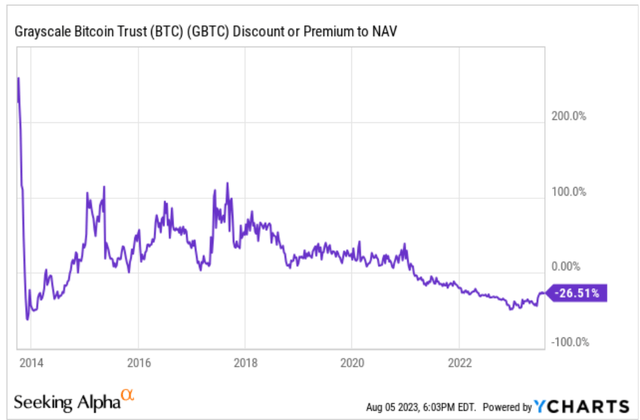

GBTC Discount to Net Asset Value (NAV) at 28%

The Grayscale Bitcoin Trust (OTC:GBTC), which allows investors to hold a share of the Trust’s underlying Bitcoin, is now trading at a 27.5% discount to its underlying assets. This means for every $73.5 invested in GBTC, you are buying $100 in underlying BTC. This provides an opportunity for value investing in the cryptocurrency market through making money on the reversion of the market price of $19.22 to the Trust’s underlying holdings of $26.15 per share.

GBTC Website

GBTC has 36% upside to its underlying BTC value. However, the Trust has often traded at a premium, providing even more upside potential.

GBTC traded at above a 30% premium in the bull run of 2021

Seeking Alpha YCharts

Up until mid-2021, GBTC was not investable to its large premium to NAV. Investors would have been better off buying BTC directly. Today there is a unique opportunity to purchase shares at a discount to GBTC’s underlying BTC, with potential for the shares to revert back to some degree of a premium.

The drop from the ~38% peak premium in December 2020 to the -48% discount in December 2022 is a similar move to that seen in the 2017/2018 cycle, with GBTC peaking at a premium of above 100% in 2017, and then declining to a premium of just ~7% at the end of 2018.

We can take advantage of these movements in premiums and discounts to NAV to allow us to outperform BTC and the broader market.

Buying when GBTC hit its lowest premium to NAV of 7% in 2018 and selling in Dec 2020 when the premium reached 38% would have allowed you to outperform BTC by roughly 25%. The breakdown of that 25% would be a 2900 basis point outperformance against BTC from an increase in premium, minus roughly 400 basis points for 2 years of management fees from the Trust.

Purchasing GBTC is even more compelling this cycle, because I can justify it as a value investor looking at the net asset value of the Trust. In 2018, the GBTC premium/discount bottomed out at a premium of 7%, while we are now sitting at a discount to NAV.

| Cycle | Peak Premium | Largest Discount | Decline in Premium | Trough to Next Cycle’s Peak Change in Discount/Premium |

| 2017/2018 | +100% premium in 2017 | +7% premium in 2018 | 9300 basis points | 3100 basis point gain from increase in premium |

| 2021/2022 | +38% premium Dec 2020 | -48% discount Dec 2022 | 8600 basis points | TBD |

We will see where the peak premium lands this cycle. I would likely sell my Grayscale Trusts when their discounts narrows to zero and rotate into other holdings, but I am pointing out that there is additional upside in the form of a potential future GBTC premium.

Catalyst #1: Undeniable Pattern of 4 Year Cycles, with 3 Years Up Followed by 1 Year Down

The four-year cycle theory revolving around the halving is becoming abundantly clear. Since 2011, Bitcoin has had a clear history of 4 year cycles with 3 years up, followed by 1 year down. This has happened 3 times in Bitcoin’s history, with 2011-2014, 2015-2018, and 2019-2023 (assuming BTC ends the year above $16.6K). See historical BTC calendar year returns below.

Bitcoin Returns by Calendar Year

| Year | Return |

| 2011 | 1467% |

| 2012 | 187% |

| 2013 | 5870% |

| 2014 | -61% |

| 2015 | 35% |

| 2016 | 124% |

| 2017 | 1338% |

| 2018 | -73% |

| 2019 | 94% |

| 2020 | 302% |

| 2021 | 60% |

| 2022 | -64% |

| 2023 YTD | 75% |

According to legendary investor Sir John Templeton, “The four most dangerous words in investing are, it’s different this time.” Pattern recognition is a key to success in investing and success in life. The clear pattern in the historical data is undeniable, and the burden of proof is on the bears to explain why it’s different this time.

Catalyst #2: Potential Approval of BTC ETF

GBTC has been responding well to the news of the recent various BTC ETF applications from BlackRock, WisdomTree, Fidelity, Invesco, Valkyrie Investments, Ark Invest, and VanEck. Blackrock filed its BTC ETF application on June 15, when the GBTC discount was at -42%. The discount has since narrowed to -27.5%, with much of that move being in the 2 weeks following the BlackRock filing.

GBTC does have an outstanding lawsuit against the SEC in an effort to convert the Trust into an ETF, which would immediately close the discount to NAV to zero due to the option to redeem shares at NAV. If one of the BTC ETF applications gets approved, then GBTC should immediately spike on the news as the market reprices the probability of a success for GBTC in their effort to convert into an ETF.

I would note that this event would push returns forward in time, but would also limit the total upside potential by eliminating the possibility of a premium on GBTC, as ETFs almost never deviate far from NAV.

“Not Your Keys, Not Your Crypto” is not the safest philosophy, contrary to popular opinion

The crypto community has a well-intentioned philosophy of self-custody over your assets. They advise not to hold your crypto-assets on exchanges, which has saved countless people from disasters like FTX, Voyager, and Celsius Network. They then extend this sentiment to Grayscale, saying that issues with the broader Grayscale company could lead to the loss of assets in the Grayscale Trusts such as the Grayscale Bitcoin Trust.

GBTC is registered with the SEC, and has to file public audited quarterly reports. Any transfer between the Trust and Grayscale’s management company in excess of the regular 2% per year management fees would be picked up by the end of the quarter, and would immediately warrant SEC scrutiny. This would also have to be approved by Coinbase Custody, the custodians of the underlying Bitcoin. Coinbase is publicly traded and monitored by the SEC, so there are two levels of security against fraudulent and illegal transfers.

While Coinbase is a centralized exchange, and regular customers would likely end up as unsecured creditors in the event of a Coinbase bankruptcy, this is not the case for Coinbase Custody clients such as GBTC.

Digital assets held by Coinbase Custody are legally owned by, and held in trust for, clients. In the event of insolvency or bankruptcy of Coinbase Custody, such assets do not become property of the estate, and creditors will have no rights to such assets. – Coinbase Custody

These levels of security make owning BTC through GBTC, in my view, safer than owning BTC through self-custody. There are countless stories of people losing their hard wallets or forgetting passwords/seed phrases. Think about the number of times you forgot an important password because it was different from all the other passwords you use. Now think about the chance of you remembering a randomly generated 24 word seed phrase 7 years from now. There’s a reason we use banks instead of carrying our cash around. We trust the banks more than we trust ourselves with our money’s safety.

A Final Word

GBTC offers a unique opportunity for a value investor to purchase BTC at a discount to NAV. While I expect GBTC to significantly outperform the market, I do not currently own GBTC as I own other similar crypto trusts that are trading at larger discounts to NAV. I will write about these Trusts in future articles.

I have also recently moved to Puerto Rico to take advantage of its 0% capital gains tax rate on equities and cryptocurrencies as a part of the Act 60 program. I would advise crypto investors expecting significant gains in the projected 2024 and 2025 bull market to speak with tax professionals to see if the program makes sense for you.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here