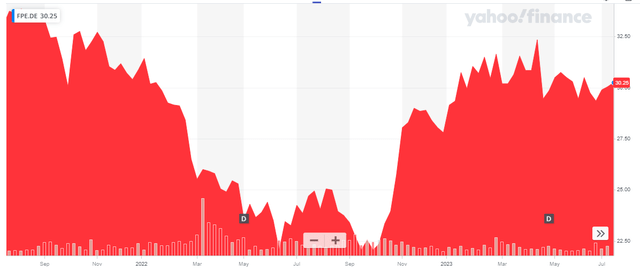

Although the non-voting preference shares are more liquid, the ordinary shares are trading at a (substantially) lower share price, while the only real difference is a statutory 1 cent per share difference in dividends: in return for not having a vote, the preference shares will always have a dividend that is 1 cent higher than the ordinary shares. As I’m mainly interested in getting the biggest bang for my buck, and as a volume of 16,000 shares per day in the ordinary shares doesn’t scare me, I will refer to the ordinary shares in this article. The 20% discount to the share price of the preference prices is just too big to pass up on. The current market cap of Fuchs is approximately 4.2B EUR.

Yahoo Finance

Expect an earnings acceleration this year

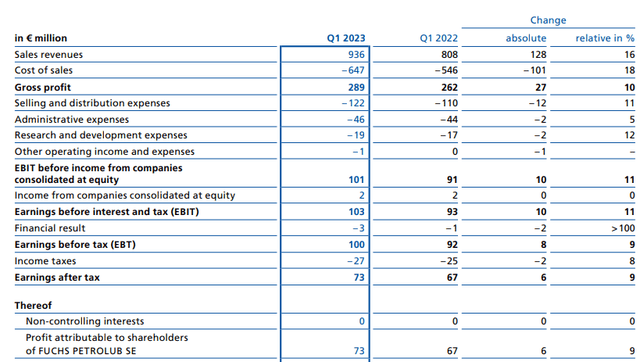

Looking at the first quarter of this year, we saw the total revenue increase by 16% to 936 EUR, and while the company clearly wasn’t immune to the rapid increase of the raw material prices, the gross profit still increased, by approximately 10%. And despite reporting increases across the board in corporate overhead (SG&A) and higher R&D expenses, the total EBIT increased by 11% to 101M EUR.

Fuchs Investor Relations

As Fuchs has a very clean balance sheet, the net finance expenses are very low at a low single-digit rate, resulting in a pre-tax income of 100M EUR and a net income of 73M EUR. This represents an EPS of 0.54 EUR per share, an increase of approximately 13% compared to the first quarter of 2023.

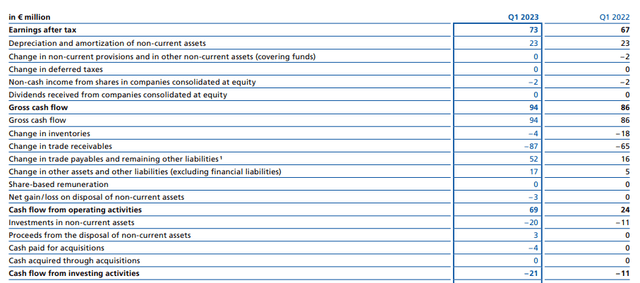

As most of my investment theses are focusing on the cash flow generation of a company, Fuchs is no exception: after all, I want to make sure the company is generating enough cash flow to cover its investments and its dividend (see later). In the first quarter of 2023, Fuchs reported an operating cash flow result of 69M EUR, which includes a 22M EUR investment in the working capital position (mainly caused by a net increase in the difference between receivables and payables). The total lease payments would be approximately 2M EUR per quarter (based on the current lease liabilities), which means the underlying operating cash flow generated by Fuchs was approximately 89M EUR.

Fuchs Investor Relations

We see the total capex was just 20M EUR, resulting in an underlying free cash flow (“FCF”) result of 69M EUR. That’s slightly lower than the reported net income due to the non-cash nature of the contribution of the gain on the sale of assets and a 2M EUR income from equity-consolidated companies. The free cash flow per share came in just over 52 cents per share.

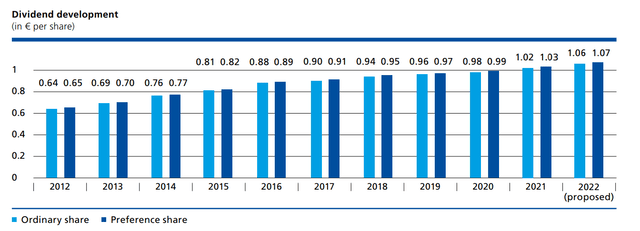

As you can see below, the dividend per preference share has been gradually increasing, and as I expect Fuchs to be able to further increase its net income and EPS, I also expect the dividend to increase by a few percent per year. The official dividend policy is to “increase it gradually but at least keeping it stable.”

Fuchs Investor Relations

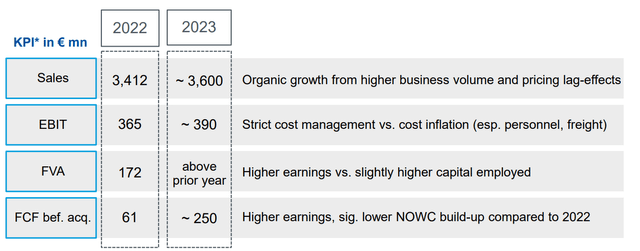

Fuchs also reconfirmed its full-year guidance. The company expects to report a full-year revenue of 3.6B EUR and an EBIT of 390M EUR. As the first quarter was tracking ahead of these estimates, it will be interesting to see if Fuchs reiterates the targets again when it publishes its H1 results or if it feels sufficiently confident to increase the targets. In any case, I will use the official guidance for now.

Fuchs Investor Relations

With a projected EBIT of 390M EUR, and knowing the net finance expenses will likely remain below 15M EUR, the pre-tax income would be around 375M EUR. Applying an average tax rate of 27% would result in a net income of 274M EUR, which would work out to around 2 EUR per share, using a net share count of 137.5M EUR (assuming Fuchs continues to buy back its shares at a pace of 1M shares per year).

Investment thesis

While the free cash flow yield of 7% already makes Fuchs interesting, the average analyst consensus estimates also seem to expect the full-year EBIT to come in well ahead of the management guidance. The consensus EBIT estimates for 2023 and 2024 are 407 and 438M EUR, respectively. For every 10M EUR in additional EBIT, the EPS will come in higher by 0.05 EUR. So a 50M EUR EBIT increase in 2024 compared to the 2023 guidance would result in an EPS of approximately 2.25 EUR per share. And considering the free cash flow result almost mirrors the reported net income, that would imply Fuchs is trading at a free cash flow yield of just over 7% based on next year’s expectations.

With a balance sheet with just a minimal amount of net debt, Fuchs is currently trading at just over 8.5 times this year’s anticipated EBITDA. And this, in combination with a robust free cash flow performance and attractive free cash flow yield, makes Fuchs attractive at the current share price. The preferred shares are obviously less attractive than the common shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here