July 25th ended up being a pretty good day for shareholders of industrial conglomerate General Electric (NYSE:GE). By the end of the day, shares had risen 6.3%, driven by financial results that exceeded expectations for the second quarter of the 2023 fiscal year. Even though I no longer own shares of the company, having sold them for a tidy profit earlier this year, I do still follow it closely and consider it a prospect should the proper circumstances present themselves. What I can say is that the data provided by management is definitely uplifting and makes me a bit regretful for having sold exactly when I did. At this time, I don’t plan to open a position in the firm again. However, its financial condition is attractive enough to keep the company rated a solid ‘buy’.

A look at the headline news

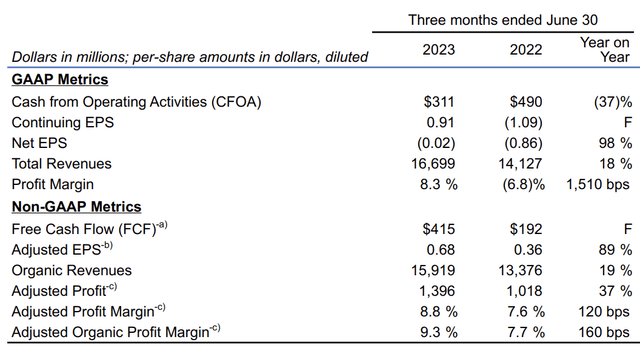

Before we get into the really fun stuff, we should touch on the headline news. The first item here would be overall revenue for the company. According to management, sales for the quarter came in at $16.70 billion. This represents an increase of about 18% over the $14.13 billion the company reported one year earlier. In addition to this, it also was $1.55 billion higher than what analysts anticipated.

General Electric

The bottom line for the company was even better. During the quarter, earnings per share from continuing operations came in at $0.91. This marks a significant improvement over the $1.09 per share loss the company reported one year earlier. In addition to exceeding with the company achieved last year, earnings also came in $0.37 per share higher than what analysts were expecting them to. On an adjusted basis, earnings were considerably lower at $0.68 per share. Even this though exceeded expectations set by analysts to the tune of $0.22 per share.

The gem flies high

Ever since I started following General Electric years ago, I have considered the crown jewel of the company to be its aviation division. This is currently known as GE Aerospace and it will be all that remains of the traditional enterprise when management spins off its other operations early next year. This is the part of the business that has achieved not only attractive growth, but that also boasts robust margins. For a couple of years, GE Aerospace truly struggled. At one point, there were operational issues caused by Boeing’s (BA) 737 MAX aircraft that resulted in a reduction in demand for the famous LEAP engines that General Electric produces. There was also the issue of the pandemic, which caused global air travel to fall precipitously and stay there for some time.

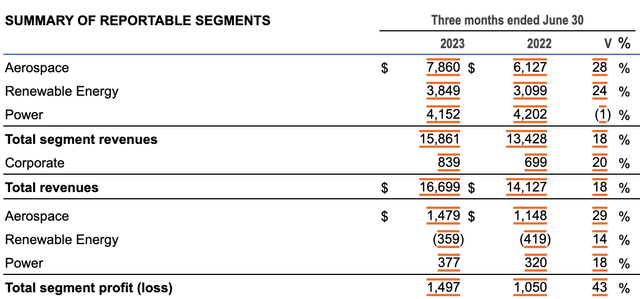

Fast forward to today, and the firm’s aviation operations are alive and well. Revenue in the most recent quarter came in at $7.86 billion. That’s a whopping 28% above the $6.13 billion generated one year earlier. According to management, continued growth in demand for commercial air travel was largely responsible for this jump. They said, for instance, that during the second quarter of 2023, global commercial departures were 21% higher than what they were the same time one year earlier. What’s more, departures during that time came in at 98% of the levels that we saw in 2019.

General Electric

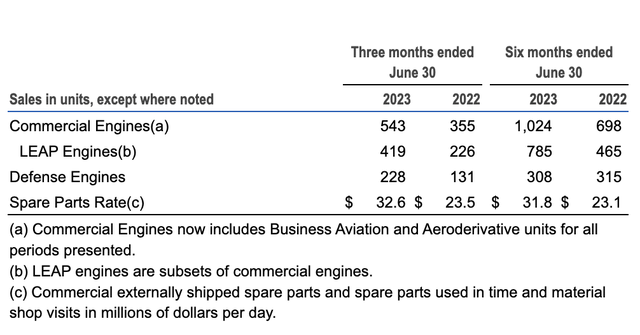

The company benefited during this time from a jump in the number of LEAP engines that it sold from 226 to 419. On top of this though, the number of engines sold for defense purposes skyrocketed from 131 to 228. This allowed defense related revenue decline from $1.10 billion to $1.34 billion. Though that increase accounts for only a small portion of the rise, with the commercial engines and services portion of the company reporting a revenue increase from $4.31 billion to $5.70 billion. Though not as significant, the company also saw systems and other related revenue shoot up from $725 million to $818 million.

General Electric

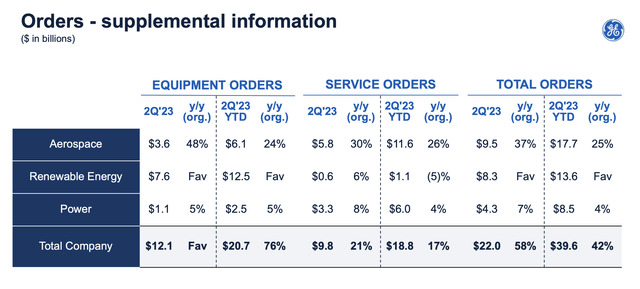

The bottom line for GE Aerospace was also nice to see you. We didn’t see much margin contraction, with the segment profit margin inching up only slightly from 18.7% to 18.8%. However, overall profitability for the segment jumped 29% from $1.15 billion to $1.48 billion. While these profitability figures are positive, there is other interesting news that should bode well for the future. The value of orders placed for the GE Aerospace segment came in at $9.5 billion for the quarter. That’s 37% higher than what the company reported one year earlier. This suggests that further good times for the company are just around the corner.

The great thing about this is that management has even decided to reflect this in guidance. The current expectation for the aviation part of the company is for organic revenue growth to be somewhere between the high teens and 20% for this year as a whole. And operating profit should now come in at between $5.6 billion and $5.9 billion. The revenue growth rate represents an upward revision compared to the mid to high teens that management previously forecasted and operating profit has been revised higher from the $5.3 billion to $5.7 billion range previously expected.

GE Vernova is improving as well

Early next year, General Electric is going to be spinning off its Power and Renewable Energy segments, as well as some other assets, into a separate publicly traded company known as GE Vernova. Compared to the aviation part of the business, GE Vernova has struggled in recent years. The good news is that we are seeing some bright spots these days. For the most recent quarter, revenue associated with the Renewable Energy segment came in at $3.85 billion. That’s up 24% from the $3.10 billion reported one year earlier. On top of this, segment profits went from negative $419 million to negative $359 million. Though not as significant, the Power segment also saw some improvement. While revenue dropped about 1% from $4.20 billion to $4.15 billion, segment profits jumped 18% from $320 million to $377 million.

General Electric

Management expects improvements to continue throughout this fiscal year. The Renewable Energy segment, for instance, is expected to grow organic revenue at the high single digit rate throughout 2023. Operating profit is also supposed to be ‘significantly better’ than it was last year. Overall orders also improved coming in at $8.3 billion for the quarter. When it comes to the Power segment, management is forecasting revenue growth to be in the low single digit range, with operating profits coming in ‘better’ than they were last year. And orders for it popped about 7% year over year, climbing to $4.3 billion.

Other important points

Outside of the specific financial data, there were some other interesting updates provided by management. For starters, management decided to monetize 32% of its ownership in GE HealthCare Technologies (GEHC). Personally, I have long felt that this enterprise is significantly undervalued and I currently own some shares in it. However, management was able to use the $2.2 billion in proceeds that it received from the transaction to help cover the $3 billion worth of redemptions that it forced through associated with its preferred stock.

The company is also redeeming the remaining $2.8 billion of preferred stock, as they made clear in a separate filing on July 25th. Historically speaking, these units were a relatively affordable way for the firm to raise significant amounts of capital. I say this because, up until early 2021, the units cost the company only 5% per annum. Admittedly, General Electric did not have the ability to write these costs off for tax purposes. But paying 5% on what was originally $6 billion it’s not all bad. The reason for the redemption now is that, effective early 2021, the 5% fixed rate on the preferred units changed to a variable rate that was based on the three month LIBOR plus an extra margin of 3.33%. Given current interest rates, this translates to 9.88% per annum. So instead of paying $300 million per year on its preferred units, the company would be paying about $592.8 million.

Another thing I should touch on involves debt. As of the end of the most recent quarter, gross debt for the company came in at $21.78 billion. That’s down from the $22.42 billion the company had three months earlier. At the same time, however, net debt worsened slightly from negative $2.39 billion to negative $1.87 billion. This still means that the company’s balance sheet is remarkably strong. And I see this as a small price to pay for getting the preferred units off its books.

General Electric

Lastly, we should touch on guidance for the year. Because of how strong the quarter was, management decided to increase guidance. Previously, they were forecasting earnings per share for 2023 of between $1.70 and $2. That has now been lifted to between $2.10 and $2.30 compared to the $2.05 that analysts had been forecasting. Free cash flow has also been pushed higher, with management estimating that it should come in at between $4.1 billion and $4.6 billion compared to the $3.6 billion to $4.2 billion previously forecasted.

Takeaway

From all that I can see, the picture for General Electric and its investors looks fantastic. There are some areas that the company can and should continue to improve on. But as far as earnings data goes, I don’t think there’s much more than anybody could expect. Revenue is growing, profits are growing, guidance has been lifted higher, the balance sheet has more impressive than it was previously, and management is making interesting financial moves aimed at improving the company’s bottom line and simplifying its corporate structure. I see this as a win across the board and I have no problem keeping the company rated a ‘buy’ in response.

Read the full article here