General Motors Company (NYSE:GM) is the 4th largest automobile manufacturer in the world by revenue.

companiesmarketcap.com

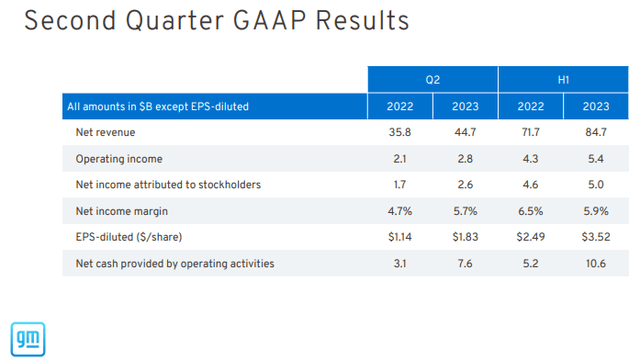

GM just reported its latest quarterly earnings and the results were excellent.

GM

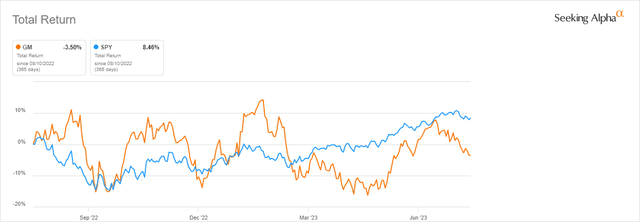

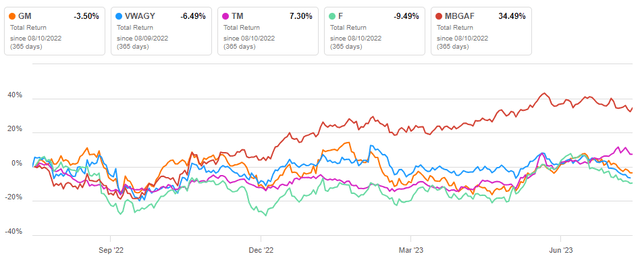

If we compare GM’s total return (including dividends) for the last 12 months, it has underperformed the S&P 500 (SPY) by -4% to +9%.

Seeking Alpha

That indicates that generally speaking, it has not been a good year for GM.

The question for investors at this point in time is, does GM represent a reasonable potential investment return, including dividends, or should investors be on the lookout for better investment performance somewhere else?

In this article, we will look at GM’s prospects for the next year to try and determine the price direction out to 2024 as compared to the last year.

GM’s Stock Key Metrics

Let’s look at GM’s financial metrics, comparing the latest TTM (Trailing Twelve Months) with the previous year. All in all, they look excellent.

I use the financial metrics to discover what I consider to be positive investment numbers (yellow boxes) and compare them with any negative investment numbers (orange boxes).

Seeking Alpha and author

One quick look at the financial metrics table above comparing 2022 TTM to 2023 TTM shows that even though GM increased Revenue (Line 2) by 31% it also increased EPS (Line 10) up 36%, EBITDA (Line 13) by 6%, and FCF (Line 15) by a huge 80%. This could imply that GM had problems with cost containment due to inflation and possibly logistical problems in 2021 but has overcome them in the last 12 months.

GM’s price (Line 1) decreased by 7% over the last 12 months in spite of a large increase in Revenue (Line 2) of 31%. Gross Margin (Line 4) dropped marginally. This would indicate no improvement in operational efficiency from one year to the next but that was more than offset by the huge revenue increase.

The PE Ratio (Line 11) has shrunk from 7.4x to 4.9x a decrease of 32% in spite of the large increase in revenue of 31%. This could imply GM is considered to be a potential turnaround candidate since the PE ratio dropped by 32% in spite of a revenue increase of 31%. This implies that GM is vastly underpriced compared to the previous year.

Net Debt (Line 12) increased by 200% but because the EBITDA increased by 6% the Debt/EBITDA improved by 182%. Please note the negative debt values mean that GM had a net cash balance in both years but more cash this year than last.

FCF (Free Cash Flow) on (Line 15) was negative in both years but much improved this year.

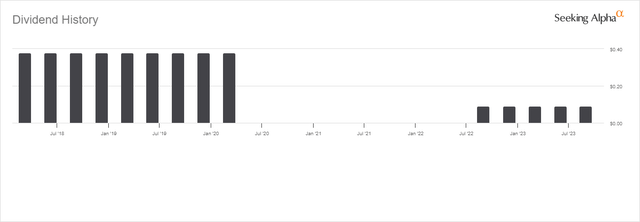

A big plus was the reestablishing of the dividend (Line 17) increasing it from zero to $.36.

So GM had very positive results over the last 12 months and in spite of that, the share price dropped by 31%. This could imply that GM’s share price has an excellent chance to turn around if they can keep results for the current year at least as good as the last 12 months.

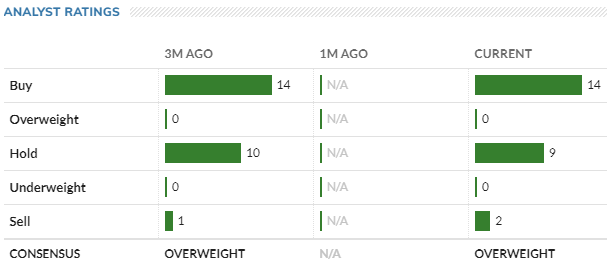

What Do Analysts Think Of GM?

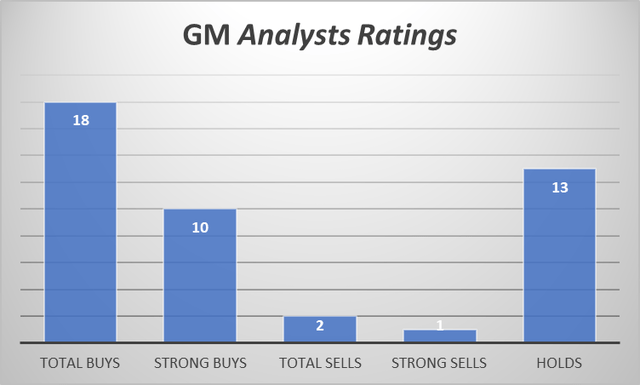

Wall Street and Seeking Alpha analysts are decidedly upbeat about GM with 18 Buys and only 2 Sells. Also, Strong Buys outnumber Strong Sells by 10 to 1. So analysts are upbeat about GM’s prospects going forward.

Seeking Alpha and author

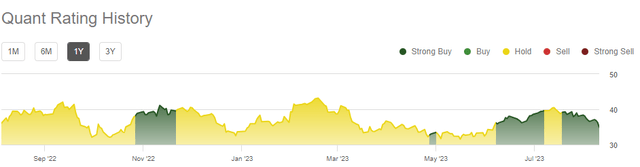

GM’s quant rating has been varying between Hold and Buy for the past 12 months but with a Buy rating currently.

Seeking Alpha

MarketWatch analysts also have a consistent “Buy” rating on GM reinforcing the positive ratings from analysts and quants.

MarketWatch

All in all, GM appears to have consistent Buy ratings from all sources.

So based on the above ratings GM seems to be a Buy.

How Does GM’s Price Compare To Other Companies In Its Market Sector?

A legitimate question when looking at any stock is to compare its performance with other stocks in the same market sector. If we look at GM’s performance over the last year and compare it to other stocks in the automotive sector, we can see GM is right in the middle of the pack with a -3.5% return. Ford and Volkswagen are worse and Toyota and Mercedes are better.

Seeking Alpha

This would imply the automotive sector has had a challenging year similar to GM. This could imply GM’s recent problems are at least somewhat related to the sector in general.

GM’s Dividend and Share Buybacks

GM eliminated its dividend in 2020 and recently restored it at the lower rate of $.09 per quarter from $.38 per quarter prior to 2020.

Seeking Alpha

GM’s long-term dividend record is pretty bad too.

Seeking Alpha

I would not buy GM based on dividends.

GM has also bought back approximately 15% of its shares over the last 10 years a decent record for a capital-intensive business.

Seeking Alpha

GM’s dividend record is lousy but its share buyback record is OK.

Is GM’s Stock A Buy, Sell, or Hold?

Obviously, there are risks with a GM investment. Besides the day-to-day competitive risks, there are inflation and recession risks. Other risks such as competing in the fast-growing EV (Electric Vehicle) market against strong competitors like Tesla are very challenging especially when you consider that traditional car companies like GM must also maintain the production of their ICE (Internal Combustion Engine) cars and trucks.

And, of course, higher interest rates hurt businesses like GM because so many of their buyers finance their purchases.

In spite of GM’s strong financial metrics for the last year, decreasing sales in China also poses a risk as China struggles economically.

One positive point is GM’s Price to Sales ratio is near an all-time low for the last 10 years.

Seeking Alpha

That could be a positive sign for a possible turnaround in the share price if results improve to last year’s record.

In spite of the excellent financial metrics, I feel the risks of high-interest rates, negative recessionary prospects, and a sluggish Chinese economy make GM a Hold until we can see some improvements in those 3 areas of concern.

Read the full article here