Gladstone Capital (NASDAQ:GLAD) might see lower net investment income next year as the central bank pointed to lower key interest rates for 2024. As a consequence, I would expect the business development company’s net investment income and dividend growth to slow in the near future, and am, thus, modifying my stock classification to Sell.

Though Gladstone Investment’s First Lien portfolio is growing, I do see headwinds in a higher-rate environment and I am in the process of under-weighting those business development companies that are presently still trading into a NAV premium.

My Rating History

Gladstone Capital is mainly invested in floating-rate loans that threw off growing net investment income in a rising-rate environment in the last year, therefore supporting the BDC’s portfolio growth and a net asset value premium valuation.

With the central bank shifting its interest rate policy in December, the business development company is looking at a slowdown in net investment income growth and possibly a decline in the company’s margin of dividend safety. With net investment income headwinds on the horizon, I am worried that Gladstone Capital’s net asset value premium might also disappear.

First Lien-Centric, Growing Investment Portfolio Facing Headwinds

The business development company predominantly focuses on middle market companies that find it challenging to receive traditional bank financing.

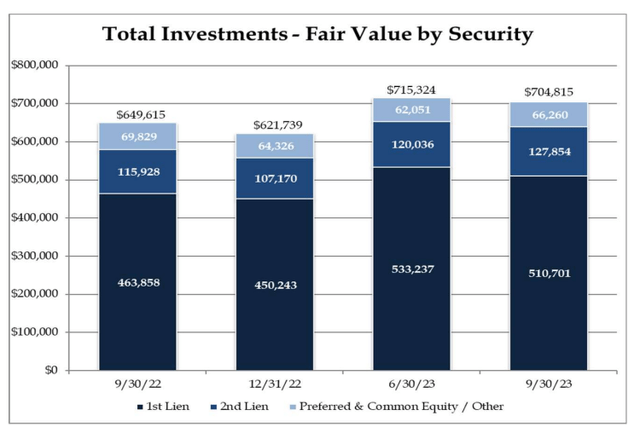

Gladstone Capital is a relatively tiny business development company with a portfolio of only $704.8 million which consisted mainly of First and Second Liens.

At the end of the last quarter, which also marked the end of Gladstone Capital’s financial year, the business development had 72.5% of its funds invested in First Liens with another 18.1% going to Second Liens and 9.4% to Equity investments that have the potential to yield a lucrative portfolio exit for the business development company.

Total Investments – Fair Value By Security (Gladstone Capital)

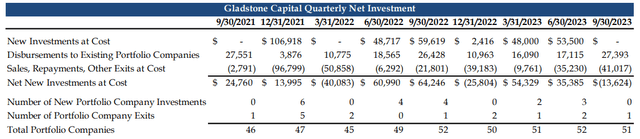

Gladstone Capital’s portfolio is growing, too, primarily because of new investments in the first half of 2023. The business development company now has investments in 51 different portfolio companies and initiated $76 million in new investments, net of sales and repayments, in 2023. Gladstone Capital’s portfolio grew in total value by 13% since the end of last year.

Quarterly Net Investment (Gladstone Capital)

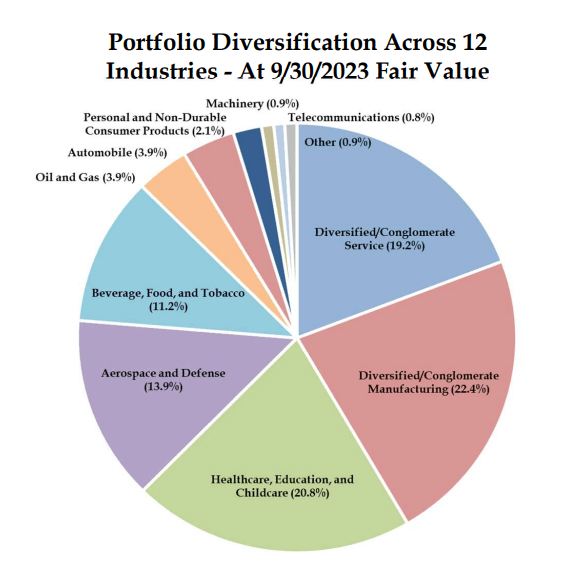

Gladstone Capital’s portfolio diversification as such is not that much different to me than the one you would find with other business development companies. The business development company is overweight a number of sectors that tend to have less-volatile earnings profile such as Conglomerate Services, Healthcare, Childcare, and Education.

Portfolio Diversification Across 12 Industries (Gladstone Capital)

Dividend Coverage Might Be On The Brink Of Deterioration

Gladstone Capital’s debt investment portfolio is 89.2% floating-rate (at cost) which caused the business development company’s net investment income per average weighted share to go up by 27% YoY in 3Q-23. Thus, the central bank has been quite instrumental in lifting the business development company’s net investment income.

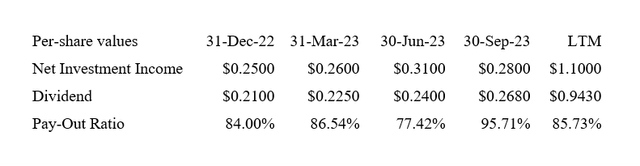

The business development company earned a total of $1.10 per weighted average share in the last year which stacks up favorably to a total $0.94 per share dividend pay-out.

The payout ratio has risen, however, close to 96% in the last quarter which raises questions about dividend sustainability as the central bank has said that it anticipates to cut short-term interest rates next year.

With possibly slowing net investment income growth, or maybe even negative growth in 2024, Gladstone Capital’s dividend has a very small margin of dividend safety. Deteriorating dividends might also lead to a lower valuation multiple for Gladstone Capital.

Dividend (Author Created Table Using BDC Information)

A Premium That Might Not Be Deserved In A Low-Rate Environment

Gladstone Capital is presently selling for an 11% net asset value premium and I would expect this premium to ultimately disappear completely in a low-rate environment which makes it harder to produce net investment income and dividend growth. Thus, I see a more realistic valuation scenario in 2024 that points to a valuation at net asset value.

At a present stock price of $10.42, equates to a 10% downside potential. Competitors sell for small discounts or premiums to book value and given the Fed shift anticipated for 2024 I generally expect growing valuation pressure for business development companies.

Valuation Upside, Interest Rate Concerns

Gladstone Capital might have upside potential, or at least limited downside potential, if the central bank takes its time with its interest rate policy shift. As such, a net asset value discount might not appear in 2024 and a net asset value premium might be sustained after all.

Generally speaking, however, I think that floating-rate BDCs, particularly those business development companies that sell at substantial, 10% or higher, premiums to net asset value have uncompelling risk/reward relationships.

My Conclusion

Gladstone Capital has a First Lien-centric investment portfolio, good diversification, and provides a dividend for passive income investors that is covered by net investment income. Considering that the business development company is concentrated in First and Second Lien floating-rate debt, however, I think it stands to reason that Gladstone Capital is set for at least slowing growth with respect to its net investment income in 2024.

The margin of dividend safety has declined in the last quarter also and therefore I see net asset value risks for Gladstone Capital, as I do for the entire business development company market.

In response to my concerns, I am reducing my exposure to business development companies and cutting off those that are presently selling at a net asset value premium, like Gladstone Capital.

Read the full article here