Major developed market central banks around the globe are almost unanimously indicating rate cuts won’t happen until next year, and in some cases have indicated additional hikes are still to come. The stark contrast with market expectations that global monetary loosening would begin before year-end likely means that optimistic growth expectations also need to be called into question.

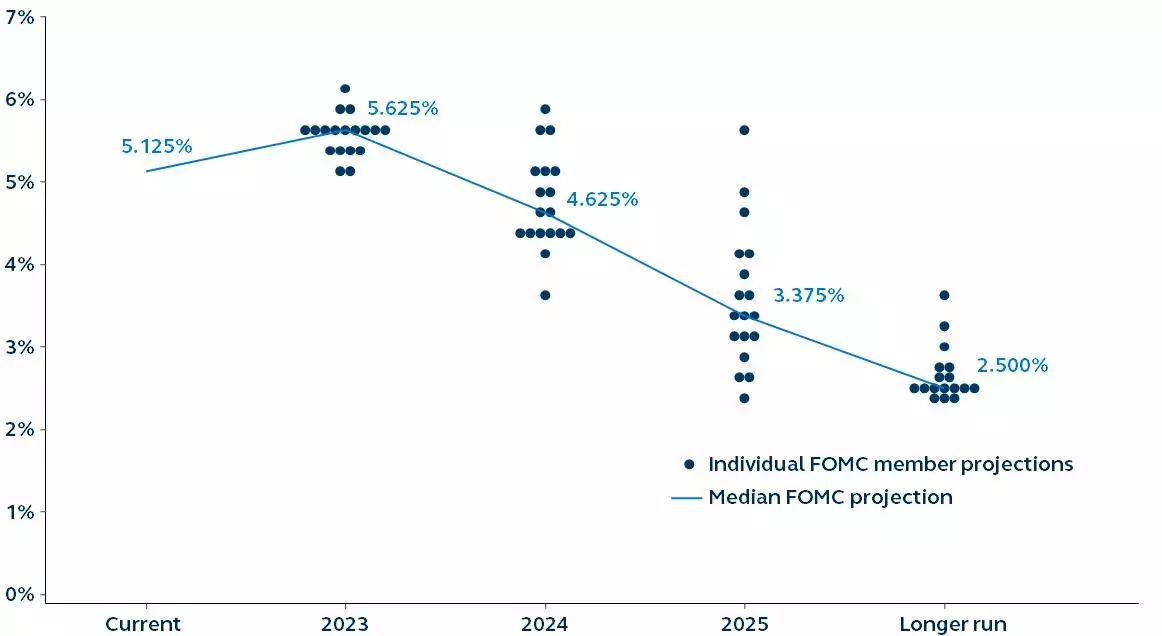

U.S. Federal Reserve dot plot

FOMC participants’ projection of the Federal Funds Rate

Source: Clearnomics, Federal Reserve, Principal Asset Management. Data as of June 16, 2023.

Recently, broad market consensus had converged around the idea that global monetary loosening would start before year-end. However, these expectations may have been presumptuous. Not only have major central banks indicated that rate cuts are not to be expected until next year, but policy rates may still have even further to rise.

- Federal Reserve: The latest dot plot shows that the majority of committee members expect at least two more hikes this year. By contrast, markets currently expect just one more hike and, until just a month ago, believed rates had already peaked.

- European Central Bank: President Lagarde indicated that policy rates are “very likely” to increase again in July. Furthermore, the ECB raised its 2023 core inflation forecast to 5.3%, suggesting there is likely a strong need to continue hiking beyond July.

- Bank of England: Following a string of significant upside inflation surprises, markets have raised their peak rate expectations from 5.00% a month ago to 5.75% currently.

- Reserve Bank of Australia and the Bank of Canada: Both central banks have recently ended their monetary tightening pauses by introducing surprise policy hikes.

Market sentiment has been improving under the assumption that monetary tightening is coming to an end and economic growth has escaped unscathed. Now that risks have swung towards higher terminal rates, sanguine growth expectations need to be questioned. Market sentiment is beginning to look vulnerable.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here