Overview

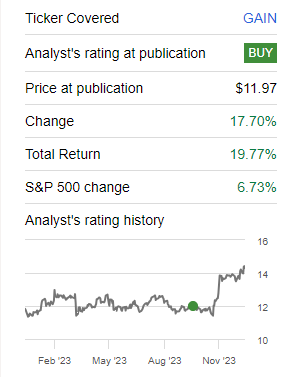

About 3 months ago, I previously covered Gladstone Investment (NASDAQ:GAIN) and rated it as a buy. Since then, the stock has a total return of nearly 20% while outpacing the S&P 500 (SPY). It has also paid out a huge supplemental dividend payment of $0.88/share. Since then, the price has quickly run up from $12/share to over $14/share. Despite the run up, I continue holding GAIN and reinvesting the dividends.

Seeking Alpha

GAIN stands out as a well-managed BDC (Business Development Company) with a remarkable performance track record spanning the past decade. The company has consistently increased its distribution payout and has supplemented it with additional payments throughout the year, in addition to the large bonus payment previously mentioned.

Valuation

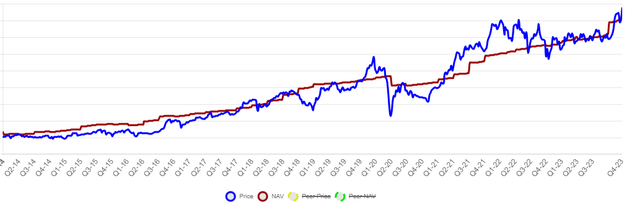

The price has moved up substantially in the last 3 month period but so has the NAV. Typically, when we see a BDC’s NAV and stock price increase simultaneously, it’s generally considered positive. This alignment indicates that the company’s underlying assets are gaining value, leading to increased wealth for shareholders. In addition to this, the price premium remains quite low at only 2% over NAV. For reference, the 3 year average premium to NAV is 7.9%.

CEF Data

This kind of movement generally means that the market has a vote of confidence in GAIN’s portfolio and management. Additionally, a rising NAV may signal improved income potential, which can support future dividend growth or sustainability. In addition, a BDC with a growing NAV and stock price is likely to draw new investors, enhancing its capacity to raise additional capital and strengthen its financial position.

I believe we also have the catalyst of upcoming interest rate cuts from the Fed. There are four anticipated interest rate cuts for 2024. I think it is likely that as interest rates fall, we will see more investors deploying capital into high quality high yielding assets such as GAIN.

Growing Portfolio

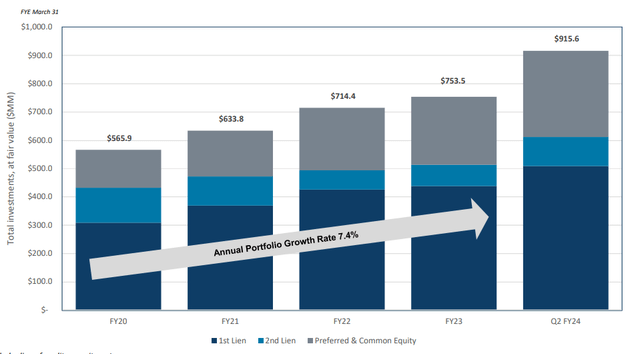

Gladstone Investment primarily emphasizes Secured First Liens, constituting 56% of the company’s investments. Secured Second Liens represent around 13% of their investment portfolio, while a substantial 26% is attributed to preferred stock. Secured first lien loans offer a higher priority in repayment in the event of borrower default, providing GAIN with increased security and protection of its assets.

Additionally, the lower default rates associated with secured first lien loans contribute to a more stable and predictable income stream. Including these loans in the portfolio allows GAIN to diversify its debt investments, spreading risk across different sectors and companies. In distressed situations, the liquidity of secured positions becomes an asset. Speaking of liquidity, GAIN has a solid liquidation coverage strategy, with the fair value of all its assets accounting for approximately 206% of the company’s liabilities. Diversifying across 25 companies and 15 industries, GAIN demonstrates a significant level of diversity in its portfolio.

GAIN Q2 2024 Presentation

GAIN made investments in nine new companies, deploying approximately $277 million of fresh capital. This initiative underscores GAIN’s commitment to expanding its investment portfolio and seeking opportunities for growth. Additionally, the company successfully exited investments in 13 companies, realizing a return of proceeds totaling $354.0 million.

These exits demonstrate GAIN’s proficiency in portfolio management, capitalizing on favorable market conditions and optimizing returns for its investors. A combination of all these things reinforces that GAIN is a top tier BDC that can continue to provide reliable income into the future. The successful exits reflects GAIN’s large supplemental dividend payment previously mentioned as well.

Dividend

The declared monthly dividend of $0.08/share remains unchanged since my last write-up. While this has been the payout since the start of 2022, it would be nice to see a slight raise going into the new year. We shall see what the next announcement brings. As previously mentioned, GAIN paid out a huge supplemental dividend of $0.88/share. This payment was equal to 11 months of regular distribution payments and that’s the kind of income that keeps me adding to me position.

The dividend growth story here has also been impressive for an asset that is already yielding close to 7%. The 5 year dividend CAGR comes in at 10%. The supplemental distribution was confirmed to be a result of a buyout strategy. It’s safe to assume that this ties in to the previously mentioned company exits. The announcement by David Dullum confirmed this with his statement:

“This additional supplemental distribution highlights the strength of Gladstone Investment’s buyout strategy and its ability to reward its shareholders with meaningful supplemental distributions from the realized capital gains generated on the equity portion of the Company’s successful exits” – David Dullum, President of Gladstone Investment

Financials

Since my last analysis, GAIN reported a net investment loss of $1.7 million, translating to -$0.05 per weighted-average common share, marking a significant decrease compared to the net investment income of $8.4 million recorded in the previous quarter. The decline was primarily attributed to a rise in total expenses. Those were driven by increased accruals for capital gains-based incentive fees and interest expense.

Total investment income remained consistent at $20.3 million. The net asset value per common share stood at $14.03, representing an increase from the previous period. The rise was primarily fueled by $48.7 million in net unrealized appreciation on investments and $0.3 million in realized gains on investments. These positive factors were partially offset by $12.2 million in distributions paid to common shareholders and a net investment loss of $1.7 million.

Despite a net investment loss of $1.7 million, the report maintains a consistent total investment income of $20.3 million, indicating financial stability. Notably, the net asset value per common share increased to $14.03, driven by $48.7 million in net unrealized appreciation and $0.3 million in realized gains. While $12.2 million in distributions and a net investment loss of $1.7 million are noted, the overall positive portfolio performance underscores GAIN’s effective management.

Interest Rates

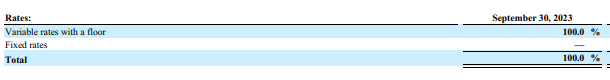

The impact of declining interest rates in 2024 can be multifaceted. BDCs like GAIN often benefit from a reduced cost of borrowing when interest rates drop. This potentially improves net interest margins and overall profitability. As stated in GAIN’s 10-Q:

We target to have approximately 90% of the loans in our portfolio at variable rates or variable rates with a floor mechanism, and up to approximately 10% at fixed rates.

GAIN 10-Q

GAIN invests in floating-rate instruments and may experience stable or increased income from these investments as interest payments are often tied to short-term benchmark rates. Lower interest rates can also present refinancing opportunities, allowing management to optimize their cost structure.

However, I think it’s important to also consider the challenges associated with a prolonged low-interest-rate environment. While income from floating-rate investments may remain stable or increase, the overall search for yield becomes more challenging. It’s entirely possible that they may face the dilemma of finding attractive investment opportunities with competitive yields.

Takeaway

Gladstone Investment has shown strong performance in the past three months, delivering a total return of nearly 20% and outperforming the S&P 500. The stock’s substantial price increase aligns positively with the growth in Net Asset Value (NAV), reflecting the underlying appreciation of the company’s assets and embracing confidence from the market.

The company’s strategic portfolio management is evident in recent investments and exits, deploying $277 million in fresh capital and realizing returns of $354.0 million. While the declared monthly dividend remains unchanged, the impressive supplemental dividend of $0.88/share further reflects GAIN’s successful exits and buyout strategy.

As GAIN navigates the impact of declining interest rates in 2024, its focus on variable-rate loans positions it well to benefit from reduced borrowing costs. However, challenges in finding attractive investment opportunities amid a low-interest-rate environment may arise. GAIN’s continued strategic management and solid financial performance position it as a top-tier BDC with the potential for reliable income in the future.

Read the full article here